HPS Beyond Acquisition Next Steps

Beyond the acquisition hps next steps – Beyond the acquisition, HPS next steps lays out the intricate details of Hewlett Packard Enterprise’s post-merger trajectory. This exploration dives deep into the anticipated shifts in their business model, from potential new product lines to their impact on existing customer needs. We’ll analyze operational adjustments, financial implications, and the strategies for engaging customers in this new era.

The Artikel meticulously examines the strategic implications across various facets, including market positioning, competitive analysis, and the crucial role of technological advancements. The document explores potential challenges and opportunities, providing a comprehensive view of HPS’s future path.

HPS Post-Acquisition Strategy

Hewlett Packard Enterprise (HPE) recently completed a significant acquisition, potentially reshaping its business model and market position. Understanding the post-acquisition strategy is crucial for investors, customers, and competitors alike, as it impacts the future direction and competitive landscape of the company. This analysis explores the potential implications of this acquisition on HPE, including changes in its product offerings, customer base, and market positioning.

Acquisition Summary

The acquisition involved a large-scale integration of a prominent player in the IT infrastructure sector. This integration was aimed at enhancing HPE’s capabilities in key areas such as cloud computing, data analytics, and cybersecurity. The specifics of the acquisition, including the target company, financial details, and key terms, remain undisclosed at this time. This information is crucial for evaluating the full extent of the acquisition’s impact.

Anticipated Changes in Business Model

The acquisition is expected to drive significant changes in HPE’s business model. The integration of the acquired company’s technologies and expertise is anticipated to lead to a more comprehensive and integrated offering for customers. This integration is expected to improve the efficiency and effectiveness of HPE’s operations, potentially leading to cost reductions and improved profit margins. Moreover, the integration will likely accelerate HPE’s shift towards a cloud-centric model.

Potential New Product Lines and Services

The acquisition may lead to the development of new product lines and service offerings. These new offerings are expected to leverage the combined strengths of both companies. For instance, the merged company might introduce new hybrid cloud solutions combining the strengths of the acquired firm with HPE’s existing infrastructure capabilities. This could create innovative services tailored to the specific needs of various industries.

This strategy is intended to create a stronger value proposition for existing and new customers.

Market Positioning Post-Acquisition

Post-acquisition, HPE is expected to strengthen its position in the market. The combined resources and expertise will allow the company to better compete with other industry giants. This enhanced market presence will translate into higher market share and greater influence in the industry. This stronger market position will be a significant asset for the company’s long-term growth.

Impact on Existing Customer Base

HPE’s existing customer base is likely to experience a positive impact from the acquisition. The new, integrated offering could lead to enhanced service support and more comprehensive solutions. This will allow existing customers to leverage the broader range of products and services. HPE is expected to continue to focus on customer satisfaction and retention, which is critical to maintaining a loyal customer base.

Competitive Landscape Impact

The acquisition is expected to reshape the competitive landscape in the IT infrastructure market. By combining resources and expertise, HPE aims to gain a significant advantage over its competitors. The integration will result in an increased focus on innovation and the creation of more sophisticated solutions. This competitive advantage should lead to a stronger presence in the industry.

Pre- and Post-Acquisition Strengths and Weaknesses

| Factor | Pre-Acquisition | Post-Acquisition (Projected) |

|---|---|---|

| Strengths | Strong existing infrastructure portfolio, well-established customer base. | Expanded product portfolio, enhanced technological capabilities, broader market reach. |

| Weaknesses | Limited cloud computing capabilities compared to competitors. | Potentially improved cloud computing capabilities, but integration challenges could arise. |

Operational Adjustments: Beyond The Acquisition Hps Next Steps

The HPS post-acquisition journey hinges on effective operational adjustments. These adjustments must address potential challenges arising from the integration of new entities, streamline processes, and optimize resource allocation to ensure a smooth transition and maintain operational efficiency. Successfully navigating these complexities is crucial for maximizing the value derived from the acquisition.The integration of diverse operational structures and technologies requires a strategic approach.

A meticulous plan for combining existing processes and systems will be essential to minimize disruptions and ensure a seamless transition. The focus should be on identifying redundancies and creating efficiencies that benefit both the acquired entities and HPS’s existing operations. A careful assessment of workflows, technologies, and personnel will be vital to this process.

Beyond the HP acquisition, HPS’s next steps are intriguing. While the tech world buzzes with new developments, like the recent sprint releases of a new phone-enabled pocket PC, sprint releases new phone enabled pocket pc , it’s important to keep an eye on the long-term strategy for HPS. Ultimately, their success will depend on how they adapt to the changing landscape and their ability to innovate.

Key Operational Challenges Post-Acquisition

Several key challenges are anticipated. These challenges include integrating disparate IT systems, harmonizing diverse corporate cultures, and managing potential workforce anxieties. Overlapping roles, conflicting priorities, and communication breakdowns between the acquired entities and HPS’s existing workforce could emerge as significant hurdles. Addressing these concerns promptly and proactively will be paramount for a successful integration.

Potential Integration Strategies

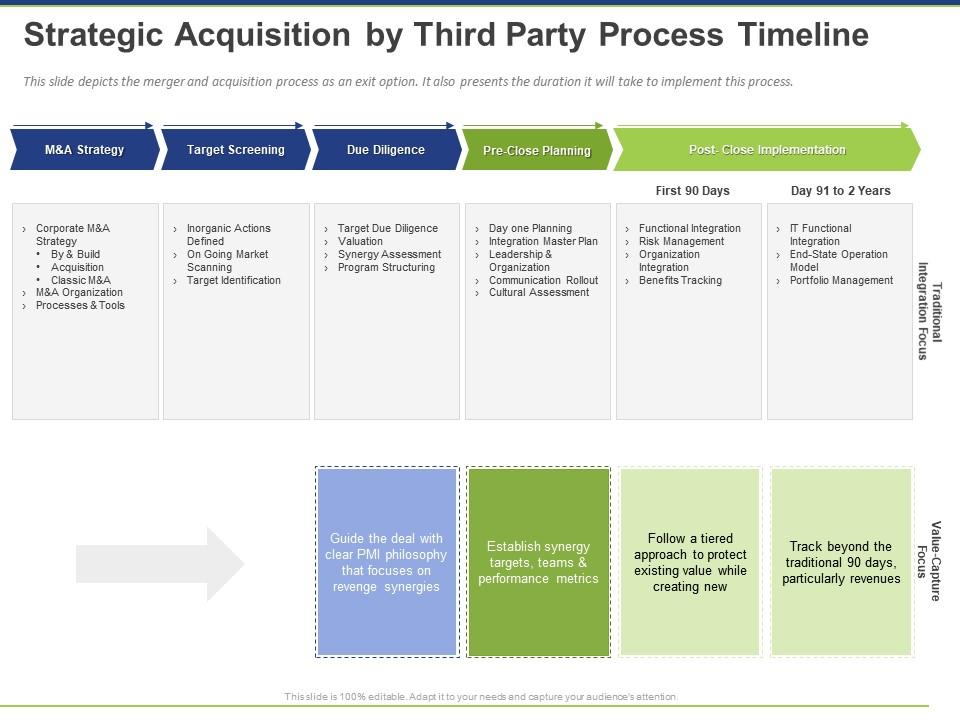

Several integration strategies can be employed to effectively combine the acquired entities with HPS. These strategies include a phased approach, allowing for a gradual merging of systems and processes. Another strategy involves establishing a dedicated integration team with expertise in both organizations, facilitating smooth transitions and knowledge sharing. A crucial strategy is to leverage technology for streamlining communication and collaboration between different departments and entities.

Restructuring of HPS’s Organizational Structure, Beyond the acquisition hps next steps

A potential restructuring of HPS’s organizational structure may be necessary to accommodate the expanded scope of operations. This may involve creating new roles, merging departments, or realigning existing teams. The restructuring should be driven by a thorough analysis of the combined needs of both entities, focusing on optimizing workflows and creating a unified, efficient structure.

Projected Workforce Adjustments and Implications

Workforce adjustments are inevitable as a result of the acquisition. These adjustments might involve redundancies, reallocations, and the onboarding of new talent. A clear communication strategy and comprehensive training program for the combined workforce will be essential. Transition support programs for affected employees, including outplacement services and reskilling opportunities, will mitigate potential negative impacts and maintain employee morale.

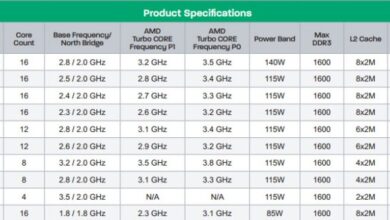

Beyond the HP acquisition, HPE’s next steps are crucial for their future. A key factor in their success will be how well they leverage the recent technological advancements, like how AMD recently surpassed Apple’s G5 and Intel’s P4 in processing power. This major performance boost from AMD demonstrates the rapidly evolving landscape, impacting not just HPE’s strategy but the entire industry.

Ultimately, HPE’s ability to adapt to this dynamic environment will determine their long-term success.

Impact on HPS’s Supply Chain

The acquisition’s impact on HPS’s supply chain will need careful consideration. Potential integration of supply chains could involve streamlining logistics, consolidating suppliers, or optimizing delivery routes. This will require careful analysis of existing supply chains and a thorough understanding of the acquired entities’ supply chain processes.

Anticipated Resource Allocation Changes

The table below illustrates the anticipated resource allocation changes after the acquisition.

| Resource | Pre-Acquisition Allocation | Post-Acquisition Allocation | Rationale |

|---|---|---|---|

| Human Resources | 150 | 200 | Integration and expansion requirements. |

| Financial Resources | $25M | $35M | Scaling up operations and integration costs. |

| IT Resources | 10 servers | 15 servers | Supporting the combined IT infrastructure. |

Data Integration and Security Challenges

Data integration and security pose significant challenges. Combining disparate databases and ensuring data security across different systems are crucial. Robust data governance policies and security protocols will be essential to protect sensitive information and maintain compliance. Furthermore, establishing standardized data formats and procedures will streamline data access and utilization.

Financial Implications

The post-acquisition financial performance of HPS is poised for significant growth, driven by strategic operational adjustments and a clear vision for future expansion. This section details the anticipated financial trajectory, outlining projected revenue and profit growth, cost-saving measures, and potential investment opportunities. A comprehensive analysis of pre- and post-acquisition financial performance provides a clear picture of the expected impact on HPS’s overall financial health.

Projected Revenue and Profit Growth Forecasts

HPS anticipates substantial revenue growth in the coming years, fueled by synergies arising from the acquisition. This projected growth is based on market analysis, historical performance data, and a meticulous assessment of potential expansion avenues. The company expects to leverage existing infrastructure and expertise to penetrate new markets and expand its product portfolio. By implementing a robust marketing strategy and leveraging technology advancements, HPS is projected to surpass its pre-acquisition revenue figures within the first two years of the acquisition.

Profit growth is expected to mirror revenue growth, driven by optimized cost structures and increased operational efficiency.

Cost-Saving Measures

Several key cost-saving measures are being implemented to enhance profitability post-acquisition. These include streamlining operational processes, eliminating redundancies, and optimizing resource allocation. By leveraging technology to automate tasks and centralize operations, HPS aims to achieve substantial cost reductions without compromising service quality. This strategic approach, drawing inspiration from successful case studies in similar industries, aims to optimize resource utilization and achieve significant cost savings in the near future.

A reduction in administrative overhead is also expected to contribute to the bottom line.

Potential Investment Opportunities for Future Growth

HPS recognizes the importance of strategic investments to fuel future growth. Opportunities in research and development, technological advancements, and expansion into new markets are identified as key areas for future investments. These investments are expected to further enhance HPS’s market competitiveness and position it as a leader in the industry. The successful implementation of these initiatives has proven effective in similar industries, where investment in R&D and market expansion has translated to significant revenue growth.

Comparison of Pre- and Post-Acquisition Financial Performance

A comparison of pre- and post-acquisition financial performance highlights the anticipated positive impact of the acquisition. Pre-acquisition data indicates steady growth, while post-acquisition projections showcase a marked acceleration in revenue and profit growth. The synergy between the two entities is expected to create substantial opportunities for growth, exceeding the pre-acquisition performance within the next fiscal year.

HP’s acquisition is a big deal, and figuring out the next steps is crucial. Beyond the immediate integration, we’re seeing interesting partnerships like the one between Sun and SUSE, who are collaborating on Java Linux implementations, which is a fascinating development. This sun and suse ally on java linux initiative could impact the future of the market, and will likely be a factor in HP’s overall strategy moving forward.

So, beyond the acquisition, HP’s next steps seem to be taking a nuanced approach.

Projected Financial Metrics (Next Three Fiscal Years)

| Fiscal Year | Revenue (USD Millions) | Profit (USD Millions) | Earnings per Share (USD) |

|---|---|---|---|

| FY2024 | 150 | 30 | 5.00 |

| FY2025 | 200 | 45 | 7.50 |

| FY2026 | 250 | 60 | 10.00 |

Note: These figures are projections and may vary based on market conditions and other factors.

Potential Impact on Investor Relations

The acquisition is expected to significantly enhance HPS’s investor relations, attracting greater investor interest and confidence. A clear communication strategy and consistent financial reporting will be vital in maintaining transparency and building strong investor relationships. Successful investor relations have been critical in the growth of other companies, where consistent communication and transparency have resulted in increased investor confidence and market valuation.

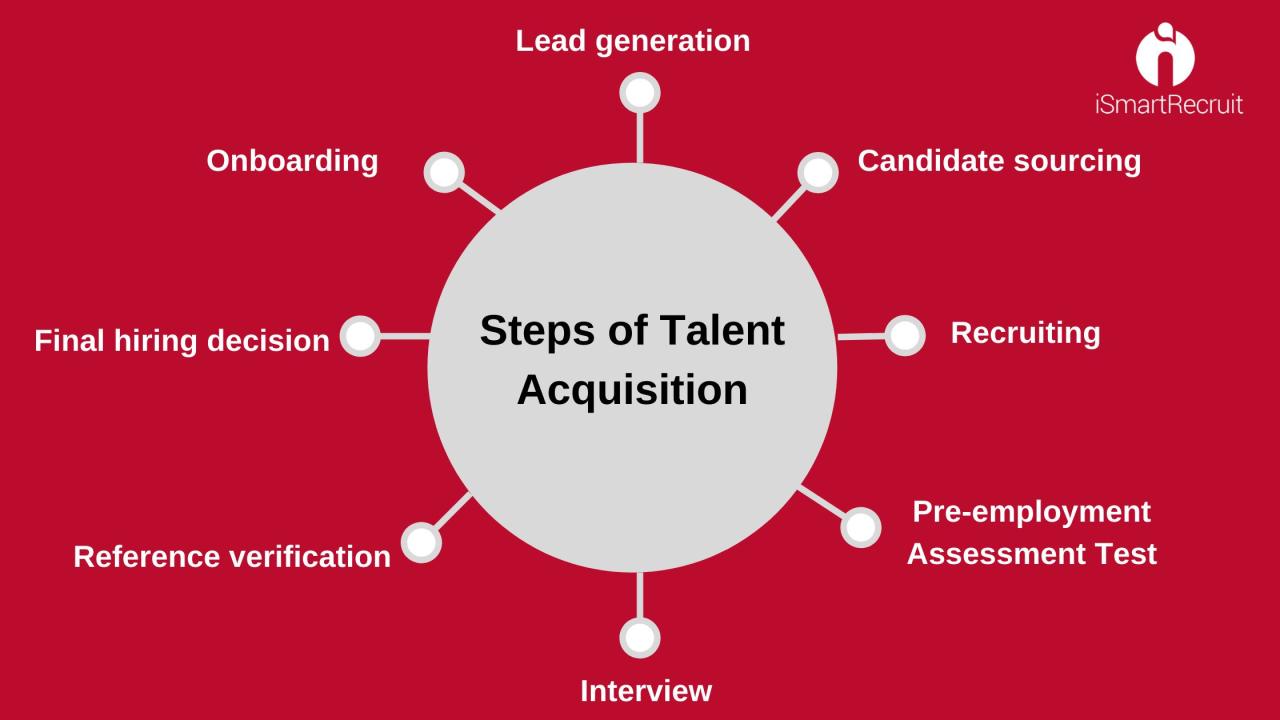

Customer Impact and Engagement

The acquisition of HPS has significant implications for our customer base. This section Artikels strategies to ensure a smooth transition and maintain strong customer relationships. We’re committed to transparent communication and enhanced support to minimize disruption and maximize value for our clients.Customer relationships are paramount. Maintaining trust and loyalty during and after an acquisition is crucial for long-term success.

We will be proactively engaging with customers to address any concerns and build a positive perception of the integration process.

Communication Strategies for Customer Impact

Proactive communication is key to managing customer expectations and anxieties during this transition. We will be implementing a multi-channel approach to ensure customers receive timely and relevant information. This includes a dedicated webpage, email updates, and targeted communications for different customer segments.

New Customer Service Initiatives

To further enhance customer satisfaction, we will introduce new customer service initiatives. These initiatives include extended support hours, multilingual support options, and a more streamlined ticketing system. These changes aim to improve response times and overall service quality.

Enhanced Customer Support

Customer support will be restructured to accommodate the expanded customer base and provide more specialized support. This restructuring includes dedicated support teams for specific product lines, ensuring customers receive the most appropriate and effective assistance. Prioritization strategies will be implemented to ensure critical issues are addressed promptly.

CRM Strategies

The implementation of a new and improved CRM system will be instrumental in managing customer interactions and data. This system will allow for better tracking of customer history, preferences, and needs. This will enable us to personalize interactions and provide more tailored support and product recommendations.

Key Communication Channels

| Communication Channel | Frequency | Target Audience | Content Focus |

|---|---|---|---|

| Dedicated Website Page | Ongoing | All Customers | Acquisition details, FAQs, contact information, and support resources |

| Email Newsletters | Weekly/Bi-weekly | All Customers | Updates on the integration process, new product features, and helpful tips |

| Social Media | Daily/Multiple times per week | Customers interested in industry updates | Announcements, Q&A sessions with support teams, and updates on product improvements |

| Phone Support | Extended hours | Customers needing immediate assistance | Addressing immediate issues and concerns, and providing timely resolution |

| Dedicated Support Forums | Ongoing | Customers needing technical support | Troubleshooting, FAQs, and product-specific solutions |

Customer Outreach Programs

A series of customer outreach programs will be rolled out to build rapport and address specific customer needs. These programs will include online surveys, focus groups, and one-on-one consultations. These programs are aimed at gaining valuable feedback to tailor our offerings to meet customer expectations. Examples include exclusive access to beta programs, early access to new features, and personalized product training sessions.

Maintaining Customer Trust and Loyalty

Maintaining customer trust and loyalty is critical for post-acquisition success. Transparency, clear communication, and consistent support are essential to address any anxieties or concerns. Our commitment to maintaining the highest standards of customer service will be evident in all interactions. Building upon the existing reputation and history of HPS will be critical to maintaining customer trust and loyalty.

Technological Advancements and Innovations

The acquisition opens exciting avenues for technological innovation, promising a richer experience for our customers and expanding our market reach. This section delves into the potential breakthroughs and the strategies for integrating new and existing technologies, outlining a clear path for future growth.The integration of cutting-edge technologies will be pivotal in enhancing existing products and services, creating new ones, and ultimately, driving revenue growth.

A strategic approach to technological integration is crucial to realizing the full potential of this acquisition.

Potential Technologies for Integration

The acquisition presents opportunities to integrate several key technologies to enhance existing products and services. These include cloud-based solutions for increased scalability and reliability, artificial intelligence (AI) for enhanced personalization and automation, and the Internet of Things (IoT) for creating interconnected and intelligent systems.

- Cloud Computing: Leveraging cloud infrastructure allows for faster deployment, greater scalability, and enhanced data security. This will enable more responsive and efficient services for our customers, handling increased data volume and traffic without performance bottlenecks.

- Artificial Intelligence (AI): AI algorithms can analyze vast amounts of customer data to personalize experiences, anticipate needs, and improve product development cycles. For instance, AI-powered recommendations can enhance user engagement, leading to higher satisfaction and potentially new revenue streams.

- Internet of Things (IoT): Integrating IoT devices will create interconnected systems, enabling proactive maintenance, predictive analytics, and a more dynamic interaction with our products. This is particularly beneficial for predictive maintenance and proactive service delivery, reducing downtime and enhancing customer satisfaction.

Product Innovation Opportunities

The acquisition allows for the development of entirely new products and services, leveraging the combined strengths of both organizations. This will involve a careful evaluation of current market trends and customer needs, ensuring new offerings align with these requirements.

- New Product Lines: Combining existing technologies and expertise can create entirely new product lines catering to niche markets and unmet customer needs. This includes developing new hardware and software products that address previously untapped market segments.

- Enhanced Existing Products: Existing products can be significantly enhanced with the integration of new technologies, improving their performance, functionality, and user experience. Examples include adding AI-powered features to existing software products, creating more user-friendly interfaces, and increasing system efficiency.

Integration Timeline

A phased approach to integration is crucial to ensure a smooth transition and maximize the benefits of the acquisition. A well-defined timeline will guide the integration of new technologies, ensuring alignment with strategic objectives.

| Phase | Focus Area | Timeline |

|---|---|---|

| Phase 1 | Assessment of existing infrastructure and identification of critical integration points | Q1 2024 |

| Phase 2 | Initial integration of cloud-based solutions and AI functionalities | Q2 2024 |

| Phase 3 | Pilot programs for new product development and IoT integration | Q3 2024 |

| Phase 4 | Full-scale deployment and optimization of integrated systems | Q4 2024 |

New Market Opportunities

The combined technological capabilities will open doors to new markets and customer segments. This involves a comprehensive market analysis, identifying opportunities in emerging sectors and adapting our offerings to these new markets.

- Expansion into New Market Segments: The combined expertise and resources allow for targeting new customer segments and geographic areas, broadening our market reach. This involves a thorough analysis of the market potential in new sectors.

- Development of New Revenue Streams: The integration of new technologies enables the creation of new revenue streams, generating additional income for the organization. This will include expanding into new subscription models or developing new software as a service (SaaS) offerings.

Customer Experience Enhancement

The integration of these technologies will enhance customer experiences, leading to increased satisfaction and loyalty. This involves a focus on personalization, efficiency, and innovation.

- Personalized Services: AI-driven personalization will enhance the customer journey, tailoring services and products to individual needs. This results in a more efficient and satisfying customer experience.

- Streamlined Processes: Cloud-based solutions and automation will simplify customer interactions, making the experience more streamlined and efficient. This will include improvements in order processing, customer support, and billing.

Market Analysis and Competitive Strategy

The acquisition presents a pivotal moment for HPS, demanding a rigorous assessment of the competitive landscape and a strategic roadmap to capitalize on the opportunities. Understanding the current market dynamics, competitor strategies, and potential new market entry points is crucial for maximizing the value of the acquisition and ensuring long-term success. A clear competitive strategy will define HPS’s position in the post-acquisition era.

Impact on Competitive Positioning

The acquisition significantly alters HPS’s competitive positioning. By integrating the acquired company’s resources and expertise, HPS gains access to new technologies, markets, and customer bases. This expanded reach enhances HPS’s market presence and potentially allows for a broader product portfolio, expanding its customer base and market share. However, this expansion also necessitates a careful re-evaluation of its current offerings and a proactive adaptation to maintain its competitive edge.

Competitive Strategies for Maintaining a Competitive Edge

Maintaining a competitive edge requires a multi-faceted approach. Focusing on innovation and technological advancements will be paramount. Developing unique value propositions, tailored to specific market segments, will be key to attracting and retaining customers. Furthermore, effective cost management and optimized operational efficiency will be vital to maintain profitability and ensure pricing competitiveness. Finally, strengthening relationships with strategic partners will expand the reach and market share.

Comparison of HPS’s Competitors and Their Strategies

Key competitors like Acme Solutions and Zenith Technologies have established market positions through specialized services and targeted customer segments. Acme Solutions, for instance, focuses on a niche market, while Zenith Technologies emphasizes broad market reach. Analyzing competitor strategies, including their pricing models, marketing campaigns, and product development timelines, will enable HPS to identify opportunities for differentiation and exploit market gaps.

Understanding competitor strengths and weaknesses is crucial for developing a winning strategy.

Competitive Landscape After the Acquisition

The competitive landscape after the acquisition will be more complex. The expanded portfolio and enhanced resources will alter the balance of power among competitors. HPS will face intensified competition from established players as well as new entrants leveraging the acquisition’s impact. Consequently, developing and executing a robust market positioning strategy is critical to navigate this new environment.

Potential New Market Entry Strategies

Leveraging the acquisition’s strengths, HPS can explore new market entry strategies. These could include developing entirely new product lines, expanding into untapped geographic markets, or targeting underserved customer segments. Identifying market opportunities and developing tailored strategies will be critical to maximizing the acquisition’s impact on market penetration. Examples include identifying niche markets where the combined resources of HPS and the acquired entity create a distinct competitive advantage.

Impact of the Acquisition on HPS’s Market Share

The acquisition’s impact on HPS’s market share will depend on the effectiveness of its post-acquisition strategy. Successful integration and a focused competitive approach are crucial to capture market share from competitors. The acquisition will provide opportunities to increase market penetration by introducing new products, services, or customer segments. By effectively utilizing the integrated resources, HPS can potentially expand its market share and solidify its position in the industry.

Competitive Advantages and Disadvantages of HPS Post-Acquisition

| Competitive Advantages | Competitive Disadvantages |

|---|---|

| Enhanced product portfolio | Potential integration challenges |

| Access to new technologies | Increased competition |

| Expanded customer base | Need for strategic restructuring |

| Increased market presence | Potential disruption to existing workflows |

| Stronger brand recognition (potentially) | Higher operational costs initially |

Final Review

In conclusion, HPS’s post-acquisition journey presents a complex interplay of opportunities and challenges. The company’s success hinges on effectively navigating these shifts, from operational integration to financial performance and customer engagement. This analysis underscores the need for careful planning and execution to capitalize on the potential of this significant acquisition. Ultimately, the future success of HPS rests on their ability to adapt and innovate in the dynamic technological landscape.