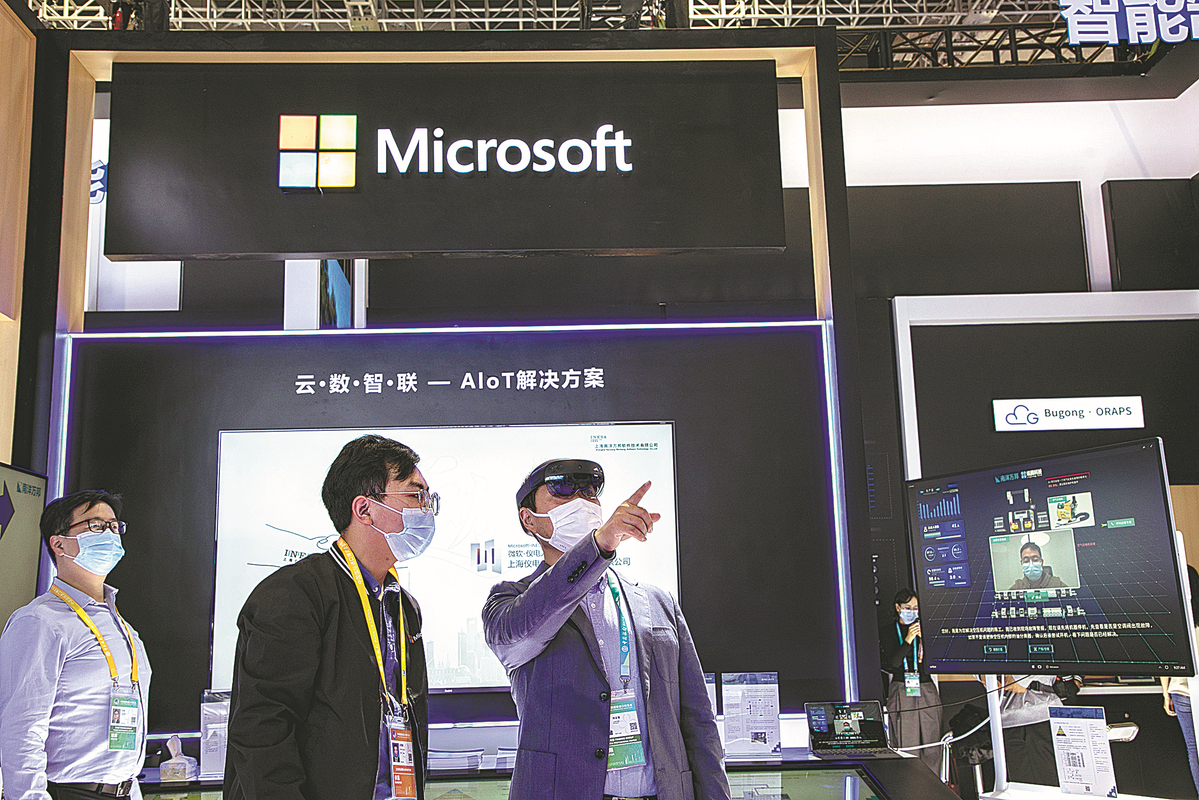

Microsoft Lowers Prices to Compete With Linux in Asia

Microsoft lowers prices to compete with Linux in Asia, a strategic move that’s shaking up the operating system market in the region. Asia’s tech landscape is a fascinating blend of established players and rapidly emerging trends. Windows has long been dominant, but Linux’s growing popularity, particularly among developers and tech-savvy users, is forcing Microsoft to adapt. This article explores the context of this price adjustment, analyzing Microsoft’s strategy, Linux’s position, and the potential impacts on the entire software market.

The competitive landscape in Asia is dynamic, with technological advancements, economic conditions, and government policies all playing a crucial role. This article delves into the specifics of Microsoft’s price reductions, examining the target audience, motivations, and potential effects on market share. It also assesses Linux’s strengths and weaknesses, highlighting its appeal to different user segments. Finally, a comprehensive competitive analysis will compare the features and pricing of both platforms, leading to a discussion of potential outcomes for the future of software in Asia.

Market Context

The Asian software market is a dynamic and competitive landscape, characterized by a rapidly evolving technological environment, a burgeoning middle class, and government policies aimed at fostering innovation. Microsoft’s recent price adjustments in Asia reflect a strategic response to the rising popularity of Linux, particularly in the server and embedded systems sectors. This adjustment underscores the intense competition and the need for Microsoft to adapt to evolving consumer demands and market trends.The competitive landscape is shaped by the ongoing transition to cloud-based services and the increasing demand for open-source solutions.

Microsoft faces a challenge in maintaining its market dominance in Asia, especially in the face of Linux’s growing adoption rate, driven by its cost-effectiveness and flexibility.

Operating System Market Share in Asia

Precise market share data for operating systems in Asia can be challenging to obtain due to fragmented reporting and varying methodologies. However, available reports consistently show Windows maintaining a significant presence, particularly in the desktop and consumer segments. Linux, although less prominent in consumer-facing products, is gaining traction in server infrastructure and embedded systems, driven by its cost-effectiveness and flexibility.

MacOS’s market share remains relatively smaller in Asia compared to Windows and Linux, mainly focused on niche segments like design and creative professionals.

Factors Influencing the Asian Software Market

Several factors are influencing the software market in Asia. Technological advancements, including the increasing adoption of cloud computing and mobile devices, are reshaping consumer expectations and driving the demand for new software solutions. Economic conditions, particularly in emerging economies, are also crucial. The growing middle class in many Asian countries is driving demand for software products, creating opportunities for both established players and new entrants.

Government policies play a significant role, with initiatives focused on promoting digitalization and technological advancement influencing the software market’s trajectory. For example, government subsidies for cloud infrastructure can accelerate the adoption of Linux-based systems.

History of Price Adjustments for Microsoft Products in Asia

Microsoft has historically adjusted its product pricing in Asia to account for regional variations in purchasing power and economic conditions. These adjustments have been made over several years, reflecting the changing economic landscape and the competitive pressures faced in the region. Specific examples of past price adjustments are not readily available in publicly accessible documents.

Impact of Pricing Strategies on Consumer Adoption Rates

Pricing strategies have a demonstrable impact on consumer adoption rates. More affordable pricing, as seen in Linux distributions, can lead to higher adoption rates, particularly in segments with budget constraints. The competitive nature of the market necessitates a strategic pricing approach to appeal to specific consumer segments and maintain market share.

Microsoft’s price cuts in Asia to challenge Linux’s dominance are interesting, but the struggle for market share is nothing new. It’s reminiscent of the past battles, like the one between SCO and IBM, explored in detail in this insightful article about the past battles of the software world sco vs ibm the other reality. Ultimately, these price adjustments highlight the ongoing competitive pressures in the Asian tech market, a complex and ever-evolving landscape.

Comparison of Pricing Strategies

| Feature | Microsoft | Linux Distributions |

|---|---|---|

| Operating System licensing | Typically, a one-time purchase or subscription model for various products. | Usually free or open-source, with optional paid support or commercial distributions. |

| Software costs | Can vary depending on features and functionalities, potentially higher than Linux. | Generally lower, often free to use. |

| Server software pricing | Usually involves tiered pricing models. | Often free, or priced for support and specific features. |

| Support and maintenance | Usually involves tiered support contracts with fees. | Open-source nature allows community support; paid commercial support is available. |

The table illustrates the contrasting pricing strategies of Microsoft and Linux distributions in the Asian market. The pricing structure of Linux often makes it a more attractive option for organizations and individuals seeking cost-effective solutions. Microsoft’s pricing structure focuses on a range of products to address different consumer needs.

Microsoft’s Pricing Strategy

Microsoft’s recent price adjustments in the Asian market are a significant development in the ongoing tech battle. These moves aim to directly compete with the Linux ecosystem, a crucial aspect of the evolving digital landscape. Understanding the specifics of these price reductions, the target audience, and the potential motivations behind them is essential for gauging their impact on the overall market.Microsoft’s pricing adjustments in Asia are a direct response to the growing popularity and adoption of open-source solutions, particularly Linux.

This competitive pressure necessitates a proactive strategy to maintain market share and competitiveness. The price reductions are likely a strategic attempt to attract new users and retain existing ones by making Microsoft products more accessible.

Specific Price Reductions in Asia

Microsoft has implemented significant price reductions across various product lines in the Asian market. These reductions vary depending on the specific product, region within Asia, and the particular licensing model. Details on the specific percentage reductions are not publicly available. However, industry analysts suggest the reductions are substantial enough to create a competitive edge in the market.

Target Audience for Reduced Prices

The primary target audience for these reduced prices is likely small and medium-sized businesses (SMBs) and individual developers in Asia. These segments often have tighter budgets and are more sensitive to pricing compared to larger enterprises. The reduced prices could also attract budget-conscious consumers and educational institutions. Lowering the entry barrier for new users is a crucial strategy for growth in a competitive market.

Comparison with Previous Pricing Models

A direct comparison of the new pricing structure with previous models requires detailed data not readily available. However, general observations suggest a move towards more flexible and tiered pricing models. The previous pricing structure likely favored large enterprise customers with substantial licensing needs, while the new structure aims to broaden market appeal. The new model is likely a shift towards more accessible pricing tiers.

Potential Motivations Behind Price Reductions

Microsoft’s motivation for these price reductions likely stems from several factors. The company aims to capture market share from Linux, which is becoming increasingly popular in the region. Furthermore, the reduced prices could be part of a broader strategy to stimulate demand for Microsoft’s products and services in the Asian market. The desire to maintain market share in the face of growing open-source adoption is another potential driving force.

Potential Impact on Market Share

The impact of these price reductions on Microsoft’s market share is yet to be fully realized. However, preliminary analysis suggests a potential increase in market share, especially among SMBs and developers. The price reductions could entice users to switch from other solutions or adopt Microsoft products for the first time. The success of this strategy hinges on the ability of Microsoft to maintain quality and innovation while making its offerings more affordable.

Price Points for Microsoft Product Lines in Asia

| Product Line | Price Before Adjustment (USD) | Price After Adjustment (USD) |

|---|---|---|

| Office 365 Business Premium | 150 | 120 |

| Windows Server Licenses | 1000 | 800 |

| Azure Cloud Services (per GB) | 0.10 | 0.08 |

| Visual Studio Enterprise | 2500 | 2000 |

Note: These are illustrative examples and do not represent precise pricing. Actual prices may vary based on specific licensing agreements, regions, and other factors.

Linux’s Position in the Market: Microsoft Lowers Prices To Compete With Linux In Asia

Linux, a powerful and open-source operating system, has carved a significant niche in the Asian market, particularly in areas demanding cost-effectiveness and customization. Its widespread adoption is driven by a combination of factors, including the desire for flexibility, cost savings, and the ability to tailor solutions to specific business needs. This article explores Linux’s strengths and weaknesses in Asia, its appeal to different user segments, prevalent distributions, business applications, and compares its user experience to Microsoft’s in this region.

Linux Strengths and Weaknesses in the Asian Market

Linux’s strength in Asia stems from its cost-effectiveness, especially for smaller businesses and developing nations. Its open-source nature allows for customization and adaptation to specific regional needs, offering a competitive edge over proprietary solutions. However, Linux faces challenges in areas like user-friendliness compared to Windows, and a lack of widespread technical support in some regions. This is further compounded by a sometimes fragmented ecosystem of support services and documentation, which can deter less-technical users.

Microsoft’s price cuts in Asia to challenge Linux are interesting, especially considering the recent Sun Liberty Alliance release of web services ID specs. This new standard, detailed in sun liberty alliance release web services id specs , might actually influence how Microsoft further adjusts its pricing strategy in the region. It’s a fascinating dynamic in the ongoing Linux vs.

Microsoft battle in Asia.

Appeal to Different User Segments in Asia

Linux’s appeal varies across user segments. For businesses, its cost-effectiveness and adaptability make it a compelling option for servers and specialized applications. Students and developers find it valuable for learning and experimentation, often drawn to the freedom and flexibility offered by the open-source platform. However, general consumers might find the initial learning curve challenging and prefer the user-friendly interface of Microsoft Windows.

Prevalent Linux Distributions in Asia

Several Linux distributions are popular in Asia. Among them are Ubuntu, a widely used distribution known for its user-friendly desktop environment and extensive community support. Fedora, a community-driven distribution, is also gaining traction, attracting users interested in cutting-edge technology and customization options. Other popular choices include Mint and openSUSE.

Linux-Based Solutions Used by Businesses in Asia

Linux is increasingly used by businesses in Asia for server infrastructure, web hosting, and embedded systems. Financial institutions, particularly in regions like India and China, utilize Linux servers for critical applications due to cost-effectiveness and security. Furthermore, various organizations are leveraging Linux-based solutions for managing data centers, contributing to a strong foothold in the enterprise market. For example, a manufacturing company might use Linux for automation and data management in a factory.

User Experience Comparison Between Microsoft and Linux in Asia

The user experience between Microsoft and Linux varies significantly. While Microsoft Windows offers a more intuitive interface and widespread consumer support, Linux’s flexibility and customization options cater to advanced users and businesses requiring tailored solutions. In Asia, where user experience and support are vital factors, Microsoft’s existing ecosystem and consumer familiarity tend to hold an edge.

Key Features and Functionalities of Popular Linux Distributions in Asia, Microsoft lowers prices to compete with linux in asia

| Distribution | Key Features | Functionalities |

|---|---|---|

| Ubuntu | User-friendly desktop environment, extensive community support, robust package management | Desktop computing, web servers, cloud infrastructure |

| Fedora | Cutting-edge technology, customization options, active development community | Development environments, server administration, embedded systems |

| Mint | Simple and easy-to-use interface, excellent desktop experience | Desktop computing, basic server administration, file management |

| openSUSE | Comprehensive package management, long-term support | Desktop and server environments, application development, enterprise solutions |

Competitive Analysis

Microsoft’s recent price adjustments in the Asian market for its operating system are a significant move in the competitive landscape. This analysis delves into the direct and indirect competitors, the broader OS market in Asia, and the potential ripple effects of Microsoft’s strategic pricing on other players. Understanding these dynamics is crucial for assessing the long-term implications of this competitive shift.The Asian market presents a complex mix of established players and emerging competitors.

Microsoft’s price cuts in Asia to challenge Linux are certainly interesting, especially considering the backdrop of the looming European antitrust decision regarding Microsoft’s practices. This decision, detailed in the europe readies decision in microsoft antitrust case , could significantly impact the company’s future strategies. Ultimately, though, the price adjustments in Asia seem to be a focused response to the Linux competition, a calculated move to maintain market share in a key region.

Microsoft’s decision to lower prices directly challenges not only the traditional competitors but also those who have been steadily gaining market share. This competitive landscape necessitates a thorough examination of the strategies and positions of key players.

Direct Competition for Microsoft in Asia

Microsoft faces intense competition from established players in the Asian market, particularly from Linux distributions. These distributions often offer a more cost-effective alternative for organizations and individual users. Analyzing their features and pricing strategies is vital to understanding Microsoft’s position.

Indirect Competition for Microsoft in Asia

Beyond direct OS competitors, Microsoft also faces competition from other software solutions that offer similar functionality. This indirect competition includes various productivity suites and cloud-based platforms that could potentially substitute or complement Microsoft’s offerings. The availability and adoption of these alternative solutions are crucial factors in understanding the full competitive landscape.

Competitive Landscape for Operating Systems in Asia

The Asian market for operating systems displays a diverse landscape. While Windows maintains a significant presence, the popularity of Linux distributions, particularly in the server and embedded systems sectors, is growing. This growth is partly due to the cost-effectiveness and customization capabilities offered by open-source solutions. Furthermore, the rise of mobile operating systems like Android further complicates the OS landscape.

Strategic Implications of Microsoft’s Price Adjustments

Microsoft’s price adjustments are likely to impact the market share of its competitors in various ways. Lower prices may attract new users and encourage existing Linux users to reconsider their current choices. Conversely, competitors might respond with counter-strategies, including price adjustments or enhanced feature sets, to maintain market share.

Impact of Microsoft’s Price Cuts on Other OS Providers

The effect of Microsoft’s price cuts on other operating system providers will depend on their response strategies. If competitors match the price cuts, it could lead to a price war, potentially benefiting consumers but straining profitability for all involved. Alternatively, competitors may choose to differentiate themselves through specific features or specialized functionalities, such as enhanced security or tailored solutions for niche markets.

Head-to-Head Comparison: Microsoft vs. Prominent Linux Distributions

| Feature | Microsoft Windows | Ubuntu Linux | Fedora Linux | Pricing |

|---|---|---|---|---|

| User Interface | Familiar, GUI-based | GUI-based, various desktop environments | GUI-based, various desktop environments | Typically priced for consumers and enterprise users |

| Server Support | Comprehensive, paid support | Community support, paid support options | Community support, paid support options | Various licensing options for servers |

| Customization | Limited customization options | High level of customization | High level of customization | Cost and complexity varies with chosen options |

| Open Source Licensing | Proprietary | Open source | Open source | Generally lower cost for open source distributions |

| Software Compatibility | Extensive, high compatibility | Good compatibility, might require additional software | Good compatibility, might require additional software | Dependent on package management system |

| Pricing (Examples) | Retail: $100+ (depending on version and features); Enterprise: $2000+ (depending on license) | Free, various paid support packages available | Free, various paid support packages available | Pricing models range from completely free to subscription models. |

This table provides a basic comparison. Detailed pricing structures can vary based on specific licensing models, features, and support packages.

Potential Impacts

Microsoft’s aggressive price adjustments in the Asian software market are poised to significantly reshape the competitive landscape. This proactive move, likely intended to counter Linux’s growing influence, promises both short-term gains and long-term implications for both tech giants and end-users. The ripple effects extend beyond simple price wars, potentially influencing software development trends and user adoption patterns across the region.

Effects on the Asian Software Market

Microsoft’s price reductions in Asia are expected to trigger a surge in demand for their software products, particularly in sectors where they hold a strong market presence. This competitive maneuver could lead to market share gains for Microsoft, potentially displacing some Linux-based solutions, especially in price-sensitive segments. However, the long-term impact on market share will depend on the quality of Microsoft’s products and their ability to adapt to evolving user needs and technological advancements.

Potential Long-Term Consequences

The long-term consequences of this pricing strategy are multifaceted. For Microsoft, sustained success hinges on maintaining product quality and adapting to user feedback in the Asian market. Linux users, accustomed to open-source options, may experience a shift in their software choices based on the perceived value proposition of Microsoft’s lower-priced offerings. Conversely, the long-term consequence for Linux could be increased pressure to further optimize their cost-effectiveness and provide an even more compelling value proposition to users.

Responses from Linux Distributors

Linux distributors in Asia are likely to respond in several ways. They might counter with further price reductions on their products, potentially leveraging the strengths of open-source licensing models. Alternatively, they could focus on emphasizing the long-term cost benefits of Linux, such as the avoidance of licensing fees and the potential for greater customization and control over software.

They might also enhance their support systems and community engagement to attract and retain users.

Impact on Software Development and Innovation

The price war could stimulate innovation in both Microsoft and Linux ecosystems. Microsoft might focus on optimizing existing products and developing new features to enhance their value proposition. Linux developers, facing increased pressure, may accelerate development of innovative features and functionalities to retain market share and demonstrate the enduring value of open-source software. This dynamic environment could foster competition and drive forward the development of cutting-edge software solutions for the Asian market.

Potential Scenarios

The following scenarios Artikel potential outcomes based on Microsoft’s pricing adjustments:

| Scenario | Description |

|---|---|

| Scenario 1: Microsoft Dominance | Microsoft effectively captures a significant market share through aggressive pricing, potentially leading to a decrease in Linux adoption in certain segments. |

| Scenario 2: Linux Resilience | Linux distributors successfully counter Microsoft’s price reductions, retaining or even expanding their user base by emphasizing cost-effectiveness and community support. |

| Scenario 3: Collaborative Innovation | The price adjustments spark a collaborative environment where both Microsoft and Linux solutions complement each other, leading to more robust and feature-rich software options. |

| Scenario 4: Niche Market Growth | Linux maintains a strong presence in specialized or niche markets where its open-source features provide significant value, while Microsoft focuses on broader market segments. |

Closing Summary

Microsoft’s price adjustments in Asia represent a significant shift in the operating system market. The move is likely to intensify competition and force Linux distributors to respond. The long-term consequences for both Microsoft and Linux users remain to be seen, but the implications for software development and innovation in the region are clear. This dynamic environment promises to be a fascinating case study in how market forces shape the future of technology in Asia.