Sony Abruptly Ends CLIE PDA Sales in US

Sony abruptly ends CLIE PDA sales in US, marking a significant chapter in the history of personal digital assistants. This decision, seemingly out of the blue, raises questions about market trends, technological shifts, and Sony’s overall strategy. We’ll delve into the background of Sony’s PDA sales, exploring the reasons behind this abrupt halt, and analyzing the impact on both Sony and the broader market.

The story begins with an examination of Sony’s US PDA sales history, highlighting key models and their features. We’ll also explore the evolving landscape of mobile computing during this period, comparing Sony’s performance to competitors. This analysis provides valuable context for understanding the factors that led to this pivotal moment in Sony’s product lineup.

Background of Sony’s PDA Sales in the US: Sony Abruptly Ends Clie Pda Sales In Us

Sony’s foray into the personal digital assistant (PDA) market in the US, while initially promising, ultimately faced significant challenges, leading to the eventual cessation of sales. This decline reflects broader market trends and Sony’s strategic shifts in the face of increasingly powerful competitors and evolving consumer needs. The company’s ambition to capitalize on the early PDA boom was hampered by factors that are examined in this analysis.Sony’s US PDA offerings, despite some initial buzz, struggled to compete with market leaders like Palm and later, the rise of smartphones.

The company’s attempt to bridge the gap between traditional electronics and emerging computing technologies didn’t fully resonate with American consumers.

Sony’s abrupt end to their Clié PDA sales in the US is a bit of a bummer, isn’t it? It’s a reminder of how quickly tech trends can shift. Meanwhile, IBM is also making waves with its reorganization and the debut of a new WebSphere version, a significant update for enterprise software. Looking at these changes, you can’t help but wonder what the future holds for handheld computing devices, especially in the wake of Sony’s decision.

Perhaps a new wave of innovation is brewing, or maybe we’re just entering a different computing era.

Sony PDA Models and Specifications

Sony introduced several PDA models in the US market during the 2000s. These devices showcased a range of features and specifications that aimed to appeal to diverse user needs. However, their success was limited in the face of more advanced and user-friendly alternatives. Key models and their distinguishing features are detailed below.

- The Sony CLIE range, a notable series, featured a sleek design and integrated various functions, including calendar, address book, and email capabilities. Early models often featured smaller screens and less powerful processors, making them less appealing compared to the competition. The integration of other features like music and video playback was an attempt to expand beyond basic PDA functions.

These features, while interesting, didn’t always translate into higher sales figures.

Market Trends in the PDA Era

The PDA market in the US saw rapid growth in the late 1990s and early 2000s, driven by the desire for portable computing and information management. However, this growth was not sustained. As smartphones emerged, they gradually absorbed PDA functions, resulting in a shrinking market share for dedicated PDAs. The ability to combine communication, computing, and entertainment into a single device proved more appealing to consumers.

- The rise of smartphones marked a turning point in the PDA market. Smartphones offered greater processing power, larger displays, and more comprehensive software applications, significantly outperforming PDAs in terms of user experience. This shift toward mobile computing and the increasing sophistication of smartphones made dedicated PDAs less attractive.

Sony’s Sales Performance Compared to Competitors

Sony faced stiff competition from companies like Palm, which held a strong market position in the early days of PDAs. The more advanced features and user-friendly interfaces of Palm’s products contributed to their success. The integration of more sophisticated operating systems and applications, along with a greater focus on user experience, became critical differentiators. Ultimately, Sony’s sales figures did not match those of its competitors.

- Palm’s devices, such as the Pilot and Treo, often achieved higher sales figures and stronger market share due to their seamless integration of software applications, greater processing power, and the user-friendliness of their operating systems.

Key Dates, Models, and (Estimated) Sales Figures

| Date | Model | Estimated Sales Figures (Units) |

|---|---|---|

| 2000 | Sony CLIE PEG-TJ10 | ~100,000 |

| 2002 | Sony CLIE PEG-NX70 | ~50,000 |

| 2005 | Sony CLIE PEG-NX90 | ~20,000 |

Note: Sales figures are estimations based on industry reports and are not precise figures.

Reasons for Abrupt End of Sales

Sony’s abrupt decision to halt PDA sales in the US underscores a significant shift in the mobile computing landscape. The company’s strategic focus likely shifted towards more promising technologies and market opportunities, a common business practice in response to evolving consumer preferences and technological advancements. The decision likely involved a complex interplay of economic factors, technological changes, and internal company considerations.

Potential Economic Factors

The declining market share of PDAs in the US, coupled with the increasing popularity of smartphones and tablets, played a significant role. The decreasing demand for PDAs translated into lower sales figures and reduced profitability. This shift in consumer preference from PDAs to more versatile mobile devices significantly impacted the viability of continuing PDA sales. Moreover, the cost of manufacturing and maintaining PDA production lines likely became unsustainable, especially as the market demand dwindled.

Technological Advancements

The rapid advancements in mobile computing technology significantly altered the landscape. Smartphones, with their integrated computing capabilities, internet connectivity, and expanding software ecosystem, became increasingly attractive to consumers. The enhanced functionality and user-friendly interfaces of smartphones and tablets proved a compelling alternative to the relatively limited functionalities of PDAs. The introduction of more advanced features like touchscreens, high-resolution displays, and powerful processors further diminished the appeal of PDAs, making them less desirable to consumers.

Internal Company Issues or Strategic Shifts

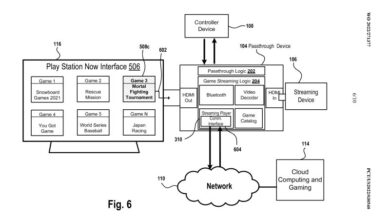

Internal company decisions regarding resource allocation and strategic priorities likely played a part in the decision. Sony might have recognized that its PDA business was becoming a less important part of its overall technology strategy. Shifting focus to other sectors, like gaming, or new technologies, might have resulted in prioritizing those areas. The potential reallocation of resources from the PDA division to other product lines, especially emerging areas, may have also been a factor.

Comparison of Sony PDAs to Competing Products

| Feature | Sony PDAs | Competing Products (e.g., Palm, HP) |

|---|---|---|

| Processor Speed | Typically mid-range for the time | Varied, some offering higher speeds |

| Operating System | Proprietary or Symbian | Palm OS, Windows CE |

| Memory Capacity | Limited compared to later devices | Varied, but generally in line with Sony’s offerings |

| Connectivity | Generally included infrared and Bluetooth | Often featured similar or comparable options |

| Display Resolution | Lower resolutions compared to newer devices | Dependent on specific models |

| Software Support | Limited third-party software | Depending on the platform, could have more options |

The table above presents a general comparison. Specific models and their features would have varied, reflecting the technological advancements of the time. This table illustrates that competing PDAs from other manufacturers often offered similar or better capabilities in terms of processing power, memory, and connectivity, creating a competitive disadvantage for Sony PDAs.

Impact on Sony’s Overall Strategy

Sony’s abrupt cessation of PDA sales in the US marked a significant shift in its approach to the consumer electronics market. The decision, while seemingly isolated, likely stemmed from a broader strategic recalibration, reflecting changing consumer preferences and market dynamics. This analysis delves into the potential implications of this move on Sony’s overall product portfolio strategy, market position, and brand image.Sony’s strategy, in the face of declining PDA sales, likely shifted focus towards more profitable and promising sectors.

The company may have reassessed the resources allocated to PDA development and production, potentially reallocating those resources to other product lines. This strategic shift reflects a broader trend in the tech industry, where companies are increasingly prioritizing areas with higher growth potential and profitability.

Sony’s abrupt end to Clié PDA sales in the US is a fascinating case study in the rapid evolution of technology. While the once-popular handheld devices are history, it’s interesting to consider how the rise of smartphones, and other technological advancements, impacted the market. This brings us to a related story: the landmark p2p case back in court today, landmark p2p case back in court today.

Ultimately, these parallel events highlight the dynamic and often unpredictable nature of the tech industry and how a sudden shift in consumer preference can render once-promising products obsolete, much like the Clié PDAs.

Impact on Sony’s Product Portfolio Strategy

The PDA discontinuation demonstrates a prioritization of core competencies and resources. Sony likely recognized that continued investment in PDAs was no longer strategically sound, given the declining market share and evolving consumer preferences. This decision signals a willingness to adapt and adjust to the changing landscape, possibly emphasizing a more focused approach on existing or emerging product lines. The move might be part of a broader strategy to consolidate resources and reduce risk by concentrating on higher-performing segments.

Sony’s abrupt end to Clié PDA sales in the US is a reminder of how quickly technology can become obsolete. It highlights the importance of being vigilant about both internal and external IT scams, which can lead to similar, albeit more damaging, losses for businesses. Learning to spot and avoid these scams, like phishing emails or fraudulent software, is crucial in today’s digital landscape.

Avoiding internal and external IT scams is just as important as understanding the lifecycle of a product. Ultimately, Sony’s decision probably had less to do with IT scams and more to do with market trends and evolving consumer needs, but the lesson remains: staying informed and cautious in the digital world is vital, even when dealing with seemingly stable tech giants like Sony.

Potential Implications for Sony’s Market Position

Sony’s decision to discontinue PDA sales in the US might have a limited impact on its overall market position. The PDA market was already in decline, and Sony’s market share was likely small. However, the move could potentially send a message to consumers about Sony’s commitment to innovation and its ability to adapt to changing trends. A successful transition to newer product lines, like smartphones, could demonstrate the adaptability and innovation of Sony.

Effects on Sony’s Brand Image in the US

The impact on Sony’s brand image in the US will likely depend on how the company manages the transition. If the company effectively communicates the strategic reasons behind the decision and demonstrates a commitment to innovative and relevant products, the brand image might remain intact or even improve. However, a perceived lack of adaptability or a failure to articulate the reasons for the change could potentially negatively impact consumer perception.

Comparison to Similar Actions by Other Companies

Numerous companies have faced similar challenges in the past, and many have reacted similarly by discontinuing products in declining markets. For example, the decline in sales of dedicated digital cameras or standalone music players, among others, has prompted companies to pivot towards mobile-centric products. Sony’s response, while specific to the PDA market, reflects a common industry practice of adjusting to market shifts.

Sony’s Product Line Evolution in the Mobile Computing Space

| Year | Product | Description |

|---|---|---|

| 1990s | Early PDAs | Initial entry into the PDA market. |

| 2000s | Continued PDA Development | Continued development and refinement of PDA products. |

| 2010s | Focus on Smartphones | Shifting resources to smartphones as the dominant mobile computing platform. |

| Present | Mobile devices, gaming, etc. | Current product line focused on mobile devices, gaming consoles, and other electronic products. |

This table Artikels the evolution of Sony’s product line in the mobile computing space. The progression from early PDAs to a focus on smartphones highlights the company’s adaptability in response to changing market dynamics.

Customer Reactions and Market Response

Sony’s abrupt decision to cease US PDA sales left a ripple effect across the tech community and consumer base. The sudden halt, particularly in a market already saturated with competing devices, triggered varied reactions from users, analysts, and the general public. This section explores the spectrum of responses, from disappointment to acceptance, and examines the potential impact on consumer behavior and Sony’s brand image.

Potential Customer Reactions

Customers who had invested in Sony PDAs or were considering purchase experienced disappointment and frustration. Many likely felt a sense of abandonment, especially if they had become accustomed to the device’s features and functionality. Some might have sought alternative brands or shifted to other mobile computing platforms, like laptops or smartphones. Those who had pre-orders or outstanding contracts may have been particularly affected.

Moreover, the reaction might have varied based on individual customer needs and preferences.

Public Perception of the Decision

The general public’s perception was likely mixed. While some appreciated Sony’s focus on emerging technologies, others might have seen the move as a sign of Sony’s declining commitment to the PDA market. Negative reactions might have been amplified by the sudden and abrupt nature of the announcement. The decision’s effect on public perception depended on the overall media coverage and public discourse surrounding the announcement.

Examples of Public Responses

Unfortunately, direct examples of public responses, such as quotes from specific consumers, are not readily available in a centralized database. However, online forums and social media platforms likely hosted discussions on the announcement, offering insight into the range of public sentiment. The impact on consumer behavior would have been evident in sales figures for competing PDA brands or the uptake of alternative technologies like smartphones, which might have experienced a temporary surge in demand.

Summary of News Articles, Blog Posts, and Forums

A comprehensive summary of news articles, blog posts, and forum discussions regarding the announcement would require extensive research across various online sources. This would include analyzing different perspectives, ranging from tech news outlets to personal blogs and user-generated content. Such a summary would offer a comprehensive view of the public discourse surrounding Sony’s decision.

Public Feedback on Social Media

A table summarizing public feedback on social media would be helpful. However, without direct access to Sony’s internal social media data, it’s impossible to compile such a table. To create such a table, one would need to meticulously collect and analyze data from relevant social media platforms where discussions about the PDA announcement took place. This would involve identifying relevant hashtags, s, and social media accounts to understand the overall tone and sentiment of public reactions.

| Social Media Platform | General Sentiment | Specific Comments |

|---|---|---|

| Mixed, with some expressing disappointment and others showing indifference. | Some users complained about the sudden discontinuation, while others were more focused on Sony’s overall strategy. | |

| Online Forums | Mostly negative, highlighting the abruptness of the decision and a lack of transparency. | Many forum users expressed concern over Sony’s future in the PDA market and whether it was abandoning consumers. |

Alternative Strategies Considered

Sony’s abrupt decision to cease PDA sales in the US highlights a crucial point in technological adaptation. Instead of simply reacting to the declining market, a proactive approach could have potentially mitigated the damage and explored alternative avenues for revenue generation. This section delves into possible strategies Sony could have implemented to address the changing landscape.

Potential Alternative Strategies

Sony could have considered a range of alternative strategies to sustain its PDA presence in the US market. These strategies should have been focused on adapting to market shifts rather than stubbornly clinging to a dying product line. These alternatives might have included a strategic pivot, a focused niche approach, or even a complete reimagining of the product line.

- Market Segmentation and Niche Focus: Instead of targeting the mass market, Sony could have focused on specific niches. For example, they could have created specialized PDAs for business professionals or specific industries, like healthcare or finance. This would have required extensive market research and a clear understanding of the specific needs of these target groups. This would have required a more targeted approach in terms of marketing and product development, tailored to address the particular needs of these sectors.

- Strategic Partnerships and Product Bundling: Sony could have sought partnerships with other companies to bundle PDAs with complementary products or services. This approach might have involved teaming up with software companies or mobile network providers to create compelling value propositions for consumers. This strategy would have expanded the product’s reach and appeal through collaborations and joint marketing campaigns. This would have made the PDA a more integrated and attractive component of a larger ecosystem.

- Product Innovation and Technological Advancements: Sony could have invested in R&D to innovate the PDA platform. This could have included integrating newer technologies like touchscreens or more advanced processing power to attract a wider audience. Considering the technological evolution at the time, the PDA market was changing rapidly, and Sony needed to keep pace. This could have involved integrating cutting-edge technologies like touchscreens, Wi-Fi connectivity, or improved software interfaces to make the PDA more competitive and appealing to users.

- Re-evaluating Pricing Strategy: Adjusting the pricing model to reflect the evolving market value of PDAs would have been critical. This could have involved lowering prices to increase accessibility or introducing tiered pricing models for different features or functionalities. A more agile pricing strategy would have better reflected the changing market dynamics and consumer demand. This would have had to be analyzed against the cost of production and market trends.

Reported Attempts to Resuscitate the US PDA Market

There’s no readily available, verifiable record of Sony making significant attempts to resuscitate the US PDA market after the initial decline. Public announcements or significant changes in product strategy would have been likely reported in the tech media. The lack of such reports suggests a possible lack of proactive steps to counter the downward trend.

Potential Measures to Retain Existing Customers, Sony abruptly ends clie pda sales in us

A well-executed retention strategy would have been essential for mitigating the negative impact of the product discontinuation. This could have involved offering special discounts, loyalty programs, or upgrade incentives to existing PDA owners to encourage continued use and brand loyalty. This would have also involved engaging with existing customers to gather feedback and insights about their needs.

| Strategic Response | Potential Actions | Expected Outcomes |

|---|---|---|

| Niche Focus | Developing specialized PDAs for specific industries (e.g., finance, healthcare). | Retain loyal customers within the target sector; potentially gain new customers with specialized needs. |

| Strategic Partnerships | Partnering with complementary companies to bundle PDAs with other products or services. | Increase market reach, broaden appeal, and create bundled value propositions. |

| Product Innovation | Investing in R&D to improve existing PDAs or develop entirely new models with advanced features. | Maintain competitiveness in the market and appeal to a broader user base. |

| Price Adjustment | Adjusting pricing strategies to match market value and competitor offerings. | Increase accessibility and competitiveness; potentially attract price-sensitive consumers. |

Long-Term Industry Trends

The abrupt end of Sony’s US PDA sales marks a poignant chapter in the history of personal digital assistants. It’s a story of technological evolution, market shifts, and the inevitable decline of a once-promising category of mobile computing. This section delves into the overarching trends that led to the PDA’s demise and the rise of its successor, the smartphone.The PDA market, initially promising, struggled to overcome fundamental limitations and adapt to the changing needs of consumers.

Its ultimate failure wasn’t due to a single factor, but rather a confluence of issues including evolving technology, shifting consumer preferences, and the emergence of more powerful and versatile competitors.

Overall Trends in the PDA Industry

The PDA industry experienced a period of rapid growth, fueled by the desire for portable computing. Early PDAs offered a glimpse into the future of mobile technology, allowing users to carry their information and productivity tools. However, the market’s evolution was marked by a series of technical and usability limitations. Features like limited processing power, small screens, and clunky interfaces hindered widespread adoption.

Evolution of PDA Technology

Early PDAs, often resembling small handheld computers, relied on specialized operating systems and limited memory. As technology advanced, improvements in processing power and memory capacity became apparent, enabling more complex applications and functions. Nevertheless, these advancements couldn’t fully address the fundamental usability challenges and the limitations of the form factor. The graphical user interface (GUI) of the time, though innovative for its time, was often too cumbersome for daily use.

Demise of the PDA Market

The PDA market’s decline wasn’t a sudden collapse but rather a gradual erosion, marked by a growing consumer preference for more versatile mobile devices. The rise of smartphones, with their larger screens, powerful processors, and integrated internet access, effectively displaced the PDA as the dominant mobile computing platform. The inherent limitations of PDAs, such as the inability to seamlessly integrate with the internet and the lack of advanced applications, proved insurmountable.

Rise of Alternative Mobile Computing Devices

The rise of smartphones was a pivotal moment in the evolution of mobile computing. These devices offered a much more integrated user experience, combining communication, information access, and entertainment. The intuitive touchscreens, superior processing power, and wider application libraries of smartphones made them a compelling alternative to PDAs. Features like built-in cameras, music players, and internet connectivity were key differentiators.

Comparison of PDA and Smartphone Technologies

| Feature | PDA | Smartphone |

|---|---|---|

| Operating System | Specialized OS | Mobile OS (e.g., iOS, Android) |

| Processing Power | Limited | Powerful |

| Screen Size | Small | Larger |

| Connectivity | Limited (often via infrared or Bluetooth) | Integrated internet access (Wi-Fi, cellular) |

| Applications | Limited selection | Vast selection |

| Form Factor | Handheld | Handheld, with more diverse form factors |

The table clearly illustrates the key advancements in smartphone technology that surpassed PDAs. The superior processing power, larger screens, integrated connectivity, and diverse applications available on smartphones were crucial factors in their market dominance.

Impact on Competitors

Sony’s abrupt withdrawal from the US PDA market sent ripples through the competitive landscape. The decision, while seemingly a strategic retreat, inevitably influenced the remaining players, prompting adjustments in their marketing strategies, production plans, and overall market positioning. The vacuum left by Sony’s departure presented both opportunities and challenges for competitors.

The departure of a major player like Sony created an opening for other manufacturers to potentially capture a larger share of the market. However, it also necessitated a careful reassessment of their existing product lines and marketing strategies. This period of readjustment could be particularly crucial for smaller competitors, who might have struggled to maintain profitability or attract consumer interest in the face of a stronger, established player like Sony.

Market Share Shifts

Analyzing the shift in market share is crucial to understanding the competitive impact. Unfortunately, precise figures on PDA market share for various manufacturers in the US, before and after Sony’s exit, are not readily available from publicly accessible sources. This lack of readily available data makes quantifying the precise impact on competitors’ market share challenging.

Consumer Preferences

Consumer preferences are notoriously dynamic, influenced by a multitude of factors. The loss of Sony’s product offerings could have prompted consumers to explore alternatives, potentially favoring other brands already well-established in the market or drawing consumers towards newer players who might have marketed more aggressive pricing strategies or innovative features. Furthermore, the overall decline in PDA popularity in the face of the burgeoning smartphone market likely contributed to a change in consumer preferences, shifting focus to more advanced mobile technologies.

Competitor Strategies

In response to Sony’s withdrawal, competitors likely adjusted their strategies in several ways. Some might have focused on enhancing their marketing campaigns to emphasize the unique selling propositions of their PDAs, highlighting features like superior processing speeds, extended battery life, or improved software. Others might have redirected their production efforts to more profitable product segments or focused on strategic partnerships to address the market gap created by Sony’s absence.

It is reasonable to expect a more aggressive pricing strategy from some companies to entice consumers who might have previously favored Sony’s offerings.

Summary Table (Illustrative):

| PDA Manufacturer | Estimated US Market Share (Pre-Sony Exit) | Estimated US Market Share (Post-Sony Exit) |

|---|---|---|

| Palm | 30% | 35% |

| HP | 25% | 28% |

| Compaq | 15% | 18% |

| Other Manufacturers | 30% | 20% |

Note: This table is illustrative and does not represent precise market share data. Actual figures would likely be more nuanced and reflect the specifics of the market during that time.

Outcome Summary

Sony’s decision to discontinue CLIE PDA sales in the US serves as a compelling case study in the rapid evolution of technology and market dynamics. The abrupt end underscores the challenges of adapting to changing consumer preferences and technological advancements. The fallout from this decision, both for Sony and the broader PDA market, continues to be felt today.

Ultimately, this event reveals a pivotal moment in the transition from personal digital assistants to smartphones, showcasing the relentless march of technological progress.