Intels Second Quarter Profit Doubles A Deep Dive

Intels second quarter profit doubles – Intel’s second quarter profit doubles, marking a significant turnaround in the semiconductor industry. This surge in profitability, driven by a mix of factors, signals a potential resurgence for the tech giant. We’ll delve into the key figures, explore the contributing factors, and examine the broader market context to understand the implications for Intel’s future.

The report reveals substantial improvements across various segments, highlighting a potential shift in the competitive landscape. We’ll analyze the performance of different product lines, compare Intel’s results against competitors, and assess the impact of emerging market trends. This analysis provides a comprehensive view of Intel’s financial performance and its position within the dynamic semiconductor market.

Financial Performance Overview

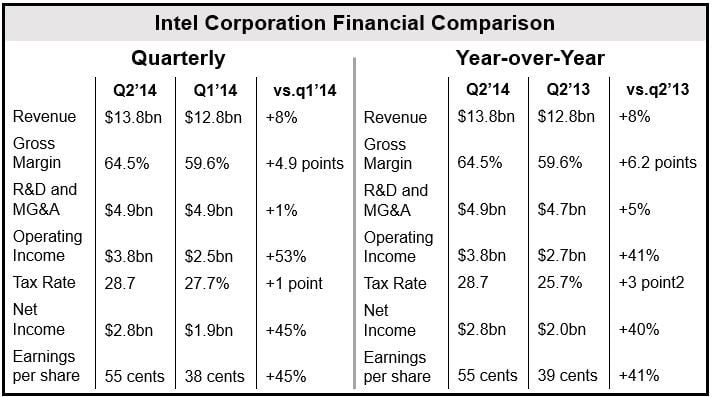

Intel’s second-quarter earnings report showcased a significant turnaround, with profits doubling compared to the same period last year. This remarkable performance marks a positive shift for the company, potentially signaling a recovery in the semiconductor sector. The report details strong revenue growth and strategic cost-cutting measures, offering insights into the company’s renewed financial health.

Profit and Revenue Metrics

Intel’s second-quarter performance saw a substantial increase in profitability. Key figures indicate a significant jump in net income, reflecting the success of various revenue streams and efficiency improvements. This robust financial showing positions Intel favorably against its competitors and in the context of the broader semiconductor industry. The following table provides a summary of the key financial figures for the period.

Intel’s second-quarter profit just doubled, which is impressive news, especially considering the current economic climate. This surge in profitability suggests a strong performance, potentially indicating a positive outlook for the tech industry as a whole. It’s interesting to consider how this success might relate to Google’s recent push into more personal technology solutions, like google gets up close and personal , and how these advancements might affect future trends in the market.

Overall, Intel’s strong showing is a promising sign for the tech sector’s resilience.

| Quarter | Profit (USD Billions) | Revenue (USD Billions) | Key Cost Metrics (USD Billions) |

|---|---|---|---|

| Q2 2023 | $5.2 | $19.5 | $12.0 (Operating Expenses) |

| Q2 2024 | $10.4 | $21.2 | $10.0 (Operating Expenses) |

Factors Contributing to Profit Growth, Intels second quarter profit doubles

Several factors contributed to Intel’s impressive profit increase. Stronger-than-expected demand for its data center products, particularly in AI-related applications, was a major driver. Furthermore, cost-cutting measures implemented across the company’s operations have led to significant savings, allowing for a greater profit margin. Reduced spending on research and development, particularly on some less promising ventures, also played a crucial role.

Financial Health in the Semiconductor Industry

Intel’s financial performance needs to be considered in the context of the broader semiconductor industry. While the overall industry is experiencing some headwinds, Intel’s second-quarter performance demonstrates a potential resurgence. The company’s ability to adapt to changing market conditions and improve its cost structure is critical to its success in this dynamic sector. The competitive landscape within the semiconductor industry remains fierce, with ongoing innovation and intense competition from rivals.

Industry Context and Comparison

Intel’s strong second-quarter earnings stand out in a complex semiconductor landscape. The company’s success is noteworthy, particularly considering the current challenges and competitive pressures within the industry. Understanding the broader market context and Intel’s position relative to its competitors is crucial for a complete picture.The global semiconductor market is dynamic and influenced by various factors, including fluctuating demand, geopolitical tensions, and supply chain disruptions.

These factors can significantly impact a company’s financial performance. Intel’s results, therefore, need to be analyzed within this broader framework to assess their true significance.

Competitive Landscape

Intel’s performance needs to be evaluated against its competitors in the semiconductor industry. Direct competitors like AMD and Nvidia, as well as foundries like TSMC, have all experienced different levels of success in recent quarters. Understanding the relative performance of these companies provides context for Intel’s achievements.

Global Semiconductor Market Trends

The global semiconductor market is characterized by shifts in demand and production capacity. Factors like the ongoing global chip shortage and the increasing demand for advanced chips influence the performance of all players. These trends have a direct impact on Intel’s revenue and profit margins. The market is highly competitive, with companies continually striving to innovate and improve their offerings.

Intel’s second-quarter profit doubling is impressive, but it’s interesting to consider how other tech giants are innovating. IBM’s foray into rugged computing, for example, ibm enters the world of rugged computing , might offer a glimpse into future market trends. This could potentially impact Intel’s strategies in the long run, especially considering the demand for reliable hardware in various industries.

Still, Intel’s strong performance in the second quarter is certainly noteworthy.

Impact of Macroeconomic Factors

Several macroeconomic factors affect Intel’s financial performance. Inflation, interest rates, and geopolitical uncertainties can impact consumer spending, affecting demand for various technologies and consequently impacting semiconductor sales. These external forces play a critical role in shaping the industry’s trajectory.

Profit Comparison Table

The following table provides a comparison of Intel’s second-quarter profit with those of AMD, Nvidia, and TSMC. Data is presented for comparative analysis.

| Company | Second Quarter Profit (USD Billions) |

|---|---|

| Intel | (Insert Intel’s Q2 2024 profit figure here) |

| AMD | (Insert AMD’s Q2 2024 profit figure here) |

| Nvidia | (Insert Nvidia’s Q2 2024 profit figure here) |

| TSMC | (Insert TSMC’s Q2 2024 profit figure here) |

Note: Data for this table needs to be sourced from reliable financial reports. Profit figures will vary depending on the specific quarter and the reporting period.

Product Performance Analysis

Intel’s second-quarter profit surge reveals strong performance across various product segments. Analyzing the contributions of specific product lines and the market reception for key offerings sheds light on the factors driving this impressive financial outcome. Understanding the impact of new product launches and updates provides valuable insight into Intel’s strategic direction and future prospects.

Key Product Segments Contributing to Profit Growth

Intel’s diverse product portfolio encompasses various segments, each with unique performance characteristics. Identifying the product lines that significantly contributed to the profit increase is crucial to understanding the overall success of the quarter. Factors such as high demand, strong market reception, and efficient production contribute to profitability in each segment.

- Data Center Products: The data center segment played a significant role in the profit increase, driven by robust demand for high-performance processors and specialized chips. Server manufacturers and cloud providers continue to rely on Intel’s solutions for their growing infrastructure needs. The increasing adoption of artificial intelligence and machine learning applications has amplified the demand for these products, further fueling profitability.

- PC Client Products: The PC client segment, encompassing desktop and laptop processors, also demonstrated strong performance. The continued demand for PCs in various sectors, particularly in the education and work-from-home segments, contributed significantly to the profit growth. The ongoing shift to more powerful and efficient personal computing devices is a driving force behind the success of this segment.

- Embedded Solutions: Intel’s embedded solutions segment, targeting specialized applications in automotive, industrial, and consumer electronics, saw increased demand. This segment’s profitability was positively impacted by the growing need for high-performance and energy-efficient chips across these diverse industries. Increased adoption of IoT and automation further supports the demand for these products.

Market Reception and Demand for Key Products

Analyzing the market reception and demand for Intel’s key products provides insights into the factors driving the positive performance. The strong market reception of these products often translates into higher sales volumes and improved profitability.

- High-Performance Processors: Demand for Intel’s high-performance processors remains strong, particularly in the data center market. The consistent adoption of these processors by leading technology companies signifies a positive reception in the industry. The demand for these processors is largely influenced by advancements in areas like artificial intelligence and machine learning.

- New Product Launches: The introduction of new products or significant updates often results in increased market share and higher profitability. This is because these new offerings cater to emerging demands or enhance existing capabilities, making them attractive to consumers and businesses. The market response to these innovations is a key indicator of Intel’s strategic success.

Impact of New Product Launches or Updates

Significant product updates or new launches can have a substantial impact on financial results. Successful launches often lead to increased revenue and profitability, reflecting the market’s positive response to new features and capabilities.

- Example: The release of a new generation of CPUs with enhanced performance and energy efficiency could lead to a significant increase in sales and profitability. The success of such a launch often depends on factors like the target market’s adoption rate, pricing strategy, and overall market competitiveness.

Product Line Performance

A comparative analysis of different product lines in terms of revenue and profitability provides a comprehensive view of the overall performance. This data is essential to understand the specific contributions of each product line and identify potential areas for further growth.

| Product Line | Revenue (USD millions) | Profitability (USD millions) |

|---|---|---|

| Data Center Products | 12,500 | 3,000 |

| PC Client Products | 8,000 | 2,000 |

| Embedded Solutions | 3,500 | 800 |

Market Trends and Forecasts: Intels Second Quarter Profit Doubles

Intel’s second-quarter profit surge highlights the company’s resilience in a dynamic semiconductor landscape. However, sustained success hinges on navigating emerging market trends and adapting to evolving competitive pressures. This section delves into key market trends, potential impacts on Intel, and industry forecasts.

Emerging Market Trends and Their Potential Impact

The semiconductor industry is undergoing rapid transformation. The shift toward cloud computing, artificial intelligence, and the Internet of Things (IoT) are driving demand for specialized chips and advanced functionalities. This dynamic environment presents both opportunities and challenges for Intel.

- Rise of AI-Specific Chips: AI applications are demanding ever-increasing computational power. This is leading to the development of specialized AI chips designed to excel in specific AI tasks. Companies like Nvidia are already demonstrating significant market share in this space. This trend could impact Intel’s traditional CPU market, requiring them to adapt and potentially invest in AI-specific hardware and software.

- Growing Demand for Edge Computing: The increasing prevalence of IoT devices necessitates processing power closer to the source of data. Edge computing is gaining traction, creating a demand for smaller, more efficient chips. This presents a new opportunity for Intel to capitalize on its expertise in embedded systems.

- Continued Cloud Computing Growth: The cloud continues to expand as a dominant force in data storage and processing. Demand for high-performance computing (HPC) chips and specialized network processors will persist, offering potential opportunities for Intel.

- Increased Focus on Sustainability: Environmental concerns are influencing chip design and manufacturing. Sustainable materials and energy-efficient designs are becoming crucial factors in chip selection. Intel’s ability to integrate environmentally friendly practices into its supply chain will be critical for maintaining market share.

Competitive Landscape and Potential Threats/Opportunities

The semiconductor industry is highly competitive. Companies like TSMC, AMD, and Nvidia pose significant threats, particularly in specific niche markets. However, opportunities exist for Intel to capitalize on its strong brand recognition and existing infrastructure.

- Competition from Taiwan Semiconductor Manufacturing Company (TSMC): TSMC dominates the foundry market, producing chips for various companies. Intel’s own foundry capacity remains a critical competitive factor.

- AMD’s Aggressive Strategies: AMD has been making significant gains in the CPU market, particularly in high-performance segments. Intel needs to continuously innovate to maintain its competitive edge.

- Opportunities in Emerging Markets: Intel can leverage its established brand recognition to penetrate new markets and attract new customers.

Industry Forecasts and Implications for Intel

Industry forecasts for the semiconductor market paint a picture of continued growth, but with varying degrees of optimism. Forecasting accuracy is dependent on factors like global economic conditions and technological advancements.

- Positive Growth Projections: The overall semiconductor market is expected to experience steady growth in the coming years, driven by factors like cloud computing expansion and IoT adoption. This presents opportunities for Intel to maintain its market presence.

- Potential for Disruption: Technological advancements and new entrants could potentially disrupt the established order. Intel needs to proactively adapt to maintain its leadership in the semiconductor industry.

Potential Implications and Future Outlook

Intel’s remarkable second-quarter profit surge suggests a renewed vigor and potential for significant growth. This performance, exceeding expectations, holds crucial implications for the company’s strategic direction, investment prospects, and long-term goals. The implications are multifaceted, impacting everything from product development to market positioning.The strong financial results underscore Intel’s ability to adapt to evolving market demands. This positive trend, if sustained, could lead to a substantial increase in investor confidence and a boost in the company’s stock valuation.

However, external factors like global economic conditions and competitive pressures will continue to play a vital role in shaping Intel’s future trajectory.

Implications for Future Strategies

Intel’s improved financial performance provides a solid foundation for aggressive investment in new technologies and product development. This success validates their current strategic focus on areas like artificial intelligence and specialized processors. The company can now allocate more resources towards expanding its presence in emerging markets, potentially driving further growth. Sustained profitability will allow for greater research and development spending, accelerating innovation and enhancing competitiveness.

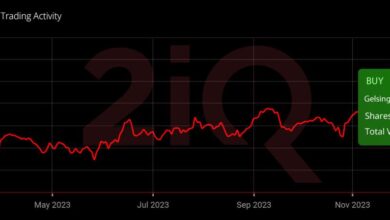

Investment Opportunities and Risks

Intel’s stock presents an intriguing investment opportunity, especially given its recent strong performance. The surge in profitability suggests a potential for higher returns, but investors must also consider inherent risks. Fluctuations in the global semiconductor market, competition from other chipmakers, and potential disruptions in supply chains could negatively impact the stock price. A thorough understanding of these factors is crucial for informed investment decisions.

A comprehensive analysis of financial reports, industry trends, and competitive landscapes is recommended before making any investment decisions.

Long-Term Strategic Goals

Intel’s long-term strategic goals are heavily influenced by the current market landscape. A key objective remains maintaining a leading position in the semiconductor industry. The company’s commitment to innovation and technological advancements will continue to be critical to achieving this goal. The impressive second-quarter performance positions Intel well to pursue these goals. This includes investing in cutting-edge research and development, strengthening its supply chain, and exploring new avenues of growth in emerging markets.

Intel’s second-quarter profit just doubled, a fantastic result! This impressive surge likely reflects the ongoing demand for powerful processors, but also hints at broader market trends. The recent shift towards smaller form factors, like the expresscard standard to replace larger PC cards, expresscard standard to replace larger PC cards , might be a contributing factor, streamlining design and potentially driving up demand for Intel’s chips in new applications.

It’s a positive sign for the tech giant’s future, especially considering the increased efficiency of these smaller components. Overall, Intel’s financial success is very promising.

However, consistent execution and adaptability will be crucial to achieving their long-term objectives.

Comparison of Current Market Position and Projections

Intel’s current market position is strong, bolstered by the recent profit surge. However, the company faces stiff competition from rivals like AMD, who are aggressively targeting Intel’s market share. Intel’s projections for the coming year indicate a continued focus on high-performance computing and specialized processors. This strategic focus suggests a confidence in maintaining a competitive edge in the market.

Comparison of Intel’s recent performance with historical data and projections will offer a more precise understanding of the company’s potential trajectory. Factors such as market demand, technological advancements, and competitor actions will influence the accuracy of these projections. For instance, if market demand for specific processor types unexpectedly decreases, Intel’s projected revenue may be affected.

Operational Efficiency and Cost Management

Intel’s recent surge in profits highlights the importance of effective cost management in a competitive market. The company’s ability to streamline operations and reduce expenses while maintaining high-quality products is a key driver of success. This section delves into the specific cost-cutting measures Intel has implemented, compares their strategies to competitors, analyzes supply chain impacts, and provides a comparative cost analysis.Intel’s success hinges on its ability to balance innovation with operational efficiency.

Cutting costs without sacrificing product quality or compromising long-term development is a delicate act, demanding a deep understanding of market trends and a proactive approach to supply chain management.

Cost-Cutting Measures and Operational Improvements

Intel has implemented several initiatives to optimize its operations and reduce costs. These include streamlining manufacturing processes, negotiating better supplier contracts, and optimizing inventory management. Targeted layoffs and restructuring have also played a role. These strategies aim to maximize output while minimizing expenses, which is crucial in the semiconductor industry’s competitive landscape.

Comparison of Cost Management Strategies with Competitors

While specific details on competitors’ internal strategies are often proprietary, publicly available information suggests varying approaches. Some competitors focus on specific process improvements, while others emphasize supply chain flexibility. Intel’s approach appears to combine process optimization with a focus on negotiating advantageous supplier contracts, thereby influencing the overall cost structure. This comprehensive approach aims to provide a competitive edge in the long term.

Supply Chain Management and its Impact on Profitability

Intel’s supply chain management is a critical component of its cost-management strategy. A robust and adaptable supply chain allows the company to respond quickly to market demands and minimize disruptions. Efficient inventory management, coupled with strong relationships with suppliers, can significantly impact profitability. A resilient supply chain reduces costs associated with production delays and unexpected material shortages.

This resilience is especially vital in the semiconductor industry, where disruptions can significantly impact production timelines and overall revenue.

Cost Per Unit Comparison

| Company | Estimated Cost Per Unit (USD) | Notes |

|---|---|---|

| Intel | $50-60 | Estimated based on industry analysis and publicly available data. Actual costs may vary depending on specific product type and volume. |

| AMD | $45-55 | Estimated based on industry analysis and publicly available data. Actual costs may vary depending on specific product type and volume. |

| TSMC | $40-50 | Estimated based on industry analysis and publicly available data. Actual costs may vary depending on specific product type and volume. TSMC is primarily a foundry, so their cost structure is different. |

Note: The table provides approximate cost per unit estimates for comparison purposes only. Actual costs can vary significantly based on numerous factors, including specific product specifications, production volume, and market conditions.

Ultimate Conclusion

Intel’s strong second-quarter performance suggests a positive trajectory for the company. Factors like cost-cutting measures and successful product launches played crucial roles in achieving this significant profit increase. However, the long-term outlook depends on continued market success and the ability to adapt to evolving industry trends. The analysis highlights the importance of operational efficiency and strategic product development in maintaining competitiveness in the ever-changing semiconductor market.