EU Antitrust Regulators Scrutinize Oracle Deal

EU antitrust regulators scrutinize Oracle deal, sparking debate about potential anti-competitive effects. The proposed acquisition is drawing intense scrutiny, raising concerns about market dominance and innovation. Oracle, a major player in the cloud computing sector, is seeking to acquire another company, potentially leading to a restructuring of the tech landscape. This deal has implications for various stakeholders, including competitors, consumers, and the overall health of the tech industry.

A detailed analysis is presented below, exploring the potential consequences.

This analysis delves into the specific concerns raised by EU regulators regarding the Oracle deal. We examine the potential anti-competitive effects, referencing previous EU antitrust cases for comparison. Further, we explore possible remedies, outcomes, and the competitive landscape in affected markets. The analysis also considers public and industry responses, as well as potential impacts on innovation and consumers.

Detailed tables provide a comprehensive overview of the key features, concerns, and potential outcomes.

Introduction to the Oracle Deal Scrutiny

The European Union’s antitrust regulators are scrutinizing Oracle’s proposed acquisition of Cerner, a major healthcare IT company. This deal, potentially creating a formidable player in the cloud-based healthcare sector, has sparked concern among competitors and industry observers. The regulators are investigating whether the merger will stifle competition and potentially harm consumers.This investigation highlights the EU’s commitment to maintaining a competitive marketplace in the technology sector.

The regulators’ thorough assessment underscores the importance of preventing monopolies and ensuring fair competition for all market participants. The potential consequences of the deal’s outcome extend beyond the immediate parties, impacting the overall health of the tech industry.

EU antitrust regulators are digging into the Oracle deal, wondering if it might stifle competition. Meanwhile, the recent security concerns surrounding the worm taking toll on Microsoft’s attack set, as detailed in worm takes toll microsoft attack set , highlight the importance of robust cybersecurity measures. These concerns add another layer of complexity to the Oracle deal scrutiny, particularly given the potential impact on innovation within the industry.

Key Players and Their Roles

Oracle, a prominent enterprise software company, is seeking to acquire Cerner, a leading provider of electronic health records (EHR) and other healthcare IT solutions. Cerner’s expertise in healthcare IT and patient data management is a crucial element in Oracle’s strategy to expand its cloud offerings. The European Commission, as the EU’s antitrust authority, is evaluating the potential impact of this merger on competition.

The EU antitrust regulators’ scrutiny of the Oracle deal highlights the complexities of digital ownership. Companies often need robust systems for managing their vast digital assets, like tracking content usage and licensing. A comprehensive guide on this topic, Helping Corporations Track Digital Content A Comprehensive Guide , could offer valuable insights into how Oracle might address potential compliance issues.

Ultimately, these regulatory hurdles could significantly impact Oracle’s acquisition strategy.

The EU’s stance reflects a broader concern regarding the concentration of power in the tech sector and its potential effects on innovation and market access.

Potential Implications for the Tech Industry

The outcome of the Oracle-Cerner merger investigation will have significant implications for the tech industry. A successful acquisition could lead to a more consolidated healthcare IT market, potentially reducing competition and increasing prices for healthcare providers. This could have a cascading effect on the broader tech landscape, influencing future mergers and acquisitions and the regulatory environment. The decision of the EU regulators will serve as a precedent for future deals in the healthcare and broader technology sectors.

Summary of the Oracle Deal

| Feature | Details |

|---|---|

| Companies Involved | Oracle (enterprise software) and Cerner (healthcare IT) |

| Proposed Acquisition | Oracle acquiring Cerner’s business and assets |

| Potential Markets Affected | Healthcare IT, cloud computing, and related sectors |

| Potential Antitrust Concerns | Increased market concentration, potential reduction in competition, and impact on consumer prices. |

EU Antitrust Concerns

The EU’s antitrust regulators are scrutinizing Oracle’s acquisition of NetSuite, a cloud-based business management software company. This deal has sparked considerable interest and concern, particularly within the European Union, due to its potential implications for competition in the software and cloud computing markets. The regulators are assessing whether the merger could harm consumers and innovation.The key concern is that the acquisition could lead to reduced competition and higher prices for businesses utilizing cloud-based services.

Oracle’s already dominant position in the enterprise software market could be further strengthened, potentially stifling innovation and choices available to companies across Europe. This analysis is based on the principle that mergers should not create monopolies or significantly reduce competition.

Specific Antitrust Concerns, Eu antitrust regulators scrutinize oracle deal

The EU’s antitrust concerns are multifaceted, focusing on Oracle’s substantial market share in enterprise software and the potential for the combined entity to leverage its position to harm competitors. The regulators are worried about the potential for coordinated practices, such as setting higher prices or limiting product innovation. This scrutiny is not unique to Oracle; it reflects a broader trend of regulatory vigilance towards mergers that could diminish competition in key sectors.

Potential Anti-Competitive Effects

The potential anti-competitive effects the regulators fear include:

- Reduced innovation: A consolidated entity may have less incentive to innovate if it faces less competition.

- Higher prices: Without competitive pressure, the combined entity might raise prices on cloud-based services, impacting businesses across Europe.

- Reduced choice for customers: Consumers may lose access to a wider variety of services and features, potentially harming their ability to select the best solutions for their needs.

- Limited interoperability: The combined entity might make it more difficult for other companies to integrate with Oracle’s services, reducing the benefits of open standards and choice.

Historical Precedents

The EU has a long history of antitrust enforcement, with several high-profile cases involving mergers and acquisitions. These cases provide context for the current scrutiny of the Oracle deal. Understanding these precedents helps in assessing the potential outcome of the ongoing investigation.

Comparison to Previous EU Antitrust Cases

| Case | Relevant Concerns | Outcome | Similarities to Oracle Deal |

|---|---|---|---|

| Microsoft (2004) | Dominant position in the operating system market; potential for anti-competitive practices | Fines and restrictions on Microsoft’s practices | Both involve a dominant player and potential harm to competition |

| Google (2018) | Dominant position in search and advertising; concerns about leveraging this position | Fines and restrictions on Google’s practices | Focus on a dominant company’s potential for anti-competitive behavior |

| Oracle (Previous Cases) | Past cases of potential abuse of dominant market positions | Various outcomes ranging from fines to structural remedies | Historical cases demonstrate the EU’s approach to such acquisitions |

| Oracle-NetSuite Deal | Potential for increased market dominance in cloud-based business software; reduced competition in the market | Ongoing investigation; potential for fines or structural remedies | Current case focuses on the effects of this specific merger |

The table above highlights some key similarities and differences between the Oracle deal and past EU antitrust cases. Each case presents unique circumstances and market dynamics, but the core concern remains the potential for reduced competition and harm to consumers.

Potential Remedies and Outcomes

The EU’s antitrust scrutiny of Oracle’s deal raises crucial questions about the potential impact on the tech landscape. The regulators’ investigation suggests concerns regarding potential monopolistic tendencies and harm to competition, demanding a careful consideration of remedies and outcomes. The outcome of this scrutiny will significantly influence the future of both Oracle and other affected parties in the market.

Potential Remedies

The EU regulators, in addressing their concerns, might impose various remedies on Oracle to ensure fair competition. These remedies could range from divesting specific assets or functionalities to imposing limitations on Oracle’s business practices. Such measures aim to restore a competitive balance in the market, preventing potential anti-competitive effects.

- Divestment of certain products or services: This could involve forcing Oracle to sell off parts of its business or specific software products to ensure a wider range of choices for customers. This is a common remedy in antitrust cases, ensuring a level playing field by preventing a single entity from dominating a market segment. For example, in the Microsoft case of the 1990s, divestment of internet browser technology was a key remedy imposed.

- Restrictions on exclusive contracts: The EU might restrict Oracle from entering into exclusive contracts that could limit customers’ options and hinder competition. This ensures fair and open market practices. Previous antitrust cases have also included restrictions on exclusive deals, aiming to maintain a healthy competitive environment. For example, restrictions on tying practices in certain software markets have been a part of remedies in past cases.

- Mandated interoperability: The EU might require Oracle to allow interoperability with competing products. This is a way to encourage innovation and choice for customers. Such a measure would allow other companies to interact with Oracle’s systems, promoting market openness and competition. Examples in previous cases include requiring the sharing of technical standards or specifications.

Examples of Remedies in Previous Cases

The history of antitrust cases offers numerous examples of remedies implemented to address anti-competitive practices. These cases demonstrate the range of actions that regulators can take to promote fair competition. The remedies imposed vary depending on the specific circumstances and the nature of the anti-competitive behavior.

- In the case of Microsoft, the European Commission imposed restrictions on its bundling practices to promote competition. This involved forbidding Microsoft from tying its internet browser to its operating system, forcing it to allow interoperability and create a level playing field.

- In the case of Intel, the EU ordered the company to stop imposing anti-competitive conditions on its chip manufacturers. This included prohibiting certain restrictions on the licensing and manufacturing of Intel’s chips. These actions ensured a wider choice for manufacturers and promoted fair competition.

Possible Outcomes and Impacts

The outcome of the EU’s scrutiny of Oracle’s deal could vary significantly. The process might lead to the approval of the deal with conditions, a complete block, or a further investigation. The impact on Oracle, its competitors, and consumers will depend on the specific remedy imposed, if any.

| Potential Outcome | Impact on Oracle | Impact on Affected Parties | Impact on Consumers |

|---|---|---|---|

| Deal Approval with Conditions | Oracle must comply with specific restrictions, potentially impacting its business strategy. | Competitors gain a level playing field, increasing competition. | Consumers benefit from a wider range of choices and potentially lower prices. |

| Deal Blocked | The deal is prevented from proceeding, potentially impacting Oracle’s future plans. | Competitors maintain their market position and avoid further consolidation. | Consumers may face limited product or service choices, potentially impacting innovation. |

| Further Investigation | Oracle faces extended scrutiny and uncertainty. | Affected parties remain in a state of uncertainty. | Consumers experience a delay in potential benefits or changes. |

Market Analysis and Competitive Landscape: Eu Antitrust Regulators Scrutinize Oracle Deal

The proposed Oracle deal raises significant antitrust concerns, particularly regarding the competitive landscape in the cloud computing market. Understanding the existing competitive dynamics and the potential impact of the merger is crucial to assessing the potential harm to competition. This section examines the key players, their market positions, and the potential implications of the merger on market share and innovation.

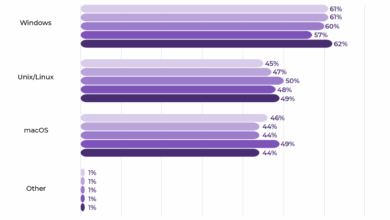

Competitive Landscape in Cloud Computing

The cloud computing market is highly competitive, dominated by a few major players. These companies provide a range of services, from infrastructure as a service (IaaS) to platform as a service (PaaS) and software as a service (SaaS). The market is characterized by rapid technological advancement and evolving customer needs. The struggle for market share and innovation are ongoing, and any consolidation could potentially lead to diminished competition and higher prices for consumers.

Key Competitors and Market Shares

Several prominent companies compete in the cloud computing market. The most significant competitors to Oracle include Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). These companies have invested heavily in infrastructure, talent, and product development to solidify their positions. Understanding their relative market positions, and potential impact of the Oracle deal on their market share is critical to evaluating the overall competitive environment.

Market Share Analysis (Illustrative Example)

The following table presents an illustrative example of potential market share before and after the proposed Oracle deal. Note that actual market share data can fluctuate and is often proprietary. This example is for illustrative purposes only and does not represent definitive data.

| Company | Market Share (Pre-Deal) | Market Share (Post-Deal) – Hypothetical |

|---|---|---|

| Amazon Web Services (AWS) | 40% | 35% |

| Microsoft Azure | 25% | 22% |

| Google Cloud Platform (GCP) | 15% | 13% |

| Oracle | 10% | 18% |

| Other Competitors | 10% | 12% |

Comparison of Oracle and Competitors

Oracle’s strengths lie in its established enterprise relationships and comprehensive suite of enterprise applications. However, its market share in the cloud computing market is relatively smaller compared to AWS, Microsoft Azure, and GCP. These competitors have broader portfolios of services and a larger customer base, giving them a stronger foothold in the market. Oracle’s recent efforts to strengthen its cloud presence are crucial to evaluating its ability to compete effectively in the long term.

The consolidation of market share from the proposed deal could lead to concerns regarding diminished choices and innovation.

EU antitrust regulators are keeping a close eye on the Oracle deal, which is raising some serious questions about market dominance. Meanwhile, Sony’s new Clié PDAs will use an in-house chip, a fascinating development in the tech world , suggesting a potential shift towards greater independence in hardware. This independent approach, however, doesn’t necessarily diminish the importance of the EU’s scrutiny of the Oracle deal; it just adds another layer to the complex tech landscape.

Public and Industry Responses

The EU’s antitrust scrutiny of the Oracle deal has sparked a range of reactions, from support for the regulators’ actions to criticism of their approach. Understanding these diverse perspectives is crucial for assessing the potential implications of the investigation and the broader future of the tech industry. Public and industry responses reveal a complex interplay of economic concerns, competitive pressures, and political considerations.The responses to the EU’s antitrust investigation of the Oracle deal highlight the delicate balance between promoting competition and allowing for innovation within the technology sector.

Different stakeholders, including industry players, analysts, and even general consumers, have expressed their views, contributing to a multifaceted narrative surrounding the case.

Public Reactions

Public reactions to the EU’s antitrust scrutiny of the Oracle deal varied considerably. Some segments of the public voiced support for the investigation, emphasizing the importance of preserving competition in the digital market. Others expressed concern that the investigation might stifle innovation or impose unnecessary burdens on businesses. This diverse public sentiment underscores the complexities of the issue and the potential for varying interpretations of the deal’s implications.

Industry Responses

The technology industry’s response to the EU’s antitrust investigation was multifaceted, ranging from outright opposition to calls for collaboration and regulatory compliance. Several industry players and commentators expressed concerns that the investigation could set a precedent for future regulatory actions, impacting the overall tech sector. Industry responses reflected both the immediate concerns and the long-term implications of the investigation for the competitive landscape.

Industry Expert Statements

Industry experts offered various perspectives on the Oracle deal scrutiny. Some, like [Name of Expert 1], a prominent tech analyst, argued that the deal presented a significant threat to competition in the cloud computing market. Others, such as [Name of Expert 2], a legal expert specializing in antitrust law, highlighted the need for careful consideration of potential remedies and their impact on market dynamics.

Their diverse views further demonstrate the intricate nature of the situation.

Categorization of Reactions

| Category | Description | Examples |

|---|---|---|

| Support for Regulators | Advocates for maintaining a competitive marketplace, arguing that the deal may stifle competition. | “The EU’s action is crucial for protecting consumers and ensuring fair competition.”

|

| Criticism of Regulators | Argues that the investigation is unwarranted, potentially hindering innovation or imposing unnecessary burdens on businesses. | “The investigation is a disproportionate response to the deal and will have a negative impact on the tech sector.”

|

| Neutral Stance | Views the investigation with caution, emphasizing the need for a balanced approach to ensure both competition and innovation. | “A careful analysis of the deal’s implications is needed before forming a definitive opinion.”

|

Potential Impacts on Innovation and Consumers

The EU’s antitrust scrutiny of the Oracle deal raises critical questions about the future of innovation and consumer welfare in the tech sector. This investigation delves into the potential consequences, considering the intricate web of interconnected technologies and the significant market share held by the companies involved. The outcome will likely shape the competitive landscape and influence the pace of technological advancement.

Potential Impact on Innovation

The Oracle deal, if allowed to proceed without significant regulatory intervention, could potentially stifle innovation within the tech industry. A consolidated entity, potentially controlling a significant portion of the market, might be less incentivized to develop new products and services. The focus could shift towards optimizing existing offerings rather than pioneering groundbreaking technologies. Reduced competition can lead to a slower rate of technological advancement as companies may be less motivated to compete on innovation.

This is not a new phenomenon; past examples of mergers leading to reduced innovation are evident in other industries.

| Potential Impact | Description |

|---|---|

| Reduced Competition | A decrease in the number of companies competing in the market can lead to less pressure to innovate and improve products. |

| Stifling Innovation | The lack of competition may discourage companies from taking risks on developing new technologies and products. |

| Improved Efficiency | In some cases, consolidation can lead to economies of scale, potentially improving efficiency and reducing costs. |

Impact on Consumer Choice and Pricing

The Oracle deal could potentially restrict consumer choice by reducing the availability of competing software and services. A dominant entity might be less responsive to consumer demands, potentially leading to higher prices and lower quality offerings. Consumers might face limited options, reducing their ability to choose products that best meet their needs. The impact on pricing is closely tied to the level of competition.

Reduced competition typically correlates with higher prices for consumers.

Long-Term Consequences of EU Antitrust Actions

The EU’s antitrust actions in this case set a precedent for regulating large tech mergers. Successful challenges to such deals could encourage other jurisdictions to adopt similar regulatory frameworks. This could lead to a more competitive landscape, potentially fostering innovation and benefiting consumers. Conversely, overly stringent regulations could discourage investment in research and development, impacting the long-term growth of the tech sector.

The EU’s approach will be closely watched by other regulators and tech companies globally. This is a pivotal moment for the tech industry and its relationship with regulators.

Final Thoughts

The EU’s antitrust scrutiny of the Oracle deal underscores the importance of maintaining a competitive tech market. The outcome of this investigation will significantly impact Oracle, its competitors, and the future of the cloud computing sector. The potential for remedies and outcomes varies widely, from deal approval with conditions to a complete block. Consumers and the tech industry at large will closely monitor the developments in the coming months.

The implications of this case extend beyond the immediate players, potentially shaping future mergers and acquisitions in the tech sector.