Avoiding Another Tech Recession Strategies for Survival

Avoiding another recession in tech is crucial for the industry’s continued growth and stability. This article delves into the current state of the tech sector, analyzing past recessions, and outlining strategies for navigating potential future downturns. We’ll explore current trends, economic indicators, and the actions companies can take to ensure a healthy and prosperous future for the industry.

The tech industry has experienced significant fluctuations in the past. Understanding these historical patterns is vital in predicting and mitigating risks. This analysis examines the factors that contributed to past recessions and identifies common threads that could signal another downturn. We’ll explore the impact of investor sentiment, macroeconomic events, and emerging technologies on the industry’s resilience.

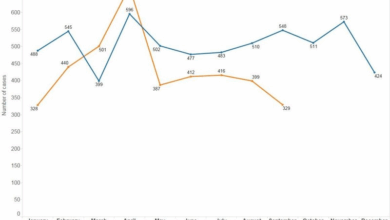

Identifying Current Tech Trends

The tech industry, once a beacon of innovation and growth, now navigates a complex landscape of economic headwinds and shifting investor sentiment. The current state is characterized by a delicate balance between continued technological advancement and the need for prudent financial management. Understanding the interplay of current trends and economic indicators is crucial for anticipating potential challenges and identifying opportunities.

Current State of the Tech Industry

The tech industry is a multifaceted ecosystem, encompassing sectors like cloud computing, artificial intelligence, e-commerce, and software development. While some sectors are experiencing robust growth, others are facing challenges. For instance, the cloud computing sector remains strong, driven by the increasing demand for data storage and processing solutions. Conversely, certain areas of AI, particularly those relying on speculative investment models, are facing scrutiny and reduced funding.

E-commerce is still a major force, but the rise of inflation and interest rates is impacting consumer spending habits.

Major Economic Indicators

Several economic factors significantly influence the tech sector. Interest rates play a pivotal role in impacting borrowing costs for tech startups and established companies, which can significantly impact their financial health and ability to expand. Inflation erodes purchasing power, potentially reducing consumer spending on tech products and services. Consumer spending, a critical driver of tech revenue, is influenced by factors such as job market conditions, economic confidence, and disposable income.

Factors Contributing to Potential Future Economic Downturns

Several factors can contribute to future economic downturns in the tech sector. Excessive valuations and speculation in certain sectors, coupled with a lack of profitability, can create vulnerabilities. Rapid changes in technology, while driving innovation, can also lead to unforeseen consequences. Furthermore, increasing competition from established players and emerging competitors can result in market share fluctuations and financial pressures.

The recent market corrections have highlighted the importance of sound financial strategies and risk management for tech companies.

Examples of Companies Experiencing Financial Difficulties

Several tech companies have encountered financial challenges in recent times. For example, the struggles of some crypto-related firms illustrate the risks associated with speculative investments. Similarly, companies reliant on highly volatile markets or those with substantial debt burdens are more susceptible to financial strain during economic downturns. The implications for these situations include job losses, market share shifts, and a reassessment of investment strategies.

Investor Sentiment

Investor sentiment toward tech startups and established companies has evolved in response to economic conditions. Concerns about inflation, rising interest rates, and a potential recession have dampened investor enthusiasm in some areas. The current focus on profitability and sustainable growth has shifted the investment landscape, emphasizing companies with strong fundamentals and demonstrable revenue streams. Investors are now prioritizing companies with a clear path to profitability over those primarily focused on rapid growth without sufficient revenue generation.

Analyzing Historical Recessions in Tech

The tech industry, while renowned for its rapid growth, has experienced its share of tumultuous periods. Understanding past recessions provides valuable insights into potential pitfalls and successful strategies for navigating future economic downturns. A deeper look into these historical events can illuminate the forces at play, allowing us to better anticipate and respond to challenges.The cyclical nature of technological advancements and market fluctuations often leads to periods of intense scrutiny and readjustment.

Examining previous recessions reveals patterns and lessons that can be applied to the current economic climate, empowering us to proactively address emerging risks and capitalize on opportunities.

Causes of Past Tech Recessions

The tech industry is susceptible to a variety of factors that can trigger a recession. Overvaluation of stocks, the bursting of bubbles, and shifts in consumer demand are just a few examples. A combination of factors often precipitates a downturn.

- Excessive Investment and Speculation: Periods of rapid growth often attract excessive investment, leading to overvaluation of companies and assets. This can create an unsustainable bubble, ultimately resulting in a dramatic correction when the market realizes the inflated valuations.

- Shifting Consumer Preferences: Technological advancements, while often disruptive, can sometimes lead to shifts in consumer preferences. This can cause a decrease in demand for existing products or services, forcing companies to adapt and potentially leading to job losses and market contraction.

- Economic Slowdowns: External economic downturns can significantly impact the tech industry. Recessions in other sectors often lead to reduced spending on technology, impacting both companies and investors.

Effects of Past Tech Recessions

The effects of past tech recessions have often been widespread and impactful. Job losses, decreased investment, and a general sense of uncertainty are common consequences. These effects ripple throughout the broader economy.

- Job Losses: Layoffs and hiring freezes are common during tech recessions, affecting various roles, from engineering and design to marketing and sales. The magnitude of job losses depends on the severity of the downturn and the structure of the affected companies.

- Reduced Investment: Investor confidence plummets during recessions, leading to a decrease in venture capital funding and investment in new technologies. This can stifle innovation and slow the pace of development.

- Market Correction: Stock prices typically decline sharply, impacting both publicly traded companies and private equity investments. This correction often leads to a reevaluation of company valuations and market expectations.

Strategies Employed During Past Downturns

Companies have adopted various strategies to navigate past economic downturns. These strategies often involve cost-cutting measures, strategic restructuring, and a focus on long-term value creation.

- Cost-Cutting Measures: Reducing operating expenses is a crucial aspect of surviving a recession. Companies may implement measures such as layoffs, hiring freezes, and reduced spending on non-essential activities. For example, reducing travel budgets, decreasing advertising expenditures, and minimizing operational costs can be key strategies.

- Strategic Restructuring: Re-evaluating the company’s structure and operations can be essential for adapting to a changing market. This might involve merging departments, streamlining processes, or selling non-core assets. These actions can strengthen the company’s core competencies and increase efficiency.

- Focus on Long-Term Value: Companies often focus on long-term value creation during downturns. This means investing in research and development, building strong brand recognition, and cultivating loyal customer relationships. These long-term strategies are often critical for sustaining a company’s position in the market.

Lessons Learned From Past Recessions

Past recessions have highlighted several crucial lessons for the tech industry. Understanding these lessons can help companies prepare for and respond to future downturns.

- Overvaluation and Bubble Formation: A critical lesson is recognizing and mitigating the risks of overvaluation and bubble formation. Companies need to focus on sustainable growth and realistic valuations, rather than chasing short-term gains.

- Adaptability and Resilience: Adaptability and resilience are key traits for navigating market downturns. Companies need to be prepared to change strategies, restructure operations, and adapt to new market conditions. This includes focusing on agility and rapid response capabilities.

- Long-Term Vision: Maintaining a long-term vision and focusing on value creation is crucial for weathering economic storms. This involves investing in research and development, building strong brands, and cultivating loyal customer relationships.

Successful Strategies to Navigate Economic Downturns

Numerous successful strategies have been employed by companies during past downturns. These strategies often involve a combination of cost-cutting, strategic restructuring, and long-term value creation.

- Amazon’s focus on operational efficiency during the 2008 recession demonstrated a commitment to cost-cutting and restructuring. This focus on efficiency enabled the company to maintain its competitive advantage and adapt to the changing economic landscape.

- Google’s consistent investment in research and development, even during economic downturns, demonstrates the importance of long-term value creation. This investment laid the foundation for future innovations and ensured the company’s long-term success.

Evaluating Potential Recessionary Triggers

The tech sector, historically volatile, is susceptible to cyclical downturns. Understanding potential triggers for a future recession is crucial for navigating the landscape and mitigating risks. Recognizing these triggers allows companies to adapt strategies and individuals to prepare for potential economic shifts.Identifying the specific factors that precipitate a tech recession is complex, but understanding potential macroeconomic and geopolitical events, consumer trends, and emerging technologies is vital for informed decision-making.

The interplay of these elements can create a cascading effect, potentially leading to a prolonged downturn.

Potential Macroeconomic Events

Several macroeconomic events can significantly impact the tech sector. Inflationary pressures, rising interest rates, and global economic slowdowns can directly affect consumer spending, impacting demand for tech products and services. For example, during the 2008 financial crisis, the subsequent reduction in consumer spending led to a significant decline in demand for tech products, which in turn caused a ripple effect throughout the entire tech industry.

Emerging Technologies and Market Reshaping

Emerging technologies can both accelerate economic growth and introduce unforeseen challenges. The rapid advancement of artificial intelligence (AI), for instance, could displace certain jobs in the tech sector, potentially triggering a wave of layoffs and restructuring. Conversely, AI could also create new job opportunities and industries, potentially offsetting the negative impacts.

Avoiding another tech recession hinges on a few key factors, and recent events like the online extortion bust highlight a crucial problem: profitability. The recent crackdown on online extortion, detailed in this insightful piece on online extortion bust highlights profit problem , serves as a stark reminder that unsustainable practices can quickly derail entire sectors. Addressing the root causes of these issues is vital for building a healthier, more resilient tech landscape and preventing a future downturn.

Consumer Behavior Shifts

Changes in consumer behavior can dramatically alter the demand for tech products and services. A shift towards more sustainable or privacy-focused technologies, for instance, could create new market opportunities, but also require companies to adapt their strategies and product offerings. For example, the rise of e-commerce led to increased demand for certain tech products and services, while potentially impacting traditional retail businesses.

Geopolitical Events and Their Impact

Geopolitical events, such as trade wars, sanctions, and geopolitical instability, can significantly disrupt the global tech landscape. These events can affect supply chains, limit access to markets, and increase uncertainty for tech companies. The impact of the Russia-Ukraine conflict, for example, on global supply chains has highlighted the vulnerability of tech companies to unforeseen geopolitical events.

Specific Risks and Challenges

Several risks and challenges could trigger another tech recession. These include a significant decline in venture capital funding, a decrease in consumer spending, and increased competition. The tech sector’s high reliance on venture capital for funding makes it particularly vulnerable to changes in investor sentiment and market conditions. High inflation and increased interest rates could reduce consumer spending and lead to a decline in demand for tech products and services.

A surge in competition from established players or new entrants could also put pressure on the profitability of tech companies.

Strategies for Avoiding Another Recession

Navigating the volatile tech landscape requires proactive strategies to mitigate the risks of economic downturns. Past recessions, while often cyclical, have demonstrated the importance of adaptable business models and resilient financial frameworks. This discussion Artikels a framework for anticipating and mitigating risks, focusing on strategies for cost management, innovation, and talent retention to ensure sustained profitability and growth.The tech sector, notoriously susceptible to rapid shifts in market demand and technological advancements, needs a proactive approach to recessionary threats.

Companies must anticipate potential triggers, adjust to evolving economic conditions, and maintain operational flexibility. This involves not just reacting to downturns, but also proactively shaping the business to withstand them.

Anticipating and Mitigating Risks

A crucial aspect of recession avoidance is the development of early warning systems. By closely monitoring key economic indicators, such as inflation rates, interest rates, and consumer confidence, companies can identify potential red flags and prepare contingency plans. Historical data analysis, coupled with market intelligence, provides valuable insights into patterns and potential triggers for future recessions.

Adapting to Shifting Economic Conditions

Companies need to be agile and responsive to changing economic landscapes. This requires flexibility in product development, pricing strategies, and operational processes. Developing diverse revenue streams and exploring new market segments can enhance resilience. For instance, a company heavily reliant on cloud computing could diversify into cybersecurity or managed services to lessen the impact of a potential downturn in cloud adoption.

Managing Costs and Maintaining Profitability

During economic downturns, cost-cutting measures are essential. This involves strategic resource allocation, renegotiating contracts, and optimizing supply chains. Non-essential spending should be minimized while maintaining essential operational functions. Furthermore, exploring alternative funding options, such as venture capital or private equity investments, can provide necessary capital during periods of reduced investor confidence.

Fostering Innovation and Growth

Innovation remains a key driver for growth, even during economic uncertainty. Companies should invest in research and development, foster a culture of experimentation, and encourage the exploration of disruptive technologies. This involves supporting internal innovation teams and encouraging collaboration across departments. Furthermore, actively seeking out and acquiring promising startups or technologies can accelerate growth and diversification.

Attracting and Retaining Top Talent

Maintaining a skilled workforce is crucial for long-term success. Attracting and retaining top talent requires competitive compensation packages, robust benefits, and a supportive work environment. Offering opportunities for professional development and skill enhancement can foster employee loyalty and retention. Transparency regarding the company’s financial health and future plans can also build trust and confidence among employees.

Financial Management & Investment Strategies

Navigating a potential tech recession requires proactive financial strategies. Companies need to anticipate challenges and implement robust plans to preserve capital, attract investment, and weather the storm. This involves a multifaceted approach encompassing cash flow management, strategic investments, and rigorous financial health assessments. Effective financial management is critical to ensuring long-term viability during economic downturns.Sound financial strategies are not just about survival; they are about positioning a company for future growth.

A recession can force companies to rethink their priorities, allowing them to identify inefficiencies and implement cost-cutting measures without sacrificing long-term value. This is a time for companies to sharpen their focus on operational excellence and make data-driven decisions about investments and resource allocation.

Avoiding another tech recession hinges on a lot of factors, and one key area that’s gaining traction is sender ID antispam tech. This new technology, like sender ID antispam tech making strides , is crucial for filtering out unwanted emails and spam, potentially reducing the financial strain on companies. Ultimately, robust anti-spam measures could contribute significantly to the overall health of the tech sector and help prevent a future downturn.

Cash Flow Management During a Recession, Avoiding another recession in tech

Effective cash flow management is paramount during a recession. Companies must meticulously track and predict cash inflows and outflows. This includes forecasting revenue, managing expenses, and optimizing working capital. Anticipating potential revenue shortfalls and implementing strategies to mitigate them are crucial. For example, negotiating favorable payment terms with suppliers, accelerating invoice collection, and exploring alternative financing options can significantly bolster cash reserves.

Sound Financial Strategies for Startups and Established Tech Firms

Startups often face greater financial pressures during a recession. Strategies for startups may include securing seed funding or venture capital, focusing on cost-effective operations, and strategically partnering with established firms. Established tech firms can leverage their existing resources to navigate the downturn. Strategies might include cost-cutting measures, strategic acquisitions, and investment in innovative technologies that create new revenue streams.

This involves assessing the potential for revenue generation from existing products or services.

Securing Funding and Attracting Investors During Uncertain Times

Attracting investment during a recession requires demonstrating resilience and a clear path forward. Startups should highlight their innovative technology, market potential, and robust financial projections, even with economic uncertainty. Established firms need to emphasize their proven track record, strong balance sheets, and strategic plans for navigating the downturn. Companies should also consider alternative funding sources such as private equity firms or strategic partnerships.

Investor presentations should emphasize the company’s ability to adapt and thrive despite the economic climate.

Alternative Investment Strategies for Mitigating Risk

Alternative investments can play a crucial role in mitigating risk during a downturn. Examples include real estate investment trusts (REITs), private equity, or hedge funds. Diversification into these sectors can help to offset potential losses in the tech sector. Understanding the specific risk profiles of alternative investments is vital. A well-diversified portfolio across traditional and alternative asset classes can significantly reduce the overall risk exposure.

Evaluating the Financial Health of Tech Companies

Evaluating financial health is essential for identifying potential risks and opportunities. Key financial metrics to consider include revenue growth, profitability, debt levels, and cash flow. Analyzing historical financial data and comparing it to industry benchmarks is important. Detailed financial statements, including balance sheets, income statements, and cash flow statements, provide crucial insights. Using financial ratios, such as the debt-to-equity ratio and the current ratio, helps to gauge the financial strength of the company.

Innovation and Adaptability

Navigating economic downturns requires a proactive approach to innovation and adaptability. Tech companies must anticipate changing market demands and proactively develop strategies to not only weather the storm but also emerge stronger. This involves more than just cost-cutting; it necessitates a fundamental shift in mindset, focusing on fostering a culture of continuous improvement and creative problem-solving.Staying ahead of the curve during economic instability is crucial for tech companies.

A robust innovation pipeline and an adaptable organizational structure are key to success. This involves identifying new market opportunities, developing novel solutions, and quickly pivoting to capitalize on emerging trends. Companies that embrace these principles are better positioned to withstand economic pressures and maintain growth.

Maintaining Innovation During Economic Instability

A robust innovation pipeline is paramount to sustained growth, even during economic headwinds. Companies must maintain and even increase their investment in research and development, ensuring they are exploring novel technologies and solutions that might become critical in the future. This can include supporting internal start-up initiatives or collaborating with external partners to explore promising new ideas.

Examples of Successful Adaptations

Many tech companies have demonstrated resilience in the face of economic shifts. For instance, companies like Netflix, initially a DVD rental service, adapted to the rise of streaming, creating a new revenue model that successfully expanded their user base and cemented their position as a leader in the streaming industry. Similarly, companies like Zoom, while not completely new, experienced explosive growth in adoption during the COVID-19 pandemic, demonstrating the value of a quickly adaptable and scalable platform.

These examples highlight the importance of responsiveness and proactive adaptation in a dynamic market.

Creating New Revenue Streams

Identifying new revenue streams is vital for mitigating potential losses during economic instability. This can include exploring adjacent markets, developing new product lines, or offering premium services. For example, a company specializing in cloud storage might introduce a managed security service or a professional-grade data analysis platform. A successful strategy involves thorough market research and identifying unmet needs.

Diversifying Products and Services

Diversification of products and services can reduce reliance on a single revenue stream, lessening the impact of potential market fluctuations. This might involve expanding into new geographic markets, introducing new product features, or developing entirely new product categories. For example, a social media company might launch a dedicated business-to-business platform, or a gaming company could venture into esports hosting and management.

Encouraging a Culture of Adaptability

Cultivating a culture of adaptability is essential for long-term success. This requires fostering a climate of open communication, encouraging experimentation, and empowering employees to take calculated risks. Regular feedback sessions, cross-functional collaboration, and a willingness to pivot quickly are critical components of this approach. Promoting psychological safety is crucial to allow employees to express new ideas without fear of judgment.

Regulatory and Policy Implications

Navigating economic downturns requires a nuanced understanding of how government regulations and policies impact the tech sector. The tech industry, with its rapid innovation and global reach, is particularly sensitive to changes in the regulatory landscape. Policymakers play a crucial role in fostering a climate that promotes resilience and prevents a deeper spiral during a recession.Government regulations can significantly influence the tech industry’s ability to operate and innovate during a downturn.

Regulations related to data privacy, antitrust, and cybersecurity, for instance, can create both opportunities and challenges. These policies often require careful consideration, as they must balance the need to protect consumers and foster innovation.

Government Regulations Impacting the Tech Industry

Government regulations play a crucial role in shaping the tech industry’s response to economic downturns. Regulations regarding data privacy, antitrust enforcement, and cybersecurity can directly impact a company’s ability to operate efficiently and innovate during a recession. Stringent regulations, for example, might lead to increased compliance costs, potentially hindering expansion and investment. Conversely, well-designed regulations can promote stability and consumer confidence, thus supporting the sector during challenging times.

Policy Decisions Influencing Tech Sector Resilience

Government policies can significantly influence the tech sector’s resilience to economic downturns. Policies that encourage investment in research and development, provide tax incentives for startups, and support workforce development initiatives can bolster the sector’s ability to adapt and innovate during economic hardship. Effective policies can foster a climate of confidence, encouraging continued investment and job creation, even in a recessionary environment.

Successful Government Policies Supporting the Tech Industry

Several examples demonstrate how effective government policies can support the tech industry during economic downturns. Tax incentives for research and development, targeted grants for startups, and initiatives promoting digital literacy and workforce development have been implemented by various governments to boost innovation and create jobs. These policies often lead to a more sustainable and resilient tech sector. For example, the US government’s investments in semiconductor research and development have strengthened the nation’s position in this crucial technology area, fostering resilience against global competition.

Potential Government Interventions to Prevent or Mitigate a Tech Recession

Government interventions can be crucial in preventing or mitigating a tech recession. Targeted subsidies for R&D in emerging technologies, support for workforce retraining programs, and initiatives to foster digital infrastructure development can provide crucial impetus during an economic downturn. This kind of proactive support can stimulate innovation and create a foundation for future growth. The European Union’s investments in 5G infrastructure, for example, fostered technological advancement and helped ensure its tech sector remained competitive.

Avoiding another tech recession hinges on a lot more than just market trends. Security breaches, like the recent Sophos worm spying on innocent computer users, sophos worm spies on innocent computer users , highlight the critical need for robust cybersecurity measures. If companies don’t prioritize this, it could further destabilize the industry and potentially trigger another downturn.

We need to learn from these incidents to build a more resilient tech sector.

Comparing Regulatory Approaches to Economic Downturns

| Regulatory Approach | Description | Potential Benefits | Potential Drawbacks |

|---|---|---|---|

| Proactive Support | Implementing policies that proactively support innovation and job creation, such as tax incentives and grants. | Stimulates economic activity, fosters innovation, and creates jobs. | Potential for increased government spending and bureaucracy. |

| Reactive Intervention | Responding to economic downturns with targeted measures, such as financial aid or regulatory relief. | Addresses immediate crises and supports affected companies. | Can be slower to implement and might not be as effective as proactive policies. |

| Flexible Regulations | Adjusting regulations in response to economic changes, allowing for flexibility in policy implementation. | Promotes adaptability and prevents stifling innovation. | Potential for inconsistency and lack of clarity in policy implementation. |

This table highlights the potential advantages and disadvantages of various regulatory approaches during economic downturns. Understanding these trade-offs is crucial for policymakers to make informed decisions that foster a resilient tech sector.

Employee Management & Retention: Avoiding Another Recession In Tech

Navigating economic uncertainty requires a proactive and empathetic approach to employee management. Maintaining a positive and productive work environment is crucial for both individual employee well-being and organizational stability. A company’s ability to retain talent during a downturn often dictates its long-term success and resilience. Companies must understand and address the anxieties and concerns of their employees while simultaneously exploring strategic ways to ensure financial health and operational efficiency.Effective employee management strategies are essential for maintaining morale and productivity, especially during times of economic hardship.

This involves proactive communication, understanding the anxieties of employees, and exploring flexible solutions to address potential financial concerns and challenges.

Effective Strategies for Managing and Motivating Employees

Proactive communication is key during uncertain times. Transparency about the company’s financial situation and future plans builds trust and alleviates anxieties. Open dialogue channels, such as regular town halls or dedicated forums, can be instrumental in fostering a sense of shared responsibility and purpose. Regular updates, however, should be factual and avoid speculation or ambiguity. Companies should also actively listen to employee concerns.

This includes creating opportunities for feedback and actively addressing employee concerns, even if they seem insignificant. Acknowledging their contributions and recognizing their efforts can significantly improve morale. A supportive and empathetic approach is crucial in demonstrating the company’s commitment to its employees during challenging times.

Methods to Maintain Employee Morale and Productivity

Maintaining employee morale is vital. Offering opportunities for professional development, even during a downturn, shows commitment to employee growth and reinforces their value. This can be achieved through online courses, mentorship programs, or internal training sessions. Recognizing and rewarding employees for their contributions, even with modest incentives, can bolster motivation and reinforce a positive work culture. Companies can also explore flexible work arrangements to accommodate personal circumstances, without sacrificing productivity.

Flexible work hours, remote work options, or compressed workweeks can be effective ways to address personal and professional needs.

Examples of Companies that Successfully Retained Employees

Companies that successfully navigated past recessions often prioritized employee well-being. For example, companies like Salesforce, known for its robust employee support programs, have demonstrated a commitment to maintaining employee morale even during economic downturns. Another example is Microsoft, which has historically invested in employee development and retention programs, fostering a positive and supportive work environment that contributes to employee satisfaction and loyalty.

These companies prioritized communication, addressed concerns directly, and fostered a sense of community and shared purpose.

Approaches to Employee Compensation and Benefits During a Recession

Adjusting compensation and benefits during a recession requires careful consideration. Companies must balance cost-cutting measures with employee well-being.

| Compensation Approach | Description | Potential Benefits | Potential Drawbacks |

|---|---|---|---|

| Salary Freeze | Holding salaries constant for a specified period. | Reduces immediate costs. | Can negatively impact employee morale and retention if not accompanied by other support measures. |

| Reduced Hours/Salary | Temporary reduction in working hours or salary for employees. | Preserves employment while reducing costs. | Can impact income and potentially productivity. Must be clearly communicated and justified. |

| Benefit Reduction/Restructuring | Adjusting or reducing benefits packages. | Reduces costs, especially for health insurance or retirement contributions. | Can negatively impact employee well-being. Should be reviewed and re-evaluated regularly. |

| Increased Focus on Non-Financial Incentives | Emphasis on recognition, appreciation, and development opportunities. | Motivates employees without directly impacting financial compensation. | May not be sufficient for all employees. Should be accompanied by other measures. |

Methods for Fostering a Supportive and Positive Work Environment

Fostering a positive work environment during economic uncertainty requires a proactive and supportive approach. Companies should actively promote open communication, encouraging feedback and addressing concerns promptly. Employee resource groups can play a vital role in supporting employees from diverse backgrounds and ensuring their well-being. Regular check-ins with employees, showing empathy and understanding, are essential to maintaining morale and productivity.

A culture of trust and mutual respect is essential in navigating economic uncertainty. A supportive work environment is an investment in employee loyalty and productivity.

Final Wrap-Up

Ultimately, avoiding another tech recession hinges on proactive measures and a comprehensive understanding of the current landscape. Companies must adopt robust financial strategies, foster innovation, and maintain adaptability to weather any storm. By learning from the past and proactively addressing potential risks, the tech industry can position itself for continued success and resilience. The future of tech depends on the actions taken today.