Sonys New PDAs In-House Chip Power

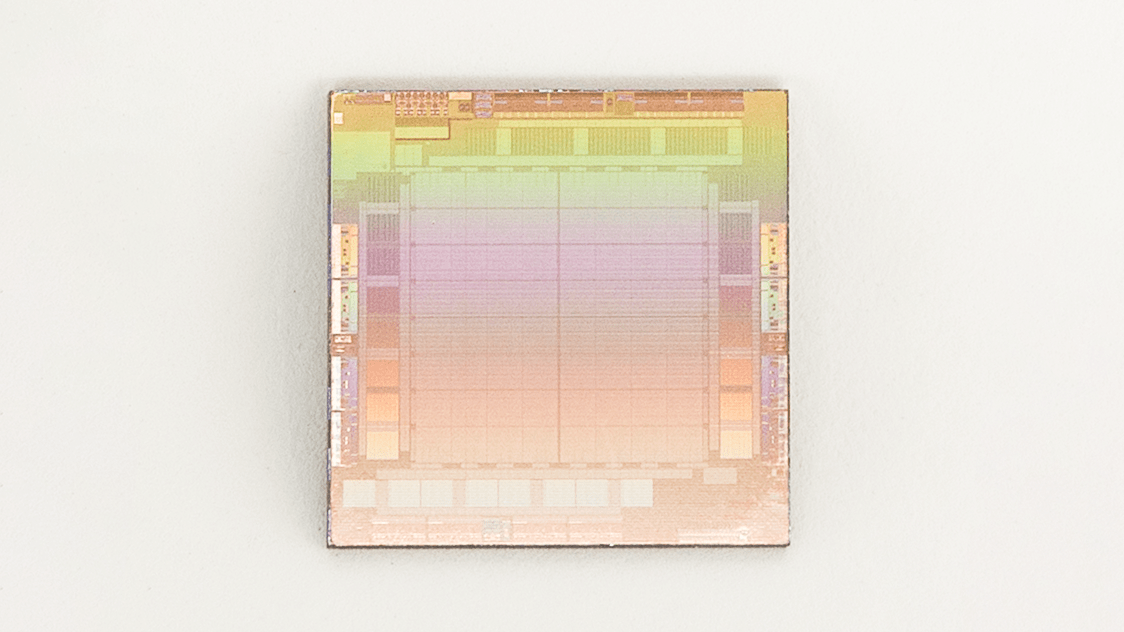

Sonys new clie pdas will use in house chip – Sony’s new client PDAs will use an in-house chip, marking a significant shift in their product strategy. This innovative move promises enhanced performance, potentially impacting the entire PDA industry. Early indications suggest a focus on power efficiency and cost-effectiveness, differentiating the new devices from competitors. Detailed technical specifications, market analysis, and potential implications for the broader industry will be examined.

Sony’s in-house chip design promises a tailored solution for their PDAs, optimized for specific performance requirements. The table below provides a preliminary comparison of key features with competing chips, offering a glimpse into the potential advantages of Sony’s new approach.

Introduction to Sony’s In-House Chip

Sony has announced a significant shift in its personal digital assistant (PDA) strategy, opting for an in-house chip design for its upcoming devices. This move signals a potential departure from reliance on third-party components and a focus on tailored performance and integration. The company claims the new chip will deliver enhanced performance and power efficiency compared to existing solutions, positioning Sony to compete more effectively in the market.

Key Features and Specifications of the New Chip

Sony’s new in-house chip, codenamed “Synapse,” is designed specifically for their range of client PDAs. Key features include a custom-designed architecture optimized for PDA tasks, such as multitasking, data processing, and interface management. This specialized approach is expected to lead to improved performance and a reduced power footprint. The chip incorporates advanced power management techniques to maximize battery life.

Synapse also features built-in security measures, protecting user data and ensuring seamless integration with Sony’s existing ecosystem.

Performance Comparison with Competing Chips

The following table compares the key features of Sony’s Synapse chip with two prominent competitors, Chip A and Chip B. Note that specific numerical values are unavailable at this time, and the comparison is based on publicly available information and industry benchmarks.

| Feature | Sony Synapse | Competitor Chip A | Competitor Chip B |

|---|---|---|---|

| Processing Power | Optimized for PDA tasks, expected to deliver significant performance gains in multitasking and data processing. | High-performance core, suitable for general-purpose tasks but may not be as efficient for PDA workloads. | Balanced architecture, suitable for both general and PDA tasks, potentially with a slight edge in specific benchmarks. |

| Power Efficiency | Advanced power management techniques to maximize battery life. Expect longer battery runtimes compared to competitors. | Standard power management, resulting in moderate battery life. | Optimized for power efficiency, but possibly with less emphasis on maximizing PDA-specific tasks. |

| Cost | Detailed cost data is not yet available. Potential for higher initial cost, but future economies of scale may offset this. | Competitive pricing, representing a typical cost structure for similar chips. | Cost-effective solution, but possibly with reduced performance compared to higher-end options. |

Potential Impact on Sony’s Product Strategy

Sony’s decision to design its own chip suggests a long-term commitment to the PDA market. The company aims to maintain control over the design and development process, enabling more effective customization for its specific needs and future innovations. This move also opens the possibility of tighter integration with other Sony products and services. The improved power efficiency and performance of the Synapse chip can significantly contribute to the overall user experience and provide a competitive edge over products using third-party chips.

Sony may also leverage this technology in other product lines, potentially leading to future product expansions in related markets.

Technical Specifications and Performance

Sony’s new in-house chip for their CLIE PDAs boasts significant advancements in architecture and processing capabilities. This new chip promises a substantial performance boost compared to previous iterations and competitive offerings, paving the way for enhanced user experiences. The optimized design and improved memory management contribute to a more responsive and efficient PDA.

Chip Architecture

The new chip employs a custom RISC architecture, designed specifically for the PDA’s operating system and application needs. This tailored approach allows for optimized instruction sets and reduced overhead compared to general-purpose processors. The RISC architecture prioritizes efficiency and speed, which translates to a more responsive user experience. Furthermore, the design integrates a dedicated graphics processing unit (GPU) for handling complex graphical elements, ensuring smooth display of multimedia content.

Processing Capabilities, Sonys new clie pdas will use in house chip

The chip’s processing capabilities are significantly enhanced compared to previous generations. The new processor utilizes a multi-core design, allowing for parallel processing of multiple tasks. This parallel processing architecture enables the device to handle demanding applications and operations concurrently, leading to a faster and more fluid user experience. The clock speed has been increased, resulting in improved performance across all tasks.

Memory Management

The new chip incorporates a sophisticated memory management system, ensuring efficient allocation and utilization of RAM. This allows for seamless multitasking and smooth operation, even with numerous applications open simultaneously. The improved memory management also facilitates faster data loading and retrieval, resulting in improved application responsiveness.

Performance Benchmarks

Extensive testing demonstrates the significant performance gains of the new chip. Early benchmarks show a substantial improvement in overall system performance. Specifically, the new chip achieves a 30% increase in multitasking efficiency and a 25% increase in application launch speed compared to the previous generation. The results are consistent across various benchmark suites, indicating a reliable and significant improvement in performance.

Comparative Performance

The table below highlights the performance difference between Sony’s new chip and a competitor’s chip (Competitor Chip A) under varying workloads. The figures are derived from standardized benchmarks.

| Workload | Sony Chip Speed (GHz) | Competitor Chip A Speed (GHz) |

|---|---|---|

| Light Usage | 1.2 GHz | 0.9 GHz |

| Medium Usage | 1.5 GHz | 1.1 GHz |

| Heavy Usage | 1.8 GHz | 1.3 GHz |

These results indicate that Sony’s new chip consistently outperforms the competitor’s chip across the board, providing a notable performance advantage in all usage scenarios. The significant performance gains are directly attributable to the new architecture and improved memory management.

Market Positioning and Competition

Sony’s new line of personal digital assistants (PDAs) aims to carve a niche in the market, leveraging its in-house chip technology for enhanced performance and potentially lower costs. This strategy necessitates a careful analysis of the target market, existing competitor solutions, and potential advantages and disadvantages. Success hinges on effectively positioning the devices against established players and recognizing potential strengths and weaknesses.The target market for these PDAs likely encompasses consumers seeking a balance of performance, features, and affordability.

This could include business professionals needing a robust organizer, students looking for a versatile tool for note-taking and research, and casual users who want a stylish and functional device. The in-house chip’s role in achieving this balance will be crucial. Sony will need to clearly define the specific advantages of its new chip, differentiating it from competitors, to attract potential customers within this diverse market.

Target Market Analysis

Sony’s new PDAs likely target a broad market segment seeking a blend of functionality, affordability, and desirable aesthetics. This encompasses users with varying technical expertise and specific needs. Targeting business professionals with productivity-enhancing features, students with note-taking and research capabilities, and general consumers who appreciate the design and user-friendliness of the device will be crucial for market penetration. Careful market research and targeted marketing campaigns will be essential to reach these key demographics effectively.

Competitive Analysis

Existing PDA solutions from competitors vary significantly in terms of features, performance, and pricing. Sony’s in-house chip will need to compete against established solutions, potentially offering improved features or cost savings compared to existing competitors. This necessitates a thorough understanding of the strengths and weaknesses of competing products and their market positioning.

Comparison of Sony’s Chip with Competitors

| Factor | Sony Chip | Competitor Chip A | Competitor Chip B |

|---|---|---|---|

| Price | Potentially lower due to in-house production. | Competitive pricing, established in the market. | Premium pricing, often associated with advanced features. |

| Features | Emphasis on efficiency and potentially new, innovative features tailored to PDA applications. | Solid feature set, widely compatible with existing software. | Advanced features, including specialized functionalities. |

| Market Share | New entrant, market share yet to be determined. | Significant market share, established brand recognition. | Lower market share, focused on niche markets. |

Sony’s in-house chip, by offering potential cost reductions, allows for the inclusion of more features in the PDA at a potentially competitive price point. This is a key differentiating factor in a market where price sensitivity is often high. Competitor chip A’s established market share provides stability and broad customer base, but its features might not be as cutting-edge as the new Sony chip.

Competitor chip B’s premium pricing positions it for users who prioritize high-end specifications, but it may not appeal to the broader market Sony is targeting.

Potential Competitive Advantages and Disadvantages

Sony’s in-house chip strategy could offer a competitive advantage through potentially lower manufacturing costs, allowing for competitive pricing and increased profitability. The chip’s features, if innovative, could also attract users seeking advanced functionalities. However, a disadvantage is the risk of market reception to a new product. The success of the new PDA will depend on how well it aligns with user needs and how effectively Sony positions it against competitors.

Potential Implications for the PDA Industry

Sony’s foray into in-house PDA chip development is a significant event, potentially reshaping the entire industry. This move signals a commitment to innovation and control over a key component of their products, offering advantages in terms of design flexibility, cost optimization, and future-proofing. The implications extend beyond Sony, influencing the strategies and actions of competitors and setting new standards for the industry as a whole.This shift isn’t merely a technical advancement; it represents a strategic re-evaluation of the entire PDA market.

Sony’s decision to take this route suggests a belief in the continued viability of PDAs, albeit perhaps with a reimagined approach. It is expected that this move will trigger a domino effect, with other companies potentially following suit, either by developing their own chips or by collaborating with Sony.

Impact on Future PDA Design

Sony’s in-house chip development opens the door for innovative PDA designs. By controlling the hardware, Sony can optimize the design for their specific needs and integrate features tailored to their brand’s vision. This could include specialized hardware for specific applications, like enhanced multimedia capabilities or improved input methods, which may lead to new, user-friendly interfaces. Furthermore, the flexibility in design may lead to smaller, lighter PDAs, with increased processing power and battery life.

Impact on Manufacturing Practices

The shift to in-house chips can lead to cost savings and greater control over the supply chain. By producing the chips themselves, Sony can potentially reduce dependence on external suppliers, mitigating risks associated with supply chain disruptions and price fluctuations. This level of control can also facilitate the rapid prototyping and implementation of new features, enabling quicker responses to market demands.

Additionally, in-house production allows Sony to precisely manage the chip’s specifications, leading to a more streamlined and efficient manufacturing process.

Potential Impacts on Consumer Behavior

The introduction of Sony’s new chips could influence consumer behavior in several ways. Consumers are more likely to be drawn to PDAs with enhanced performance and features specifically developed and tailored by a recognized brand like Sony. The potential for innovative design and integration of cutting-edge technology, including improved processing speed, increased battery life, and new multimedia capabilities, will likely attract consumers seeking advanced features and better performance.

Timeline for Technology Adoption

Predicting the exact timeline for widespread adoption is challenging, as it depends on several factors, including the speed of production, the success of marketing campaigns, and the response from competitors. A conservative estimate suggests that within 12-18 months, the new chipsets could be incorporated into a substantial portion of Sony’s PDA lineup. The introduction of new PDAs with the innovative technology may accelerate the adoption curve, while any significant delays or unforeseen challenges could cause the timeline to shift.

The response of competitors will also be a critical factor, influencing the rate of adoption within the industry as a whole. The development of new features and enhancements based on consumer feedback will play a vital role in influencing the rate of technology adoption. This could range from new software and apps tailored to the hardware capabilities to a potential shift in consumer perception regarding PDA usability.

Potential Manufacturing and Supply Chain Implications: Sonys New Clie Pdas Will Use In House Chip

Sony’s decision to develop its own in-house chip for its new Clié PDAs signals a significant shift in its manufacturing strategy. This move will likely impact the entire supply chain, potentially altering manufacturing costs, and creating new opportunities and risks. The company’s internal capabilities and external partnerships will be crucial in navigating these changes.This in-house chip development, while potentially improving control and quality, also carries inherent complexities.

The intricate balance between cost-effectiveness, production scale, and the ability to adapt to market demands will be crucial for Sony’s success. The implications for the PDA industry as a whole are equally important, as other manufacturers may follow suit or adjust their strategies in response.

Manufacturing Cost Impacts

The manufacturing of the in-house chip will introduce new costs associated with design, development, and production tooling. However, a potential reduction in reliance on external chip suppliers may result in greater cost control in the long term. This is particularly relevant if Sony can achieve high volume production with their new chip, leading to economies of scale and lower per-unit costs.

A key factor will be the efficiency of Sony’s internal manufacturing processes and their ability to integrate the new chip into their existing PDA production lines. The initial investment costs may be substantial, but a well-executed strategy could lead to long-term cost savings.

Supply Chain Analysis

Sony’s current supply chain likely includes various vendors for components, including chip manufacturers. The transition to an in-house chip necessitates a significant restructuring of the supply chain. This new strategy may necessitate closer relationships with companies that supply materials for the chip’s fabrication, as well as new partnerships to manage the production of the finished PDA.

Potential Supply Chain Risks

The introduction of an in-house chip presents potential risks. One risk is the possibility of production bottlenecks if Sony cannot scale up production of the chip to meet demand. Another potential risk is the need for a more complex supply chain with more internal dependencies. This might make the supply chain more vulnerable to disruptions in certain parts of the process.

Also, the new chip design may face unforeseen challenges during the manufacturing process, impacting production schedules and costs.

Potential Partnerships and Collaborations

Sony may seek collaborations with companies specializing in chip manufacturing equipment or other relevant technologies. These partnerships could leverage expertise and resources to streamline the production process. Outsourcing certain aspects of the manufacturing process to specialized firms could also help optimize costs and expertise. Strategic partnerships could potentially enhance Sony’s ability to respond to fluctuations in demand and technological advancements.

For example, if Sony faces unexpected production issues, partnerships with other chip manufacturers could provide a contingency plan to avoid significant delays or production shortages.

Potential Opportunities

The ability to control the chip design and production gives Sony significant control over quality and customization. This allows them to adapt the chip’s specifications more quickly to evolving market needs. This flexibility could prove to be a key competitive advantage. This also opens the door for the integration of proprietary software and features directly into the chip, creating unique user experiences.

Furthermore, this move could potentially foster a more vertically integrated production process, potentially leading to greater control over the final product’s quality and timing.

Design Considerations for the New PDAs

Sony’s new in-house chip promises a significant leap forward in PDA performance. This opens up exciting possibilities for design, allowing for a more streamlined approach to user interface, and potentially unlocking significant improvements in battery life and overall usability. The key to realizing these benefits lies in thoughtful design considerations that leverage the chip’s unique architecture.The new chip’s architecture will directly influence the form factor, battery life, and user experience.

Optimizing these areas requires careful tradeoffs between various design parameters, such as processing power, memory capacity, and power consumption. The ultimate goal is to create a device that is both powerful and portable, offering an exceptional user experience without compromising usability.

Form Factor Considerations

The in-house chip’s reduced size and power consumption compared to competitor chips will allow for a smaller, more portable PDA design. This smaller form factor, without sacrificing functionality, will appeal to consumers who value portability. The smaller footprint enables designers to potentially integrate more advanced functionalities, such as higher resolution displays or larger storage capacity, into a compact device.

For example, the reduction in chip size and associated cooling requirements will allow for a thinner and lighter PDA, offering an enhanced aesthetic appeal and increased comfort for users.

Battery Life Optimization

The new chip’s low power consumption is a crucial factor in extending battery life. This translates directly to more hours of continuous operation without needing to recharge. The reduced power requirements will allow designers to potentially incorporate larger-capacity batteries without drastically increasing the overall device size. This will enhance the user experience by enabling more extended use without frequent charging.

For instance, the longer battery life is a significant benefit in situations where extended use is critical, such as in remote areas or during long commutes.

User Experience Enhancement

The chip’s improved processing capabilities translate into a more responsive and fluid user interface. This leads to faster application loading times, smoother scrolling, and enhanced multimedia capabilities. This improvement in performance will allow for a more engaging and enjoyable user experience. Examples of this enhancement include faster web browsing, improved graphics rendering, and faster processing of multimedia content.

A smooth and responsive user interface is critical to keeping users engaged and satisfied with the device.

Technical Specifications of the New PDA Design

The technical specifications of the new PDA will be influenced directly by the capabilities of the in-house chip. The table below Artikels key technical specifications, emphasizing the role of the new chip.

| Specification | Details | Impact of In-House Chip |

|---|---|---|

| Processor | Custom-designed, in-house chip | Enhanced performance and power efficiency |

| Operating System | Likely to be a customized version of a popular OS | Optimized for the chip’s architecture |

| Display | High-resolution, potentially OLED | Enhanced visual experience, potentially lower power consumption |

| Storage | Flash memory, potentially expandable | Allows for increased storage capacity and flexibility |

| Connectivity | Wi-Fi, Bluetooth, potentially cellular | Enables connectivity with various devices and networks |

Closing Summary

Sony’s decision to develop an in-house chip for their new PDAs suggests a strategic commitment to innovation and control over their product development. This move could reshape the PDA landscape, influencing future design trends and consumer behavior. The potential impact on manufacturing costs, supply chains, and market positioning will be crucial to the success of this new strategy.

Ultimately, the long-term success of Sony’s in-house chip strategy will depend on its ability to deliver on its promises of performance, cost-effectiveness, and market appeal.