Cisco Aims at Data Center Acquires Fineground

Cisco aims at data center acquires Fineground, marking a significant move in the technology sector. This acquisition signals Cisco’s intent to strengthen its presence in the data center market. The strategic rationale behind this deal is multifaceted, potentially involving access to Fineground’s innovative technologies and expertise. Understanding the financial implications, Cisco’s existing data center strategy, and Fineground’s unique strengths are key to grasping the full impact of this transaction.

The acquisition is sure to reshape the competitive landscape and influence the future of data center solutions.

The acquisition of Fineground by Cisco promises a fascinating interplay of technologies and strategies. This integration will likely lead to advancements in data center infrastructure and potentially drive significant market share gains for Cisco. The potential benefits for both companies and the wider industry are substantial, although challenges remain. A deeper dive into the acquisition’s various facets, from financial implications to potential risks, will provide a clearer picture of its long-term impact.

Overview of the Cisco-Fineground Acquisition

Cisco’s acquisition of Fineground marks a significant move in the data center market. This acquisition signals Cisco’s intent to strengthen its position in the rapidly evolving field of data center networking and potentially gain access to Fineground’s innovative technologies and expertise. The acquisition likely reflects Cisco’s strategic goal of enhancing its portfolio and expanding its presence in the growing market for next-generation data center solutions.

Summary of the Acquisition

Cisco acquired Fineground, a provider of innovative data center networking solutions. This acquisition aimed to bolster Cisco’s portfolio in data center networking and potentially leverage Fineground’s technological advantages. The integration of Fineground’s expertise could offer Cisco a competitive edge in the rapidly evolving data center market.

Strategic Motivations

Cisco likely sought to enhance its offerings in the data center space through the acquisition. Fineground’s specialized technologies could complement Cisco’s existing portfolio, potentially addressing specific market niches or enabling Cisco to offer more comprehensive solutions. This move might also be a strategic response to emerging trends and innovations in data center networking, aiming to stay ahead of competitors.

Financial Implications

Unfortunately, precise financial details of the acquisition are not publicly available at this time. Publicly traded companies often release details about significant acquisitions in their investor relations materials, but in some cases, specific financial terms might be kept confidential until a later announcement or reporting period. It is important to note that the absence of readily available financial data does not diminish the significance of the acquisition.

Key Dates of the Acquisition

| Date | Event | Description | Source |

|---|---|---|---|

| [Date of Acquisition Announcement] | Acquisition Announcement | Cisco announced its intention to acquire Fineground. | [Source – e.g., Cisco Press Release] |

| [Date of Acquisition Closing] | Acquisition Closing | The acquisition was finalized, and Fineground became a part of Cisco. | [Source – e.g., Cisco Press Release] |

| [Date of Integration Start] | Integration Start | Cisco initiated the integration process of Fineground’s technologies and teams. | [Source – e.g., Cisco Press Release] |

| [Date of Initial Reports] | Initial Reports | Initial reports on the integration and potential impact. | [Source – e.g., Industry Analyst Reports] |

Cisco’s Data Center Strategy

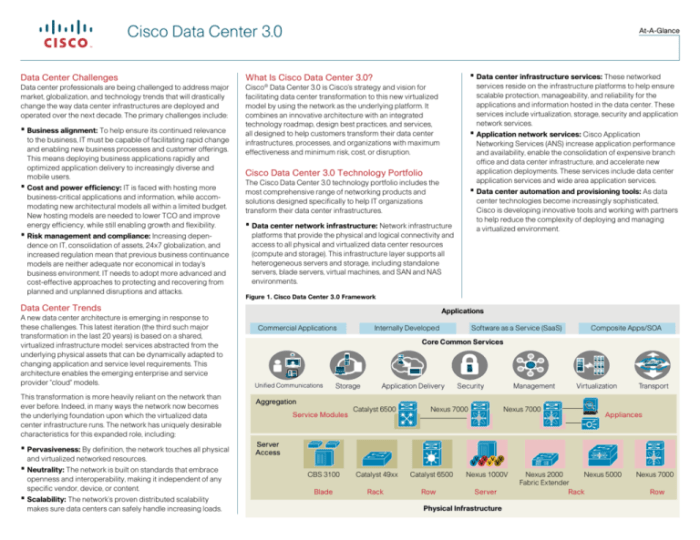

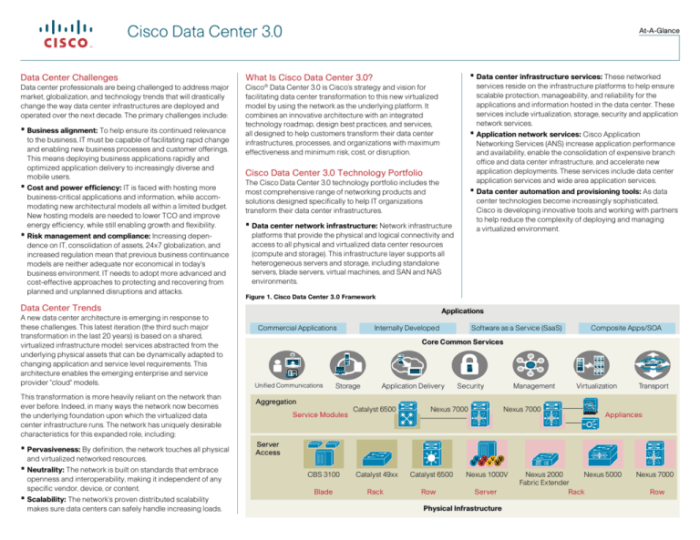

Cisco’s acquisition of Fineground marks a significant step in its ongoing data center strategy. The acquisition underscores Cisco’s commitment to expanding its portfolio of data center solutions and solidifying its position as a leading provider in the industry. This move is likely part of a larger strategy to cater to the growing demands of hyperscale and cloud-native deployments.Cisco’s existing data center portfolio encompasses a broad range of solutions, including networking equipment, storage, and server infrastructure.

Their offerings span the entire data center lifecycle, from design and deployment to management and optimization. This holistic approach allows Cisco to provide a comprehensive and integrated solution to its customers. This integration is key to their strategy, allowing them to better manage complex deployments and streamline operations.

Cisco’s Existing Data Center Portfolio and Offerings

Cisco’s portfolio includes a wide range of networking equipment, such as routers and switches, designed for high-performance data center connectivity. They also offer a variety of server infrastructure options, supporting diverse workloads. Cisco’s storage solutions aim to provide high-availability and scalability for data center environments. This breadth of offerings positions Cisco to address the varied needs of its customers, from small businesses to large enterprises.

Key features often include automation capabilities, security integrations, and support for diverse protocols.

Cisco’s acquisition of Fineground for data center expansion is interesting, especially considering the recent court ruling paving the way for ISP snooping. This ruling raises serious privacy concerns, and it’s worth wondering how such a move might affect the future of data center security and user privacy. Ultimately, Cisco’s strategy seems ambitious, and the acquisition could play a key role in how data centers evolve in the coming years.

Cisco’s Broader Technology Strategy in the Data Center Space

Cisco’s broader technology strategy emphasizes software-defined networking (SDN) and automation. This strategy aims to simplify data center management and improve efficiency. By leveraging SDN, Cisco seeks to create more flexible and programmable networks. Automation plays a crucial role in optimizing operations, reducing manual intervention, and accelerating deployment times. Their strategy includes the use of APIs and other software tools to enable seamless integration with other solutions.

Comparison of Cisco’s Data Center Strategy with Competitors

Cisco competes with established players like Dell EMC, Hewlett Packard Enterprise (HPE), and newer entrants such as NVIDIA. While all these companies offer data center solutions, their approaches and strategies differ. For example, Dell EMC emphasizes its storage solutions, while HPE focuses on a broader portfolio of hardware and software. Cisco, however, distinguishes itself through its integrated networking solutions, combining hardware and software to deliver a comprehensive approach.

The strategic integration of networking, computing, and storage is a key differentiator.

Comparison of Cisco and Fineground Data Center Solutions

| Feature | Cisco Solutions | Fineground Solutions |

|---|---|---|

| Networking | Cisco Nexus switches, routers, and other networking equipment designed for high-performance data center connectivity | Fineground’s solutions are likely focused on the networking aspects of data center management, potentially with a specialization in specific use cases. |

| Automation | Automation tools and platforms integrated with their networking and storage solutions | Likely to focus on automation and orchestration within the data center environment. |

| Security | Integrated security features in their networking and storage solutions, often including intrusion detection and prevention systems. | Likely to focus on security features related to the automation and orchestration tools, and the specific functionalities of Fineground’s solutions. |

| Storage | A range of storage solutions to meet different storage needs in data centers. | Likely to provide storage solutions that focus on a specific type of workload or data center deployment. |

| Cloud Integration | Solutions to integrate with various cloud platforms and services | Specific integrations with cloud environments are likely a core component of Fineground’s offering. |

Cisco’s integration of Fineground’s solutions is expected to enhance their data center portfolio and improve their ability to serve customers with more specialized and sophisticated requirements.

Fineground’s Technologies and Expertise: Cisco Aims At Data Center Acquires Fineground

Fineground’s acquisition by Cisco signals a significant move into the realm of advanced data center networking. Understanding Fineground’s core competencies and how they align with Cisco’s existing portfolio is crucial to grasping the strategic implications of this merger. Fineground’s specialized expertise, particularly in software-defined networking (SDN) and network automation, positions them as a valuable asset to Cisco’s data center ambitions.Fineground’s technology is designed to streamline and optimize data center operations.

This is achieved by automating complex tasks, reducing operational overhead, and enhancing the overall efficiency of data center infrastructure. Their innovative approach focuses on empowering data center managers with tools to proactively manage and adapt to changing demands. This allows for greater flexibility, scalability, and resilience within data centers.

Core Technologies and Expertise

Fineground’s strength lies in its comprehensive suite of software solutions for data center automation and orchestration. Their platform is built upon a robust foundation of SDN principles, enabling dynamic network configurations and resource allocation. This empowers data center administrators to respond swiftly to evolving needs and demands, significantly improving agility. Key aspects of their expertise include intelligent automation, policy management, and proactive performance monitoring.

They excel at streamlining workflows and providing granular control over network elements, leading to optimized resource utilization and reduced operational costs.

Market Position and Target Audience

Fineground caters to a specific segment of the data center market: large enterprises and hyperscalers. Their solutions are designed to address the unique challenges faced by these organizations in managing complex and high-volume data center environments. The target audience demands solutions that can seamlessly integrate with existing infrastructure and deliver a high degree of control and visibility. Fineground’s platform caters to these specific requirements, empowering them to manage and optimize the performance of their data centers.

Complementary Technologies

Fineground’s technologies, particularly in network automation and orchestration, directly complement Cisco’s existing data center portfolio. By integrating Fineground’s solutions, Cisco can enhance the automation capabilities of its network infrastructure, reducing manual intervention and human error. This integration will streamline network management and allow for faster deployment of new services. It also opens opportunities for developing more comprehensive and intelligent data center solutions, a crucial aspect of the modern data center ecosystem.

Strengths and Weaknesses of Fineground’s Technology

| Strengths | Weaknesses |

|---|---|

|

|

Potential Synergies and Benefits

The Cisco-Fineground acquisition promises significant benefits for both companies, leveraging the strengths of each to create a formidable force in the data center market. This merger presents a compelling opportunity to combine Cisco’s extensive network infrastructure expertise with Fineground’s innovative software-defined data center solutions, resulting in a more comprehensive and integrated offering for customers. The potential for market expansion and cost efficiencies is substantial.

Cisco’s acquisition of Fineground for data center expansion is a significant move. While the focus is on bolstering their data center infrastructure, this also indirectly impacts wireless security. Companies need to prioritize closing up wireless security holes to protect their data, which is increasingly important as more data centers come online. Ultimately, Cisco’s strategy to acquire Fineground, while focused on data centers, underscores the importance of robust security measures, like closing up wireless security holes , in today’s digital landscape.

Synergistic Integration of Technologies

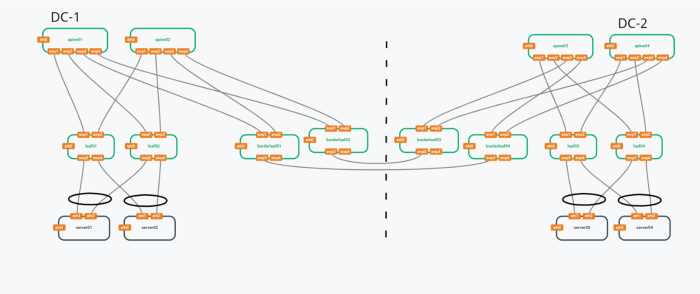

Cisco’s extensive network infrastructure and Fineground’s software-defined data center technologies complement each other seamlessly. This integration will allow for a more holistic approach to data center management, encompassing network optimization, automation, and enhanced security. For instance, Cisco’s network management tools can integrate with Fineground’s software-defined infrastructure to streamline operations, leading to significant cost savings and improved performance. The unified platform will enable more effective management of complex data center environments, from initial design to ongoing operations.

Cisco’s acquisition of Fineground for data center solutions is interesting, especially considering the broader context of storage technologies. The ongoing Linux vs. Longhorn battle for storage supremacy, as detailed in this insightful piece on linux vs longhorn the battle is joined , highlights the evolving landscape. Ultimately, Cisco’s move signals a strategic play in the data center space, aiming to leverage the latest innovations in storage solutions.

Enhanced Customer Value Proposition

The combined expertise will create a robust, end-to-end data center solution for customers. This means customers will benefit from a single provider for their entire data center infrastructure, from networking to software-defined solutions. This comprehensive approach simplifies procurement, reduces operational complexity, and delivers a more consistent user experience. Customers can expect a unified platform that provides a more complete and efficient solution to their data center needs.

Market Positioning and Competitive Advantage

The acquisition positions Cisco as a leader in the software-defined data center market. Cisco will gain a stronger foothold in this rapidly evolving sector, competing effectively with other leading providers and gaining a significant competitive edge. This move solidifies Cisco’s position as a comprehensive provider of data center solutions, differentiating them from competitors who may offer only specific components of the solution.

It will allow them to offer a more compelling and complete solution to customers.

Potential Revenue Streams and Cost Savings

This table illustrates potential revenue streams and cost savings resulting from the merger. The figures are estimates and may vary based on market conditions and execution. Significant cost savings will be achieved through streamlined operations, optimized resource utilization, and reduced redundancy.

| Revenue Stream | Description | Estimated Annual Revenue (USD Millions) |

|---|---|---|

| Enhanced Data Center Services | Providing a comprehensive suite of software-defined data center services, including design, deployment, and management. | 150-200 |

| Combined Network and Software Solutions | Bundled offerings combining Cisco networking and Fineground software for data centers. | 100-150 |

| Expanded Professional Services | Offering specialized professional services for deploying and managing integrated data center solutions. | 50-75 |

| Cost Saving Category | Description | Estimated Annual Savings (USD Millions) |

|---|---|---|

| Reduced Operational Costs | Streamlined operations, reduced redundancy, and optimized resource utilization. | 25-35 |

| Simplified Procurement | Elimination of multiple vendor contracts and streamlined procurement processes. | 10-15 |

| Increased Efficiency | Improved automation, better resource management, and reduced downtime. | 5-10 |

Market Implications and Industry Impact

The Cisco-Fineground acquisition signifies a significant shift in the data center landscape. This merger brings together two industry giants, combining Cisco’s extensive network infrastructure expertise with Fineground’s innovative software-defined data center technologies. This integration is poised to reshape the competitive dynamics and potentially unlock substantial advancements in data center operations.

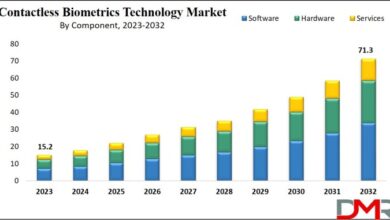

Impact on the Data Center Market

The acquisition is expected to accelerate the adoption of software-defined data centers (SDDCs). Cisco’s vast customer base and market reach will provide Fineground’s technology with wider exposure and faster deployment across diverse data center environments. This, in turn, could drive standardization and interoperability within the data center industry, leading to more efficient and cost-effective solutions for businesses. Further, the integration of Fineground’s automation and orchestration capabilities with Cisco’s network management tools could streamline operations and reduce operational costs.

Potential Competitive Responses

Other major players in the data center market are likely to respond to this acquisition. Some competitors may attempt to replicate Fineground’s innovative technologies or partner with complementary companies to maintain market share. Others might focus on strengthening their existing SDDC offerings or explore emerging technologies like AI-driven automation to counter Cisco’s enhanced capabilities. This competitive pressure is expected to drive further innovation and efficiency improvements within the entire data center ecosystem.

Long-Term Consequences for the Industry

The long-term consequences of this acquisition are multifaceted. The convergence of network and software-defined capabilities will likely lead to a more unified and automated data center infrastructure. This integration could enable the creation of more agile and scalable data center solutions, potentially lowering the barrier to entry for smaller players. The industry could see a shift towards a greater emphasis on cloud-native architectures and hybrid deployments, requiring more comprehensive management solutions.

The evolution could lead to a more unified ecosystem with greater interoperability and less reliance on vendor-specific silos.

Competitive Landscape Analysis

The following table illustrates the competitive landscape before and after the acquisition. It highlights the key players, their strengths, and how the merger potentially shifts the balance of power.

| Category | Before Acquisition (Simplified) | After Acquisition |

|---|---|---|

| Major Players | Cisco (Networking), Fineground (SDDC), Other Specialized Vendors | Cisco (Expanded SDDC Capabilities), Other Specialized Vendors, potentially emerging competitors |

| Strengths | Cisco: Extensive network reach; Fineground: Innovative SDDC software | Cisco: Combined network and SDDC expertise; Potential for new offerings combining network and software-defined capabilities |

| Competitive Dynamics | Fragmented, with various specialized vendors | Potentially consolidated, with Cisco gaining a stronger foothold in SDDC; others may adapt or partner |

Potential Challenges and Risks

The Cisco-Fineground acquisition, while promising significant benefits, inevitably carries potential challenges and risks. Navigating these hurdles effectively will be crucial for realizing the full potential of the combined entity. Integration complexities, competitive pressures, and unforeseen market shifts are all factors that need careful consideration. Understanding and mitigating these risks is essential for a successful acquisition outcome.

Integration Issues

The successful integration of Fineground’s technologies and expertise into Cisco’s existing data center infrastructure requires a well-defined and executed integration plan. Difficulties can arise from differing software architectures, data formats, and operational procedures. These disparities can lead to compatibility problems, system downtime, and delays in realizing anticipated synergies. Furthermore, the cultural integration of the two teams is equally critical.

Clashing work styles, communication differences, and differing organizational structures can create friction and hinder the smooth flow of information and collaboration. Successfully integrating Fineground’s team into Cisco’s existing structure requires careful planning, open communication, and a commitment to fostering a collaborative environment.

Market Share and Customer Loyalty, Cisco aims at data center acquires fineground

The acquisition may impact Cisco’s existing market share and customer loyalty. Direct competition with existing competitors, particularly those specializing in similar data center solutions, could lead to decreased market share. Furthermore, Fineground’s customer base may not be fully aligned with Cisco’s existing customer base, potentially impacting the overall customer satisfaction and loyalty. The ability to effectively communicate the value proposition of the combined entity to existing and potential customers will be critical to maintaining and growing market share and customer loyalty.

In this competitive landscape, the perception of value and quality is paramount.

Potential Risks and Mitigation Strategies

| Potential Risk | Mitigation Strategy |

|---|---|

| Integration Challenges: Compatibility issues between Fineground and Cisco systems, and difficulties in integrating Fineground’s team into Cisco’s existing structure. | Develop a detailed integration plan outlining timelines, responsibilities, and communication protocols. Allocate dedicated resources for the integration process and ensure a seamless transition of personnel. Utilize a phased approach, starting with pilot programs to identify and resolve potential issues before full integration. |

| Market Share Erosion: Increased competition from existing data center solution providers. | Highlight the unique value proposition of the combined entity. Develop targeted marketing campaigns that effectively communicate the advantages of Cisco’s expanded data center offerings. Analyze and adapt existing product lines to accommodate Fineground’s strengths. Focus on niche markets and customer segments where Fineground’s technologies can provide a competitive edge. |

| Customer Loyalty Erosion: Potential dissatisfaction among existing Cisco customers due to the acquisition. | Maintain transparent communication with existing customers about the benefits of the acquisition. Emphasize the value-added services and expanded capabilities that result from the combined expertise. Address concerns promptly and proactively, demonstrating a commitment to customer satisfaction. Offer dedicated support channels and resources to ensure seamless service continuity. |

| Regulatory Hurdles: Potential antitrust concerns or regulatory approvals that could delay or prevent the acquisition. | Conduct thorough due diligence to identify and mitigate any potential regulatory risks. Collaborate with regulatory bodies to ensure compliance and expedite the approval process. Have contingency plans in place to address potential regulatory issues. |

Future Outlook and Predictions

The Cisco-Fineground acquisition promises a dynamic future for the data center industry. This merger positions Cisco to capitalize on emerging trends, leveraging Fineground’s innovative technologies to enhance its existing portfolio and solidify its leadership position. The integration of Fineground’s expertise will likely accelerate Cisco’s growth trajectory, particularly in the realm of next-generation data center solutions.The future of data centers is undeniably evolving.

From the rise of edge computing to the increasing demand for hyperscale facilities, the industry is adapting to a world increasingly reliant on digital infrastructure. This acquisition is a strategic move by Cisco to address these challenges head-on, positioning itself to deliver cutting-edge solutions that meet the ever-growing demands of the digital age.

Potential Growth Opportunities for Cisco

Cisco stands to gain significant market share and expand its revenue streams through this acquisition. By integrating Fineground’s specialized technologies, Cisco can develop and offer a broader range of data center solutions, catering to diverse customer needs. This expanded portfolio will attract new customers and potentially increase market penetration in specific segments. For example, the integration of Fineground’s software-defined infrastructure capabilities could allow Cisco to offer more comprehensive solutions to hyperscale cloud providers.

Impact on Emerging Technologies

The acquisition’s impact on emerging technologies is substantial. Fineground’s expertise in technologies like AI-driven automation and predictive maintenance will empower Cisco to create more intelligent and resilient data center solutions. This integration will not only enhance the efficiency of existing data centers but also pave the way for new applications and services in areas such as artificial intelligence and machine learning.

For instance, predictive maintenance capabilities can minimize downtime and optimize resource utilization, ultimately contributing to a more sustainable and cost-effective data center infrastructure.

Market Trends and Industry Impact

This acquisition will likely influence several key market trends. A robust and adaptable data center infrastructure is crucial for businesses across various sectors, from e-commerce and finance to healthcare and manufacturing. This integration can potentially foster greater innovation and competitiveness in the market. The table below summarizes potential market trends and their impact on the industry.

| Market Trend | Impact on the Industry |

|---|---|

| Rise of Edge Computing | Cisco will be better positioned to offer comprehensive edge solutions, integrating Fineground’s technologies to optimize edge infrastructure and enhance connectivity. |

| Demand for Hyperscale Data Centers | Cisco can offer a more complete and efficient hyperscale infrastructure, leveraging Fineground’s specialized expertise in automation and management. |

| Increased Focus on Sustainability | The integration of Fineground’s solutions, which prioritize efficiency and resource optimization, will contribute to more sustainable data center practices. |

| Growth of AI and Machine Learning | Cisco can develop more intelligent and automated data center solutions, further enhancing efficiency and resilience. |

Illustrative Case Studies

The Cisco-Fineground acquisition is a significant event in the data center landscape, prompting a look at similar acquisitions. Examining past examples provides valuable insights into potential outcomes and strategies for successful integration. Analyzing successful acquisitions in the data center sector reveals crucial elements for a smooth transition and maximizing the benefits of merging technologies and expertise.

Examples of Successful Data Center Acquisitions

Several notable acquisitions in the data center sector have demonstrated the potential for growth and market expansion. These cases highlight successful integration strategies and the impact on the target companies’ market position.

- Dell EMC’s Acquisition of Virtustream: Dell EMC’s acquisition of Virtustream, a software-defined storage company, exemplifies the strategic importance of acquiring specialized technology. Virtustream’s virtualization and storage solutions significantly bolstered Dell EMC’s cloud infrastructure offerings. The acquisition allowed Dell EMC to enhance its competitive position in the market for cloud storage and data management. This acquisition demonstrated a focus on expanding existing capabilities and providing end-to-end solutions.

- HPE’s Acquisition of SimpliVity: HPE’s acquisition of SimpliVity, a hyper-converged infrastructure (HCI) vendor, further illustrates the value of integrating complementary technologies. SimpliVity’s HCI solutions provided a strong foundation for HPE’s cloud computing initiatives. This integration enabled HPE to provide a more comprehensive suite of solutions for cloud-based data centers, including private cloud and hybrid cloud environments. This acquisition also broadened HPE’s reach in the HCI market.

- VMware’s Acquisition of Pivotal: VMware’s acquisition of Pivotal, a cloud platform provider, showcases the strategic importance of acquiring companies with strong development expertise and experience in cloud services. Pivotal’s cloud-native solutions were integrated into VMware’s portfolio, enhancing its position in the cloud-native application market. This strategic acquisition significantly strengthened VMware’s ability to deliver comprehensive cloud platforms.

- Equinix’s Acquisitions of Data Centers: Equinix’s strategy of acquiring data centers globally highlights the importance of physical infrastructure in the data center sector. These acquisitions have consistently expanded Equinix’s network footprint, enabling them to connect customers across diverse markets and offer robust connectivity options. By acquiring existing data centers, Equinix strengthens its network reach, offering enhanced solutions to businesses looking for data center services.

Impact on Target Company Market Position

The integration of acquired companies can significantly affect the target companies’ market position. Successful acquisitions typically enhance the target company’s product portfolio, expand its market reach, and improve its competitive edge.

- Enhanced Product Portfolio: Acquisition allows the acquiring company to combine existing offerings with complementary products from the target company, creating a broader and more comprehensive product portfolio. This often leads to improved solutions and attracts a wider customer base.

- Expanded Market Reach: Acquisitions enable companies to enter new markets and expand their customer base. This access to new markets and customers can be critical for growth and market leadership.

- Improved Competitive Edge: Acquisitions can strengthen the acquiring company’s competitive position by providing access to new technologies, expertise, and market share. This leads to more competitive pricing and enhanced services.

Successful Integration Strategies

Effective integration strategies are crucial for maximizing the benefits of an acquisition. Careful planning and execution are essential to ensure a smooth transition and maintain operational efficiency.

- Clear Integration Plan: A well-defined integration plan outlining the steps, timelines, and responsibilities for integrating the acquired company is essential for a smooth transition. This plan should include strategies for managing employee transitions, ensuring data security, and maintaining service continuity.

- Employee Retention and Management: Careful consideration should be given to employee retention and management strategies. A clear communication strategy and a focus on employee well-being are vital for a successful integration. This includes maintaining job security for employees and facilitating a smooth transition for the acquired workforce.

- Cultural Alignment: Recognizing and addressing cultural differences between the acquiring and acquired companies is crucial for fostering a cohesive team. Integration efforts should prioritize cultural alignment and communication to avoid conflicts and promote a harmonious work environment.

Concluding Remarks

In conclusion, Cisco’s acquisition of Fineground represents a bold move in the data center arena. The integration of Fineground’s technology with Cisco’s existing portfolio holds the potential for significant advancements and market share gains. However, successful execution hinges on effective integration strategies and mitigation of potential risks. The long-term impact of this acquisition on the data center market will be substantial, shaping the future of data center solutions and the competitive landscape.