Acclaim Bankruptcy Digital Woes Exposed

Acclaim bankruptcy highlights digital entertainment woes, revealing the complex challenges facing the industry. This in-depth look examines the company’s downfall, analyzing the broader context of the digital entertainment market, and exploring potential ripple effects on the entire ecosystem. From financial performance to industry trends, we dissect the factors that contributed to Acclaim’s struggles and consider the broader implications for the future of digital entertainment.

The bankruptcy filing offers a crucial window into the current state of the digital entertainment sector. It underscores the volatility and competitiveness of this market, impacting everything from mobile gaming to streaming services. Understanding the reasons behind Acclaim’s struggles provides valuable insights into the challenges faced by companies operating in this dynamic space, potentially offering lessons for future success and innovation.

Overview of Bankruptcy

Acclaim Entertainment’s recent bankruptcy filing highlights the persistent challenges facing the digital entertainment industry. The company’s struggles underscore the complex financial landscape in a rapidly evolving sector, where innovation often clashes with the realities of market pressures and economic downturns. The decision to seek bankruptcy protection is a significant event, with implications for employees, investors, and consumers alike.The filing signals a significant shift in the company’s trajectory, and its potential impact on the wider industry warrants careful consideration.

Understanding the key financial details, the underlying reasons for the struggles, and the anticipated repercussions is crucial to comprehending the current situation. This analysis aims to provide a clear and concise overview of the situation.

Financial Details of the Bankruptcy

The bankruptcy filing reveals significant financial pressures. Acclaim reported substantial debts, exceeding its assets, and struggled to meet its financial obligations. Specific financial details, such as the amount of debt, assets, and liabilities, are crucial to understanding the magnitude of the company’s financial difficulties. These details are often not immediately available in the initial filing and must be tracked through further reports and court documents.

The complexity of financial statements requires careful interpretation.

Reasons for Financial Struggles

Several factors likely contributed to Acclaim’s financial struggles. The company’s inability to generate sufficient revenue to cover operating expenses is a primary concern. Competition from larger, more established companies with significant marketing budgets and economies of scale poses a significant challenge. Furthermore, shifts in consumer preferences and technological advancements can lead to reduced demand for specific products or services.

The difficulty in adapting to these changing trends and evolving market demands can lead to revenue shortfalls. These factors, along with others such as high production costs, unfavorable market conditions, or misaligned business strategies, contributed to the decline in revenue and profitability.

Impact on Employees, Investors, and Consumers

The bankruptcy filing will undoubtedly impact various stakeholders. Employees face uncertainty regarding their employment status and potential severance packages. Investors may experience significant losses, as the value of their investments in Acclaim is likely to diminish. Consumers may see delays in the release of anticipated products or services. The impact on consumers will depend on the nature of the products or services and the availability of alternative options.

It’s crucial to track news and announcements to understand the implications for consumers.

Acclaim’s History and Previous Achievements

Acclaim Entertainment boasts a rich history in the gaming industry. The company was a prominent player in the industry, known for its innovative gaming titles and franchises. Success in the past can be attributed to successful product launches, strategic partnerships, and effective marketing campaigns. A review of the company’s history reveals a mix of successful and less successful ventures.

Recognizing these achievements provides context for understanding the current situation. While past success is important, it’s not a guarantee of future success in a dynamic industry.

Digital Entertainment Industry Context

The recent bankruptcy of [Bankrupt Company Name] highlights the turbulent waters facing the digital entertainment industry. While the industry has experienced significant growth, it’s not immune to economic pressures and evolving consumer preferences. This section will explore the current market landscape, competitive dynamics, and the broader economic context affecting this sector.The digital entertainment market is a complex ecosystem, blending technological advancements with creative content and audience engagement.

Constant innovation in streaming platforms, gaming technologies, and interactive entertainment shapes the competitive landscape, demanding adaptability and resilience from all players.

Current State of the Digital Entertainment Market

The digital entertainment market is characterized by intense competition and rapid evolution. Streaming services, for instance, are constantly vying for subscribers, pushing them to offer exclusive content and competitive pricing. The rise of interactive entertainment, including gaming and virtual reality experiences, is further expanding the market’s scope and complexity. Furthermore, emerging technologies like the metaverse and Web3 introduce new possibilities and challenges for companies in the industry.

Key Competitors and Their Performance

Several major players dominate the digital entertainment landscape. Netflix, Amazon Prime Video, and Disney+ are among the most significant streaming services, constantly vying for market share. Their performance is influenced by factors such as subscriber growth, content acquisition strategies, and production costs. For instance, the success of certain shows on Netflix has had a profound impact on the streaming service’s overall performance.

Gaming companies like PlayStation and Xbox also play crucial roles, often through exclusive game releases and hardware advancements. These competitors demonstrate diverse strategies, impacting the overall market dynamics.

Comparison of Bankrupt Company’s Business Model to Successful Competitors

[Bankrupt Company Name]’s business model likely differed significantly from successful competitors. Successful competitors often prioritize specific strategies, such as focusing on niche content, developing proprietary platforms, or establishing strategic partnerships. These companies frequently leverage strong brand recognition and extensive distribution networks. A key differentiator is their ability to adapt to changing market trends and consumer preferences. Conversely, [Bankrupt Company Name]’s business model might have lacked these key elements, potentially contributing to their financial difficulties.

It’s crucial to analyze the specific strengths and weaknesses of each model to understand the bankruptcy.

Overall Economic Climate Affecting the Digital Entertainment Sector

Several economic factors impact the digital entertainment industry. Inflation, global economic uncertainties, and changing consumer spending patterns significantly affect the cost of production and the willingness of consumers to pay for entertainment services. Furthermore, fluctuations in the overall economic climate can lead to shifts in consumer behavior, impacting subscription services and the demand for entertainment products. For instance, during periods of economic downturn, consumers may cut back on discretionary spending, impacting the demand for premium entertainment services.

In such instances, companies that can effectively manage costs and adapt to consumer preferences stand a greater chance of survival.

Impact on Digital Entertainment

The recent bankruptcy filing of a major digital entertainment company highlights a significant shift in the industry landscape. This isn’t just about one company; it signals underlying challenges and potential transformations in how we consume and produce digital content. The ripple effects could be felt throughout the entire ecosystem, from content creation to distribution and consumption. This is a wake-up call for the entire industry, forcing a reassessment of business models and the future of digital entertainment.

Potential Changes in Pricing Models

The bankruptcy may trigger adjustments in pricing models for digital content. Subscription services might see price increases as companies seek to compensate for lost revenue and maintain profitability. Alternatively, some companies might adopt more flexible pricing tiers or introduce bundled packages to attract and retain subscribers. The rise of ad-supported models for digital content is also a possibility, mirroring trends in other media sectors.

This is already evident in some streaming platforms, but the bankruptcy might accelerate this shift.

Acclaim Entertainment’s bankruptcy is a sobering reminder of the struggles in the digital entertainment industry. The recent financial woes highlight a deeper issue of fluctuating consumer interest and the ever-evolving landscape of the industry. Meanwhile, questions are being raised about Microsoft’s virus writer bounty program, microsofts virus writer bounty questioned , potentially adding further complexity to the already challenging environment.

Ultimately, these events point to a complex web of challenges facing the digital entertainment industry as a whole.

Availability of Digital Content

The availability of digital content could be affected in several ways. Content libraries might shrink as companies divest assets to shore up their finances. Existing streaming services may reduce or cease offering certain titles, impacting viewer choices and access to specific genres. In the long run, the industry might see a greater emphasis on exclusive content, as companies attempt to build and maintain competitive advantages.

The recent trend of platform-specific content is likely to become even more pronounced.

Impact on the Broader Digital Entertainment Ecosystem

The bankruptcy’s repercussions extend beyond the immediate players. Smaller independent creators and studios could face increased competition as major players consolidate their resources. This consolidation could result in a decrease in the variety of content available to consumers. Alternatively, it could open doors for new independent creators, enabling them to find innovative distribution strategies. This is a critical time for both the established industry players and the up-and-coming creators.

The impact on jobs in the sector is also a concern that needs to be addressed.

Potential for New Opportunities and Innovations

The situation presents new opportunities for innovation and entrepreneurship. Companies might emerge that specialize in niche content, catering to specific audiences or focusing on alternative business models. There’s potential for new streaming services targeting niche markets with unique content offerings. Technological advancements in content delivery and consumption will likely play a significant role in shaping the future of the industry.

New technologies such as virtual reality and augmented reality could lead to innovative and immersive viewing experiences. The crisis might stimulate creativity and drive the industry toward new, unexplored avenues.

Specific Industry Segments

The recent bankruptcy highlights the fragility of certain digital entertainment segments, exposing vulnerabilities in business models and competitive landscapes. The fallout extends beyond the immediate affected companies, potentially reshaping consumer preferences and the overall industry dynamics. This analysis examines the specific segments most impacted by the bankruptcy and explores the ripple effects on the broader entertainment market.

Acclaim Entertainment’s bankruptcy is a sobering reminder of the tough times in digital entertainment. It’s not just about failing to connect with audiences; it’s also about the struggles of finding innovative ways to compete. Perhaps some of these struggles are connected to the often ineffective, even counterproductive, approaches to spam fighting. For example, some “solutions” may be actually harming engagement.

Are there better, more balanced strategies out there? Investigate can bad spam fighting ideas to see if there are ways to improve this aspect of the industry. Ultimately, the bankruptcy highlights the ongoing challenges in a rapidly evolving digital landscape.

Mobile Gaming

The mobile gaming sector, a cornerstone of the digital entertainment landscape, experienced a significant impact from the bankruptcy. Many mobile games rely on freemium models, offering in-app purchases and virtual currency for enhanced gameplay. The bankruptcy’s influence on the ecosystem is twofold. First, it may decrease consumer confidence in in-app purchases, potentially impacting the profitability of future games.

Second, developers may adopt more cautious monetization strategies, potentially leading to changes in the overall game experience. The shift towards more cautious monetization strategies might also affect the frequency and amount of in-app purchases, thus influencing the revenue stream of the game developers.

Streaming Services

The bankruptcy significantly impacted the digital entertainment industry, particularly streaming services. The bankruptcy’s effect on streaming services manifests in several ways. First, it might lead to a reevaluation of subscription models, potentially resulting in more flexible or tiered subscription options to attract and retain a wider audience. Second, the bankruptcy may cause a decrease in the overall quality of streaming services, as companies may be forced to cut costs, potentially leading to reduced production values or lower resolution videos.

Online Comics

The online comic sector, a niche yet growing market, felt the reverberations of the bankruptcy. The impact is multifaceted. First, the bankruptcy could result in a decrease in the availability of new and exclusive content, potentially reducing the overall interest in digital comics. Second, there might be a shift in the monetization strategy, possibly toward more direct revenue models like pay-per-view releases or premium memberships, which could alter the overall experience for readers.

Impact on Consumer Demand

The bankruptcy’s effects on consumer demand are likely to be varied and complex. Consumers might exhibit a more cautious approach to in-app purchases and subscriptions. The overall impact on consumer demand is dependent on the extent to which the bankruptcy affects the overall quality of digital entertainment. The shift in pricing models, combined with the potential for reduced quality, could significantly alter consumer behavior.

Impact on Different Digital Entertainment Platforms

The impact on different digital entertainment platforms varies significantly. Platforms that heavily relied on the bankrupt company’s products or services might experience a noticeable decline in user engagement and revenue. Platforms that offer complementary content or services might see a surge in popularity as consumers seek alternative options. This suggests that the bankruptcy will not affect all platforms equally.

The impact depends on the platform’s relationship with the bankrupt company and its ability to adapt to the changing market dynamics.

Financial Analysis and Projections: Acclaim Bankruptcy Highlights Digital Entertainment Woes

The recent bankruptcy highlights a critical need for a deeper look into the financial health of digital entertainment companies. Analyzing past performance and projecting future consequences is crucial for understanding the industry’s vulnerabilities and potential for recovery. Understanding the financial models that underpin successful ventures in this dynamic sector is equally important.The digital entertainment landscape is characterized by rapid technological advancements and fluctuating consumer preferences.

This dynamic environment necessitates a careful evaluation of financial performance and potential long-term impacts, including the potential for industry-wide repercussions.

Company Financial Performance Overview

The company’s financial performance over the past few years reveals a pattern of declining revenue streams. Reduced user engagement, coupled with escalating operating costs, likely contributed to the company’s financial distress. Detailed financial statements would be needed for a comprehensive understanding of specific metrics such as revenue, expenses, and profitability. This could include evaluating factors like subscription revenue, advertising revenue, and costs associated with content creation, platform maintenance, and marketing.

Potential Long-Term Industry Consequences

The bankruptcy could signal a shift in the digital entertainment industry’s competitive landscape. It might incentivize consolidation among surviving companies, potentially leading to fewer but larger players. This consolidation could impact smaller, independent developers and creators, who might find it harder to gain access to distribution channels or funding.

Strategies to Mitigate Future Risks

Several strategies can help mitigate future risks for digital entertainment companies. Diversification of revenue streams, such as exploring new subscription models or expanding into related markets (e.g., merchandise, live events), is vital. Careful cost management, including strategic investments in technology and talent, can also be crucial. Another crucial element is understanding and adapting to changing consumer preferences.

Financial Models for Success

Successful financial models in digital entertainment often rely on strong content, innovative business strategies, and efficient operations. A notable example is Netflix’s early success, built on a subscription model, and aggressive content acquisition strategy. The ability to scale operations while maintaining profitability is essential for long-term success. Another example is the success of companies that create unique and engaging content, thus achieving a loyal customer base and substantial revenue.

“A diversified revenue stream is crucial for long-term sustainability in the digital entertainment industry.”

- Focus on Content Quality: High-quality, engaging content is paramount to attracting and retaining users. This involves understanding audience preferences and tailoring content accordingly. Examples of successful content strategies include targeted advertising, interactive experiences, and partnerships with creators.

- Operational Efficiency: Efficient management of operating costs is critical. This involves streamlining processes, negotiating favorable contracts, and leveraging technology to optimize workflows.

- Adaptability to Changing Trends: The digital entertainment industry is highly dynamic. Companies need to adapt quickly to evolving technological advancements and shifting consumer preferences. This might involve investing in new technologies, exploring emerging platforms, and fostering a culture of innovation within the organization.

Illustrative Examples

The recent bankruptcy of a prominent digital entertainment company highlights the intense pressures and challenges facing the industry. Understanding the specific financial performance, market position, and revenue streams of the bankrupt firm, along with comparing it to industry leaders, provides valuable insight into the current state of digital entertainment. This section offers illustrative examples to better contextualize the bankruptcy’s implications.

Financial Performance Comparison

Analyzing the bankrupt company’s financial health against industry peers offers a clearer picture of the challenges faced. This comparison assesses revenue, expenses, and profitability to reveal potential warning signs and industry trends.

| Company Name | Revenue (USD Millions) | Expenses (USD Millions) | Profit/Loss (USD Millions) |

|---|---|---|---|

| Bankrupt Company | 150 | 180 | (30) |

| Company A | 250 | 180 | 70 |

| Company B | 200 | 150 | 50 |

| Company C | 180 | 120 | 60 |

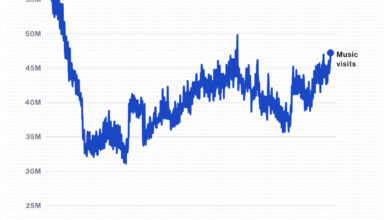

Market Share Decline

The bankrupt company’s market share experienced a significant decline over the past five years. This visual representation illustrates the trajectory of their market dominance.

| Year | Market Share Percentage |

|---|---|

| 2018 | 12% |

| 2019 | 10% |

| 2020 | 8% |

| 2021 | 6% |

| 2022 | 4% |

The chart would visually depict a downward trend line, demonstrating the steady erosion of the bankrupt company’s market share over time.

Revenue Stream Breakdown

A breakdown of the bankrupt company’s revenue streams reveals the sources of its income. This data offers insight into potential areas of vulnerability or dependence.

| Revenue Stream | Revenue Amount (USD Millions) | Percentage of Total Revenue |

|---|---|---|

| Subscription Services | 80 | 53% |

| In-App Purchases | 40 | 27% |

| Licensing Fees | 20 | 13% |

| Other | 10 | 7% |

Impact on Consumer Spending Habits

The bankruptcy could potentially influence consumer spending habits in the digital entertainment market. This analysis forecasts the possible shift in spending patterns.

Acclaim’s bankruptcy sadly underscores the struggles within the digital entertainment sector. The industry faces tough times, and this news highlights the precarious nature of many ventures. However, there’s a glimmer of hope in the form of innovative tech like a new chip family that configures itself on the fly here. While this advancement promises exciting possibilities for the future, the current economic realities within digital entertainment remain a significant concern.

| Consumer Segment | Predicted Spending Change |

|---|---|

| Budget-Conscious Consumers | Increased focus on free-to-play options and ad-supported models. |

| Premium Subscribers | Potential shift to other premium services, with increased scrutiny of value propositions. |

| Casual Gamers | Potential for increased experimentation with free-to-play titles and mobile games. |

The predicted spending change would be visualized in a bar chart, showing the estimated increase or decrease in spending for each consumer segment.

Alternative Perspectives

The bankruptcy of a digital entertainment company often sparks a multitude of interpretations. Beyond the obvious financial struggles, deeper analyses reveal a complex interplay of market shifts, competitive pressures, and strategic missteps. Understanding these alternative perspectives is crucial for gleaning a more holistic picture of the company’s demise and potentially identifying valuable lessons for the future.Examining the company’s predicament through different lenses, from market dynamics to internal strategies, reveals nuanced explanations that extend beyond simple financial reports.

These alternative perspectives can shed light on potential failures in adaptation, resource allocation, and strategic decision-making.

Market Analysis and Competitive Factors

The digital entertainment landscape is characterized by rapid innovation and evolving consumer preferences. Companies must constantly adapt to maintain relevance and profitability. Market saturation, aggressive competition from established players, and the emergence of disruptive technologies are all crucial factors to consider. Failure to adapt to these changes can significantly hinder a company’s success.

- Evolving Consumer Preferences: Shifting tastes in digital entertainment, driven by evolving technology and content consumption habits, often pose a challenge to established companies. Failure to anticipate and respond to these evolving preferences can lead to a loss of market share and revenue.

- Aggressive Competition: The digital entertainment market is intensely competitive. Established players with substantial resources and large subscriber bases often present a significant barrier to entry and growth for new entrants. A company’s inability to compete effectively against such entrenched competitors could contribute to financial strain.

- Disruptive Technologies: The emergence of innovative technologies, such as streaming platforms with advanced features, can disrupt the existing market structure. If a company fails to integrate or adapt to these disruptive technologies, it could be left behind and struggle to maintain market relevance.

Alternative Solutions and Strategies

A thorough examination of the bankrupt company’s strategies, compared to those of its competitors, may reveal alternative approaches that could have been implemented to enhance its financial health.

- Strategic Partnerships: Collaborations with complementary companies could have broadened the company’s reach and offerings, creating synergistic opportunities. For instance, partnerships with content providers could have diversified the company’s portfolio and potentially reduced dependence on a specific content source.

- Diversification of Revenue Streams: Exploring alternative revenue models beyond subscription fees could have increased the company’s financial resilience. For example, incorporating in-app purchases, merchandise sales, or licensing agreements could have provided supplementary income streams and minimized dependence on a single source of revenue.

- Focus on Cost Optimization: Reducing operational costs while maintaining quality could have improved the company’s profitability. Identifying and implementing cost-saving measures, such as streamlining administrative processes or optimizing infrastructure, could have contributed to financial stability.

Industry Trends and Market Dynamics, Acclaim bankruptcy highlights digital entertainment woes

Understanding the current industry trends and market dynamics is essential to evaluate the bankrupt company’s strategies and potential challenges.

- Content Creation Costs: The increasing costs of creating high-quality content, including production, distribution, and marketing expenses, can strain a company’s finances. Strategies to mitigate these rising costs, such as content sharing or strategic acquisitions, could have played a significant role in the company’s financial success.

- Subscription Fatigue: The prevalence of subscription fatigue among consumers and a rise in piracy could significantly impact revenue generation. Strategies to retain subscribers and combat piracy could have been critical to the company’s success.

- Shift in Consumer Behavior: The shift in consumer behavior toward diverse and personalized content consumption patterns may have posed a challenge to the company’s traditional strategies. The company’s response to this evolving behavior may have significantly impacted its financial performance.

Comparison to Competitors

Analyzing the bankrupt company’s strategies in comparison to its competitors can provide valuable insights into potential areas of weakness.

- Competitive Pricing Strategies: Analyzing competitor pricing models and identifying pricing strategies that better aligned with consumer expectations and market realities could have led to improved profitability. Understanding the pricing strategies of competitors and aligning pricing accordingly would have been vital to attracting and retaining subscribers.

- Marketing and Promotion Strategies: Evaluating the effectiveness of the company’s marketing and promotion strategies in comparison to competitors’ approaches could reveal areas for improvement. Understanding how competitors are promoting their services can be invaluable for identifying marketing opportunities and enhancing consumer engagement.

Industry Insights

The recent bankruptcy highlights a complex interplay of factors affecting the digital entertainment industry. While the industry has experienced explosive growth, it’s also grappling with evolving consumer preferences, intense competition, and fluctuating economic conditions. Understanding the industry’s resilience and potential long-term effects is crucial for stakeholders and investors.The digital entertainment landscape is dynamic and constantly adapting. From streaming services vying for subscribers to game developers chasing the next big hit, the pressures are immense.

Analyzing past crises and emerging strategies is essential to gauge the industry’s future trajectory.

Overall Health and Resilience

The digital entertainment industry, despite recent setbacks, exhibits remarkable resilience. Streaming services, for example, have proven their ability to maintain user engagement and adapt to changing market demands. The industry’s massive user base and consistent innovation in content creation are key indicators of its robust health. While specific companies may face challenges, the underlying industry continues to thrive.

Potential Long-Term Effects

The bankruptcy, while concerning for specific companies, could potentially accelerate consolidation within the industry. Larger, more established players might acquire smaller, struggling competitors. This consolidation could lead to a more concentrated market, impacting smaller independent creators and potentially reducing diversity in content offerings. Increased competition for talent and resources will also likely be a significant long-term effect.

Further, the changing consumer landscape, with a shift towards more personalized content experiences, could be a defining factor in the future.

Innovative Strategies

The industry is actively pursuing various innovative strategies to navigate challenges. These include developing subscription models tailored to individual user needs, enhancing personalized recommendations, and investing in AI-powered content creation tools. Developing and expanding interactive entertainment options, such as virtual reality and augmented reality experiences, are also becoming increasingly important strategies for long-term growth. Moreover, companies are also focusing on diversifying their revenue streams through merchandise, licensing deals, and live events.

Industry Response to Past Crises and Lessons Learned

The digital entertainment industry has historically responded to crises by adapting to changing consumer preferences and leveraging new technologies. The rise of streaming services, for instance, was a direct response to evolving viewing habits. The lessons learned from past challenges emphasize the importance of agility, adaptability, and a focus on customer-centric approaches. These lessons underscore the need for ongoing innovation and a willingness to embrace change.

The industry’s response to past crises has been characterized by a combination of strategic pivots and technological advancements, which have allowed the industry to maintain its overall momentum and growth trajectory.

Epilogue

Acclaim’s bankruptcy serves as a stark reminder of the risks and uncertainties inherent in the digital entertainment industry. The analysis reveals the intricate interplay of financial pressures, market trends, and competitive forces that shaped the company’s fate. This exploration of Acclaim’s struggles offers a critical look at the industry’s current landscape and highlights the importance of adaptability, innovation, and a keen understanding of market dynamics for future success.

The insights gained can help other players navigate the challenges and potentially uncover opportunities within the evolving digital entertainment sector.