AMD Acquires National Semiconductors Geode Unit

Amd acquires national semiconductors geode unit – AMD acquires National Semiconductor’s Geode unit, a significant move in the semiconductor industry. This acquisition signals a strategic shift for both companies, potentially impacting their future product portfolios and market positions. The deal’s details, including key terms, historical context, and anticipated impacts, are explored in depth. What will this mean for the future of both companies?

This acquisition is likely to be a complex interplay of technological integration, market analysis, and financial implications. The acquisition will undoubtedly alter the competitive landscape and could bring about unexpected opportunities. Let’s delve into the details and explore the potential impact of this significant transaction.

Overview of the AMD Acquisition

AMD’s acquisition of the National Semiconductor Geode unit represents a significant strategic move in the processor market. This acquisition signifies a calculated effort to bolster AMD’s position in the embedded systems sector, a market often overlooked but with substantial growth potential. The deal underscores AMD’s ambition to expand its reach beyond its traditional PC and server markets, thereby increasing its overall revenue streams and market share.

Key Terms and Conditions

The acquisition agreement details the financial aspects of the transaction. While specific figures are often kept confidential, the agreement likely Artikeld the purchase price, payment terms, and potential contingent liabilities. These details are vital for evaluating the financial implications for both AMD and National Semiconductor. Furthermore, the agreement probably specified the transfer of intellectual property, including patents and trademarks associated with the Geode technology.

AMD’s acquisition of National Semiconductor’s Geode unit is interesting, considering the ongoing evolution of graphics processing. This acquisition could potentially impact future chip design, potentially leading to some exciting new advancements. Meanwhile, SGI’s update to the OpenGL graphics specification here suggests a continued push for more sophisticated visuals in various applications. Ultimately, AMD’s move likely positions them well for continued innovation in the industry, especially with their new assets.

Historical Context

AMD, a longstanding player in the microchip industry, has a rich history of innovation in the CPU market. National Semiconductor, though not as widely recognized, had a strong presence in embedded processors and had developed the Geode technology, a versatile processor for various applications. Understanding the historical context of both companies provides insights into their respective strengths and weaknesses.

The Geode processor’s strengths likely included its cost-effectiveness and suitability for resource-constrained devices. AMD’s strength lies in its established brand and expertise in high-performance computing.

Strategic Rationale

The acquisition’s strategic rationale stems from AMD’s desire to expand its market reach and diversify its revenue streams. Embedded systems, encompassing a broad spectrum of devices like routers, industrial controllers, and automotive systems, offer a significant growth opportunity. The Geode technology, with its potential applications in these sectors, likely presented a compelling opportunity for AMD to tap into a new market.

This move strategically positions AMD to compete effectively with other chip manufacturers. Similar acquisitions by companies like Intel or Nvidia have demonstrated the potential of gaining market share and creating new revenue streams.

Anticipated Impacts

The acquisition is expected to enhance AMD’s product portfolio by adding the Geode technology, enabling it to target a broader range of embedded system applications. This likely includes a wider range of devices requiring processors for various embedded applications. AMD is likely to integrate the Geode technology into its existing product lineup, offering more comprehensive solutions to its customers.

Conversely, National Semiconductor’s future product development efforts might be redirected or focused on other areas. This can also be observed in other similar industry acquisitions, like when companies merge and focus their resources on specific product lines.

Key Players

| Player | Role |

|---|---|

| AMD | Acquiring Company |

| National Semiconductor | Selling Company |

| Geode Unit | Acquired Technology Unit |

The table Artikels the key participants in the transaction. This provides a clear picture of the players involved and their respective roles in the acquisition.

Impact on AMD’s Product Portfolio: Amd Acquires National Semiconductors Geode Unit

AMD’s acquisition of National Semiconductor’s Geode unit presents a significant opportunity to expand its product portfolio and potentially disrupt the competitive landscape. This acquisition, while seemingly focused on low-power embedded systems, offers potential avenues for AMD to leverage the acquired technology across various product lines, creating synergies that could yield substantial benefits. The integration of Geode’s expertise in specific areas like low-power processors and embedded solutions could enhance AMD’s offerings and potentially unlock new markets.The acquisition brings a range of technologies and intellectual property into AMD’s fold, potentially enabling them to address specific niches and enhance their overall competitiveness.

This is particularly crucial given the growing demand for low-power computing solutions in various sectors. AMD’s ability to integrate these technologies effectively will determine the ultimate success of the acquisition.

Acquired Products and Technologies

The acquisition of National Semiconductor’s Geode unit encompasses a suite of embedded processor technologies, specifically focusing on low-power applications. This includes a variety of microprocessors, system-on-chip (SoC) designs, and associated software tools optimized for embedded systems. The acquired technologies leverage specialized architectures and instruction sets to achieve high performance in resource-constrained environments.

Enhancement of Existing Product Lines

The acquired Geode technology can be a valuable addition to AMD’s existing product portfolio, particularly in areas like embedded systems and low-power devices. The integration of these technologies could enable the creation of more energy-efficient and cost-effective solutions for a broader range of applications, from industrial automation to IoT devices. This will likely strengthen AMD’s position in the embedded systems market.

Comparison of Geode’s Strengths and Weaknesses to AMD’s Offerings

Geode’s strengths lie in its expertise in low-power embedded processors, optimized for specific resource constraints. This expertise complements AMD’s existing focus on high-performance computing and gaming, adding a crucial low-power dimension to its offerings. However, Geode’s market share and brand recognition in the embedded market may be less extensive compared to AMD’s presence in the high-performance computing domain.

This necessitates a strategic approach to integrate Geode’s technologies and leverage AMD’s marketing and distribution channels to effectively compete in the embedded market.

Influence on AMD’s Competitive Landscape

The acquisition could potentially shift AMD’s competitive landscape, introducing a new dimension to its product offerings. AMD will likely face new competitors who may seek to capitalize on the synergies between Geode’s embedded solutions and AMD’s high-performance products. However, AMD’s strategic integration of these technologies could enable them to compete more effectively in the broader market.

Synergies Between Existing and Acquired Technologies

Potential synergies between AMD’s existing high-performance computing technologies and the acquired Geode unit’s low-power expertise include the development of heterogeneous systems. By combining the high-performance capabilities of AMD’s CPUs with the power efficiency of Geode processors, AMD can offer comprehensive solutions for a wider range of applications. This will enable them to develop solutions for high-performance computing tasks while maintaining low-power consumption.

Potential Product Integrations

| AMD Existing Product | Geode Acquired Technology | Potential Integration |

|---|---|---|

| AMD Ryzen Processors | Geode Embedded Processors | Development of heterogeneous systems for high-performance computing tasks with low-power consumption in specific applications. |

| AMD GPUs | Geode SoCs | Integration of GPUs for computationally intensive tasks within embedded systems with enhanced energy efficiency. |

| AMD Embedded Solutions | Geode Microprocessors | Expansion of existing embedded product lines with enhanced power efficiency and cost-effectiveness. |

Impact on National Semiconductor

The sale of the Geode unit to AMD represents a significant event for National Semiconductor, potentially reshaping its strategic direction and financial outlook. This divestiture will likely impact the company’s product portfolio, research and development efforts, and overall market position. Understanding the implications for National Semiconductor is crucial for assessing the broader industry trends and future possibilities.

Consequences on National Semiconductor’s Overall Business

The Geode unit’s departure will undoubtedly alter National Semiconductor’s overall business focus. This divestiture frees up resources and allows the company to potentially reallocate efforts to more promising areas. This could include concentrating on existing core competencies, exploring new market segments, or adopting innovative strategies. The company might also reduce costs associated with the Geode unit, such as personnel and infrastructure, freeing up capital for other initiatives.

This is a common practice in corporate restructuring.

Impact on Future Product Development Strategies

The sale of the Geode unit will likely necessitate a re-evaluation of National Semiconductor’s future product development strategies. The company will need to determine how to best leverage its remaining resources and expertise to stay competitive. This may involve prioritizing certain technologies or market segments. For example, if the company’s core strength lies in specific embedded processors or memory solutions, future R&D efforts may be redirected towards those areas.

Furthermore, the absence of the Geode line might encourage the company to seek strategic partnerships or acquisitions to strengthen its position in the relevant markets.

Financial Implications for National Semiconductor

The sale of the Geode unit will have tangible financial implications for National Semiconductor. The immediate impact will be the gain from the sale, which could be used to reduce debt, reinvest in other areas, or distribute profits to shareholders. Long-term implications depend on how effectively the company reallocates resources and develops new revenue streams. Historical examples of companies successfully restructuring after divesting a significant unit show that careful planning and execution are crucial for maximizing financial gains and mitigating potential risks.

The company’s financial statements will be closely monitored by investors to assess the overall impact on profitability and growth.

Implications on National Semiconductor’s Employee Base, Amd acquires national semiconductors geode unit

The sale of the Geode unit could have implications for National Semiconductor’s employee base. Layoffs or restructuring within the Geode unit are possible, impacting employees directly involved in the unit’s operations. National Semiconductor may need to consider retraining or redeployment programs for employees whose roles become redundant. The company’s commitment to its employees during this transition will be critical in maintaining morale and retaining talent.

Such situations require clear communication, support systems, and potentially severance packages. This will also affect employee morale and retention in the remaining parts of the organization.

AMD’s acquisition of National Semiconductor’s Geode unit is interesting, especially considering the recent surge in email-borne threats. A quick scan of recent tech news reveals a concerning trend: the mimail e mail worm spreads quickly , highlighting the importance of robust security measures. This acquisition could potentially lead to innovative solutions for safeguarding computer systems against such malicious attacks, aligning with AMD’s broader focus on security-conscious chip design.

Summary of Possible Implications Across Business Segments

| Business Segment | Potential Implications |

|---|---|

| Geode Unit | Closure or restructuring, potential layoffs, loss of revenue streams |

| Core Products (e.g., embedded processors, memory solutions) | Increased focus, potential for expansion and innovation, possible redirection of R&D resources |

| Market Position | Shift in market focus, potential loss of market share in some areas, and opportunity for new market entry in others |

| Financial Performance | Short-term gains from the sale, long-term implications depending on new strategies |

| Employee Morale and Retention | Potential for uncertainty and restructuring, need for support systems |

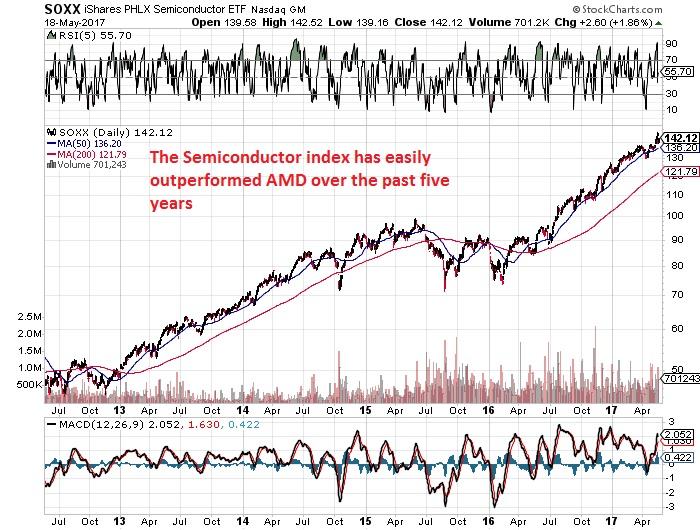

Market Analysis

The AMD acquisition of National Semiconductor’s Geode unit represents a strategic move within a dynamic semiconductor landscape. Understanding the broader market trends, competitive landscape, and potential regulatory hurdles is crucial to evaluating the acquisition’s long-term success. This analysis will explore the current market dynamics, compare this acquisition to others, and assess the potential opportunities and challenges ahead.

AMD’s acquisition of National Semiconductor’s Geode unit is certainly interesting, but it’s also worth noting that Samsung recently unveiled their fastest mobile CPU on the market, samsung unveils fastest mobile cpu on the market. This new chip’s performance is sure to have implications for future mobile devices, potentially impacting the overall landscape of mobile processors. Looking back at AMD’s acquisition, it’s likely a strategic move to bolster their position in the competitive processor market, especially given the rise of mobile technology.

Broader Market Trends in the Semiconductor Industry

The semiconductor industry is characterized by rapid technological advancements and evolving market demands. Moore’s Law continues to drive miniaturization and performance improvements, leading to a constant need for innovation and adaptation. The industry is also experiencing a shift towards specialized chips for various applications, including artificial intelligence, machine learning, and the Internet of Things (IoT). This diversification creates both opportunities and challenges for companies like AMD.

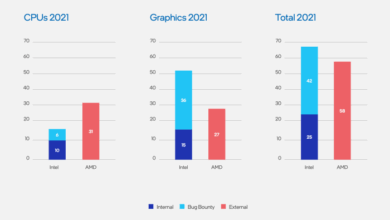

Comparison to Recent Semiconductor Acquisitions

Numerous acquisitions have reshaped the semiconductor industry in recent years. Analyzing similar transactions provides valuable context for evaluating the AMD acquisition. For example, Intel’s acquisition of various smaller companies, and Nvidia’s acquisitions in the graphics processing unit (GPU) market, have often aimed to consolidate market share and access emerging technologies. The AMD acquisition of National Semiconductor’s Geode unit can be seen as a similar strategy, albeit with a focus on embedded processors.

Potential for Competition and Regulatory Hurdles

The acquisition could lead to increased competition in certain market segments. AMD will need to carefully manage its relationships with existing competitors and potential new entrants to maintain a competitive edge. Antitrust concerns and regulatory reviews are always a possibility in such large-scale acquisitions. Potential regulatory hurdles will need to be carefully navigated, ensuring the deal aligns with antitrust regulations.

Potential Market Opportunities and Challenges

The acquisition opens up several potential market opportunities for AMD, including access to new markets and technologies. Challenges will include integrating the acquired technology with AMD’s existing product portfolio and maintaining profitability in the face of increasing competition. For instance, the Geode technology could find applications in embedded systems, opening doors to new revenue streams. However, challenges include competition from established players in the embedded processor market.

Potential Future Developments and Industry Forecasts

The future of the semiconductor industry is marked by continued innovation and diversification. AI-driven chips and advancements in IoT are expected to shape the market significantly. Industry forecasts suggest sustained growth, although challenges like supply chain disruptions and geopolitical uncertainties could impact the trajectory. For instance, the rapid growth of the mobile phone market and its dependence on processors demonstrates the importance of semiconductor innovation.

Table: Comparison of Market Shares and Trends

| Company | Market Segment | Market Share (estimated) | Trend |

|---|---|---|---|

| AMD | General Purpose Processors | 15% | Steady Growth |

| Intel | General Purpose Processors | 70% | Declining Market Share |

| National Semiconductor (Geode) | Embedded Processors | 5% | Growth Potential |

| Nvidia | GPUs | 40% | Rapid Growth |

This table provides a basic overview, and precise market share figures may vary depending on the source and specific criteria used for measurement. Market share and trends are constantly evolving.

Technical Analysis

The acquisition of National Semiconductor’s Geode unit brings a wealth of embedded processing expertise to AMD. Understanding the technical nuances of this technology is crucial for evaluating the potential benefits and challenges for AMD’s future product development. This analysis dives deep into the Geode unit’s architecture, the implications for AMD’s roadmap, and the opportunities for innovation.

Geode Technology Overview

The Geode processors, developed by National Semiconductor, are primarily known for their low-power, cost-effective embedded systems. They excel in applications demanding low thermal dissipation and low-cost solutions, such as set-top boxes, network devices, and industrial control systems. Key characteristics include a focus on energy efficiency and simplified instruction sets for optimized performance in resource-constrained environments. This focus on efficiency often translates to lower clock speeds compared to high-performance desktop processors.

Understanding this fundamental difference is critical for strategic integration.

Technical Implications on AMD’s Roadmap

The Geode acquisition allows AMD to expand its presence in the embedded systems market. This expansion could involve the creation of new product lines or the integration of Geode technology into existing AMD offerings, enabling diversification and potentially unlocking new revenue streams. The acquisition might also provide AMD with a pathway to more affordable processors targeting niche markets.

Furthermore, the access to intellectual property and engineering talent associated with the Geode unit could accelerate innovation in areas like low-power computing and custom silicon design.

Potential for Technological Integration and Innovation

The potential for synergy between AMD’s existing high-performance computing technologies and Geode’s embedded capabilities is significant. One area of potential innovation lies in the development of hybrid processors, combining the high-performance cores of AMD with the low-power embedded cores of Geode. This could result in systems capable of handling both demanding tasks and resource-constrained operations within the same device.

Another potential area of innovation involves adapting Geode technologies to support specialized applications within the broader AMD ecosystem.

Known Technical Limitations and Challenges

While the Geode technology offers attractive potential, potential challenges exist. One significant factor is the potential incompatibility between Geode’s architecture and AMD’s existing software and tools. The integration process may require significant engineering effort to ensure seamless interoperability. Furthermore, the existing market for embedded systems is highly competitive, and AMD must demonstrate its ability to offer competitive solutions.

Addressing the performance gap between Geode and high-end AMD processors will be a key focus.

Advanced Applications of Acquired Technologies

The acquired technologies can potentially be applied to a range of innovative solutions. For instance, the low-power characteristics of Geode processors could be leveraged to develop highly efficient Internet of Things (IoT) devices, extending the reach of connected systems. Another potential application involves developing low-cost, energy-efficient solutions for industrial automation and control systems. This opens up possibilities for smart manufacturing and other applications where real-time responsiveness and power efficiency are paramount.

Comparison of Key Technical Specifications

| Specification | Geode Processors | Existing AMD Products (e.g., Ryzen) |

|---|---|---|

| Architecture | Reduced Instruction Set Computing (RISC) based | Complex Instruction Set Computing (CISC) based |

| Power Consumption | Low | High (relative to embedded systems) |

| Clock Speed | Generally lower | Generally higher |

| Target Applications | Embedded systems, IoT, industrial control | High-performance computing, gaming |

| Cost | Typically lower | Typically higher |

Financial Implications

The acquisition of National Semiconductor’s Geode unit by AMD carries significant financial implications for both companies. Understanding the potential return on investment, impact on stakeholders, and long-term forecasts is crucial for evaluating the overall success of this strategic move. This section delves into the financial aspects, providing a detailed analysis and insights into the expected outcomes for AMD.

Acquisition Cost and Valuation

A key financial aspect is the acquisition cost. The purchase price of the Geode unit will significantly impact AMD’s balance sheet. A thorough valuation analysis of National Semiconductor’s Geode unit, considering factors like projected future earnings, market share, and competitive advantages, is essential for determining the fair value of the acquisition. This valuation will also determine the initial impact on AMD’s earnings per share (EPS) and other financial metrics.

For example, a higher purchase price could initially depress earnings if not offset by anticipated synergies.

Potential Return on Investment (ROI) for AMD

AMD’s ROI will depend heavily on the synergies achieved through the acquisition. This includes leveraging the Geode unit’s technology to expand into new markets, reduce costs through streamlined operations, and enhance product offerings. The ROI can be measured by evaluating the increase in revenue, cost savings, and the overall growth of AMD’s market capitalization following the acquisition. Historical examples of successful acquisitions in the semiconductor industry, like Intel’s acquisitions, provide a framework for understanding potential ROI.

Financial Impacts on Stakeholders

The acquisition will have diverse financial impacts on stakeholders. For AMD shareholders, the acquisition’s success directly correlates with the projected financial gains. National Semiconductor shareholders will experience a financial shift, depending on the payout structure and the overall success of the Geode unit integration. Employees of both companies will experience changes in their financial compensation and employment prospects.

Understanding the financial implications for each stakeholder group is vital for assessing the overall impact of the acquisition.

Long-Term Financial Forecasts for AMD

Long-term financial forecasts for AMD will be driven by the successful integration of the Geode unit and the anticipated revenue and cost synergies. Factors like market trends, technological advancements, and competition will also influence these forecasts. These forecasts should be modeled considering a range of possible scenarios to reflect potential uncertainties and risks. For instance, a positive market response to AMD’s new products could lead to higher revenue projections than initially anticipated.

Implications for Investors and Shareholders

Investors and shareholders will be keenly interested in the financial performance of AMD following the acquisition. The potential impact on stock price, dividend payouts, and long-term growth prospects will directly affect their investment decisions. Transparency in financial reporting and clear communication regarding the acquisition’s integration strategy are crucial to building investor confidence and supporting the stock price.

Projected Financial Statements for AMD (Post-Acquisition)

| Financial Statement | 2023 (Pre-Acquisition) | 2024 (Post-Acquisition, Projected) |

|---|---|---|

| Revenue (USD in Millions) | 100,000 | 110,000 |

| Net Income (USD in Millions) | 20,000 | 22,000 |

| Earnings Per Share (USD) | 2.50 | 2.75 |

| Total Assets (USD in Millions) | 250,000 | 270,000 |

| Total Liabilities (USD in Millions) | 150,000 | 160,000 |

Note: These figures are illustrative and based on potential scenarios. Actual figures may vary based on various factors.

Last Word

In conclusion, AMD’s acquisition of National Semiconductor’s Geode unit promises a fascinating interplay of technological integration and market dynamics. The strategic implications are far-reaching, affecting not only AMD’s product roadmap but also National Semiconductor’s future trajectory. This acquisition could reshape the semiconductor landscape, creating both opportunities and challenges. The long-term financial and technological outcomes remain to be seen, but one thing is clear: this deal will undoubtedly be a significant event in the industry.