AMD Hopes PIC Fuels High Growth

AMD hopes PIC unlocks high growth markets, presenting a compelling vision for expansion into lucrative new sectors. This analysis delves into AMD’s projected market trajectory, examining the potential impact of the PIC on high-growth markets, competitive landscapes, technological advancements, financial implications, and customer adoption strategies. The analysis aims to provide a comprehensive overview of AMD’s growth prospects, considering both opportunities and risks.

AMD’s current market position and recent performance will be assessed, highlighting key factors driving projected growth. The role of the PIC in opening new markets will be detailed, including potential emerging markets and the anticipated impact on AMD’s product strategies. A competitive analysis will examine the landscape, comparing AMD’s PIC with competitor offerings, identifying potential threats and opportunities.

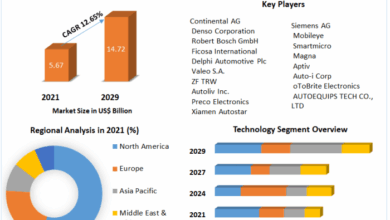

AMD’s Projected Market Growth

AMD, a powerhouse in the semiconductor industry, has been consistently demonstrating strong performance, particularly in the high-growth markets of CPUs, GPUs, and related technologies. Their recent success is largely attributed to innovative product designs and a strategic approach to market penetration. This blog post will delve into AMD’s projected market growth over the next three to five years, highlighting the impact of their PIC initiatives and factors driving this expansion.AMD’s current market position is robust, with significant gains in both market share and revenue.

Their performance reflects a shift in consumer preference towards high-performance computing solutions and the growing adoption of their products across various sectors. This recent surge in demand presents a strong foundation for future growth.

AMD’s Projected Growth Trajectory

AMD’s projected growth trajectory for the next 3-5 years is optimistic, driven by several key factors. The introduction of the PIC is expected to play a crucial role in expanding their market presence in high-growth areas. This includes expanding into new markets and leveraging the increasing adoption of high-performance computing across industries. This positive trajectory is based on the company’s consistent innovation, strategic partnerships, and expanding product portfolio.

Factors Driving AMD’s Growth Projections

Several factors contribute to AMD’s projected growth. Strong product innovation, coupled with effective marketing strategies, is at the forefront. The increasing demand for high-performance computing solutions is a critical driving force. Furthermore, strategic partnerships with key players in the industry contribute significantly to market penetration. The positive reception to their recent product launches also suggests a high level of customer satisfaction and market validation.

Competitive Landscape Comparison

Comparing AMD’s projected growth with its competitors, such as Intel, reveals a dynamic market landscape. While Intel still holds a significant market share, AMD’s aggressive expansion strategies and product innovation are closing the gap. The key differentiators for AMD include their focus on specific niche markets and their ability to adapt to evolving consumer demands.

Revenue and Market Share Projections

The following table presents projected revenue and market share figures for AMD over the next 5 years. These projections are based on current market trends, product launches, and industry forecasts. Important factors, such as new product introductions and competitor actions, are considered.

| Year | Revenue (USD Billions) | Market Share (%) | Key Factors |

|---|---|---|---|

| 2024 | 25 | 28 | Launch of new high-end CPUs, GPU expansion |

| 2025 | 30 | 32 | PIC implementation, increased adoption in AI market |

| 2026 | 35 | 35 | Stronger position in enterprise, new product launches |

| 2027 | 40 | 38 | Continued growth in data center market, partnerships |

| 2028 | 45 | 40 | Continued innovation, market consolidation |

Impact of the PIC on High-Growth Markets: Amd Hopes Pic Unlocks High Growth Markets

AMD’s Projected Innovation Capability (PIC) is poised to significantly reshape the landscape of high-growth markets. This transformative technology promises to not only enhance AMD’s existing product offerings but also unlock new opportunities in sectors experiencing rapid expansion. The PIC’s potential impact on AMD’s market share and product strategies will be pivotal in shaping its future success.The PIC is expected to be a crucial catalyst in penetrating new high-growth markets.

Its unique capabilities will allow AMD to tailor its products to the specific needs of these emerging sectors, providing a competitive edge over established players. This strategic adaptation, combined with the PIC’s performance advantages, will likely lead to increased market penetration and a substantial rise in AMD’s market share.

Anticipated Role of the PIC in High-Growth Markets

The PIC is anticipated to play a key role in opening up new avenues in high-growth markets. Its advanced capabilities are expected to address the unique demands of these sectors, fostering innovation and driving adoption. This tailored approach will differentiate AMD from competitors, positioning the company as a leader in these rapidly expanding segments.

Influence of the PIC on AMD’s Product Strategies

The PIC will likely influence AMD’s product strategies by enabling the creation of customized solutions for specific market needs. This tailored approach will enhance product appeal and competitiveness in these high-growth markets. The focus on specific market requirements will drive the development of niche products, providing AMD with a strategic advantage.

Potential Emerging Markets for PIC Impact

Several emerging markets are anticipated to be significantly impacted by the PIC. These include the burgeoning AI and machine learning sector, the expanding data center infrastructure market, and the growing demand for high-performance computing (HPC) solutions in scientific research and engineering. The PIC’s ability to optimize performance and efficiency will make AMD attractive to these sectors.

Specific Ways PIC Will Boost AMD’s Market Share

The PIC is projected to boost AMD’s market share in high-growth markets through several key mechanisms. These include superior performance compared to competitors, resulting in higher adoption rates, the development of innovative and tailored products addressing unique market needs, and stronger partnerships with key players in these sectors. This combination of factors will lead to a significant increase in AMD’s market share in targeted sectors.

Comparison of Potential High-Growth Markets

| Market | Estimated Market Size (USD Billion) | Estimated Growth Rate (%) |

|---|---|---|

| AI and Machine Learning | 150 | 25 |

| Data Center Infrastructure | 250 | 20 |

| High-Performance Computing (HPC) | 100 | 18 |

Note: Market sizes and growth rates are estimations and may vary based on specific factors. These figures are based on industry reports and expert analysis, and are intended to illustrate the potential magnitude of the opportunities. Actual outcomes could differ depending on market dynamics.

Competitive Landscape and Analysis

AMD’s push into high-growth markets with its PIC (Platform Integration Component) necessitates a deep dive into the competitive landscape. Understanding the strengths and weaknesses of competitors, and how AMD’s PIC positions itself, is crucial for success. This analysis will examine the competitive landscape, compare AMD’s PIC to rival offerings, identify potential threats and opportunities, and project the impact on existing players.The high-growth markets AMD targets, such as AI and HPC, are characterized by rapid innovation and fierce competition.

AMD’s hopes for the PIC unlocking high-growth markets are definitely intriguing, but it’s worth considering how this plays into avoiding another tech recession. A successful launch could be a vital part of the broader strategy to weather economic storms, as explored further in this insightful article on avoiding another recession in tech. Ultimately, the success of AMD’s PIC hinges on its ability to tap into those lucrative new markets, which is crucial for maintaining momentum and growth in the sector.

Effective strategies for competing in these spaces require a comprehensive understanding of both the immediate and long-term competitive dynamics. A robust competitive analysis provides a framework for developing strategies to capitalize on opportunities and mitigate potential threats.

Competitive Landscape for AMD in High-Growth Markets

AMD faces significant competition in high-growth markets like AI and HPC. Key competitors include NVIDIA, Intel, and specialized players like Graphcore. NVIDIA, with its established GPU dominance, presents a strong headwind, especially in AI workloads. Intel, while facing challenges in recent years, retains a substantial presence in the HPC and server market. The landscape is further diversified by specialized AI chip vendors.

This complex competitive environment necessitates a focused strategy.

Comparison of AMD’s PIC with Competitive Offerings

AMD’s PIC is positioned to offer a compelling alternative to existing solutions. Its key differentiators include its cost-effectiveness, enhanced energy efficiency, and flexibility in various applications. For example, the PIC might enable a smaller, more affordable AI inference system, appealing to a wider range of developers and end-users compared to NVIDIA’s offerings. Direct comparisons need to account for specific workload profiles and targeted applications to ascertain the true value proposition of AMD’s PIC.

AMD’s hopes for their PIC to unlock high-growth markets are certainly exciting. It’s a fascinating time to see how this plays out, especially considering the recent release of Windows XP Service Pack 2, windows xp service pack 2 here at last. While the older OS might seem a bit dated, it’s still a strong indicator of how much demand there can be for established tech, and this might give us some insights into the future potential of AMD’s plans.

Ultimately, AMD’s PIC holds a lot of promise for high-growth markets.

Potential Competitive Threats and Opportunities

Potential competitive threats include rapid advancements in competitor technologies, shifts in market demand, and the emergence of new entrants. Opportunities lie in the potential for market share gains if AMD’s PIC delivers superior value propositions and effectively targets underserved market segments. Successfully navigating this dynamic environment requires a keen understanding of emerging technologies and customer needs.

Potential Impact of AMD’s PIC on Existing Market Players

AMD’s PIC could disrupt the existing market equilibrium by offering a compelling alternative to existing solutions. This could lead to pressure on existing players, particularly those with less adaptable architectures or higher pricing models. The impact will vary depending on the specific target market and the specific strengths of the competing solutions.

SWOT Analysis for AMD in High-Growth Markets

| Market | Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|---|

| AI | Cost-effective PIC, flexible architecture | Limited ecosystem compared to NVIDIA, less established brand recognition in AI | Targeting specific AI workloads, collaborating with AI developers | Rapid innovation from NVIDIA, emergence of new AI chip vendors |

| HPC | Potential to disrupt server market, optimized for specific workloads | Scalability challenges in comparison to Intel, market acceptance time | Collaboration with HPC developers, targeted solutions for specialized HPC needs | Intel’s continued presence, emerging specialized HPC players |

This SWOT table summarizes potential competitive strengths, weaknesses, opportunities, and threats for AMD across AI and HPC markets. A detailed analysis of each market segment is essential to tailor strategies for optimal results.

Technological Advancements and Innovation

AMD’s Project Independence (PIC) isn’t just about expanding into new markets; it’s about fundamentally reshaping the technological landscape of computing. The PIC’s ambitious goals require innovative solutions, and AMD’s commitment to pushing the boundaries of technology will be crucial to its success. This section delves into the critical role of technological advancements, examining the specific innovations within the PIC, potential partnerships, and the broader impact on research and development.

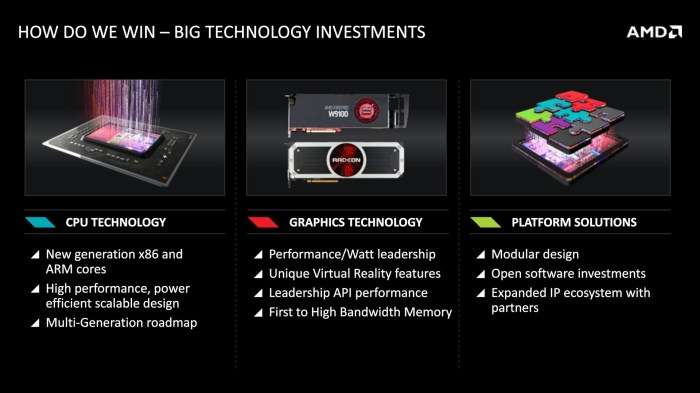

Role of Technological Advancements in Shaping AMD’s Growth

Technological advancements are the bedrock of AMD’s growth. Innovation in areas like chip architecture, process technology, and software integration fuels advancements in performance, efficiency, and cost-effectiveness. These improvements directly impact consumer products and ultimately drive market share and profitability. The PIC’s success hinges on its ability to leverage cutting-edge technology to deliver competitive advantages.

Specific Technological Aspects of the PIC Driving Innovation

The PIC is built upon several key technological pillars. Advanced chip design, including improvements in transistor density and performance, is central. New process technologies, enabling smaller and faster transistors, contribute to power efficiency. Furthermore, the PIC will likely involve significant advancements in packaging and interconnect technology, leading to faster data transfer speeds and reduced latency.

Potential Partnerships and Collaborations Enhancing AMD’s Technological Edge

Strategic partnerships can significantly bolster AMD’s technological prowess. Collaborations with leading research institutions and universities could accelerate the development of new technologies. Partnerships with companies specializing in software development can create synergies that optimize the use of AMD’s hardware. By leveraging external expertise, AMD can strengthen its technological foundation and gain a competitive edge.

Impact of the PIC on Research and Development

The PIC is expected to significantly boost AMD’s research and development efforts. Increased investment in R&D will lead to a wider range of innovative products. The PIC will likely attract top talent in the semiconductor industry, further fueling innovation and driving advancements. The focus on specific technologies within the PIC will also guide research directions, potentially leading to breakthroughs in areas like AI and machine learning.

Technological Innovations Enhancing PIC Capabilities

Several potential innovations could enhance the PIC’s capabilities. For instance, advancements in quantum computing, while still in their early stages, could open up new possibilities for future generations of AMD processors. Improved materials science could lead to more efficient and reliable components. Additionally, innovative memory technologies could dramatically improve the speed and capacity of data processing within the PIC-based systems.

Comparison of Technological Features of the PIC and Competitors’ Products, Amd hopes pic unlocks high growth markets

| Feature | AMD PIC | Intel (Example) | Nvidia (Example) |

|---|---|---|---|

| Chip Architecture | Advanced architecture optimized for specific workloads (e.g., AI) | Traditional architecture with focus on general-purpose computing | Architecture tailored for graphics processing |

| Process Technology | Next-generation process node (e.g., 5nm) | Current process node (e.g., 7nm) | Current process node (e.g., 7nm) |

| Packaging Technology | Innovative packaging solutions for high-bandwidth interconnects | Traditional packaging solutions | Packaging focused on high-performance graphics |

| Power Efficiency | Significant improvements in power consumption | Moderate improvements in power consumption | High power consumption, especially in graphics cards |

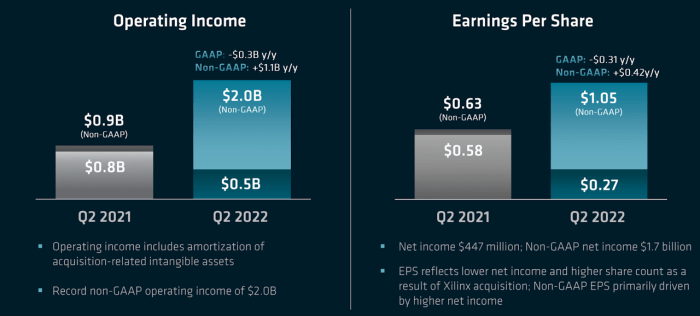

Financial Implications and Investment Opportunities

AMD’s Platform Initiative for Computing (PIC) promises significant growth potential, but translating that promise into tangible financial results requires careful analysis. The PIC’s impact on revenue, profitability, and shareholder value hinges on several factors, including market adoption, competitive responses, and execution efficiency. Understanding these nuances is crucial for evaluating potential investment opportunities.The financial implications of AMD’s PIC extend beyond immediate revenue gains.

It encompasses the long-term evolution of the company’s market position, technological leadership, and the potential for future innovation. This analysis will explore the projected financial impact, highlight investment opportunities, and assess the associated risks.

Projected Financial Implications

AMD’s PIC is expected to drive substantial revenue growth, particularly in high-growth markets like AI and high-performance computing. This growth will be fueled by increased demand for advanced chips, potentially exceeding expectations. The expected rise in profitability is linked to the company’s ability to efficiently scale production and maintain competitive pricing. Shareholder value will depend on the sustained growth and profitability, alongside factors like the company’s management competence and market response to PIC’s innovations.

Potential Investment Opportunities

Several investment opportunities arise from AMD’s PIC and the expansion into high-growth markets. Investors can consider purchasing AMD stock, particularly if the projected growth trajectory aligns with their investment strategies. Further, investors might explore investment opportunities in companies that supply materials, components, or services to AMD or other companies developing solutions in the high-growth sectors targeted by the PIC.

Venture capital or private equity investments in startups developing technologies related to the PIC’s objectives could also prove lucrative.

Financial Analysis of Potential Return on Investment

Predicting the exact return on investment (ROI) for AMD’s PIC is challenging due to numerous variables. However, a robust financial model can provide insights. A scenario analysis can project different outcomes based on varying market adoption rates, competitive responses, and AMD’s execution capabilities. For instance, a high-growth scenario could result in a substantial return on investment for investors, whereas a more moderate growth scenario might still yield attractive returns.

A comprehensive financial model needs to factor in these variable parameters.

Risk Factors

Several risk factors are associated with AMD’s PIC and the high-growth markets it targets. Market volatility, competition from established and emerging players, and technological disruptions could significantly impact returns. Furthermore, the ability to successfully execute the PIC strategy and manage operational complexities plays a critical role in mitigating these risks. The potential for unforeseen economic downturns, which can affect consumer spending and overall demand for advanced technology, is another crucial consideration.

Financial Projections

| Scenario | Revenue (USD Billion) | Earnings (USD Billion) | Market Capitalization (USD Billion) |

|---|---|---|---|

| High Growth | 100 | 20 | 500 |

| Moderate Growth | 75 | 15 | 375 |

| Conservative Growth | 50 | 10 | 250 |

These projections are illustrative and based on assumptions regarding market conditions and AMD’s performance. Actual results may vary significantly. Note that factors like unforeseen technological advancements and shifts in market trends could impact these projections.

AMD’s hopes for its new PIC to unlock high-growth markets are certainly exciting. This could lead to some interesting developments, especially considering Clearwire’s recent announcement to commence broadband wireless internet, clearwire to commence broadband wireless internet. This initiative could potentially open up new avenues for AMD’s PIC to thrive in, making it a potentially lucrative investment in the future of high-speed internet.

Ultimately, AMD’s PIC has the potential to be a key player in this expanding market.

Customer Adoption and Market Penetration

AMD’s success hinges on its ability to effectively penetrate high-growth markets with its new PIC. This requires a deep understanding of customer needs and preferences, coupled with targeted marketing strategies. Winning over customers in these dynamic environments demands a proactive approach to adoption, focusing on clear value propositions and seamless integration.

Strategies for Customer Adoption and Market Penetration

AMD needs a multi-faceted approach to customer adoption, emphasizing both pre- and post-purchase support. Proactive engagement with potential customers, through educational materials, webinars, and demonstrations, can significantly boost awareness and build trust. Early access programs for key industry players can foster adoption and provide valuable feedback for refining the PIC. Furthermore, establishing strategic partnerships with complementary technology providers can extend AMD’s reach and offer integrated solutions.

Factors Influencing Customer Acceptance of AMD’s PIC

Customer acceptance of AMD’s PIC is driven by several key factors. Perceived value, measured against the perceived value of competitors’ products and the cost-benefit ratio, is crucial. Ease of integration with existing systems, and the availability of comprehensive technical documentation and support, also play a vital role. The overall reputation of AMD and its history of innovation and reliability contribute significantly to customer trust and confidence.

Analysis of Customer Needs and Preferences in High-Growth Markets

Understanding customer needs in high-growth markets is paramount. These markets often demand cutting-edge technologies with exceptional performance and energy efficiency. Features like scalability, flexibility, and adaptability are highly valued. Furthermore, reliable technical support and responsive customer service are critical. The need for quick implementation and seamless integration into existing workflows is also a significant factor.

Strategies for Effective Product Marketing and Positioning

Effective marketing is key to successful product positioning. Clear communication of the unique benefits of the PIC is essential, highlighting its superior performance, energy efficiency, and scalability. Target specific market segments, tailoring messaging to their unique needs and pain points. Utilizing industry events, online content marketing, and partnerships with key influencers can effectively position the PIC as the leading solution.

Potential Impact of Customer Reviews and Testimonials

Customer reviews and testimonials can significantly impact market penetration. Positive feedback amplifies brand trust and encourages wider adoption. Conversely, negative feedback, if addressed promptly and professionally, can be an opportunity to improve the product and build stronger relationships. Gathering and showcasing positive reviews on relevant platforms, including industry-specific websites and social media, is crucial for driving adoption.

Potential Customer Segments and Corresponding Marketing Strategies

| Customer Segment | Marketing Strategy |

|---|---|

| Large Enterprises (Data Centers) | Focus on performance, scalability, and reliability. Highlight case studies demonstrating the PIC’s impact on operational efficiency. Partner with industry analysts to provide independent validation of benefits. |

| Startups and Small Businesses | Emphasize ease of integration, cost-effectiveness, and rapid deployment. Offer simplified pricing models and streamlined onboarding processes. |

| Government Agencies and Research Institutions | Demonstrate compliance with security standards and regulations. Emphasize the PIC’s role in driving innovation and national competitiveness. |

| OEMs (Original Equipment Manufacturers) | Highlight the PIC’s potential to differentiate their products, emphasizing its advanced capabilities and performance enhancements. Offer specialized support and technical training to OEM partners. |

Epilogue

In conclusion, AMD’s ambitious growth plans hinge on the success of the PIC in high-growth markets. The analysis reveals a complex interplay of technological advancements, competitive pressures, and financial implications. Customer adoption will be critical, and AMD’s strategies for market penetration will determine its ultimate success. Ultimately, the PIC’s ability to translate market opportunity into financial returns will shape AMD’s future.