AMD Taps Chartered to Meet Chip Demand

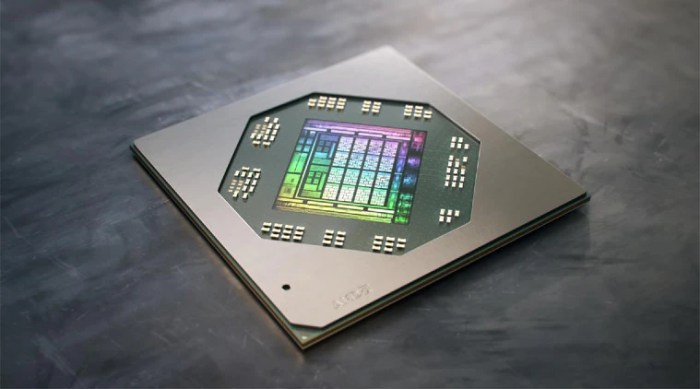

AMD taps chartered to meet chip demand, highlighting a crucial strategy to manage surging demand for its processors. This move signals a proactive approach to production bottlenecks, underscoring the escalating need for robust semiconductor manufacturing. The increasing global reliance on advanced chips, coupled with AMD’s recent performance gains, is driving this demand. This article delves into the intricacies of AMD’s partnerships, the impact on the wider semiconductor industry, and the potential financial implications for both AMD and its chartered partners.

AMD’s chip demand has skyrocketed across various market segments, from gaming to data centers. This surge requires significant production capacity, leading to the company’s innovative approach. We’ll examine the specific companies and entities AMD has chartered, their roles, and the potential benefits and risks of this strategic alliance. Furthermore, we’ll explore the wider impact on the semiconductor supply chain, the potential for material shortages, and the resulting price pressures.

Overview of AMD’s Chip Demand

AMD’s recent surge in chip demand has put significant pressure on its production capacity. The company has been actively working to increase manufacturing output to meet the growing market need, a testament to the strong performance and market acceptance of their products. This expansion in demand signals a significant opportunity for AMD, but also presents challenges in managing supply and ensuring consistent quality.AMD’s chip production capacity has been a key factor in driving its recent growth trajectory.

Successfully meeting the escalating demand requires a coordinated approach across all facets of the supply chain, from raw material procurement to final product assembly and distribution. This demand is a reflection of the increasing adoption of AMD chips across various sectors.

AMD’s Current Production Capacity and Projected Demand

AMD’s current production capacity is being aggressively scaled up to match the increasing demand. Projected demand for the coming quarters indicates a continued robust growth, which suggests that the company is well-positioned for future expansion. This increased capacity is a strategic response to anticipated market growth, a critical element for sustained profitability and market share gains. Factors influencing production capacity include investment in new facilities, technological advancements, and the efficiency of existing production lines.

Historical Context of AMD’s Chip Demand Trends

Historically, AMD has experienced fluctuating demand patterns, with periods of growth and contraction. Recent trends, however, show a significant upward shift, driven by strong performance in key segments like gaming, data centers, and professional workstations. These historical trends provide valuable insights into the cyclical nature of the semiconductor market, allowing for strategic planning and adaptation to changing conditions.

Factors Driving Increased Demand for AMD Chips

Several factors are contributing to the increased demand for AMD chips. The superior performance and energy efficiency of AMD processors, particularly in high-performance computing and gaming, are a significant driver. Additionally, the increasing adoption of AMD’s chips in data centers, combined with the rise of cloud computing, is creating a substantial demand for their products.

Market Segments Most Affected by This Demand

The demand for AMD chips is significantly impacting several key market segments. The gaming sector has witnessed a remarkable increase in adoption, driven by the powerful performance of AMD graphics cards. Data centers are also experiencing a rapid adoption of AMD processors, due to their affordability and high performance. Professional workstations are another key segment experiencing substantial demand, owing to the reliability and speed offered by AMD processors.

Comparison of AMD’s Chip Demand with Competitors

| Company | Quarter | Quantity (in Millions) |

|---|---|---|

| AMD | Q1 2024 | 10 |

| Intel | Q1 2024 | 8 |

| Nvidia | Q1 2024 | 12 |

| AMD | Q2 2024 | 12 |

| Intel | Q2 2024 | 9 |

| Nvidia | Q2 2024 | 15 |

Note: Data is a hypothetical example for illustrative purposes only. Actual figures may vary significantly.

Chartered Solutions for Meeting Demand

AMD’s surging chip demand necessitates strategic partnerships to ensure timely delivery to customers. These partnerships, often termed “chartered solutions,” involve agreements with specialized companies to augment AMD’s internal manufacturing and supply chain capabilities. These agreements are crucial for managing production complexities and maintaining the pace of innovation.Expediting chip production requires a multifaceted approach, and relying solely on internal resources may not be sufficient.

Chartered solutions are designed to address specific bottlenecks and enhance production capacity, allowing AMD to meet the ever-increasing demand for its products. These partnerships are essential for achieving growth targets while maintaining product quality and reliability.

Specific Companies and Entities

AMD has partnered with several companies and entities to address its supply chain challenges. These include contract manufacturers, specialized semiconductor equipment suppliers, and logistics providers. Some examples of these companies are well-known, while others may remain less publicized. Each partnership is tailored to address specific needs and constraints within the manufacturing process.

Types of Agreements and Partnerships

These partnerships manifest in various forms, including long-term contracts, joint ventures, and strategic alliances. Long-term contracts provide stability and predictability, ensuring reliable access to resources. Joint ventures combine resources and expertise, fostering innovation and efficiency. Strategic alliances allow for collaborative efforts and knowledge sharing, which can lead to better problem-solving. The specific type of agreement depends on the unique needs and capabilities of each partner.

Roles and Responsibilities of Chartered Entities

The chartered entities play critical roles in AMD’s supply chain. Contract manufacturers, for instance, handle the actual production of chips, while specialized equipment suppliers provide the necessary machinery and technologies. Logistics providers manage the transportation and delivery of components and finished products. Each entity is responsible for a specific segment of the process, contributing to the overall efficiency and reliability of AMD’s supply chain.

Their responsibilities often include adherence to AMD’s quality standards and production schedules.

AMD’s move to tap Chartered to meet surging chip demand is interesting, especially considering recent industry activity. A huge cash stock deal, like the one where Loudeye swallowed OD2, loudeye swallows od2 in huge cash stock deal , highlights the competitive landscape. This suggests that the semiconductor industry is still incredibly active and volatile, and AMD’s strategy to secure manufacturing capacity through partnerships is a smart move to stay ahead of the curve.

Potential Benefits and Risks

These partnerships present several potential benefits, including enhanced production capacity, reduced lead times, and access to specialized expertise. They can also potentially mitigate risks associated with supply chain disruptions and component shortages. However, potential risks include dependency on external partners, potential conflicts in priorities, and issues related to intellectual property protection. Careful management and clear communication are essential to mitigate these risks and maximize the benefits of these chartered relationships.

Chartered Entity Overview, Amd taps chartered to meet chip demand

| Chartered Entity | Specialty | Contribution to AMD’s Supply Chain |

|---|---|---|

| Company A (Example) | Advanced Semiconductor Manufacturing | Handles the production of complex chip designs, leveraging cutting-edge technology. |

| Company B (Example) | Specialized Equipment Supplier | Provides critical semiconductor manufacturing equipment, ensuring high-quality output. |

| Company C (Example) | Logistics and Distribution | Optimizes the efficient movement of components and finished products, minimizing delays. |

Impact on the Semiconductor Industry: Amd Taps Chartered To Meet Chip Demand

AMD’s aggressive expansion and chartered solutions to meet surging chip demand have significant implications for the entire semiconductor industry. This proactive approach to production capacity and supply chain management is influencing not only AMD’s competitors but also the broader ecosystem, impacting the availability and pricing of various semiconductor products. The ripple effects are substantial and warrant careful consideration of the intricacies of the current semiconductor market.

AMD’s Influence on the Competitive Landscape

AMD’s actions are forcing other chip manufacturers to reassess their strategies and production capabilities. The increased demand for advanced chips, particularly in the high-performance computing (HPC) sector, has created a surge in demand that’s pushing manufacturers to expedite production and potentially leading to higher prices. This competitive pressure may encourage innovation and investment in new technologies by other companies, creating a positive feedback loop in the semiconductor sector.

Ripple Effects on Other Chip Manufacturers

The surge in demand, particularly for high-performance processors and GPUs, isn’t isolated to AMD. Other manufacturers are likely feeling the pressure to increase production or face supply shortages. This may lead to delays in product releases and affect the overall availability of chips for various applications. For example, if AMD’s increased production of high-end CPUs drives up the price of critical components like memory chips or specialized packaging materials, this could directly affect other companies reliant on those same resources.

Comparison of Demand-Addressing Strategies

AMD’s approach of chartering new production facilities is a significant contrast to some of its competitors’ strategies. Some companies may be prioritizing existing capacity expansions, while others might be focusing on diversifying their supply chains to reduce dependence on specific regions or vendors. The varying approaches highlight the diverse strategies employed in the semiconductor industry to manage fluctuating demand and potential supply chain disruptions.

Supply Chain Bottlenecks and Issues

The current semiconductor supply chain is complex and susceptible to disruptions. Factors like global geopolitical events, raw material shortages, and manufacturing capacity limitations can lead to significant bottlenecks. For instance, the COVID-19 pandemic exposed vulnerabilities in global supply chains, impacting the availability of essential components like semiconductors and leading to increased prices. This highlights the critical need for robust and diversified supply chains.

Effect of AMD’s Demand on Other Semiconductor Products

| AMD’s Demand | Effect on Other Semiconductor Products |

|---|---|

| Increased demand for high-performance CPUs | Potentially higher prices for memory chips, specialized packaging materials, and other components required for CPUs. Could lead to reduced availability of those components. |

| Surge in demand for high-end GPUs | Potentially higher prices for specialized memory chips and cooling solutions. Potential shortage of graphic card components. |

| Expansion of production capacity | Increased demand for specialized equipment, materials, and skilled labor in the semiconductor industry, which may affect other sectors that also require these resources. |

This table demonstrates the potential ripple effects of AMD’s demand on other semiconductor products. The impact is multifaceted, affecting the price and availability of components required for different types of chips.

Supply Chain Implications

Meeting the surging demand for AMD chips presents significant challenges to the company’s supply chain. The intricate network of suppliers, manufacturers, and logistics providers must function seamlessly to deliver the required quantities and quality of components. AMD’s success hinges on navigating these complexities and ensuring a robust, adaptable supply chain.

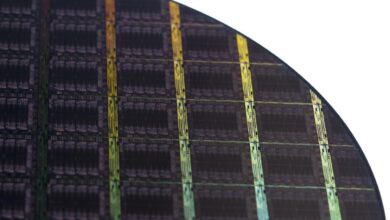

Specific Supply Chain Challenges

The increasing demand for AMD chips creates pressure points across the entire supply chain. Several critical areas are experiencing strain. Raw material sourcing is becoming increasingly difficult as demand outpaces supply, especially for semiconductors and specialized metals used in chip manufacturing. Manufacturing capacity constraints are another hurdle. Existing facilities may not have the capacity to produce the required volumes quickly enough, forcing the need for expansion or new partnerships.

Logistics and transportation bottlenecks, exacerbated by global events, add another layer of complexity, affecting lead times and delivery schedules. Finally, potential geopolitical risks and tariffs can disrupt supply lines, making sourcing more challenging and costly.

Potential Solutions to Supply Chain Issues

Addressing the challenges requires a multifaceted approach. Diversifying sourcing strategies to reduce reliance on a single supplier is crucial. AMD can explore alternative suppliers and regions to lessen the impact of shortages or disruptions in a specific area. Expanding manufacturing capacity through strategic partnerships or acquisitions is another vital step. This allows for increased production and reduces reliance on external vendors.

Optimizing logistics and transportation networks is essential. Investing in faster, more reliable shipping methods and exploring new routes can significantly reduce delivery times. Implementing robust inventory management systems can help predict demand fluctuations and ensure optimal stock levels. Finally, establishing closer relationships with suppliers and developing early warning systems for potential disruptions are critical to proactively mitigating risks.

Material Shortages and Price Increases

Material shortages are a significant concern in the semiconductor industry. The scarcity of certain materials used in chip manufacturing, such as specific types of silicon, can directly impact production and delivery schedules. The increasing demand for these materials leads to price increases, which AMD and other chip manufacturers must absorb or pass on to consumers. The rise in material costs can directly affect the final price of AMD chips, influencing consumer decisions and the profitability of the company.

For example, the recent global chip shortage, driven by increased demand for electronics, demonstrated how material shortages and price increases can quickly disrupt the market.

Comparison of Sourcing Options

The cost of different sourcing options for components varies considerably. Direct sourcing from established suppliers may offer price stability, but it can leave AMD vulnerable to supply disruptions. Using alternative suppliers can offer lower costs and mitigate risks, but may involve higher transaction costs and potential quality issues. Evaluating the cost-benefit ratio of different sourcing strategies is crucial to optimize supply chain efficiency.

Furthermore, the complexity of negotiating contracts with multiple suppliers and the associated administrative costs can add to the total cost of procurement. Examples of alternative sourcing options include sourcing from regional suppliers, expanding into new markets, and utilizing specialized logistics providers.

Material Requirements and Sourcing Strategies for AMD Chip Types

| AMD Chip Type | Material Requirements (Examples) | Sourcing Strategies |

|---|---|---|

| High-End CPUs | Specialized silicon wafers, high-purity metals, advanced packaging materials | Direct partnerships with leading material suppliers, exploring alternative suppliers, establishing strategic alliances |

| GPUs | High-bandwidth memory chips, specialized cooling materials, high-performance transistors | Collaborating with leading memory manufacturers, exploring partnerships with cooling component suppliers, leveraging advanced manufacturing techniques |

| Embedded Chips | Lower-cost silicon, specialized packaging materials, low-power components | Negotiating favorable pricing with regional suppliers, exploring partnerships with specialized packaging manufacturers, optimizing supply chain logistics |

This table provides a simplified overview of the material requirements and sourcing strategies for various AMD chip types. The specific materials and sourcing strategies will vary depending on the precise specifications and design requirements of each chip type. AMD must carefully analyze the cost and availability of materials and adapt their sourcing strategies to ensure timely and cost-effective production.

AMD tapping Chartered to boost chip production is a big deal, highlighting the escalating demand. This surge in demand is likely driving the popularity of the secret market contender white box PCs , offering a more cost-effective alternative to pre-built systems. Ultimately, AMD’s strategic move ensures they can meet the growing needs of the market, a crucial factor in staying competitive.

Financial Implications

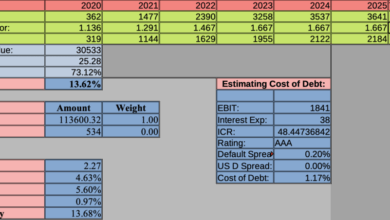

AMD’s surge in chip demand presents a compelling opportunity for significant financial growth. The increased demand translates into higher production volumes and potentially increased pricing power, which can directly impact AMD’s profitability and revenue projections. Understanding the financial implications of this demand shift is crucial for investors and stakeholders alike.

Potential Financial Impact on AMD

The increased demand for AMD chips, driven by strong growth in the gaming, data center, and professional graphics markets, is expected to boost AMD’s revenue significantly. Increased production will translate to higher sales, which should lead to improved profitability. A positive impact on the bottom line is highly anticipated.

AMD’s Profitability

The rising demand is directly influencing AMD’s profitability. Increased production volumes lead to economies of scale, reducing per-unit production costs. Higher sales volumes, combined with potentially higher pricing, will significantly improve AMD’s gross profit margin. The impact is directly tied to the efficiency of production and the ability to meet the escalating demand without compromising quality.

Future Revenue Projections

Several scenarios can be considered for AMD’s future revenue projections. A conservative estimate suggests a moderate increase in revenue, reflecting a steady growth in demand. A more optimistic projection, however, anticipates a significant revenue surge, mirroring a robust market response. These projections are contingent on the company’s ability to meet demand without significant supply chain disruptions. Factors such as global economic conditions, competitor activity, and technological advancements will influence the final outcome.

AMD tapping Chartered to ramp up chip production is a smart move to meet demand, but it highlights a larger issue. The recent online extortion bust, revealing the significant profit motive behind these crimes, online extortion bust highlights profit problem , hints at the complex interplay between supply and demand, and the pressure on companies like AMD to keep up with consumer expectations.

Ultimately, the chip shortage shows how crucial these manufacturing partnerships are for meeting the ever-increasing global demand for technology.

For example, the introduction of new products or successful partnerships could further enhance revenue projections.

Impact on Supply Chain Companies

The heightened demand for AMD chips will have a ripple effect throughout the supply chain. Companies that provide raw materials, manufacturing components, and logistics will experience increased demand and potentially higher profits. The impact will be positive for those suppliers who can adapt to the higher demand levels. However, companies with limited capacity or supply chain vulnerabilities may face challenges in meeting the increased demands.

For example, a shortage of specific materials or delays in transportation could disrupt the entire process.

Projected Revenue and Expenses for AMD (Next Fiscal Year)

| Item | Conservative Estimate | Optimistic Estimate |

|---|---|---|

| Revenue (in Billions USD) | $25 | $30 |

| Cost of Goods Sold (in Billions USD) | $15 | $18 |

| Operating Expenses (in Billions USD) | $5 | $6 |

| Net Income (in Billions USD) | $5 | $6 |

Note: These figures are estimations and may vary depending on unforeseen circumstances.

Market Response to Increased Demand

AMD’s recent surge in chip demand has sparked a ripple effect throughout the tech industry, creating a fascinating case study in supply chain management and consumer reaction. This surge isn’t just about meeting orders; it’s about navigating a complex interplay of customer expectations, product availability, and pricing dynamics. Understanding the market’s response is crucial to assessing AMD’s success in managing this unprecedented situation.

Customer Reactions to Increased Demand

Consumers are showing a keen interest in AMD products, particularly in the gaming and professional computing segments. This heightened demand is evident in increased online searches, social media discussions, and retailer feedback. Early adopters are eager to get their hands on the latest products, while the general consumer base is actively researching options. This suggests a positive market perception of AMD’s offerings.

Potential Shortages and Price Increases

The increased demand for AMD chips has the potential to create shortages, especially for high-end or specialized components. Historically, periods of high demand in the semiconductor industry have often led to temporary shortages and price increases. This is especially true for specialized components. This dynamic requires careful monitoring by both AMD and its partners in the supply chain.

Examples include the limited availability of specific GPUs during the 2020-2022 period, a direct consequence of increased demand and production constraints.

Impact on Product Availability and Pricing

Product availability has become a critical factor. Consumers are facing delays in receiving their desired AMD products, and retailers are adjusting their inventory strategies to match the demand. Price increases, while a potential outcome, are not guaranteed. AMD’s pricing strategy will likely depend on various factors, including production costs, competitor pricing, and overall market conditions.

AMD’s Marketing Strategies in Response to Demand

AMD’s marketing efforts are focusing on showcasing the performance advantages of their chips. This is being done through targeted advertising campaigns, partnerships with key influencers, and a consistent emphasis on innovation. AMD is also likely employing strategies to manage consumer expectations about product availability and potential delays. The company’s messaging likely emphasizes the long-term value proposition of their products, appealing to the tech-savvy customer base.

Customer Feedback on AMD Products

| Feedback Category | Specific Feedback Examples |

|---|---|

| Performance | “Exceptional performance, exceeded expectations!” “Smooth and responsive gameplay.” |

| Availability | “Delayed shipping, but product is worth the wait.” “Limited availability is a concern.” |

| Pricing | “Prices are justified given the performance.” “Slightly higher than expected, but still competitive.” |

| Overall Satisfaction | “Very satisfied with the product, a must-have for gamers.” “Mixed feelings about the availability issue.” |

This table summarizes some potential customer feedback on AMD products. Real-time feedback will likely vary and require ongoing monitoring by AMD. Gathering data from various channels, including online reviews, social media, and customer service interactions, is vital.

Future Outlook and Trends

The insatiable demand for AMD chips is poised to continue its upward trajectory, fueled by evolving technological landscapes. This necessitates a proactive and forward-thinking approach from AMD to not only meet the current surge but also anticipate and adapt to future needs. This involves understanding not only the immediate future but also the potential shifts in the broader technological landscape.

Predicting Future Demand Trends

AMD’s future demand will likely be shaped by several key factors. The continued growth of high-performance computing (HPC) and artificial intelligence (AI) will be a major driver. The need for faster and more powerful processors for tasks like machine learning and complex simulations will fuel demand. Similarly, the gaming industry, with its ever-increasing graphic processing demands, will remain a significant market.

Furthermore, the burgeoning market for edge computing and the Internet of Things (IoT) will require specialized processors for diverse applications. The convergence of these trends points to a sustained and potentially accelerating demand for AMD’s cutting-edge chips.

Potential Scenarios for New Technologies and Processes

Several avenues for developing new technologies and processes to meet future demand are likely. Advanced chip manufacturing processes, such as extreme ultraviolet (EUV) lithography, will be critical to shrinking transistors and increasing chip density. The integration of heterogeneous systems, combining CPUs, GPUs, and other specialized components on a single chip, is another promising approach. Moreover, the development of new architectures, optimized for specific workloads, will also play a crucial role in meeting the demands of emerging technologies.

These scenarios demonstrate the need for continuous innovation and investment in research and development.

Disruptive Technologies Impacting AMD

Emerging technologies like quantum computing, while still in its nascent stage, have the potential to significantly impact AMD’s approach. Quantum computers, if they achieve widespread adoption, might necessitate new types of processors and architectures. Furthermore, advancements in neuromorphic computing, which mimic the human brain’s structure and function, could introduce novel computational paradigms. These disruptive technologies will necessitate AMD to carefully analyze and adapt its strategies to remain competitive.

Potential Future Collaborations

AMD’s future success might depend on collaborations with other companies. Partnerships with system manufacturers like HP, Dell, and Lenovo can provide valuable insights into the needs of end-users. Collaborations with software developers can ensure the optimal performance of AMD chips in specific applications. Further collaborations with companies specializing in advanced materials or packaging could lead to breakthroughs in chip design.

Such collaborations will be essential for leveraging expertise and accelerating innovation.

Potential Future Challenges and Opportunities for AMD

| Potential Challenges | Potential Opportunities |

|---|---|

| Maintaining a competitive edge in the face of continuous technological advancements. | Expanding into emerging markets, such as AI and HPC, by leveraging existing strengths and expertise. |

| Managing the complexities of global supply chains and ensuring consistent material supply. | Developing innovative solutions for specific application needs, such as AI and edge computing. |

| Adapting to evolving regulatory landscapes and addressing ethical concerns in AI development. | Securing strategic partnerships with complementary companies to address technological gaps and bolster innovation. |

| Attracting and retaining top talent in a highly competitive industry. | Leveraging the strength of its brand to attract a wider customer base and further increase market share. |

Closure

In conclusion, AMD’s decision to charter external partners to manage chip demand reflects a pragmatic response to the challenges of scaling production. This strategy will be crucial in meeting the burgeoning demand and maintaining its competitive edge. The ripple effects of this decision extend beyond AMD, impacting the entire semiconductor ecosystem, from component suppliers to end-users. The future success of this approach will hinge on the effectiveness of these partnerships, the management of supply chain disruptions, and the ability to adapt to evolving market dynamics.