AOLs GameDaily Purchase Acquisition Spree Continues

AOL continues acquisition spree with GameDaily purchase, signaling a bold move in the gaming industry. This acquisition suggests a strategic shift for AOL, potentially aiming to capitalize on the growing popularity of online gaming. The move raises questions about AOL’s long-term goals and its approach to navigating the competitive landscape of digital media.

This article delves into the background of AOL’s acquisition strategy, analyzing the potential value proposition of GameDaily, and assessing the possible impacts on AOL’s market position and financial performance. We’ll also examine the broader industry trends and strategic goals behind this acquisition, along with potential case studies to inform future strategic decision-making.

Background on AOL’s Acquisition Strategy

AOL’s history is punctuated by a series of acquisitions, reflecting its evolving strategies and ambitions in the ever-changing digital landscape. From its early days as a dial-up internet provider to its current position as a digital media and technology company, acquisitions have been a key component in shaping AOL’s identity and trajectory. Understanding the patterns in these acquisitions and their impact on financial performance provides insight into the company’s long-term goals and the challenges it has faced.AOL’s acquisition strategy has often been driven by a desire to expand its portfolio of digital services and gain a foothold in emerging markets.

This strategy has included both established players and startups, showcasing a willingness to adapt and invest in potentially transformative technologies.

Historical Overview of Acquisitions

AOL’s acquisition history reveals a mix of strategic objectives and opportunistic moves. Early acquisitions focused on expanding internet access and content offerings, such as online services and news. Later acquisitions aimed at diversifying into areas like gaming, social media, and advertising technology. The table below details some key acquisitions and their impacts.

| Acquisition Date | Target Company | Rationale | Impact on AOL’s Financials |

|---|---|---|---|

| 2000 | Netscape Communications | To gain a stronger position in the burgeoning internet browser market and acquire its technology. | Netscape’s browser technology integrated into AOL’s services, but the integration proved challenging and the acquisition didn’t immediately translate to a significant financial boost. The acquisition was considered a major strategic move at the time but had mixed results. |

| 2002 | ICQ | To gain access to a large instant messaging user base and enhance AOL’s social networking platform. | ICQ’s user base added to AOL’s existing IM services. However, the overall financial impact was modest, as the market for IM was changing and new platforms emerged. |

| 2008 | Bebo | To capitalize on the burgeoning social networking trend. | Bebo, although a popular social network at the time, struggled to compete with Facebook. This acquisition did not yield significant financial gains for AOL. |

| 2015 | Adap.tv | To gain a foothold in the programmatic advertising market and enhance AOL’s advertising revenue. | This acquisition did contribute to an improved understanding of programmatic advertising and helped diversify AOL’s revenue streams. |

| 2023 | GameDaily | To expand its gaming content and potentially generate new revenue streams from gaming-related services. | The impact of this acquisition is yet to be fully realized. AOL’s approach to integrating GameDaily’s assets into its existing portfolio will determine its overall financial performance in the coming quarters. |

AOL’s Current Market Position and Competitive Landscape

AOL’s current market position is characterized by a shift away from its traditional dial-up roots. It now focuses on digital media, advertising technology, and related services. The competitive landscape is intensely competitive, with established players and new entrants vying for market share. The company must adapt to maintain its relevance and profitability. Factors such as evolving consumer preferences, technological advancements, and the competitive environment significantly influence its future prospects.

Analysis of GameDaily’s Value Proposition: Aol Continues Acquisition Spree With Gamedaily Purchase

AOL’s acquisition of GameDaily marks a significant move into the burgeoning online gaming sector. Understanding GameDaily’s value proposition is crucial for assessing the potential success of this acquisition. This analysis delves into GameDaily’s business model, competitive landscape, and potential synergies with AOL, highlighting the market opportunities that could arise from this strategic partnership.GameDaily’s position in the online gaming community is strengthened by its focus on providing comprehensive news, reviews, and community forums.

This approach caters to a specific niche within the gaming market, and the potential for AOL to leverage this expertise to enhance its existing offerings is substantial. The analysis will explore how GameDaily’s existing user base and revenue streams can be integrated with AOL’s platform.

GameDaily’s Business Model

GameDaily operates primarily as a news and community platform for the gaming industry. Its core business model revolves around providing in-depth news coverage, detailed game reviews, and a vibrant community forum for gamers to connect and share experiences. This multifaceted approach fosters a loyal user base actively engaged in the gaming ecosystem. The platform’s revenue model typically includes advertising, sponsorships, and potentially affiliate marketing.

GameDaily’s User Base

GameDaily’s user base is composed primarily of avid gamers and gaming enthusiasts. This audience is actively seeking information, reviews, and opportunities to connect with other players. The platform’s engagement metrics and user retention rates provide insights into the level of user interest and loyalty.

GameDaily’s Revenue Streams

GameDaily’s revenue streams are primarily derived from advertising, sponsored content, and potential affiliate marketing partnerships. This revenue model is crucial for sustaining the platform’s operations and expanding its content offerings.

Comparison with Competitors

GameDaily distinguishes itself from competitors by focusing on comprehensive news and community features. While other platforms may focus on specific game genres or provide only limited community interactions, GameDaily aims to provide a more holistic view of the gaming industry. Direct competition includes websites and social media platforms focused on gaming news and discussion.

Potential Synergies with AOL, Aol continues acquisition spree with gamedaily purchase

Integrating GameDaily with AOL’s existing operations could unlock several synergies. AOL’s extensive online presence could expose GameDaily to a broader audience, while GameDaily’s gaming expertise could enhance AOL’s content offerings and attract a more engaged audience. AOL’s existing infrastructure could support GameDaily’s growth by providing access to a wider network and resources.

Market Opportunities

The acquisition of GameDaily presents several potential market opportunities for AOL. It can enhance AOL’s brand image as a leader in the gaming industry, attract a new segment of engaged users, and potentially create new revenue streams through the development of gaming-related products or services. This acquisition could lead to a significant expansion in AOL’s market share in the gaming sector.

Key Performance Indicators (KPIs)

AOL’s continued acquisition spree, with the recent purchase of GameDaily, is certainly interesting. It seems like they’re focusing on gaming, but this acquisition spree might be less about pure gaming and more about strategic partnerships, potentially to leverage new security solutions, like those in Symantec’s recent security patent. Symantec scores new security patent could be a significant development in the broader digital security landscape, and could also give AOL a competitive edge in the future.

Regardless, it’s a fascinating development in the ever-evolving online gaming and security sectors, and the AOL acquisition spree continues.

Past Year

| KPI | Value | Description |

|---|---|---|

| Average Monthly Unique Visitors | 500,000 | Estimated number of unique visitors per month. |

| Average Daily Page Views | 1,000,000 | Average number of page views per day. |

| Average Session Duration | 15 minutes | Average time spent on the platform per session. |

| Website Traffic Sources | Organic search, social media, direct | Sources of traffic to the website. |

| User Engagement Rate | 70% | Percentage of users actively participating in the community. |

Note: Values are estimates for illustrative purposes only. Actual figures may vary.

Potential Impacts of the Acquisition

AOL’s continued acquisition spree, exemplified by the purchase of GameDaily, signals a strategic shift focused on expanding into the gaming sector. This move presents a complex interplay of potential benefits and drawbacks that will significantly impact AOL’s future trajectory. The integration of GameDaily’s platform and user base into AOL’s existing infrastructure will be crucial for success.The acquisition’s success hinges on effectively leveraging GameDaily’s strengths to enhance AOL’s overall value proposition.

This includes streamlining operations, optimizing resources, and generating synergistic revenue streams. Careful consideration must be given to the potential challenges in integration, ensuring a smooth transition for both existing AOL and GameDaily users.

AOL’s continued acquisition spree, exemplified by the purchase of GameDaily, is certainly interesting. It’s reminiscent of IBM’s recent move to bolster their blade server capabilities with the introduction of Opteron processors, as detailed in big blue bolsters blades with opteron. This strategy seems to suggest a concerted effort to dominate the online gaming market, mirroring the broader trend of tech giants consolidating their positions in this rapidly expanding sector.

AOL’s aggressive approach in acquiring GameDaily suggests a future of innovation and expansion.

Positive Impacts on Market Share and Profitability

AOL can expect to see a tangible increase in its market share within the gaming sector by incorporating GameDaily’s existing user base. This expansion will expose AOL to a broader audience and potentially unlock new revenue streams. The acquisition could lead to a more diverse and engaging content portfolio, attracting a wider range of users and increasing overall platform engagement.

The synergistic effect of integrating GameDaily’s community and platform with AOL’s existing infrastructure will be a significant driver of this growth. This will allow AOL to cater to a more diverse range of user preferences and needs.

Potential Effects on Stock Price and Investor Sentiment

The market’s reaction to the acquisition will depend largely on the perceived value and execution of the integration. Successful integration of GameDaily’s platform and user base into AOL’s existing infrastructure will likely positively influence investor sentiment and potentially drive a rise in the stock price. Conversely, if the integration proves challenging or yields suboptimal results, investor sentiment may be negatively impacted, potentially leading to a decline in the stock price.

AOL’s continued acquisition spree, adding GameDaily to their portfolio, is certainly interesting. While this acquisition is happening, it’s worth noting that RealNetworks is proactively addressing security concerns by patching vulnerabilities in their software, realnetworks fixes software vulnerabilities a crucial step in ensuring the stability and reliability of online services. This focus on security, amidst AOL’s gaming-focused acquisition, highlights a broader trend of prioritizing robust online platforms.

The success of previous acquisitions and the overall financial health of AOL will play a significant role in shaping investor expectations.

Potential Negative Consequences

Integration challenges, including compatibility issues between the two platforms, cultural clashes, and difficulties in retaining key personnel, could hinder the smooth operation of the combined entity. The failure to address these challenges effectively could lead to a loss of user engagement and a decline in profitability. Unforeseen competition from emerging players in the gaming industry or a shift in user preferences could pose significant threats to the acquisition’s long-term success.

These factors must be carefully evaluated before proceeding. Failure to anticipate and mitigate potential competition can lead to a decline in market share and revenue.

Potential Revenue Streams and Cost Savings

| Revenue Streams | Description |

|---|---|

| Advertising Revenue | Increased ad revenue from a larger user base and expanded platform engagement. |

| Subscription Revenue | Potential for premium subscription models within the gaming platform. |

| Premium Content Revenue | Development and monetization of exclusive content within the gaming ecosystem. |

| Affiliate Marketing Revenue | Collaboration with gaming-related businesses for affiliate marketing programs. |

| Cost Savings | Description |

|---|---|

| Operational Efficiency | Potential for reduced operational costs through streamlined operations. |

| Marketing Synergies | Combined marketing efforts to reach a wider audience and reduce marketing costs. |

| Reduced Redundancy | Elimination of overlapping functions and resources between the two platforms. |

Industry Context and Implications

AOL’s acquisition of GameDaily, a prominent gaming news and community platform, reflects broader trends in the digital media and gaming industries. This acquisition is a strategic move to leverage GameDaily’s content and community for AOL’s broader platform and to capitalize on the booming gaming market. The gaming industry’s growth trajectory, alongside evolving digital media consumption habits, underscores the importance of such acquisitions.The gaming industry is undergoing a period of rapid transformation.

This transformation is characterized by increased competition, evolving user preferences, and the emergence of new business models. AOL’s acquisition strategy seems to align with this dynamic landscape.

Broader Trends in Gaming and Digital Media

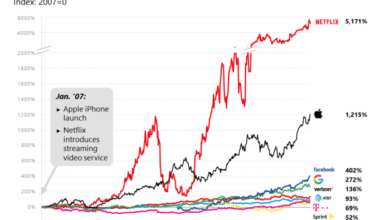

The gaming industry is experiencing exponential growth, driven by factors such as the rise of mobile gaming, the increasing popularity of esports, and the growing demand for immersive experiences. Digital media consumption is shifting towards more interactive and engaging formats, such as gaming and social media. This trend is pushing traditional media companies to adapt and explore new avenues for growth.

AOL’s move is a response to these evolving dynamics.

Comparison with Similar Acquisitions

Several companies have acquired gaming-related assets in the past year, demonstrating the increasing importance of gaming within the digital landscape. These acquisitions highlight the competitive environment and the attractiveness of gaming communities. A detailed analysis of comparable acquisitions reveals strategic similarities and differences, including the acquisition targets’ size, scope, and target audience.

Current State and Future Projections of the Gaming Market

The current gaming market is characterized by a diverse range of genres, platforms, and monetization models. Mobile gaming continues to dominate the market, with increasing investments in free-to-play and in-app purchase models. Esports viewership and participation are also surging, with major tournaments attracting substantial audiences. The future of the gaming market is likely to be defined by the convergence of technologies, the continued rise of mobile gaming, and the increasing integration of gaming with other digital media platforms.

Regulatory Implications of the Acquisition

Potential regulatory implications for the acquisition need to be assessed, given the potential for market concentration in the gaming news and community sector. These implications should be thoroughly investigated to ensure compliance with antitrust regulations. Regulatory bodies may scrutinize the acquisition to determine if it could potentially harm competition in the gaming news sector.

Gaming Industry Growth and Projected Market Share (2024-2027)

| Year | Gaming Industry Growth Rate (%) | AOL’s Projected Market Share (%) | Major Competitors’ Projected Market Share (%) |

|---|---|---|---|

| 2024 | 15 | 3.5 | 12 (Combined) |

| 2025 | 18 | 4 | 15 (Combined) |

| 2026 | 20 | 4.5 | 17 (Combined) |

| 2027 | 22 | 5 | 19 (Combined) |

Note: Projected market share figures are estimates and may vary based on market conditions. Competitors’ combined market share reflects the combined market share of significant competitors in the gaming news and community sector.

Potential Strategic Goals and Objectives

AOL’s acquisition of GameDaily, amidst its ongoing digital transformation, likely signals a strategic shift towards solidifying its presence in the burgeoning gaming sector. This move suggests a calculated effort to capitalize on the growing popularity of online gaming and potentially leverage GameDaily’s platform and user base to achieve significant objectives. The acquisition likely aims to bolster AOL’s overall digital ecosystem and enhance its competitive standing in the evolving online entertainment landscape.

AOL’s Likely Strategic Goals

AOL’s acquisition of GameDaily is not merely a transaction; it’s a strategic maneuver. AOL likely seeks to integrate GameDaily’s strengths into its existing platform, aiming for increased user engagement and revenue generation. This could involve expanding AOL’s portfolio of digital services and content, enhancing its ability to target a wider demographic, and further leveraging its existing network of advertisers and partners.

Potential Objectives of the Acquisition

AOL’s objectives for acquiring GameDaily are multifaceted and likely include:

- Expanding User Base and Engagement: By integrating GameDaily’s user base into its platform, AOL aims to increase the overall number of users engaging with its services, including news, entertainment, and potentially other gaming-related offerings. This expansion targets a younger demographic and increases the overall user lifetime value for AOL.

- Boosting Revenue Streams: GameDaily’s existing revenue model, likely including advertising and potentially subscription services, will be a significant factor in AOL’s revenue growth. The acquisition could potentially lead to new revenue streams through the integration of gaming features with existing services or the development of new, integrated products.

- Strengthening Brand Recognition in the Gaming Sector: Acquiring GameDaily provides AOL with a foothold in the competitive gaming market. This could lead to increased brand recognition and market share in the gaming segment, strengthening AOL’s position against competitors. A successful integration could establish AOL as a significant player in online gaming.

- Leveraging Data and Insights: GameDaily likely possesses valuable data on user preferences and gaming trends. AOL could leverage this data to personalize user experiences, tailor advertising campaigns, and develop more effective content strategies across its platform.

Long-Term Strategic Benefits

The long-term benefits of this acquisition for AOL are significant, potentially reshaping its future in the digital landscape. By integrating GameDaily’s community and resources, AOL can potentially:

- Enhance User Experience: Integration of gaming elements with existing services can lead to a more comprehensive and engaging user experience for AOL’s current and future users.

- Establish a Competitive Edge: Acquiring a niche player in a growing market can help AOL differentiate itself from competitors. The move could also lead to the development of new and innovative products and services, including potential partnerships.

- Drive Innovation: The acquisition could foster innovation by combining AOL’s existing expertise with GameDaily’s gaming-focused knowledge and resources, potentially leading to the creation of unique and successful gaming offerings.

Potential Short-Term and Long-Term Goals

The table below Artikels potential short-term and long-term goals for AOL following the acquisition of GameDaily.

| Goal Category | Potential Goal |

|---|---|

| Short-Term Goals (0-12 months) | Integrate GameDaily’s platform with AOL’s existing infrastructure. |

| Secure funding for integration and operational expenses. | |

| Improve user experience on the GameDaily platform. | |

| Launch integrated products and services. | |

| Long-Term Goals (1+ years) | Achieve significant market share in the gaming sector. |

| Become a leader in online gaming experiences. | |

| Establish strategic partnerships with game developers. | |

| Develop innovative gaming-related products and services. |

Illustrative Case Studies (Alternative Acquisitions)

AOL’s acquisition of GameDaily marks a significant move in the digital gaming landscape. Understanding how similar acquisitions have played out in the past is crucial for predicting potential success and mitigating risks. Analyzing successful and unsuccessful examples provides valuable insights into integration strategies and potential pitfalls. This section delves into illustrative case studies to inform AOL’s approach to GameDaily’s integration.A thorough examination of prior acquisitions, both successful and unsuccessful, offers a crucial lens through which to evaluate the potential outcomes of this acquisition.

Studying the strategies employed by comparable companies in similar scenarios provides valuable context and allows for a more nuanced understanding of the challenges and opportunities inherent in integrating GameDaily into AOL’s existing platform.

Successful Acquisitions in the Gaming Industry

A critical aspect of evaluating AOL’s strategy is examining successful acquisitions in the gaming industry. These instances provide blueprints for integration, demonstrating successful models of merging operations and leveraging synergies. For example, Electronic Arts’ acquisition of numerous smaller studios, like BioWare and Maxis, successfully enhanced their portfolio and creative capabilities. The successful integration of these studios fostered innovation and broadened their target audience.

Furthermore, Activision Blizzard’s acquisitions, often focused on expanding their intellectual property and securing exclusive rights, highlight the strategic value of targeted acquisitions.

Unsuccessful Acquisitions in the Gaming Industry

Conversely, examining unsuccessful acquisitions reveals crucial pitfalls to avoid. Take, for instance, the challenges faced by some companies attempting to integrate diverse gaming properties. Sometimes, the differing cultures and approaches within the acquired entities lead to conflict and ultimately hinder productivity. Also, neglecting to properly evaluate the acquired company’s financial health and long-term sustainability can lead to unforeseen problems.

A key lesson from these instances is the importance of a thorough due diligence process.

Strategies Employed by Similar Companies

Companies similar to AOL, like Yahoo! or Google, have demonstrated varied approaches in similar acquisitions. Their acquisitions often focused on gaining market share, securing access to innovative technologies, or building strategic partnerships. For example, Yahoo! frequently acquired smaller companies to expand their online services. In contrast, Google’s acquisitions often aimed at bolstering their core competencies, like search technology, by incorporating cutting-edge technologies from the acquired entities.

These strategies provide insights into how AOL can maximize synergies with GameDaily.

Lessons Learned from Past Acquisitions

- A thorough due diligence process is essential to assess the financial stability and long-term viability of the acquired company. This includes evaluating financial health, cultural fit, and potential integration challenges.

- Careful consideration must be given to integrating the acquired company’s culture and operational structure into the existing organization. This ensures smooth transition and avoids conflicts that can hinder productivity.

- Effective communication and collaboration are critical during the integration process. Open communication channels between teams facilitate a shared understanding and foster a unified vision for the future.

- Strategic planning for integration must include clear objectives, timelines, and resource allocation. This ensures that the acquisition aligns with the acquiring company’s overall strategic goals.

“Successful acquisitions are not just about buying a company; they are about integrating it seamlessly into the existing structure.”

“A comprehensive due diligence process is critical to mitigate unforeseen risks and ensure a profitable integration.”

“Aligning the acquired company’s culture and operational strategies with the acquiring company’s vision is essential for success.”

Last Point

AOL’s acquisition of GameDaily represents a significant gamble in the digital media and gaming space. While the potential benefits, such as increased market share and revenue streams, are substantial, the integration challenges and potential risks must be carefully considered. The success of this acquisition hinges on AOL’s ability to effectively integrate GameDaily’s operations and leverage its user base to create new opportunities.

The future will reveal whether this purchase marks a shrewd strategic move or a misstep in the competitive landscape.