Consumer Alert Identity Theft on the Rise

Consumer alert identity theft on the rise – Consumer alert: identity theft on the rise. This alarming trend highlights the increasing sophistication of cybercriminals and the urgent need for consumers to understand the risks and take proactive steps to protect themselves. From online shopping to everyday transactions, our personal information is vulnerable, and thieves are actively seeking opportunities to exploit our vulnerabilities. This article delves into the current state of identity theft, its impact on consumers, and essential prevention strategies.

Identity theft is no longer a distant threat; it’s a reality impacting millions. We’ll explore the various methods used by identity thieves, the types of personal information targeted, and the financial and emotional consequences for victims. The following sections will provide a comprehensive overview, equipping you with the knowledge and tools to safeguard your personal information.

Introduction to Consumer Alert: Identity Theft on the Rise

Identity theft is a pervasive and growing threat to consumers worldwide. The increasing reliance on digital platforms and the ease with which personal information can be stolen online has created a fertile ground for criminals. This alert provides crucial information to help individuals recognize and protect themselves against this pervasive crime. The frequency and sophistication of identity theft tactics demand vigilance and proactive measures.The prevalence of identity theft is steadily rising, fueled by the ever-expanding digital landscape.

Consumers are increasingly vulnerable as they conduct financial transactions, share personal data online, and use various online services. This escalating trend underscores the critical need for individuals to understand the tactics used by identity thieves and take necessary precautions.

Common Methods Used by Identity Thieves

Identity thieves employ a variety of sophisticated methods to steal personal information. These tactics range from seemingly harmless phishing emails to more sophisticated hacking techniques. Understanding these methods is crucial for preventing victimization.

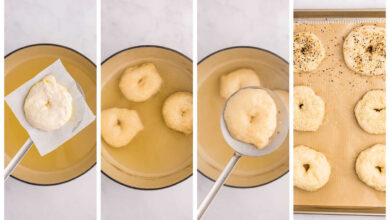

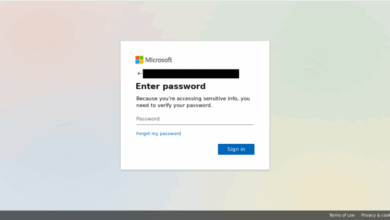

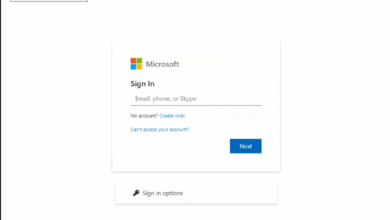

- Phishing: This involves tricking individuals into revealing personal information by posing as legitimate organizations. Criminals often send emails or text messages that appear to be from banks, social media sites, or other trusted entities, requesting sensitive data like passwords or account numbers. An example is receiving an email seemingly from a bank requesting verification of account information, which, if clicked, may redirect the user to a fake website.

- Malware: Malicious software can be installed on a computer or mobile device without the user’s knowledge. This malware can capture keystrokes, steal login credentials, or access sensitive data stored on the device. This could involve downloading a seemingly harmless software update that contains hidden malware.

- Data Breaches: Large-scale data breaches can expose vast amounts of personal information from companies, potentially compromising the data of millions of consumers. These breaches can be a result of hacking or vulnerabilities in a company’s security systems.

- Skimming: Skimming involves using devices to steal credit card information when a consumer uses a payment card at a point-of-sale terminal. Criminals may attach a small device to a card reader, capturing the data as the card is swiped.

Types of Personal Information Targeted

Identity thieves are after a variety of personal information. The goal is to use this information to open fraudulent accounts, apply for loans, or make purchases in the victim’s name. Understanding what information is targeted helps consumers take preventive measures.

With identity theft on the rise, it’s crucial to be vigilant. Protecting your personal information is paramount, especially with the increasing sophistication of cyberattacks. Fortunately, innovative solutions like those discussed by Virtela CEO Vab Goel in his insightful interview on the future of VoIP, virtela ceo vab goel on the future of voip , could offer more secure communication channels.

This underscores the need for proactive measures to combat the growing threat of identity theft.

- Social Security Numbers (SSNs): Critically important for identification, SSNs are a primary target. This number is often used to open fraudulent accounts or obtain credit in the victim’s name.

- Date of Birth (DOB): Combined with other information, DOB helps confirm identity. This is often used in conjunction with SSN to create fake identities.

- Addresses: Addresses are used for shipping fraudulent products or to receive mail associated with fraudulent accounts.

- Financial Account Information: This includes credit card numbers, bank account details, and other financial data. This is the most common target, allowing thieves to make unauthorized purchases or withdraw funds.

- Login Credentials: Passwords and usernames for online accounts allow access to various services and accounts.

Forms of Identity Theft

The following table Artikels various forms of identity theft, highlighting the common characteristics and methods.

| Type of Identity Theft | Description | Example |

|---|---|---|

| Credit Card Fraud | Unauthorized use of credit cards for fraudulent purchases. | Using stolen credit card information to make online purchases. |

| Tax Fraud | Filing fraudulent tax returns in another person’s name. | Submitting false tax information to claim a refund. |

| Bank Account Fraud | Unauthorized access to bank accounts for financial gain. | Using stolen banking credentials to withdraw funds. |

| Loan Fraud | Applying for loans in another person’s name. | Using stolen personal information to secure a mortgage. |

| Medical Identity Theft | Unauthorized use of medical records and insurance information. | Opening a fraudulent medical account and billing for services. |

Impact of Identity Theft on Consumers

Identity theft is more than just a financial inconvenience; it’s a serious crime with far-reaching consequences. The theft of personal information can lead to significant financial hardship, emotional distress, and even long-term mental health challenges. Understanding the multifaceted impact of identity theft is crucial for both prevention and recovery.The financial repercussions of identity theft are often substantial and long-lasting.

Victims frequently face unexpected debt, damaged credit scores, and difficulty obtaining loans or credit cards. This can significantly impact their ability to rent an apartment, buy a car, or even secure a job. For example, a fraudulent application for a mortgage could result in a denied loan and the potential for significant financial loss. The time and effort required to resolve these issues can be substantial, further compounding the financial burden.

Financial Repercussions

Identity theft can result in significant financial losses. These range from small, easily-recoverable amounts to substantial debts that take years to resolve. The costs associated with recovering from identity theft include not only the direct financial losses but also the time spent on resolving the issues. A victim might incur fees for credit monitoring services, fraud alerts, and legal assistance.

In some cases, victims are required to pay significant sums for legal representation, particularly if they must pursue litigation to recover damages.

Emotional Distress and Mental Health Implications

The emotional toll of identity theft can be severe. Victims often experience feelings of anxiety, stress, and even post-traumatic stress disorder (PTSD). The feeling of vulnerability and violation can lead to trust issues and difficulties forming close relationships. The constant worry about future financial security and the fear of further fraudulent activities can negatively impact a victim’s mental well-being.

It’s important to recognize that the psychological impact can be profound and may necessitate professional support.

Impact on Different Demographics

The impact of identity theft varies across demographics. Younger individuals, for example, may be particularly vulnerable to the long-term consequences of identity theft due to the impact on their credit history, which will be present for many years. Similarly, lower-income individuals may face greater difficulties in recovering from financial losses associated with identity theft due to limited financial resources.

Elderly individuals, particularly those with limited technological literacy, may be more susceptible to scams and online fraud. This means tailored support and resources are essential to address the unique vulnerabilities of different demographics.

Legal and Regulatory Responses to Identity Theft

Governments and regulatory bodies have implemented various measures to address identity theft. These measures include the establishment of consumer protection agencies, the development of fraud alert systems, and the enforcement of laws prohibiting identity theft. The Federal Trade Commission (FTC) in the US, for instance, provides resources and information to consumers regarding identity theft and reporting procedures. Laws like the Fair Credit Reporting Act (FCRA) in the US aim to protect consumers from inaccurate and fraudulent information in their credit reports.

Consequences of Identity Theft

| Category | Description |

|---|---|

| Financial | Unexpected debt, damaged credit score, difficulty obtaining loans or credit cards, increased debt, legal fees, time and effort |

| Emotional | Anxiety, stress, PTSD, trust issues, difficulties forming relationships, mental health issues |

| Legal | Filing complaints, reporting fraudulent activities, litigation, legal representation |

| Social | Negative impacts on personal relationships, isolation, fear of future, difficulty securing housing |

Prevention Strategies for Consumers: Consumer Alert Identity Theft On The Rise

Identity theft is a growing concern for individuals across the globe. Understanding and implementing preventative measures is crucial to safeguarding personal information and financial well-being. Proactive steps can significantly reduce the risk of becoming a victim of identity theft.Implementing strong security practices, from securing online accounts to recognizing phishing attempts, empowers consumers to protect themselves. By adopting these strategies, individuals can actively contribute to minimizing the threat of identity theft and maintaining control over their personal data.

Basic Security Practices

Taking proactive measures to secure personal information is paramount in preventing identity theft. These foundational practices form the bedrock of a robust security strategy.

- Regularly review your credit reports.

- Monitor bank and credit card statements diligently for any unauthorized activity.

- Maintain strong passwords and consider using a password manager.

- Enable multi-factor authentication (MFA) whenever possible.

- Be cautious about sharing personal information over email or text, especially when unexpected requests arise.

Securing Online Accounts

Robust online account security is critical for preventing unauthorized access. By adhering to best practices, individuals can safeguard their sensitive data and accounts.

- Use strong passwords, preferably unique for each account. Avoid easily guessable passwords like birthdays or names.

- Enable two-factor authentication (2FA) or multi-factor authentication (MFA) for all online accounts, including email, banking, and social media.

- Choose reputable websites for online transactions. Look for secure connections (HTTPS) and website security certifications.

- Keep software updated, including operating systems, browsers, and applications. This ensures that you have the latest security patches to mitigate vulnerabilities.

- Avoid using public Wi-Fi networks for sensitive transactions, like online banking or shopping.

Safe Online Shopping and Banking

Protecting financial information during online transactions is essential. Following these guidelines helps ensure secure online shopping and banking practices.

- Only shop on secure websites that use HTTPS.

- Be wary of suspicious emails or links that request personal information.

- Check the website’s privacy policy before providing any sensitive information.

- Use strong passwords and enable multi-factor authentication for online banking accounts.

- Never share your login credentials or financial information with anyone over email or text.

Strong Passwords and Multi-Factor Authentication

Robust password security is a cornerstone of online protection. Implementing multi-factor authentication significantly enhances security.

Strong passwords are unique, complex, and memorable.

- Use a combination of uppercase and lowercase letters, numbers, and symbols to create strong passwords.

- Avoid using easily guessable passwords like birthdays, names, or common phrases.

- Consider using a password manager to securely store and generate strong passwords for multiple accounts.

- Multi-factor authentication (MFA) adds an extra layer of security, requiring a second form of verification (e.g., a code sent to your phone) beyond your password.

- Enabling MFA on online accounts significantly reduces the risk of unauthorized access, even if a password is compromised.

Phishing Scams

Phishing scams are a common tactic used by cybercriminals to obtain personal information. Recognizing and avoiding these scams is crucial.

- Be cautious of emails or messages that ask for personal information, especially if they seem urgent or threatening.

- Verify the sender’s email address or website address carefully before clicking on any links or providing information.

- Do not reply to emails or messages that ask for your login credentials or financial information.

- Report suspicious emails or messages to the appropriate authorities.

- Be wary of emails that contain attachments from unknown senders.

Security Measures, Consumer alert identity theft on the rise

A table outlining various security measures for consumers.

| Security Measure | Description |

|---|---|

| Strong Passwords | Use unique, complex passwords for each account. |

| Multi-Factor Authentication (MFA) | Add an extra layer of security requiring a second form of verification. |

| Regular Credit Monitoring | Review credit reports regularly for any unauthorized activity. |

| Secure Wi-Fi | Avoid using public Wi-Fi for sensitive transactions. |

| Phishing Awareness | Recognize and avoid suspicious emails or messages requesting personal information. |

Consumer Rights and Resources

Identity theft is a serious crime that can have devastating consequences for victims. Understanding your rights and having access to the right resources can significantly mitigate the damage and help you recover. This section Artikels the protections available to consumers and the support systems designed to assist them.Knowing your rights and having access to the proper resources can significantly ease the recovery process after an identity theft incident.

Armed with this knowledge, you can take proactive steps to safeguard your financial well-being and reputation.

Consumer Rights When Dealing with Identity Theft

Consumers have specific rights when facing identity theft. These rights often involve protections provided by federal and state laws, as well as the specific terms of your financial contracts.

- The right to dispute fraudulent activity on your accounts:

- The right to receive timely notifications of suspicious activity:

- The right to have your identity restored and your credit report corrected:

- The right to compensation for damages incurred due to the theft:

Available Resources and Support Systems

A variety of resources and support systems are available to assist victims of identity theft. These resources often vary based on the specific type of theft and the individual circumstances.

- Federal Trade Commission (FTC): The FTC is a crucial resource, providing extensive information, reporting tools, and assistance in navigating the complexities of identity theft. They offer a wide range of resources, including complaint filing and dispute resolution services.

- State Attorneys General: State attorneys general often have dedicated identity theft units or programs to aid victims. They can offer legal guidance, information about state-specific laws, and assistance in resolving issues.

- Credit Bureaus (Equifax, Experian, TransUnion): These bureaus play a critical role in restoring credit reports. Consumers can dispute inaccurate information and place fraud alerts on their accounts.

- Non-profit organizations: Numerous non-profit organizations specialize in assisting identity theft victims. They offer guidance, resources, and support for the recovery process.

Steps to Take When You Become a Victim

If you suspect or discover you’re a victim of identity theft, immediate action is crucial.

- Secure Your Accounts: Immediately change passwords for all affected accounts and report fraudulent activity to the relevant financial institutions. This includes banks, credit card companies, and utility providers.

- Place Fraud Alerts: Contact all three major credit bureaus (Equifax, Experian, TransUnion) to place fraud alerts on your credit reports. This helps to flag suspicious activity and prevent further unauthorized actions.

- File a Complaint: Report the identity theft to the Federal Trade Commission (FTC) using their online tools or by phone. They maintain a dedicated website for reporting and can provide assistance throughout the process.

- Document Everything: Maintain meticulous records of all communication, account statements, and other relevant documentation related to the identity theft incident. This documentation can be crucial in proving the theft and seeking compensation.

Government Agencies and Non-Profit Organizations

Various government agencies and non-profit organizations offer support for victims of identity theft. Their roles and responsibilities often overlap, providing a multi-faceted approach to victim assistance.

| Agency/Organization | Specific Assistance |

|---|---|

| Federal Trade Commission (FTC) | Filing complaints, providing information, and resources |

| Federal Bureau of Investigation (FBI) | Investigating criminal activity related to identity theft |

| Consumer Financial Protection Bureau (CFPB) | Protecting consumers from financial exploitation, including identity theft |

| IdentityTheft.gov | A one-stop website for reporting and resolving identity theft issues |

Case Studies of Identity Theft

Identity theft is a pervasive and increasingly sophisticated crime, leaving victims with significant financial and emotional burdens. Understanding real-world examples of successful attacks, the recovery process, and the methods employed is crucial for developing effective prevention strategies. This section explores the intricacies of identity theft, providing insights into the stages of an attack and demonstrating the importance of proactive measures.

Real-World Scenarios of Successful Attacks

Identity theft attacks can manifest in various forms, from seemingly insignificant data breaches to elaborate schemes targeting vulnerable individuals. A common tactic involves the theft of personal information through phishing emails, masquerading as legitimate entities. These emails often contain malicious links or attachments that download malware onto the victim’s computer, enabling hackers to access sensitive data. Another prevalent method is the exploitation of weak or compromised passwords.

Hackers utilize sophisticated tools to crack passwords or gain unauthorized access to online accounts.

Methods Used to Steal Personal Information

Various methods are used to steal personal information, each with varying degrees of sophistication. Phishing, as mentioned previously, is a widespread tactic. Phishing emails often mimic legitimate organizations, tricking recipients into revealing sensitive information like usernames, passwords, and credit card details. Social engineering exploits human psychology to manipulate individuals into divulging confidential information. For example, a hacker might pose as a representative of a bank or utility company, convincing the victim to disclose account details.

Data breaches at organizations holding large quantities of personal data, such as credit bureaus or healthcare providers, can also lead to significant identity theft incidents.

Steps Taken by Victims to Recover from Attacks

The recovery process from an identity theft attack is often lengthy and complex. Victims typically report the incident to law enforcement and relevant agencies like the Federal Trade Commission (FTC). They will often have to take steps to secure and monitor their credit reports, and file fraudulent claims to banks, credit card companies, and other financial institutions. This frequently involves disputing fraudulent accounts and establishing new identities.

Comparison of Identity Theft Prevention Approaches

Several approaches to identity theft prevention exist, each with varying degrees of effectiveness. Strong password management, multi-factor authentication, and regular software updates are crucial to safeguarding accounts and preventing unauthorized access. Regularly monitoring credit reports and financial statements can help detect fraudulent activity early on. Education on the methods used by identity thieves can also significantly reduce the risk of becoming a victim.

Hey everyone, a recent consumer alert highlights the alarming rise in identity theft. It’s a real concern for all of us, and unfortunately, it’s something that’s made even more complex by the advancements in technology. For example, IBM recently opened up its custom power chips, ibm opens customizes power chips , which could potentially impact security measures in various ways.

So, it’s crucial to remain vigilant and take steps to protect your personal information in this ever-evolving digital landscape.

Creating a Plan to Respond to an Attack

A comprehensive plan to respond to an identity theft attack is essential. This should include immediate steps to report the incident to law enforcement, relevant agencies, and financial institutions. The plan should also detail the process for securing accounts, monitoring credit reports, and disputing fraudulent activity. It is crucial to document all steps taken during the recovery process.

Stages of a Typical Identity Theft Case

| Stage | Description ||—|—|| 1. Information Collection | Hackers gather personal information, often through phishing or data breaches. || 2. Account Takeover | Hackers use stolen information to access and control victim’s accounts. || 3. Fraudulent Activity | Hackers use stolen accounts to commit financial fraud, such as opening new accounts, making unauthorized purchases, or applying for loans. || 4. Detection and Reporting | Victim notices suspicious activity or receives notifications of fraudulent activity.

|| 5. Recovery and Remediation | Victim reports the incident to law enforcement, financial institutions, and credit bureaus. Steps are taken to restore financial accounts and rebuild credit. || 6. Prevention and Mitigation | Victim implements security measures to prevent future attacks, and learns from the experience. |

The Role of Technology in Identity Theft

Technology has become an integral part of our lives, streamlining many processes and connecting us globally. However, this same interconnectedness creates new vulnerabilities, making us more susceptible to identity theft. Criminals are constantly adapting their methods, leveraging advanced technology to exploit weaknesses in online systems and steal personal information. This evolution necessitates a deeper understanding of the methods and trends in cybercrime to effectively protect ourselves.The digital age has provided criminals with unprecedented tools and opportunities to commit identity theft.

From sophisticated phishing scams to elaborate data breaches, the use of technology allows perpetrators to reach and target a vast number of individuals with minimal effort and maximum impact. This article will explore the critical role of technology in identity theft, examining the tools, techniques, and trends behind these crimes.

Advanced Technology in Identity Theft

Advanced technologies, including artificial intelligence (AI) and machine learning (ML), are increasingly used by cybercriminals. AI allows for the creation of highly sophisticated phishing emails that appear legitimate, tricking victims into revealing sensitive information. Machine learning algorithms analyze vast amounts of data to identify vulnerabilities in online systems and personal profiles, making targeted attacks more efficient.

Exploiting Vulnerabilities in Online Systems

Hackers exploit vulnerabilities in online systems through various methods, including malware, phishing, and social engineering. Vulnerable websites and applications often lack proper security measures, creating entry points for malicious actors. Phishing emails and text messages mimic legitimate communications, luring individuals into revealing personal information. Social engineering techniques manipulate human psychology to gain access to sensitive data.

Data Breaches and Hacking Methods

Data breaches occur when unauthorized individuals gain access to sensitive information stored in databases. Hackers use various methods, including exploiting software vulnerabilities, employing brute-force attacks, and leveraging stolen credentials. These breaches can compromise personal information, financial accounts, and medical records, leading to significant financial and emotional harm.

Examples of data breach methods include SQL injection attacks, cross-site scripting (XSS), and denial-of-service (DoS) attacks.

Trends in the Use of Technology for Identity Theft

Trends in the use of technology for identity theft include the increasing sophistication of phishing attacks, the rise of ransomware, and the use of social media for reconnaissance and manipulation. Phishing techniques are becoming more personalized and believable, making it difficult for victims to detect them. Ransomware attacks target individuals and organizations, encrypting data and demanding payment for its release.

Social media is used to gather information about potential targets, creating profiles and developing targeted phishing campaigns.

Protecting Against Cyberattacks

Protecting against cyberattacks requires a multi-faceted approach. Strong passwords, two-factor authentication, and regular software updates are essential for minimizing vulnerabilities. Awareness of phishing attempts and social engineering techniques is crucial for preventing unauthorized access. Cybersecurity training and education are essential for individuals and organizations to stay informed about emerging threats.

Hey everyone, a recent consumer alert highlights the alarming rise in identity theft cases. It’s a serious issue, and it’s important to stay vigilant. Fortunately, companies like Trend Micro are proactively addressing these threats by enhancing their desktop security, like their recent update adding antispyware features to their security software. This proactive approach to cybersecurity, as seen in Trend Micro’s updates to desktop security adding antispyware , is crucial for protecting ourselves from these ever-evolving digital threats.

This means it’s more important than ever to keep your personal information safe and secure.

Comparison of Protection Methods

- Strong passwords are essential to securing accounts. Use a combination of uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessed passwords like birthdays or names.

- Two-factor authentication adds an extra layer of security. This requires a second verification step beyond a password, such as a code sent to a mobile device.

- Regular software updates patch security vulnerabilities. Ensure all operating systems and applications are up to date to mitigate potential risks.

- Awareness of phishing attempts is crucial. Be cautious of suspicious emails, messages, or websites, and never click on links from unknown senders.

Cyber Threats and Vulnerabilities

| Cyber Threat | Vulnerability | Impact |

|---|---|---|

| Phishing | Human error, lack of awareness | Loss of personal information, financial fraud |

| Malware | Software vulnerabilities, outdated systems | Data breaches, system damage, financial loss |

| Ransomware | System vulnerabilities, lack of backups | Data encryption, financial demands, system downtime |

| Data breaches | Security flaws in databases, poor security practices | Exposure of sensitive information, financial losses, reputational damage |

Illustrative Examples of Identity Theft

Identity theft, a pervasive threat in today’s digital age, involves the fraudulent acquisition and use of someone else’s personal information. This can range from simple inconveniences to severe financial and reputational damage. Understanding how identity theft occurs and the methods used is crucial for prevention. Recognizing the signs of potential theft is equally important to minimize the impact.

A Typical Identity Theft Incident

A common scenario involves a victim whose personal information, such as their Social Security number, date of birth, or bank account details, is stolen. This can happen through various means, from phishing scams to data breaches. Once the thief has this information, they can open new accounts in the victim’s name, apply for loans, or make fraudulent purchases.

How Personal Information Can Be Stolen

Personal information can be compromised through various methods. Phishing emails and malicious websites are common tactics. These often mimic legitimate organizations, tricking individuals into revealing sensitive data. Data breaches, where large amounts of personal information are stolen from companies, can expose millions of users to potential theft. Stolen mail containing sensitive documents is another route for thieves.

Physical access to personal records or documents can also lead to the theft of information. In some cases, social engineering, where attackers manipulate individuals into divulging their personal information, can be highly effective.

Methods Used to Exploit a Victim’s Personal Data

Criminals utilize various methods to exploit a victim’s personal information. Phishing, as mentioned earlier, is a common method. Phishing emails or text messages often appear legitimate, luring victims into revealing passwords, account numbers, or other sensitive data. Malware, malicious software, can infiltrate computers and steal information. Data breaches, as noted before, can expose large datasets containing personal information.

In some cases, criminals may gain access to personal information through social engineering, manipulating individuals into revealing confidential data. Compromised or weak passwords also play a significant role in identity theft. Lack of vigilance and security practices can expose individuals to theft.

Aftermath of an Identity Theft Incident

The aftermath of an identity theft incident can be devastating. Victims often face significant financial burdens, including fraudulent charges on their accounts, difficulty obtaining credit, and increased debt. Their credit score can be severely damaged, making it challenging to secure loans or rent an apartment. The emotional toll is also considerable, with victims experiencing stress, anxiety, and feelings of violation.

The time and effort required to resolve the issue can also be significant. It’s crucial to address the problem swiftly to mitigate the damage.

Recognizing Signs of Identity Theft

There are several indicators that might suggest identity theft. Unusual activity on bank statements or credit reports, receiving bills for services you haven’t used, and encountering problems when accessing online accounts are all potential red flags. If you see unfamiliar or unauthorized accounts opened in your name, or if your credit report shows inaccurate information, it’s essential to act quickly.

Scrutinizing your credit reports regularly is a key preventative measure. Be wary of suspicious emails or phone calls requesting personal information.

Illustrative Scenarios of Identity Theft

| Scenario | Method of Theft | Impact |

|---|---|---|

| A victim receives an email claiming to be from their bank, requesting account details. | Phishing | Fraudulent access to bank accounts and potential financial losses. |

| A victim’s personal information is compromised in a data breach at a major retailer. | Data breach | Unauthorized access to credit accounts, loans, and potentially opening new accounts in the victim’s name. |

| A victim’s mail is intercepted, and their credit card application documents are stolen. | Stolen Mail | Fraudulent applications for credit cards and loans in the victim’s name. |

| A victim’s computer is infected with malware, which steals their login credentials and financial information. | Malware | Unauthorized access to online accounts, financial accounts, and potential financial losses. |

Final Conclusion

In conclusion, identity theft is a pervasive issue demanding vigilance and proactive measures. This article has Artikeld the current state of identity theft, its impact on consumers, and essential prevention strategies. By understanding the tactics of identity thieves, the importance of strong security measures, and your rights as a consumer, you can significantly reduce your risk of becoming a victim.

Remember to stay informed, be cautious, and protect your valuable personal information. The fight against identity theft requires a collective effort, and your awareness and preparedness are crucial.