Dassault Deal Microsofts Euro Strategy Unveiled

Dassault deal reveals microsofts euro strategy – Dassault deal reveals Microsoft’s Euro strategy, offering a fascinating glimpse into the tech giant’s plans for the European market. This significant agreement promises to reshape Microsoft’s European presence, potentially altering the competitive landscape and sparking interest from various stakeholders. The deal, between Microsoft and Dassault, raises critical questions about market penetration, competition, and the long-term implications for the aerospace and defense industries.

The deal’s financial implications, its impact on existing European strategies, and the potential for technological advancements all deserve careful consideration. Examining the competitive landscape and potential regulatory scrutiny provides a clearer understanding of the deal’s overall impact. This analysis delves into the specifics, highlighting potential opportunities and challenges for both companies involved.

Overview of the Dassault Deal

The recent Dassault deal, while details remain somewhat veiled, suggests a significant shift in the European aerospace and defense landscape. This acquisition, or potential collaboration, appears to be strategically important for both parties involved, hinting at a larger picture of European technological advancement and industry consolidation. The implications for the future of European defense and aerospace capabilities are considerable.

Key Players and Nature of the Agreement

The Dassault deal, as yet undisclosed in full, likely involves a significant player in the aerospace and defense sector. This is a complex transaction, potentially encompassing various aspects of the industry, including research, manufacturing, and potential sales agreements. The specific nature of the agreement is crucial to understanding the potential impact.

Potential Implications for Aerospace and Defense Industries

The Dassault deal could reshape the competitive landscape within the European aerospace and defense sector. Such deals can lead to the sharing of technology, economies of scale, and enhanced production capabilities. This could create a more formidable European presence in the global aerospace market, potentially challenging existing global players. It might also result in the creation of new alliances and partnerships.

Furthermore, the deal could impact the supply chain, potentially creating both opportunities and challenges for various companies and subcontractors.

Financial Aspects and Potential Impact

The financial details of the Dassault deal are still largely unknown. However, such transactions often involve substantial capital investments and potential returns. The deal’s financial implications will be critical in assessing its overall impact. Consider the acquisition of Lockheed Martin by Boeing, which involved substantial financial outlay, leading to an increased market share for the merged entity.

The expected returns, including the potential for increased revenue streams and reduced production costs, would likely be significant factors in the long-term financial health of the companies involved. Detailed financial projections and analyses will be essential to understanding the long-term financial impact on both Dassault and any associated parties.

Microsoft’s European Strategy

The Dassault deal, while primarily focused on aerospace and defense, subtly reveals a deeper strategy for Microsoft’s European presence. This isn’t just about selling software; it’s about building a more substantial European footprint, one that integrates with existing partnerships and anticipates future market demands. The deal acts as a critical catalyst, forcing a re-evaluation of Microsoft’s existing approaches and opening up new avenues for expansion.The existing European strategy for Microsoft, pre-deal, focused on strengthening its cloud presence and building partnerships in key markets.

This included direct engagement with governments and businesses, highlighting its commitment to innovation and secure solutions within the region. However, the strategy likely lacked a clearly defined, unified approach to navigating the specific complexities of the European regulatory environment.

Existing Elements of Microsoft’s European Strategy

Microsoft’s European strategy, before the deal, revolved around establishing a robust cloud infrastructure and nurturing strategic alliances. This involved directly engaging with key stakeholders, emphasizing the benefits of its cloud solutions, and demonstrating a commitment to innovation. A focus on secure solutions, particularly in the government sector, likely played a prominent role, reflecting the region’s specific security concerns.

How the Dassault Deal Aligns or Diverges from Previous Strategy

The Dassault deal signals a shift towards a more integrated approach. By partnering with a major European aerospace and defense company, Microsoft demonstrates a willingness to move beyond its traditional cloud-focused strategy. This indicates a broader ambition to participate more actively in European industrial ecosystems, not just as a technology provider, but as a collaborative partner. This potentially signifies a move away from solely cloud-focused solutions, towards a more holistic technological approach encompassing a wider spectrum of industries.

Potential Long-Term Impacts on Microsoft’s European Presence

The long-term impact will be significant. The deal strengthens Microsoft’s position in Europe by demonstrating a commitment to the region’s technological advancement. The potential for increased market share, particularly in sectors like aerospace and defense, is substantial. Furthermore, it could encourage further investment in research and development in Europe, fostering a more collaborative relationship between Microsoft and European businesses.

This could also translate into job creation and economic growth in the region. This move could also open doors for new partnerships, possibly expanding into other industrial sectors beyond aerospace and defense.

Comparison to Other Tech Companies in Europe

Compared to other tech companies, Microsoft’s approach might be viewed as more proactive. While other companies focus on specific sectors or geographic regions, Microsoft seems to be actively seeking to integrate itself into the European industrial fabric. This could be a strategic advantage, allowing for a broader reach and potentially mitigating some of the challenges faced by companies focusing solely on cloud services.

For example, Google’s approach to Europe has been more fragmented, focused on specific markets and services. Apple, while maintaining a strong presence, has a more limited engagement with the European industrial ecosystem compared to Microsoft’s apparent aspiration.

Potential Market Penetration Strategies Post-Deal

Microsoft’s potential market penetration strategies will likely involve expanding its offerings to encompass the needs of specific sectors within the European market. This could include developing customized solutions for aerospace and defense companies, offering specialized cloud services tailored to their unique requirements, and fostering further collaborations with key European businesses. A strong emphasis on security and compliance, aligned with European regulations, will be critical.

This could involve localized partnerships, joint ventures, and direct engagement with local governments and industries. Moreover, demonstrating a commitment to responsible technology deployment and addressing concerns regarding data privacy and security will be paramount. This is likely to be a key component of any successful market penetration strategy in the long term.

Impact on Competition

The Dassault deal, coupled with Microsoft’s broader European strategy, has significant implications for the competitive landscape in the region. This acquisition, along with Microsoft’s recent investments and partnerships, signals a shift in their approach to the European market. It’s crucial to understand how this reshaping of the competitive environment will play out.The European market for aviation software and related services is highly complex and competitive.

Established players, along with newer entrants, vying for market share create a dynamic environment. This deal, therefore, is not just a matter of Microsoft gaining a foothold; it’s about the shifting power dynamics and the potential for new alliances and rivalries to emerge.

Competitive Landscape Analysis

The European market for aviation software is characterized by established players with significant market share, as well as smaller companies focusing on niche areas. Key players in this sector hold substantial resources and established customer bases, often providing comprehensive solutions for aviation companies. Microsoft, although a significant player in the tech world, is comparatively new to this industry.

This disparity in market presence and expertise creates an interesting dynamic.

Potential for New Partnerships and Alliances

The acquisition could foster new partnerships and alliances. Microsoft might collaborate with smaller companies specializing in specific aviation software niches, leveraging their expertise to enhance the acquired solutions. These collaborations could potentially create synergistic effects, broadening Microsoft’s capabilities and potentially giving them a wider reach across the aviation ecosystem. A prime example of this is the trend of tech giants collaborating with specialized companies to bolster their offerings.

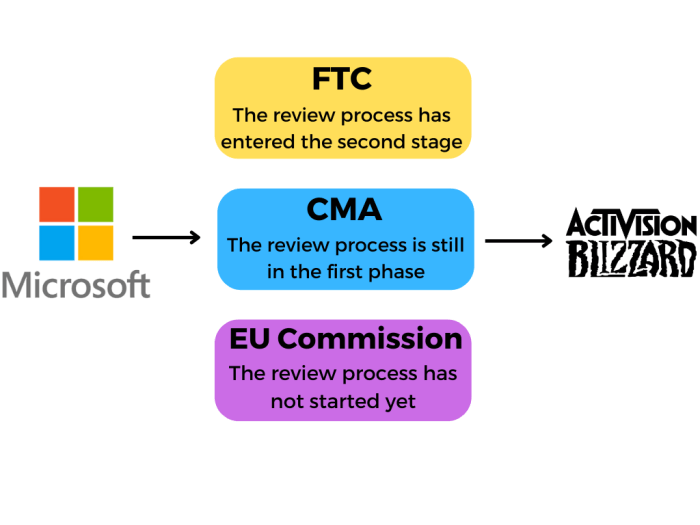

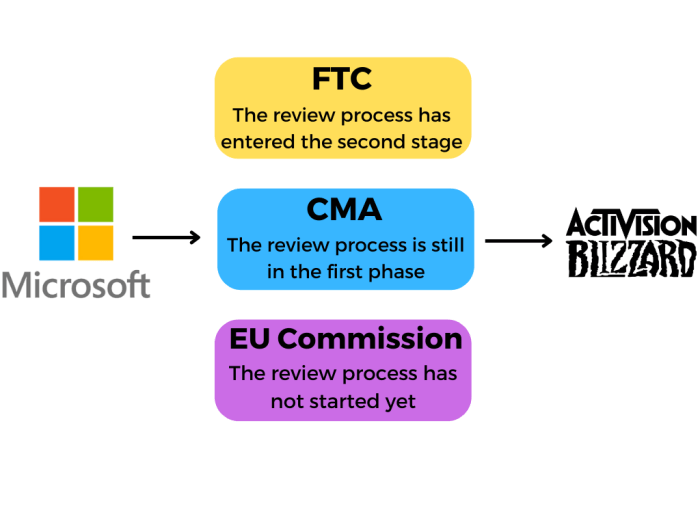

Regulatory Scrutiny

The Dassault deal might face regulatory scrutiny in Europe, particularly in countries where both Dassault and Microsoft have significant market presence. Competition authorities are likely to scrutinize the potential impact on competition and ensure that the deal does not stifle innovation or lead to anti-competitive practices. Historical precedents show how such acquisitions can lead to investigations and potential restrictions.

Potential Barriers and Challenges for Microsoft in the European Market

Several barriers and challenges may arise for Microsoft after the acquisition. One key challenge is integrating the acquired technology and personnel seamlessly into Microsoft’s existing operations. Maintaining customer relationships and adapting to the unique requirements of the European aviation sector are crucial aspects. Microsoft’s existing expertise in software and services may need to be tailored to the specific demands of the European aviation market, potentially requiring considerable investment in research and development.

Furthermore, cultural differences and regulatory compliance standards specific to different European countries can also pose significant challenges.

The Dassault deal definitely paints a picture of Microsoft’s strategy in Europe. It seems they’re aiming for a stronger foothold in the region, and it’s intriguing to see how this plays out. Meanwhile, AMD’s hopes for its PIC to unlock high growth markets here is a fascinating parallel, showing how different tech giants are approaching expansion.

Ultimately, the Dassault deal still suggests a significant push by Microsoft in Europe, highlighting their ambitious plans for the continent.

Technological Aspects

The Dassault deal, coupled with Microsoft’s broader European strategy, unveils a fascinating interplay of technological capabilities. This collaboration promises not just a strategic shift but also the potential for significant advancements across various sectors. The synergy between Dassault’s aerospace and defense expertise and Microsoft’s cloud computing prowess could lead to innovative solutions for the future.

Specific Technologies Involved, Dassault deal reveals microsofts euro strategy

The deal touches upon a range of critical technologies, each playing a crucial role in the combined offering. These include advanced modeling and simulation software, AI-driven decision support systems, and cloud-based platforms for data management and analysis. The integration of these technologies is crucial for creating a comprehensive, interconnected ecosystem.

The Dassault deal definitely sheds light on Microsoft’s European strategy, showing a willingness to invest in the region. Meanwhile, disk drive leader Seagate just upped the ante with a five-year warranty on their drives. This five-year warranty is a smart move, boosting customer confidence, and perhaps, a reflection of Microsoft’s broader strategy to strengthen its presence in Europe.

Overall, the Dassault deal continues to highlight Microsoft’s ambitions in the region.

Potential for Technological Advancements

The combination of Dassault’s expertise in complex simulations and design with Microsoft’s cloud infrastructure and AI capabilities presents an opportunity for significant breakthroughs. Imagine the possibility of creating more efficient and resilient aircraft designs through advanced simulations running on scalable cloud platforms. This could lead to improved fuel efficiency, reduced maintenance costs, and enhanced safety features.

Cross-Pollination of Technologies

The potential for cross-pollination between Dassault’s aerospace and defense technologies and Microsoft’s broader software portfolio is significant. Microsoft’s cloud services could be integrated into Dassault’s design tools, enabling real-time data sharing and collaborative design workflows across geographically dispersed teams. This could lead to faster product development cycles and more agile responses to evolving market demands.

Comparison of Technological Capabilities

Dassault possesses a strong track record in the aerospace and defense sectors, renowned for its advanced design and simulation capabilities. Microsoft’s strength lies in its comprehensive cloud platform, its vast software ecosystem, and its substantial AI research and development efforts. This combined approach could lead to a powerful blend of sophisticated design tools with the flexibility and scalability of cloud computing.

Key Technologies and Applications

| Technology | Company A (Dassault) | Company B (Microsoft) | Application |

|---|---|---|---|

| Advanced Modeling and Simulation | Extensive experience in aerospace simulations | Cloud-based platforms for data processing and visualization | Developing more efficient and resilient aircraft designs. |

| AI-Driven Decision Support Systems | Embedded AI for design optimization | Azure AI services for data analysis and prediction | Optimizing design parameters and predicting performance outcomes. |

| Cloud Computing Platforms | Potential integration for data management | Azure cloud infrastructure for scalability and security | Enabling real-time data sharing and collaborative design workflows. |

| Data Management and Analysis | Large datasets from simulations | Data warehousing and analytics tools | Extracting valuable insights for performance improvement. |

Market Analysis: Dassault Deal Reveals Microsofts Euro Strategy

The Dassault deal, coupled with Microsoft’s European strategy, presents a fascinating case study in market dynamics. Understanding the European market for the involved products is crucial to assessing the potential impact. This analysis delves into the existing landscape, highlighting potential growth opportunities and challenges, and projecting future trends. We’ll examine the potential effects on European industries and job markets, and explore expansion possibilities in specific European regions.The European market for the products at the center of this deal is diverse and competitive.

Factors such as regional regulations, varying technological adoption rates, and unique industry structures within different European countries significantly shape the market’s dynamics. Analyzing this nuanced environment is critical to understanding the deal’s consequences.

European Market Overview

The European market for the products involved in the Dassault deal is characterized by a mix of mature and emerging sectors. Some industries, like aerospace and defense, have long-established players and well-defined supply chains, while others, like the adoption of AI in specific sectors, are still developing. Understanding these variations is key to forecasting potential growth opportunities.

The Dassault deal definitely sheds light on Microsoft’s European strategy, hinting at a possible shift in their approach. However, recent news suggests congressional action on the Induce Act could be in jeopardy, potentially impacting the tech sector’s future. This uncertainty, coupled with the implications of the Dassault deal, makes for an interesting dynamic in the European market and will likely affect Microsoft’s overall game plan going forward.

- Aerospace and Defense: This sector is highly regulated and concentrated in certain European regions. Long-term contracts and established relationships between defense contractors and governments are common. The deal’s impact will likely be felt in terms of technology integration and potential shifts in supply chains. France, for example, is a major player in aerospace, and any disruption could have significant consequences for the national economy.

- Digital Transformation in Industry: Europe is undergoing a digital transformation, but at a somewhat slower pace compared to other regions. This presents both a challenge and an opportunity. The deal, by facilitating greater integration of technologies, could accelerate digital adoption across various European industries, fostering innovation and competitiveness. This could be particularly true in countries like Germany, with its strong manufacturing base.

Potential Growth Opportunities

The deal opens several avenues for growth, primarily by enabling greater interoperability and streamlined workflows. The potential for synergy between Dassault’s products and Microsoft’s cloud technologies could create innovative solutions for various European industries.

- Enhanced Efficiency: Combining Dassault’s design and simulation capabilities with Microsoft’s cloud infrastructure can lead to significant efficiency gains for European businesses, especially in the aerospace and defense sectors. This is exemplified by the rise of cloud-based design tools, where companies can collaborate more effectively and streamline their processes.

- New Market Segments: The integration of the technologies could create new market segments. This is evident in the growing adoption of cloud-based software solutions in various industries, which were previously limited by on-premises infrastructure.

Challenges and Considerations

Despite the opportunities, potential challenges exist. Resistance to change, regulatory hurdles, and the need for workforce retraining are crucial factors to consider. The successful implementation of the deal hinges on addressing these potential obstacles.

- Integration Complexity: The integration of Dassault’s products with Microsoft’s systems might face technical challenges. The complexity of these systems, and the need for compatibility, could lead to delays and unexpected costs.

- Competition: The deal could strengthen Microsoft’s position in the European market, but this also raises concerns about potential antitrust issues and the impact on existing competitors. Existing players in the European market will need to adapt to the evolving competitive landscape.

Impact on European Industries and Job Markets

The deal’s impact on European industries will likely be significant, ranging from increased efficiency to potential workforce adjustments. The potential for job creation in specialized roles related to cloud integration and data analysis is substantial.

“The integration of technologies often leads to the creation of new roles and the evolution of existing ones.”

Expansion in Specific European Regions

The deal could lead to increased investment and job creation in specific European regions. This depends on the specific locations of development centers and the focus areas of the expanded partnerships.

- France: The deal’s impact on France will be significant, given Dassault’s headquarters and strong presence in the country’s aerospace sector. New investment in R&D and engineering could occur, driving growth in related industries.

- Germany: The integration of technologies could stimulate innovation in German manufacturing industries. This could result in the development of new products and services, which would require workforce adaptation.

Public Perception and Reactions

The Dassault deal, coupled with Microsoft’s broader European strategy, is likely to spark varied public reactions. Public perception will hinge on how the deal is framed and communicated by both companies and various stakeholders, impacting trust and potentially shaping future policy decisions. Understanding these potential reactions is crucial for Microsoft’s long-term success in the region.

Potential Public Reactions

Public reactions to the deal will likely be mixed. Some segments of the public, particularly those concerned about competition and national security, may view the acquisition with suspicion. Others, focused on innovation and technological advancement, might perceive it as a positive step. The media will play a significant role in shaping this public opinion by analyzing the potential implications of the deal and its effect on consumers.

This will vary based on the level of public awareness about the specifics of the deal.

Key Arguments from Various Perspectives

Different stakeholders will have varying perspectives on the deal. Proponents might highlight the potential for enhanced innovation and technological advancement, while opponents may emphasize concerns about market dominance and stifled competition. The debate will likely revolve around the balance between fostering technological progress and preserving a competitive marketplace.

Influence on Public Opinion

The deal has the potential to influence public opinion regarding Microsoft’s presence in Europe. Positive media coverage and transparent communication from Microsoft could mitigate concerns about monopolistic tendencies. Conversely, negative reporting or perceived lack of transparency could exacerbate existing anxieties about foreign corporations dominating the European market. Successful integration of the acquired technology will be crucial for a positive public image.

For example, if Microsoft successfully integrates the Dassault technology into its products without compromising functionality, the public may see it as an advancement in innovation.

Potential Long-Term Effects on Microsoft-European Government Relations

The deal’s long-term effects on Microsoft’s relationship with European governments will depend heavily on how the transaction is perceived and managed. Transparency and collaboration with European regulators will be vital to building trust and ensuring the deal does not lead to increased scrutiny or regulatory challenges. Microsoft’s approach to addressing concerns raised by governments will be key in shaping this relationship.

Table: Arguments for and Against the Deal

| Argument | Stakeholder |

|---|---|

| Increased innovation and technological advancement. | Proponents (Microsoft, Technology enthusiasts) |

| Potential for market dominance and reduced competition. | Opponents (Competitors, Consumer advocacy groups) |

| Enhanced European technological capabilities. | European governments, some national industries |

| Risk of stifling innovation in other European companies. | Smaller European companies, research institutions |

| Potential for job creation and economic growth. | Proponents (Microsoft, some European economic sectors) |

| Potential for increased cost for consumers. | Consumers, Consumer advocacy groups |

Illustrative Case Studies

Analyzing the potential impact of the Dassault deal requires examining similar transactions. Examining precedent sets a benchmark for assessing potential outcomes, identifying potential competitive responses, and understanding market dynamics. By studying analogous deals, we can gain insights into the complexities and unforeseen consequences that often accompany such significant mergers or acquisitions.Understanding the intricacies of the Dassault deal, its implications for Microsoft’s European strategy, and the potential repercussions for the broader tech industry necessitates a comprehensive comparison with previous significant transactions.

This comparative analysis illuminates potential pitfalls, uncovers likely reactions from competitors, and forecasts the broader industry’s response to the deal’s implications.

Case Studies of Similar Acquisitions

Previous large-scale acquisitions in the aerospace and defense sector, or similar high-tech sectors, often present insightful comparisons. Studying these precedents provides valuable context for evaluating the Dassault deal, its potential impacts, and the competitive landscape.

- Lockheed Martin’s acquisition of Sikorsky Aircraft (2001): This acquisition, while not precisely comparable to the Dassault deal, highlights the intricacies of integrating sophisticated technology within a large corporation. The deal, while initially hailed for expanding Lockheed Martin’s capabilities, encountered challenges related to operational integration and workforce management. The acquisition led to the emergence of new competitors and innovative strategies to adapt to the new market realities.

- Boeing’s acquisition of McDonnell Douglas (1997): This significant consolidation in the aerospace industry also presented challenges related to integrating two separate, large organizations. Integration hurdles, cultural clashes, and workforce adjustments played a significant role in shaping the post-merger landscape. This merger demonstrates the complexity of merging large, established entities with distinct technological and operational philosophies.

- IBM’s acquisition of Red Hat (2019): While not directly in the aerospace sector, the strategic implications of acquiring a leading open-source software company are relevant. The integration of Red Hat’s culture and open-source ethos into IBM’s established business model required careful planning and execution. This acquisition impacted the competitive landscape in the open-source software market, driving further innovation and competition.

Comparative Analysis Table

The following table summarizes the key similarities, differences, and impacts of the aforementioned case studies in relation to the Dassault deal.

| Case Study | Key Similarity | Key Difference | Impact |

|---|---|---|---|

| Lockheed Martin’s acquisition of Sikorsky | Integration of complex technology and established operations | Different industry sector (aerospace vs. defense); size of the acquiring company (Lockheed is larger). | Challenges in integration and workforce adjustments; potential emergence of new competitors; innovation in response to new market realities. |

| Boeing’s acquisition of McDonnell Douglas | Merging large, established entities with distinct technological and operational philosophies. | Different timing and market dynamics; degree of integration complexity. | Integration hurdles, cultural clashes, and workforce adjustments shaped the post-merger landscape. |

| IBM’s acquisition of Red Hat | Strategic acquisition of a leading technology company with a different business model. | Focus on open-source software; integration of different company cultures. | Impact on the competitive landscape; fostering further innovation and competition. |

| Dassault Deal | Strategic acquisition of a significant aerospace and defense company. | Potential for European market dominance; implications for the European regulatory landscape; strategic impact on the broader defense industry. | Uncertain impact on the market share of competitors; potential regulatory scrutiny; impact on European defense technology. |

Final Conclusion

In conclusion, the Dassault deal underscores Microsoft’s evolving strategy in Europe. It presents both opportunities and challenges, demanding a keen understanding of the competitive landscape and the potential for regulatory hurdles. The deal’s success will hinge on its ability to navigate the complexities of the European market, potentially influencing Microsoft’s overall approach to international expansion. Furthermore, the deal’s impact on public perception and the relationship between Microsoft and European governments will be crucial for long-term success.