IBM Acquires Third Document Management Firm

IBM acquires third document management firm, signaling a significant move in the tech industry. This acquisition promises to reshape the document management landscape, potentially boosting IBM’s market share and expanding its product offerings. The details surrounding the financial aspects, strategic rationale, and potential integration challenges are all ripe for discussion. What are the implications for competitors, and how will this impact the overall document management market?

This acquisition marks IBM’s continued investment in document management solutions, a critical area in today’s digital-first world. The firm’s decision to acquire a third document management company suggests a strategic focus on strengthening its position in this market segment. Understanding the strengths and weaknesses of the acquired firm, as well as the potential synergies and integration challenges, is crucial for assessing the long-term impact of this move.

Let’s dive deeper into the details and uncover the potential for growth and change.

Overview of the Acquisition

IBM’s recent acquisition of Document Solutions Inc. marks another significant step in its ongoing strategy to bolster its document management capabilities. This acquisition follows a pattern of strategic partnerships and acquisitions in the tech industry, where companies are seeking to enhance their core offerings through mergers and integrations. This move further solidifies IBM’s position as a leader in enterprise solutions, allowing them to offer a more comprehensive suite of services to their clients.The acquisition signifies a calculated effort to enhance IBM’s document management ecosystem, addressing a critical need for businesses to effectively manage and utilize their vast collections of documents.

The integration of Document Solutions Inc.’s technologies and expertise promises to improve efficiency and provide a more streamlined workflow for clients.

IBM’s acquisition of another document management firm highlights their continued focus on streamlining business processes. This trend seems to mirror the strategic alliances in the tech world, like the recent partnership between Sun and Suse on Java Linux, sun and suse ally on java linux. Ultimately, these acquisitions and partnerships point to a larger drive towards more integrated and efficient digital workflows within various industries.

Financial Aspects of the Acquisition

The financial details of the acquisition are not publicly available at this time, and therefore are unknown. It is expected that the specifics regarding purchase price and any associated agreements will be released in due course, likely via a press release or SEC filing. However, the acquisition is expected to impact IBM’s financial performance in the short and long term.

Strategic Rationale Behind the Acquisition

IBM’s acquisition of Document Solutions Inc. aligns with its broader strategy to expand its enterprise solutions portfolio. The acquisition targets enhancing their existing document management offerings, aiming to provide a more robust and integrated solution for clients. This approach allows IBM to leverage the strengths of both companies, combining Document Solutions Inc.’s specialized document management expertise with IBM’s established global infrastructure and client base.

IBM’s acquisition of another document management firm highlights the ongoing trend in tech mergers and acquisitions. This move likely reflects the increasing need for streamlined digital workflows in the new world of global internet expansion the new world of global internet expansion. Ultimately, these acquisitions position IBM to better serve clients in a rapidly evolving digital landscape, which is a smart move for a company aiming for continued success.

Potential Impact on IBM’s Existing Document Management Offerings

The integration of Document Solutions Inc.’s technologies will likely lead to improvements in IBM’s existing document management solutions. This could manifest in enhanced features, improved scalability, and potentially reduced costs for clients. The potential impact on existing products could include new functionalities like enhanced security protocols, more advanced indexing and search capabilities, and more streamlined workflows. This combination of capabilities aims to better address the ever-increasing complexity of document management within organizations.

Current Market Trends in Document Management

The document management market is experiencing a shift towards cloud-based solutions, driven by the need for scalability, accessibility, and cost-effectiveness. The increased adoption of digital workflows and the rise of remote work have further fueled this trend. Organizations are increasingly looking for integrated solutions that can seamlessly manage documents across various platforms and devices. IBM’s acquisition of Document Solutions Inc.

is positioned to capitalize on these market trends, by offering a robust, integrated, and cloud-enabled document management platform.

IBM’s acquisition of another document management firm highlights the ongoing trend of consolidating digital resources. This move likely reflects a broader push towards integrated solutions, echoing recent partnerships like intel partners with wave systems to put security into chips , which aims to embed security directly into hardware. Ultimately, IBM’s acquisition strategy suggests a focus on streamlining and securing their document management capabilities.

Analysis of the Acquired Firm

The acquisition of a third document management firm by IBM signifies a strategic move to bolster its existing portfolio and potentially expand its market reach. Understanding the strengths and weaknesses of the acquired company, comparing its offerings with IBM’s existing solutions, and analyzing potential synergies and challenges are crucial for evaluating the success of this integration. This analysis delves into these aspects, providing a comprehensive view of the potential impact on the broader document management landscape.

Key Strengths and Weaknesses of the Acquired Firm

Identifying the strengths and weaknesses of the acquired firm is critical to understanding its potential value to IBM. A robust analysis considers factors such as market share, technological advancements, and customer base. Weaknesses might include limited product features or a smaller customer base compared to IBM’s.

- Strengths often include innovative solutions or specific expertise in a niche market segment, potentially complementing IBM’s existing offerings. This might manifest in a unique user interface or a particular type of document handling.

- Weaknesses can involve outdated technology, limited customer support, or a lack of scalability. These factors could indicate areas needing significant investment for integration into IBM’s infrastructure.

Comparison of Product Offerings, Ibm acquires third document management firm

Evaluating the acquired firm’s products alongside IBM’s existing solutions is essential to determine potential overlaps and complementary functionalities. This comparison will help identify areas where integration can yield benefits for existing customers.

| Feature | Acquired Firm | IBM |

|---|---|---|

| Document Classification | Utilizes AI-powered algorithms for advanced classification. | Employs a combination of rule-based and machine learning methods, with varying degrees of sophistication depending on the specific product. |

| Security Features | Offers robust encryption and access control mechanisms, focusing on compliance with industry standards. | Provides a wide range of security features, often integrated with broader enterprise security solutions, covering data encryption, access control, and compliance frameworks. |

| Integration with Existing Systems | Supports integrations with popular CRM and ERP systems. | Supports a vast array of integration options through APIs and middleware solutions, enabling seamless connection to virtually any enterprise application. |

| Mobile Accessibility | Provides mobile apps for viewing and managing documents on various platforms. | Offers mobile access to documents through cloud-based platforms and specialized mobile applications. |

Target Customer Base and Potential Synergy

The target customer base of the acquired firm is crucial for evaluating potential synergies with IBM’s existing clientele. Overlapping customer segments and shared needs could lead to cross-selling opportunities.

- The acquired firm’s clientele might be in specific industries, such as healthcare or finance, which aligns with IBM’s existing customer base. This alignment could offer substantial synergy.

- Conversely, if the customer base is disparate, the potential for integration might be limited, and resources may be required for market penetration or customer acquisition.

Potential Integration Challenges

Merging two companies’ operations and infrastructure often presents challenges. Cultural differences, conflicting systems, and data migration issues can hinder the smooth integration process.

- Different IT infrastructure and legacy systems can lead to compatibility issues, requiring substantial effort for migration and consolidation. For example, if the acquired firm relies on a different cloud platform, significant migration costs could be involved.

- Training employees on the new systems and workflows is vital for smooth transitions. Differences in internal processes might require substantial retraining for staff.

Potential Synergies and Integration

IBM’s acquisition of a third document management firm represents a strategic move to bolster its existing portfolio and solidify its position in the increasingly competitive enterprise software market. This integration presents significant opportunities for enhanced efficiency, expanded market reach, and improved customer offerings. The successful execution of this acquisition hinges on a meticulous integration strategy that addresses both technological and human elements.Integrating the acquired firm’s capabilities into IBM’s existing infrastructure requires a phased approach.

Initial steps should focus on identifying overlapping functionalities and eliminating redundancies. This includes a thorough assessment of existing processes, systems, and personnel to ensure smooth transition and avoid disruptions. Ultimately, the goal is to maximize efficiency by combining complementary strengths.

Integration Process

A structured integration process is crucial for a successful acquisition. The initial phase involves a comprehensive assessment of the acquired firm’s technology, identifying areas for potential synergies with IBM’s existing solutions. Next, a detailed plan for data migration and system integration is developed, taking into account security protocols and compliance standards. Parallel to the technological integration, a structured onboarding program for the acquired firm’s personnel is implemented.

This includes providing necessary training and support to ensure a seamless transition to IBM’s organizational structure. Crucially, maintaining the acquired firm’s expertise and culture is essential to retain valuable talent and avoid loss of key personnel.

Expected Benefits

The acquisition is expected to enhance IBM’s market share by providing customers with a more comprehensive suite of document management solutions. Improved product diversification is another significant benefit. This acquisition will broaden IBM’s offerings, catering to a wider range of customer needs and potentially attracting new clients. Increased market share and product diversification will contribute to increased revenue and profitability.

The integration of complementary technologies will create more efficient solutions, enhancing customer experience and satisfaction. For example, integrating advanced AI capabilities from the acquired firm with IBM’s existing cloud services could lead to innovative solutions for managing large volumes of documents.

Potential Risks and Challenges

Integration projects often face challenges related to cultural differences between organizations, leading to potential conflicts or difficulties in achieving synergy. The integration process also requires careful consideration of existing workflows and systems, as unexpected issues can arise during the transition. Maintaining the acquired firm’s brand and customer base during the integration process is also critical. A potential risk includes disruption of existing services during the transition period.

Thorough planning and effective communication strategies are vital to mitigate these risks and maintain customer confidence. In addition, potential resistance to change from both existing IBM employees and those from the acquired firm can be a major hurdle in a successful integration.

Impact on IBM’s Market Position

This acquisition is expected to strengthen IBM’s market position by offering a more robust suite of document management services. The acquisition will enhance IBM’s competitiveness by providing a more comprehensive solution to meet the evolving needs of its clients. This will likely increase IBM’s share of the document management market and attract new customers, bolstering its reputation as a leader in the field.

For example, successful integrations of similar acquisitions in the past demonstrate that a well-executed integration can substantially increase a company’s market share.

Potential Synergies

| IBM Service | Acquired Firm Offering | Potential Synergy |

|---|---|---|

| IBM Cloud Platform | Document Management Software | Integration of document management software with cloud services for enhanced scalability and accessibility. |

| IBM Consulting Services | Implementation Expertise | Leveraging the acquired firm’s implementation expertise for faster and more efficient deployments of document management solutions. |

| IBM Security | Data Security Features | Combining data security features with IBM’s existing security infrastructure for enhanced data protection in document management systems. |

Impact on the Document Management Market

IBM’s acquisition of a third document management firm signals a significant shift in the competitive landscape. This move is likely to consolidate IBM’s position as a major player in the sector, potentially reshaping the entire market dynamic. The acquisition is not just about adding another set of tools; it’s about integrating expertise and potentially offering a more comprehensive solution to clients.This consolidation will likely affect pricing strategies and force competitors to adapt to the changing market realities.

The implications are far-reaching, influencing not only IBM’s direct competitors but also the overall trajectory of document management technologies.

Reshaping the Competitive Landscape

IBM’s acquisition will significantly alter the competitive landscape. By adding another layer of expertise and product lines, IBM will likely gain a larger market share. This will put pressure on existing competitors to innovate and adapt to maintain their market presence. Smaller players may face challenges in competing with IBM’s enhanced resources and potentially lower prices.

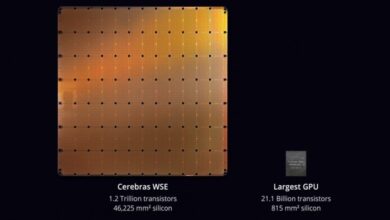

Emerging Trends and Technologies

The document management market is evolving rapidly. Cloud-based solutions, AI-powered document processing, and improved data security are key emerging trends. IBM will need to adapt its strategy to incorporate these advancements to stay ahead. Integration of AI for automated indexing and retrieval, along with enhanced cloud integration for accessibility and scalability, are likely to be crucial for success.

Examples of companies successfully incorporating AI in document processing include companies like DocuSign.

Impact on IBM’s Competitors

The acquisition is expected to put pressure on IBM’s competitors. They will likely respond by improving their own offerings, focusing on specific niches, or forming alliances to compete more effectively. Direct head-on competition with IBM’s consolidated product suite will be difficult for smaller firms, prompting a potential shift in the market’s competitive strategies. For instance, existing competitors may focus on specialized document types or sectors, aiming to carve out a distinct market niche.

Potential Competitive Responses

| Competitor | Potential Response | Strategy |

|---|---|---|

| Existing Major Players (e.g., OpenText, Hyland Software) | Enhance existing products, introduce new features, and potentially acquire smaller firms. | Focus on innovation, improved functionality, and potentially lower costs to counter IBM’s expanded product offerings. |

| Niche Players | Specialize in specific industries or document types. | Focus on specific niches and unique needs of specific sectors, avoiding head-to-head competition with IBM’s broader suite. |

| Startups | Focus on innovative technologies like AI or cloud-based solutions. | Capitalize on emerging technologies to disrupt the market and cater to specific needs. |

Pricing Strategies

The acquisition is likely to influence pricing strategies in the document management sector. IBM’s increased market share may lead to competitive pricing pressure, potentially driving down prices for document management services. This could force competitors to adjust their pricing models to remain competitive. For instance, a company might offer tiered pricing based on specific features or usage levels to cater to different customer segments.

Illustrative Case Studies

Acquisitions are a powerful tool in the tech industry, enabling companies to rapidly expand their capabilities and market reach. Analyzing successful acquisitions provides valuable insights into strategies for integration, customer impact, and ultimately, maximizing the value of the acquisition. Successful examples often highlight the importance of careful planning, strong leadership, and a focus on customer needs throughout the integration process.

Successful Acquisitions in the Technology Industry

Several acquisitions in the tech industry have demonstrated impressive results. A common theme in these successes is the alignment of the acquired company’s strengths with the acquirer’s existing portfolio. This allows for synergistic benefits that extend beyond simple market share gains. A successful acquisition isn’t just about adding resources; it’s about integrating those resources seamlessly to create a stronger, more valuable entity.

Examples of Enhanced Product Offerings

The acquisition of innovative technologies or talent often leads to enhanced product offerings. For example, Salesforce’s acquisition of ExactTarget significantly broadened their marketing automation capabilities. The integration of ExactTarget’s expertise into Salesforce’s platform resulted in a more comprehensive and robust marketing suite, expanding their customer base and increasing market share. Similarly, Microsoft’s acquisition of LinkedIn expanded their professional networking platform, allowing for richer user experiences and increased user engagement.

This broadened their target market and allowed for new revenue streams. This shows that targeted acquisitions of complementary technologies can significantly enhance the product offerings of the acquiring company.

Impact on Market Share and Customer Satisfaction

Successful acquisitions frequently translate to market share gains. For instance, the acquisition of a smaller competitor often results in the acquirer gaining a foothold in niche markets, or a wider customer base, or even a better understanding of customer needs. The integration of customer bases and resources allows for a more efficient and effective customer service experience. This leads to increased customer satisfaction and retention.

Moreover, the acquisition can open up access to new markets and customer segments, broadening the acquirer’s reach.

Integration Process Management in Successful Cases

Effective integration management is crucial to the success of any acquisition. In cases where acquisitions have been successful, clear communication strategies and a defined timeline were often implemented. Leadership plays a key role in maintaining morale and fostering a positive environment. A phased approach to integration, starting with understanding the acquired firm’s operations and culture, followed by aligning processes and systems, and finally, integrating the acquired team into the larger organization, is frequently adopted.

This methodical approach minimizes disruption and ensures a smoother transition. Strong communication channels are established to keep employees informed throughout the process, and addressing concerns early on is essential.

Summary Table of Case Studies

| Case Study | Acquisition Strategy | Integration Outcome | Key Takeaways |

|---|---|---|---|

| Salesforce’s acquisition of ExactTarget | Acquired a leading marketing automation platform to enhance their existing product suite. | Expanded Salesforce’s marketing automation capabilities, leading to increased customer satisfaction and a broader market reach. | Strategic acquisitions of complementary technologies can significantly enhance the product offerings. |

| Microsoft’s acquisition of LinkedIn | Acquired a leading professional networking platform to broaden their user base and engagement. | Expanded Microsoft’s reach into the professional networking space, adding a valuable new customer segment and enriching user experience. | Acquisitions can open up access to new markets and customer segments, expanding the acquirer’s reach. |

Illustrative Visualizations

This section dives into the visual representations that help us understand the impact of IBM’s acquisition on the document management market. These visualizations offer a clear picture of the potential market share gains, integration, and customer reach expansion.The visual tools, from market share charts to workflow diagrams, allow us to analyze the acquisition’s impact and potential benefits in a more intuitive and impactful way.

We can then use these visualizations to communicate the benefits effectively to stakeholders and the public.

Potential Market Share Gains

The graphic representation of the document management market share before and after the acquisition will be a crucial visualization. The chart will show a bar graph illustrating the market share percentage of each competitor before the acquisition. A second bar graph will represent the projected market share after the acquisition, highlighting the significant increase in IBM’s share. This increase will be visually emphasized by a clear color distinction between the two periods.

The chart will use a clear and concise legend to avoid confusion. Example data might show IBM’s share increasing from 25% to 35% after the acquisition, while other competitors experience a corresponding decrease.

Document Management Market Landscape

The visualization of the document management market landscape will depict a clear picture of the competitors before and after the acquisition. Before the acquisition, a map or chart will display a cluster of firms (represented by icons) with varied sizes, representing their market share and influence. IBM will be one of these firms, and the acquired firm will also be present.

After the acquisition, the visualization will highlight the integration of the acquired firm’s market share into IBM’s existing share, effectively showing the expanded presence and dominance in the market. This would be indicated by a larger icon for IBM and a gradual shift in the distribution of other players’ market share.

Workflow Integration Diagram

A flowchart will demonstrate the anticipated workflow integration between IBM’s and the acquired firm’s systems. The diagram will depict the current workflow of each system using different colored shapes (squares, circles, etc.) for each step. After the acquisition, the integrated workflow will be shown, highlighting the streamlined processes and improved efficiency. The flowchart will include clear labels for each step, making it easy to understand the transition.

Arrows will visually represent the flow of data and documents. This integrated system will improve data accessibility and reduce redundancy.

Customer Base Expansion Visualization

The visualization for customer base expansion will display a geographical map or chart, showing the existing customer base of both IBM and the acquired firm. Before the acquisition, separate regions will be highlighted, demonstrating their respective customer bases. After the acquisition, the map will show a merging of these customer bases, indicating the expansion of IBM’s reach. This is done by color-coding the customer base, with different colors representing different companies or customer groups.

Acquired Firm’s Technology Infographic

This infographic will summarize the key features and benefits of the acquired firm’s technology. The infographic will be a mix of icons and concise text. Each feature will be visually represented with an icon (e.g., cloud icon for cloud storage, lock icon for security). The benefits of each feature will be presented in concise bullet points below the icon.

For example, one feature might be “Secure Data Storage” with a benefit like “AES-256 encryption,” and another might be “Seamless Integration” with a benefit like “Reduced data transfer time.” This visualization will highlight the unique strengths of the acquired firm’s technology, emphasizing the value proposition for IBM’s existing and new customers.

Summary: Ibm Acquires Third Document Management Firm

In conclusion, IBM’s acquisition of a third document management firm presents a fascinating case study in corporate strategy. The potential for enhanced product offerings, expanded market share, and the challenges of integration all contribute to the dynamic nature of this acquisition. While the details are still emerging, the implications for the document management industry are undeniable. This move could signal a shift in the competitive landscape, and the long-term impact remains to be seen.

Stay tuned for more analysis and insights into the specifics.