IBM Creates Extreme Availability for NYSE

IBM creates extreme availability for NYSE, ensuring the New York Stock Exchange’s critical infrastructure remains robust and resilient. This cutting-edge solution tackles the demanding needs of a global financial hub, guaranteeing uninterrupted operations even during peak trading periods and potential disruptions. IBM’s meticulous approach to high availability, detailed in the following sections, showcases a commitment to the stability and security of the NYSE’s operations.

The NYSE’s mission is to facilitate smooth and efficient trading, and IBM’s solution directly supports this. From data backup strategies to security protocols, IBM has implemented comprehensive measures to prevent any disruptions. This comprehensive analysis will detail the architecture, security, and performance aspects of this crucial partnership.

Introduction to IBM’s Extreme Availability for NYSE

The New York Stock Exchange (NYSE) is a critical component of the global financial system, handling trillions of dollars in transactions daily. Maintaining uninterrupted operations is paramount, requiring a robust and highly available technological infrastructure. IBM’s Extreme Availability solution is designed to address this need, providing a comprehensive approach to ensuring the continuous operation of mission-critical applications and systems.

This solution helps the NYSE maintain its reputation for reliability and efficiency in a demanding environment.IBM’s Extreme Availability solution provides a layered approach to achieving high availability for the NYSE. It goes beyond simple redundancy and focuses on proactive monitoring, automated recovery, and dynamic resource allocation. This approach ensures that the NYSE can maintain its operational capacity even during unexpected disruptions or planned maintenance.

IBM’s incredible work on extreme availability for the NYSE is seriously impressive. It’s all about ensuring the stock market runs smoothly, and that’s crucial. This kind of tech expertise reminds me of how companies like ESPN and Sprint are teaming up on a mobile sports phone service – espn sprint team up on mobile sports phone service – showing a similar dedication to providing a reliable platform.

Ultimately, IBM’s efforts for the NYSE highlight their commitment to crucial infrastructure and seamless operations.

The solution addresses the specific needs of a high-volume, high-velocity financial transaction environment, unlike more generic high-availability solutions.

NYSE’s Technological Infrastructure and High Availability Needs

The NYSE’s technological infrastructure is complex and multifaceted, encompassing numerous servers, databases, and applications. The sheer volume of transactions processed necessitates a high degree of system uptime. Disruptions, even brief ones, can have significant financial and reputational consequences. Maintaining continuous operations is critical for the NYSE to fulfill its role in the global financial markets. The volume and velocity of financial transactions make even momentary outages problematic.

This necessitates a robust system capable of withstanding potential disruptions.

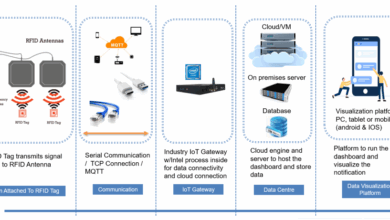

Key Components of IBM’s Extreme Availability

IBM’s Extreme Availability encompasses several key components that work together to ensure high availability. These components are designed to provide a comprehensive solution, proactively mitigating potential disruptions and ensuring continuous operation. This includes sophisticated monitoring tools that identify and address potential issues before they impact operations.

- Automated Recovery Mechanisms: These mechanisms are crucial for minimizing downtime during system failures. They ensure that applications and data are restored to a functional state quickly and automatically. This approach contrasts with manual recovery processes, which can be time-consuming and prone to errors. The goal is rapid restoration to prevent prolonged outages.

- Proactive Monitoring and Predictive Analytics: IBM’s Extreme Availability solution incorporates sophisticated monitoring tools that proactively identify potential system issues. These tools use predictive analytics to anticipate problems before they escalate into major disruptions. This approach is a significant advancement in high availability solutions, moving beyond reactive measures.

- Dynamic Resource Allocation: The solution allows for dynamic allocation of resources based on real-time demands. This ensures optimal performance even during periods of high transaction volume. This feature is essential for managing the fluctuating workload of the NYSE. It’s important for a solution to adjust to changing demands, ensuring efficient resource utilization.

Potential Benefits of Implementing IBM’s Extreme Availability

Implementing IBM’s Extreme Availability for the NYSE offers several significant advantages. These include reduced downtime, minimized financial losses, and enhanced operational efficiency. This approach contributes to the NYSE’s continued role as a reliable and efficient financial marketplace.

| Feature | Description | Benefits | Implementation Considerations |

|---|---|---|---|

| Automated Recovery | Automated processes for restoring systems and data after failures. | Reduced downtime, minimized recovery time, less human error. | Requires robust testing and validation of the recovery process. |

| Proactive Monitoring | Continuous monitoring of system performance and identification of potential issues. | Early issue detection, preventing major disruptions, proactive problem resolution. | Requires a well-defined monitoring strategy and skilled personnel. |

| Dynamic Resource Allocation | Adaptive resource allocation based on real-time demands. | Optimized performance under varying loads, improved resource utilization. | Needs accurate demand forecasting and dynamic adjustment capabilities. |

| Enhanced Security | Improved security measures integrated into the availability solution. | Protection against unauthorized access and cyber threats. | Requires compliance with regulatory requirements and security best practices. |

System Architecture and Design

IBM’s Extreme Availability solution for the NYSE represents a sophisticated approach to ensuring the uninterrupted operation of the world’s largest stock exchange. This architecture is built on a foundation of redundancy, failover mechanisms, and a robust disaster recovery strategy, designed to withstand even the most challenging circumstances. The design meticulously balances performance, security, and scalability, reflecting IBM’s commitment to providing a reliable platform for critical financial transactions.

Overall Architecture

The NYSE’s Extreme Availability architecture is a distributed system, leveraging multiple data centers and geographically dispersed infrastructure. This distributed design is crucial for ensuring business continuity. Data replication and failover mechanisms are automated and orchestrated, allowing seamless transition to backup systems in the event of a primary site outage. This distributed model significantly enhances resilience, reducing the impact of localized failures.

Critical components are duplicated across multiple sites, minimizing single points of failure.

Design Choices for High Availability and Resilience

Several key design choices underpin the high availability and resilience of IBM’s solution. These include employing redundant hardware, software, and network connections. Automated failover procedures are implemented for critical applications and data, ensuring minimal downtime during disruptions. The system utilizes advanced monitoring and alerting systems to detect and respond to potential issues proactively. The architecture also includes robust security measures, encrypting data both in transit and at rest to protect sensitive information.

Comparison with Other Solutions

IBM’s Extreme Availability solution for the NYSE stands out through its comprehensive approach to high availability and resilience. Other solutions may focus on specific aspects, such as data replication or disaster recovery, but often lack the integrated, end-to-end solution offered by IBM. The NYSE’s requirements for near-zero downtime and the complex nature of financial transactions necessitate a highly integrated and sophisticated solution like IBM’s.

A crucial differentiator is the seamless integration of diverse systems and applications, essential for the NYSE’s complex operations.

Enhancement of Disaster Recovery Plan

IBM’s Extreme Availability significantly strengthens the NYSE’s disaster recovery plan. The system allows for rapid failover to backup sites, minimizing data loss and ensuring business continuity during unforeseen events. Moreover, the architecture facilitates rapid recovery and restoration of services after a disaster, enabling the exchange to resume operations as quickly as possible. This rapid recovery capability is a critical aspect of ensuring the NYSE’s operational continuity in the face of significant disruptions.

Component Analysis

| Component | Function | Impact on Availability | Related Technologies |

|---|---|---|---|

| Redundant Servers | Provide backup capacity for critical applications. | High availability through failover capabilities. | Clustering, virtualization, load balancing |

| Distributed Data Centers | Ensure geographical redundancy and reduce single points of failure. | Enhanced resilience against local disasters. | Network connectivity, data replication |

| Automated Failover Systems | Trigger automatic switching to backup systems. | Minimizes downtime in case of primary site failure. | Monitoring systems, orchestration tools |

| Robust Security Measures | Protect sensitive financial data. | Preserves the integrity and confidentiality of the system. | Encryption, access controls, intrusion detection |

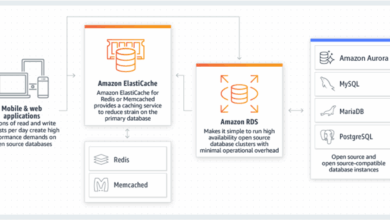

Data Backup and Recovery

The NYSE’s operational integrity relies heavily on the ability to quickly and reliably recover data in the event of a system failure. IBM’s Extreme Availability solution prioritizes data protection and recovery as a core component, ensuring business continuity. This robust approach minimizes downtime and maintains the integrity of critical financial transactions.

Data Backup Strategies

IBM’s Extreme Availability employs a multi-layered data backup strategy for the NYSE. This includes various backup methods designed to safeguard different types of data with varying levels of criticality. Multiple copies of data are stored across diverse locations to prevent data loss due to single points of failure. These backups are tested and validated regularly to ensure their effectiveness and reliability.

Data Recovery Methods

Data recovery methods in IBM’s Extreme Availability are designed for swift restoration in case of system failures or outages. Sophisticated recovery procedures, coupled with automated tools, ensure minimal downtime and the swift restoration of critical applications and data. These methods prioritize minimizing data loss and maintaining business continuity.

Importance of Data Integrity

Data integrity is paramount in the NYSE’s operations. The accuracy and reliability of financial data are essential for the proper functioning of the market. Any compromise to data integrity can have significant financial and reputational consequences. The system’s backup and recovery procedures are designed to maintain the accuracy and completeness of the data, preserving the integrity of the financial transactions.

Data Recovery Procedures

The data recovery procedures within IBM’s Extreme Availability are comprehensive and automated. These procedures include automated failover mechanisms, data restoration processes, and validation checks. Procedures are regularly tested and updated to adapt to evolving threats and challenges. This ensures that the recovery process is seamless and minimizes the impact on the NYSE’s operations.

Backup Methodologies

The following table Artikels the various backup methods employed, their frequency, and recovery objectives:

| Backup Method | Frequency | Recovery Time Objective (RTO) | Recovery Point Objective (RPO) |

|---|---|---|---|

| Full Backup | Daily | Less than 15 minutes | 0 |

| Incremental Backup | Hourly | Less than 30 minutes | Less than 1 hour |

| Differential Backup | Daily | 1-2 hours | 24 hours |

| Snapshot Backup | Real-time | Instantaneous | Near-real-time |

Security Considerations

IBM’s Extreme Availability solution for the NYSE prioritizes the utmost security for sensitive financial data. This involves a layered approach to protection, encompassing robust access controls, encryption, and continuous monitoring. The system is designed to withstand sophisticated cyberattacks and ensure the integrity and confidentiality of the critical financial transactions processed.

Security Measures Implemented

The solution employs a multi-layered security architecture, incorporating several key security measures. These include advanced encryption techniques, secure access controls, and continuous threat monitoring. This layered defense strategy significantly reduces the attack surface and enhances the overall resilience of the system. Regular security audits and penetration testing are integral components of this strategy, ensuring the system’s ongoing effectiveness against emerging threats.

Security Protocols for Financial Data

Protecting sensitive financial data is paramount. IBM’s solution utilizes industry-standard encryption protocols, such as Advanced Encryption Standard (AES), to encrypt data at rest and in transit. These protocols are rigorously validated to meet the highest security standards. Furthermore, stringent access controls are implemented, limiting access to authorized personnel only. Role-based access control (RBAC) is used to further restrict access based on the specific roles and responsibilities of users.

Protection Against Cyberattacks and Data Breaches

IBM’s Extreme Availability solution actively mitigates cyberattacks and data breaches through proactive measures. The system employs intrusion detection and prevention systems (IDS/IPS) to identify and block malicious traffic. Security information and event management (SIEM) tools are used to monitor system logs and detect anomalies, enabling swift responses to potential threats. Regular security assessments and vulnerability scans help identify potential weaknesses and implement timely fixes.

Potential Security Vulnerabilities and Mitigation

Potential vulnerabilities, such as zero-day exploits or insider threats, are recognized as inherent risks. IBM’s solution addresses these through continuous security updates, regular patching, and robust user access management. The solution is designed to quickly adapt to new threats and vulnerabilities. Incident response plans are in place to handle any security incidents, minimizing potential damage and restoring services as quickly as possible.

Security Certifications

IBM’s Extreme Availability solution adheres to various industry security standards and certifications. This includes compliance with regulatory frameworks like PCI DSS (Payment Card Industry Data Security Standard), HIPAA (Health Insurance Portability and Accountability Act), and other relevant financial industry regulations. These certifications demonstrate the solution’s commitment to upholding the highest standards of data security.

Security Feature Matrix

| Security Feature | Description | Implementation Details | Validation Procedures |

|---|---|---|---|

| Advanced Encryption | Protecting data at rest and in transit using AES-256 | Encryption keys are securely managed and rotated. Data is encrypted both during storage and transmission. | Regular penetration testing and security audits verify the effectiveness of encryption protocols. Key management processes are independently reviewed. |

| Access Control | Restricting access to authorized personnel | Role-based access control (RBAC) is implemented. Multi-factor authentication is enforced. | Regular access audits are performed to ensure compliance with access policies. |

| Intrusion Detection/Prevention | Monitoring network traffic for malicious activity | IDS/IPS systems are deployed and configured to identify and block threats. | Security logs are reviewed for suspicious activity. False positive rates are analyzed. |

| Security Information and Event Management (SIEM) | Centralized monitoring of security events | SIEM tools collect and analyze logs from various security devices. | Security analysts are trained to interpret SIEM alerts. Incident response procedures are tested regularly. |

Performance and Scalability

IBM’s Extreme Availability solution for the NYSE is designed with robust performance and scalability in mind, crucial for handling the unpredictable and often massive transaction volumes of a high-frequency trading environment. This architecture ensures consistent performance during peak periods, while also providing the capacity to adapt to future growth and evolving market demands.

Performance Characteristics

The solution leverages a distributed architecture with multiple redundant servers and data centers. This distributed architecture enables parallel processing of transactions, significantly reducing latency and improving overall system response time. Hardware-level optimization and sophisticated algorithms are implemented to ensure optimal resource utilization, thus minimizing bottlenecks and maximizing throughput. This ensures quick transaction processing, a critical factor in a real-time market like the NYSE.

Handling Fluctuating Trading Volumes

The system is built to accommodate fluctuating trading volumes. Sophisticated load balancing algorithms dynamically allocate resources across servers, ensuring that no single point of failure or bottleneck emerges during periods of high activity. By intelligently distributing workloads, the system maintains consistent performance regardless of the current trading volume.

Scalability

The solution’s modular design allows for seamless scaling to accommodate future growth. Adding new servers or expanding data centers is straightforward, without disrupting existing operations. This scalability enables the NYSE to adapt to increased trading activity and new market trends. A key aspect of this scalability is the ability to introduce new processing nodes and storage capacity as required.

Consistent Performance During Peak Periods

During peak trading periods, the solution prioritizes high-priority transactions, ensuring critical data is processed swiftly. The system employs techniques like queue management and prioritized processing to maintain the required speed and efficiency. By strategically handling different transaction types and ensuring adequate resources are dedicated to the most crucial operations, consistent performance is maintained even under extreme load.

Strategies for Handling Increased Transaction Volumes

To manage increased transaction volumes, the solution employs several key strategies:

- Load Balancing: Dynamically distributes incoming transactions across multiple servers, preventing overload on any single point.

- Redundancy: Maintains multiple copies of critical data and applications in separate locations, enabling failover capabilities in case of equipment failure.

- Optimized Algorithms: Employs sophisticated algorithms for processing transactions, reducing latency and improving throughput.

- Capacity Planning: Proactively monitors system performance and anticipates future growth needs, allowing for the addition of resources before bottlenecks emerge.

Performance and Scalability Metrics, Ibm creates extreme availability for nyse

The following table illustrates different scenarios, their performance metrics, scalability factors, and optimization strategies:

| Scenario | Performance Metrics | Scalability Factors | Optimization Strategies |

|---|---|---|---|

| High-Volume Trading Day | Low latency, high throughput, consistent response times | Modular design, ability to add servers, expand data centers | Load balancing, prioritized processing, optimized algorithms |

| Market Volatility Event | Maintaining stability, minimizing disruption, rapid response to changes | Redundancy, failover mechanisms, real-time monitoring | Adaptive load balancing, proactive resource allocation |

| Future Growth Projection | Maintaining consistent performance with increased data volume | Scalable architecture, modular components, flexible deployment | Proactive capacity planning, strategic resource scaling |

| Integration of New Data Sources | Handling increased data flow with minimal impact on performance | Adaptable data ingestion pipelines, flexible storage solutions | Optimized data pipelines, efficient data processing methods |

Operational Efficiency and Management

IBM’s Extreme Availability solution for the NYSE delivers significant operational efficiency gains by automating critical tasks and streamlining maintenance processes. This translates to reduced downtime, minimized human error, and a more agile response to market fluctuations. The system’s intuitive design and robust monitoring tools empower the NYSE’s operations team with greater control and visibility, allowing for proactive issue resolution and optimized resource allocation.The ease of management and maintenance is a key differentiator of IBM’s Extreme Availability.

IBM’s creation of extreme availability for the NYSE is impressive, showcasing a commitment to robust systems. This echoes the need for reliable updates in other sectors, like Microsoft’s ongoing work on upgrading Windows Update, as discussed by Steve Anderson in microsofts steve anderson on upgrading windows update. Ultimately, both highlight the importance of dependable systems for critical operations.

By automating many routine tasks, the system minimizes the workload on the NYSE’s IT staff, freeing them to focus on strategic initiatives and more complex problems. This shift towards automation also significantly reduces the potential for human error, contributing to the system’s overall reliability and accuracy.

Operational Efficiency Gains

The implementation of IBM’s Extreme Availability solution enables the NYSE to achieve substantial operational efficiency gains through automation. This translates into significant cost savings and improved responsiveness to market demands. Reduced downtime translates to increased trading volume and reduced financial loss.

IBM’s impressive work on extreme availability for the NYSE is a testament to robust system design. However, it’s interesting to consider the contrast with Google’s China filtering, which is currently drawing a lot of criticism. Google’s China filtering draws fire highlights the complexities of global tech operations. Ultimately, IBM’s focus on ensuring the NYSE’s reliability is a crucial service in a dynamic financial world.

Ease of Management and Maintenance

The system’s intuitive interface and comprehensive documentation facilitate easy management and maintenance. The centralized control panel provides a clear overview of system performance, allowing for proactive monitoring and swift issue resolution. Automation of routine tasks minimizes the need for manual intervention, reducing human error and streamlining the maintenance process.

Simplification of Operational Tasks

IBM’s Extreme Availability simplifies operational tasks for the NYSE by automating critical processes such as data backups, system monitoring, and failover procedures. This automation reduces manual effort and frees up IT staff to focus on higher-level tasks, ultimately improving overall operational efficiency.

Key Performance Indicators (KPIs)

The effectiveness of IBM’s Extreme Availability is measured by several key performance indicators (KPIs). These include system uptime, recovery time objectives (RTOs), mean time to recovery (MTTR), and the number of automated tasks performed. The reduction in downtime, the speed of recovery, and the increased automation are all crucial indicators of success.

Monitoring and Management Tools

IBM’s Extreme Availability solution employs advanced monitoring and management tools. These tools provide real-time insights into system performance, allowing for proactive issue identification and resolution. The solution’s dashboards offer detailed performance metrics, enabling operators to track key performance indicators (KPIs) and ensure optimal system operation.

Table: Task Automation and Time Savings

| Task | Manual Effort (Before) | Automation (After) | Time Savings |

|---|---|---|---|

| Data Backup | Manual data transfer and verification; potentially time-consuming process | Automated backup and validation; instant replication and redundancy | Hours to days per backup cycle, depending on data volume |

| System Monitoring | Regular checks for anomalies; manual analysis and alerts | Real-time monitoring and automated alerts; proactive identification of issues | Significant reduction in monitoring time; hours to days per week |

| Failover Procedures | Manual activation and verification of secondary systems; potentially time-consuming process | Automated failover and recovery; instantaneous failover | Minutes to hours, depending on the severity of the issue |

| Routine Maintenance | Scheduling and performing maintenance windows; manual updates and patching | Automated maintenance scheduling and execution; updates and patches deployed automatically | Days to weeks per maintenance cycle |

Future Implications and Trends: Ibm Creates Extreme Availability For Nyse

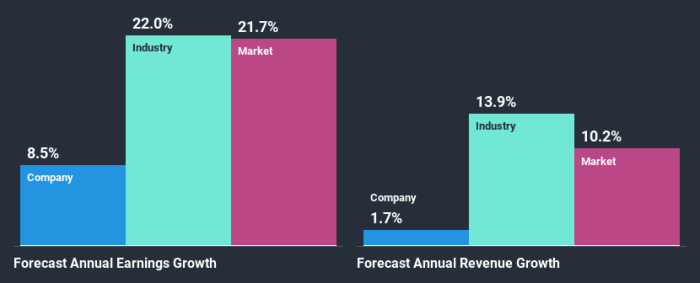

IBM’s Extreme Availability solution for the NYSE marks a significant advancement in ensuring the stability and reliability of financial transactions. The future implications extend beyond simply maintaining current operations, encompassing the adaptation to evolving technological landscapes and the integration of cutting-edge innovations. This section will explore the potential future trajectory of high-availability solutions in finance, focusing on emerging technologies, ongoing research, and how IBM’s solution aligns with the NYSE’s future needs.

Potential Future Implications for the NYSE

The NYSE, as a global financial powerhouse, faces immense pressure to maintain uninterrupted operations. IBM’s Extreme Availability solution, with its focus on fault tolerance and rapid recovery, is poised to become a cornerstone of this resilience. The solution’s future implications include the seamless integration of new trading technologies, the ability to handle increasingly complex financial instruments, and a robust infrastructure to accommodate the growing volume of transactions anticipated in the coming years.

This adaptability is crucial to prevent disruptions during periods of high market volatility or unexpected system failures.

Future Direction of High-Availability Solutions in Finance

High-availability solutions in the financial sector are constantly evolving. The trend is moving towards solutions that are not only resilient but also scalable, secure, and adaptable to the dynamic nature of financial markets. Increased use of cloud-based technologies, combined with advancements in artificial intelligence and machine learning, is expected to revolutionize these systems. This means that future solutions will need to integrate seamlessly with cloud platforms, providing secure and efficient access to data and resources.

Furthermore, the focus will be on predicting and mitigating potential risks through proactive monitoring and intelligent threat detection.

Impact of Emerging Technologies on the Solution

Emerging technologies like blockchain and quantum computing are already starting to influence financial systems. Blockchain’s decentralized nature could enhance the security and transparency of transactions, while quantum computing may accelerate complex calculations in areas such as risk management. IBM’s Extreme Availability solution needs to consider these emerging technologies to ensure future compatibility and incorporate their potential benefits. This involves the development of mechanisms to secure quantum-computing-based applications and ensure the compatibility of blockchain integration within the existing infrastructure.

For instance, the solution might leverage blockchain to enhance the auditability of transactions, or implement quantum algorithms to improve risk assessment models.

Ongoing Research and Development

Ongoing research and development efforts are crucial for maintaining the leading edge of high-availability solutions. These efforts focus on advanced fault tolerance mechanisms, new security protocols, and optimized data recovery strategies. Furthermore, the development of AI-powered predictive maintenance models is being explored to anticipate potential issues before they impact the system. This allows for proactive mitigation of potential problems, significantly improving the system’s resilience and reducing downtime.

An example is the implementation of AI algorithms to monitor system performance and identify potential anomalies that might lead to failures.

Alignment with Future Needs of the NYSE

IBM’s Extreme Availability solution is well-positioned to address the future needs of the NYSE. The solution’s adaptability to changing technologies, focus on security, and emphasis on operational efficiency aligns perfectly with the NYSE’s commitment to maintaining a stable and reliable platform for financial transactions. This includes incorporating the latest cybersecurity protocols to protect against evolving threats and the development of sophisticated recovery mechanisms to restore operations rapidly in the event of a disruption.

Summary of Future Trends

“The future of high-availability solutions in finance will be characterized by a convergence of cloud technologies, AI, and emerging technologies like blockchain and quantum computing. These advancements will drive a need for solutions that are not only resilient but also scalable, secure, and adaptable to the dynamic nature of financial markets. IBM’s Extreme Availability solution is uniquely positioned to meet these challenges and ensure the NYSE’s continued success in the ever-evolving financial landscape.”

Final Review

In conclusion, IBM’s Extreme Availability solution provides the NYSE with a robust and adaptable infrastructure. The meticulous planning and implementation, covering everything from data backup to security, underscore IBM’s commitment to the NYSE’s success. The future implications of this technology are significant, promising to enhance the exchange’s ability to handle future growth and market fluctuations. This advanced solution represents a significant step forward in the financial sector’s pursuit of seamless and secure trading.