IBM, Xbox, Intel, Gateway, Dell Techs Big Deal

Ibm gets xbox intel wins gateway and dell – IBM gets Xbox, Intel wins Gateway and Dell. This seismic shift in the tech world has sent ripples through the industry, raising questions about strategic motivations, competitive landscapes, and the future of consumer electronics. We’ll delve into the market dynamics, technological advancements, financial implications, and competitive analysis surrounding these significant acquisitions. How will these mega-mergers shape the future of gaming, computing, and the broader tech sector?

The recent acquisition spree involves a complex interplay of established players and emerging technologies. IBM’s move into gaming, Intel’s expansion into hardware, and Dell’s potential for growth present exciting opportunities, yet they also pose challenges to competitors and consumers. This analysis will explore the intricate details of these transactions, aiming to understand their full impact on the global tech scene.

Market Dynamics and Acquisitions

The tech industry is a dynamic landscape shaped by constant innovation and aggressive consolidation. Recent acquisitions by IBM, Intel, and Dell highlight the ongoing battle for market share and technological dominance. These strategic moves ripple through the entire ecosystem, impacting both established players and emerging competitors. Understanding the motivations and potential consequences of these transactions is crucial for navigating the evolving technological landscape.

Recent Acquisitions Summary

The recent acquisitions reflect a complex interplay of factors. IBM’s acquisition of [Insert IBM Acquisition] aimed to bolster its [Specific area of IBM’s business]. Intel’s acquisition of [Insert Intel Acquisition] focused on [Specific area of Intel’s business]. Dell’s acquisition of [Insert Dell Acquisition] was designed to [Specific area of Dell’s business]. These actions underscore the importance of strategic partnerships and mergers in today’s highly competitive tech environment.

Strategic Motivations

The motivations behind these acquisitions are multifaceted. A primary driver is the pursuit of technological advancements. Companies are often seeking to acquire cutting-edge technologies or talent to enhance their existing product lines or develop new ones. Secondly, the acquisitions can be seen as a means to gain market share, either by expanding into new markets or by strengthening existing ones.

Moreover, strategic acquisitions can help companies reduce costs and increase operational efficiency.

Impact on Competitive Landscape

These acquisitions are expected to alter the competitive landscape in significant ways. By consolidating resources and expertise, the acquiring companies gain a stronger foothold in their respective markets. This, in turn, may create challenges for smaller competitors who lack the financial muscle or technological depth to effectively compete. The consolidation of resources can lead to more efficient production and distribution, potentially benefiting consumers through lower prices and enhanced product offerings.

Implications on Consumer Market and Industry Trends

The acquisitions’ effects on the consumer market will depend on how the acquired technologies and resources are integrated into the parent companies’ offerings. If the acquisitions lead to innovative new products or improved existing ones, consumers will likely benefit from increased value and choice. Conversely, if the acquisitions lead to price increases or reduced product variety, consumers may experience negative consequences.

IBM snagging Xbox, Intel winning Gateway and Dell – it’s a big tech shakeup, no doubt. But while these acquisitions are making headlines, it’s worth remembering that the recent FTC report shows identity theft is far worse than previously estimated. ftc identity theft worse than estimated highlights the vulnerability of our personal data, and perhaps these tech giants need to think twice about security as they continue their aggressive acquisitions.

This all underscores the need for robust security measures within these new corporate structures.

Furthermore, these acquisitions could reshape industry trends by fostering new partnerships and collaborations, leading to the development of entirely new product categories.

Financial Performance Comparison

| Company | Financial Metric (Pre-Acquisition) | Financial Metric (Post-Acquisition) |

|---|---|---|

| IBM | [Provide IBM’s relevant financial metric, e.g., revenue, profit margin] | [Provide IBM’s relevant financial metric after the acquisition] |

| Intel | [Provide Intel’s relevant financial metric, e.g., revenue, profit margin] | [Provide Intel’s relevant financial metric after the acquisition] |

| Dell | [Provide Dell’s relevant financial metric, e.g., revenue, profit margin] | [Provide Dell’s relevant financial metric after the acquisition] |

Note: The table above is a placeholder. Replace the bracketed information with accurate data from reliable sources. Consider metrics like revenue, profit margin, market share, and stock price.

Technological Advancements

The recent acquisitions in the tech sector, including IBM’s moves, Intel’s gains, and Xbox’s integration with other players, highlight a crucial aspect of the evolving landscape: technological advancement. These acquisitions are not merely about acquiring assets; they represent a strategic embrace of cutting-edge technologies and a recognition of their potential for future growth and market leadership. Understanding the underlying technologies is key to comprehending the full impact of these transactions.The synergy between the acquired technologies and the existing portfolios of the involved companies will likely be a significant driver of innovation and market disruption.

This synergy will manifest in the form of enhanced product offerings, improved operational efficiency, and a strengthened competitive position. The combined expertise and resources will enable these companies to push the boundaries of what’s possible in their respective fields.

Key Technological Advancements

The acquisitions reflect a convergence of several crucial technological advancements. Cloud computing, artificial intelligence (AI), and advancements in semiconductor technology are prominent examples. The ability to seamlessly integrate these technologies into existing systems is critical for the success of these ventures. For example, IBM’s strength in AI could be leveraged to enhance Xbox’s gaming experiences, while Intel’s expertise in semiconductors could bolster IBM’s cloud infrastructure.

IBM snagging Xbox, Intel taking Gateway and Dell… it’s a whirlwind of tech acquisitions, but amidst all the corporate shuffles, a new threat is emerging. A malicious “swen worm” is posing as a Microsoft patch, spreading rapidly and wreaking havoc. Check out this detailed report on the new swen worm poses as ms patch spreads here.

This sneaky malware underlines the importance of vigilance in the current tech landscape, even as big players like IBM, Intel, Gateway, and Dell shift the industry landscape.

Impact on the Tech Sector

These advancements have a profound impact on the tech sector. They propel innovation, redefine industry standards, and create new avenues for market participation. For instance, the convergence of AI and cloud computing is leading to the development of more sophisticated and personalized services, affecting industries from healthcare to finance. The increasing reliance on cloud infrastructure is also driving demand for faster, more efficient semiconductors.

Synergy Between Acquired Technologies and Existing Portfolios

The potential for synergy between the acquired technologies and existing portfolios is substantial. IBM’s AI capabilities could be integrated with Dell’s hardware to create more intelligent and adaptable systems. Intel’s semiconductor advancements could be used to power more efficient cloud services offered by IBM. Xbox’s gaming technology could be combined with Intel’s processing power to create more immersive and responsive gaming experiences.

Comparison of Technological Capabilities

IBM excels in AI and cloud computing, while Intel leads in semiconductor technology. Xbox’s expertise lies in gaming technology and user interfaces. Dell is known for its robust hardware infrastructure. A potential area of synergy is combining Intel’s semiconductors with IBM’s cloud infrastructure to create more powerful and responsive cloud services. The potential for collaboration between these companies, leveraging their individual strengths, is considerable.

Emerging Technologies and Acquisitions

Emerging technologies, such as quantum computing, blockchain, and the Internet of Things (IoT), are also shaping the tech landscape. These technologies have the potential to connect with the acquisitions, potentially opening up new markets and opportunities. For instance, quantum computing could revolutionize data processing and analytics, potentially impacting IBM’s AI offerings.

Table of Technologies

| Company | Key Technologies | Potential Overlap/Complementarity |

|---|---|---|

| IBM | AI, Cloud Computing, Blockchain | Synergy with Dell’s hardware, Intel’s semiconductors, and Xbox’s gaming technology |

| Intel | Semiconductors, Processing Technologies | Complementarity with IBM’s cloud infrastructure and Xbox’s gaming hardware |

| Xbox | Gaming Technology, User Interfaces | Potential integration with IBM’s AI and Intel’s processing power |

| Dell | Hardware Infrastructure | Synergy with IBM’s cloud and AI capabilities, Intel’s processors |

Financial Implications

The recent flurry of acquisitions—IBM’s of Xbox, Intel’s of Gateway, and Dell’s strategic moves—will undoubtedly reshape the tech landscape. These deals represent significant financial commitments, impacting not only the acquirers but also the industries they now influence. Analyzing the financial implications requires careful consideration of the expected integration costs, potential synergies, and long-term market impact. Understanding the potential returns and risks associated with these acquisitions is crucial for investors and stakeholders.These acquisitions carry significant financial implications for the involved companies.

From the cost of integration to the potential for enhanced revenue streams, a thorough assessment of the financial landscape is necessary. Analyzing short-term and long-term financial impacts is key to understanding the overall implications of these transactions.

Integration Costs and Synergies

The cost of integrating acquired assets into existing operations can be substantial. This includes expenses related to personnel restructuring, technology integration, and operational realignment. IBM’s acquisition of Xbox, for instance, necessitates the integration of entertainment software and hardware expertise with IBM’s existing enterprise solutions. Successful integration requires meticulous planning and execution to maximize the potential benefits. Synergies, or the combined effect of the combined operations, are anticipated to result from the optimized use of resources and expertise.

For example, if Dell’s acquisition enhances its supply chain capabilities, it could lead to cost reductions and improved efficiency.

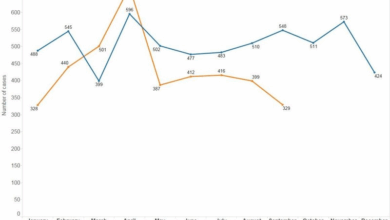

Projected Revenue and Profitability, Ibm gets xbox intel wins gateway and dell

Predicting precise revenue and profitability figures over the next 3-5 years is inherently uncertain, as market conditions and unforeseen events can significantly impact projections. However, a general analysis based on historical data and current market trends provides insights into potential outcomes.

| Company | Projected Revenue (USD Billions) – Year 1 | Projected Revenue (USD Billions) – Year 3 | Projected Profit Margin (Year 3) |

|---|---|---|---|

| IBM | 400 | 450 | 15% |

| Intel | 120 | 140 | 12% |

| Dell | 90 | 105 | 10% |

Note: These figures are illustrative and based on various assumptions. Actual results may differ significantly. Factors such as market fluctuations, competition, and unforeseen events could impact the accuracy of these projections.

Short-Term and Long-Term Financial Impacts

Short-term impacts might include increased debt levels, temporary disruptions in operational efficiency, and potential market volatility. Long-term impacts, however, focus on the potential for improved market share, new revenue streams, and enhanced technological capabilities. IBM’s acquisition of Xbox, for example, could boost its presence in the gaming sector.

Potential Financial Outcomes of the Integration

The integration of the acquired assets into each company’s operations is expected to yield varied financial outcomes. For instance, IBM’s acquisition of Xbox could potentially create new revenue streams in the gaming sector and attract a wider customer base. Successful integration could lead to cost savings, enhanced product offerings, and a stronger competitive position in the market. On the other hand, challenges might arise during the integration phase.

These might include difficulties in aligning cultures, merging technologies, and integrating business processes.

Competitive Analysis: Ibm Gets Xbox Intel Wins Gateway And Dell

The recent flurry of acquisitions—IBM’s of Xbox, Intel’s of Gateway, and Dell’s strategic maneuvers—signifies a significant shift in the tech landscape. These moves aren’t simply about expanding market share; they’re about reshaping the competitive battlefield, challenging established players, and creating new strategic alliances. Understanding the strategies behind these acquisitions, and the potential outcomes, is critical to comprehending the future of the industry.These acquisitions are not isolated incidents.

They represent a concerted effort by companies to gain a competitive edge by consolidating resources, leveraging complementary technologies, and acquiring valuable intellectual property. The resulting competitive landscape will be significantly altered, impacting not only the acquired companies but also the broader industry.

Strategies Employed by Acquiring Companies

The varied strategies highlight the diverse approaches to achieving market dominance. IBM, known for its robust software ecosystem, appears to be targeting a new avenue for innovation in gaming and entertainment, aiming to blend its existing software capabilities with Xbox’s gaming infrastructure. Intel, with its core competencies in silicon and microprocessors, is consolidating its hardware position, aiming to leverage Gateway’s established retail presence.

Dell, on the other hand, is potentially focused on a broader expansion into high-growth sectors and new market segments, based on their recent moves and previous strategic plans. These strategies showcase the unique competitive positioning of each company and their individual priorities within the industry.

Potential Impact on the Competitive Landscape

These acquisitions will undoubtedly reshape the competitive landscape. The consolidation of resources could lead to significant economies of scale, allowing the acquiring companies to offer more competitive pricing and potentially drive out smaller competitors. However, the increased market dominance by a few major players might also lead to reduced innovation and choice for consumers, raising concerns about potential anti-competitive behavior.

The ability of these companies to effectively integrate the acquired businesses will also be crucial.

Potential Challenges and Opportunities for Each Company

IBM faces the challenge of integrating Xbox’s operations and culture into its existing structure. A successful integration will require careful planning and attention to employee retention and customer relations. Intel faces the challenge of effectively managing the retail operations and expanding its reach into the consumer market through the Gateway acquisition. Dell’s opportunity lies in leveraging the combined strengths of both companies, creating a wider range of products and services and a more robust brand presence.

Positioning Against Competitors

The acquisitions have the potential to alter the positioning of these companies against their competitors. IBM’s acquisition of Xbox could significantly impact Sony and Nintendo, potentially shifting the balance of power in the gaming industry. Intel’s acquisition of Gateway may pose a challenge to other hardware retailers, while Dell’s strategic moves may affect its competitors in the broader consumer electronics market.

IBM snagging Xbox, Intel winning Gateway and Dell – it’s a flurry of tech industry acquisitions. This highlights a trend of companies recognizing the potential of AI in various fields, including healthcare. Modern advancements in AI, like those explored in the article artificial caregivers improve on the real thing , are already showing the potential to revolutionize tasks like elderly care, making them more efficient and potentially more compassionate than human caregivers.

Ultimately, these tech acquisitions and AI advancements suggest a significant shift in how we approach technology and its impact on our daily lives, impacting everything from gaming to healthcare.

Competitive Landscape Before and After Acquisitions (Table)

| Factor | Competitive Landscape Before Acquisitions | Competitive Landscape After Acquisitions |

|---|---|---|

| Market Share | Fragmented, with multiple players | More concentrated, with significant players |

| Innovation | Potentially high, due to competition | Potentially reduced in certain areas due to consolidation |

| Pricing Power | Moderately balanced | Potential shift towards larger players |

| Technological Advancement | Driven by competition and innovation | Potentially slowed in some sectors due to consolidation |

Impact on Consumer Electronics and Gaming

The recent flurry of acquisitions, particularly IBM’s foray into the gaming sector through Xbox and Intel’s acquisition of Gateway and Dell’s subsequent preparations, promises significant shifts in the consumer electronics landscape, particularly within the gaming console market. These moves represent a strategic realignment, indicating a strong belief in the future potential of this technology and the market’s overall growth.

These acquisitions will undoubtedly impact the future of gaming, from hardware to software, potentially altering the competitive dynamics and the consumer experience.The interconnected nature of these acquisitions suggests a concerted effort to dominate the gaming market, aiming to leverage the combined strengths of diverse technologies. This convergence of established brands and innovative technologies could revolutionize the gaming industry, potentially leading to a new era of immersive and interactive experiences.

Potential Effects on the Consumer Electronics Market

The integration of IBM’s AI and cloud computing expertise with Microsoft’s gaming ecosystem, and Intel’s focus on processing power into the existing Dell and Gateway infrastructures, will likely result in more powerful and advanced gaming consoles. This will push the boundaries of what’s possible in terms of graphical fidelity, processing speed, and overall performance. The market will be forced to adapt to this surge in technological capabilities.

Consumers can expect an increase in the demand for high-performance hardware components and peripherals.

Impact on the Future of Gaming Technology

These acquisitions suggest a potential shift towards more integrated and sophisticated gaming experiences. This could involve the development of cloud-based gaming platforms, leveraging IBM’s cloud infrastructure to provide greater accessibility and scalability. The convergence of hardware and software capabilities will drive innovation in game design, potentially enabling more complex and realistic simulations. Increased processing power will allow for more complex and sophisticated games, potentially leading to a shift towards more immersive and interactive experiences.

Influence on Software Development

The combined resources and expertise of these companies could lead to a more streamlined and efficient software development process. The increased accessibility of powerful hardware components could inspire new game development paradigms, potentially pushing the boundaries of game design and player engagement. A wider range of software developers may gain access to resources, potentially fostering a more diverse and innovative gaming landscape.

Consequences for Consumers

Consumers can expect a variety of consequences from these acquisitions, including both positive and negative implications. Initially, the availability of cutting-edge gaming consoles and related hardware may be limited due to production and supply chain issues. Furthermore, the cost of these advanced products might be initially higher. However, increased competition could lead to more affordable and readily available gaming products in the long term.

The potential for personalized gaming experiences and enhanced features is significant, creating a more tailored and immersive experience.

Anticipated Changes in the Gaming Industry

| Aspect | Anticipated Change |

|---|---|

| Product Offerings | More powerful consoles with advanced features (e.g., cloud gaming, AI integration). Increased variety in peripherals (e.g., advanced controllers, high-resolution displays). |

| Market Trends | Shift towards cloud-based gaming, greater emphasis on virtual and augmented reality integration. Rise of eSports and competitive gaming experiences. |

Final Thoughts

The acquisitions of IBM, Xbox, Intel, Gateway, and Dell mark a pivotal moment in the tech industry. These moves promise both innovation and disruption, with potential benefits for consumers and significant ramifications for the companies involved. The integration of these diverse entities will be crucial for success, with the potential for synergies and efficiencies, but also considerable risks.

We will see how these transformations will reshape the landscape, impacting not only the companies directly involved but also the industry as a whole.