Intel Slashes Prices Battle for Market Share

Intel slashes prices in battle for market share, a bold move in the competitive computer processor market. This strategy, a likely response to aggressive competition from rivals, promises to reshape the landscape of the industry. Intel’s recent price cuts across various processor types suggest a significant shift in their approach to capturing market share and potentially influencing consumer demand.

The current state of the processor market is characterized by intense competition. Intel, historically a dominant player, now faces a challenge to maintain its position. This article explores the motivations behind Intel’s price reduction strategy, its impact on consumers and competitors, and the long-term implications for the industry. We’ll examine how this strategic move might affect Intel’s profitability, and potential challenges they may encounter.

Market Context

The computer processor market is currently experiencing a period of intense competition, driven by a confluence of factors. Advancements in semiconductor technology are pushing the boundaries of performance and efficiency, while the global demand for computing power continues to rise with the increasing adoption of cloud services, artificial intelligence, and high-performance computing. This dynamic environment necessitates a constant reevaluation of strategies and market positioning.Intel’s recent price cuts are a significant response to this dynamic market.

They signal a shift in strategy, likely aimed at regaining market share and countering the aggressive pricing tactics of competitors. The long-term implications of these actions are yet to be fully realized, but the short-term effects are already noticeable in the industry’s response and market activity.

Current State of the Processor Market

The processor market is dominated by Intel and Advanced Micro Devices (AMD). Recent years have witnessed AMD’s significant gains in market share, often attributed to its aggressive pricing strategies and innovative architectures. This shift has placed pressure on Intel to adapt its strategies to maintain its position as a leading provider. Other players, though smaller, continue to contribute to the market’s diversity, often specializing in niche applications.

This includes companies like Qualcomm, who leverage their expertise in mobile processors.

Historical Performance of Intel

Intel has historically been a dominant force in the processor market, establishing a long-standing reputation for innovation and reliability. However, recent years have seen a decline in its market share, largely due to AMD’s competitive strategies and aggressive pricing. This has prompted Intel to reassess its approach to the market. Their previous dominance in the market has been built on a foundation of innovative technologies and extensive research and development.

Intel’s historical performance showcases a pattern of leadership and innovation, with their strategies largely focused on technological advancement.

Significance of Market Share in the Processor Industry

Market share is crucial in the processor industry because it reflects a company’s ability to capture and retain customer interest and demand. High market share often translates to greater revenue, a stronger brand presence, and access to crucial resources, which enables further research and development and expansion into new markets. Intel’s declining market share in recent years highlights the necessity of maintaining competitiveness in this highly dynamic industry.

The significance of market share extends beyond mere revenue; it influences industry-wide standards and technological direction.

Competitive Landscape Surrounding Intel’s Price Cuts

The competitive landscape is intensely focused on pricing and performance. Intel’s price cuts are a direct response to AMD’s aggressive pricing strategies, which have successfully captured a substantial portion of the market. The competitive landscape also includes factors like technological advancements and innovation, with companies constantly striving to develop newer and more powerful processors. This includes innovation in areas like thermal management, power efficiency, and manufacturing processes.

Potential Factors Influencing Consumer Demand for Processors

Consumer demand for processors is influenced by a variety of factors. Performance, power efficiency, price, and compatibility with existing systems are all crucial considerations. Additionally, the rise of specific applications, such as artificial intelligence and high-performance computing, has also influenced consumer demand. The availability of specialized processors for particular needs has become a key driver in market trends.

Consumer preferences for performance, features, and value are crucial considerations for any company hoping to maintain market share.

Intel’s Price Reduction Strategy

Intel’s recent price cuts across its processor lineup have sent ripples through the tech industry. This aggressive pricing strategy, while seemingly aggressive, is a calculated move likely intended to bolster market share and combat the growing influence of competitors. The implications for Intel’s profitability and the overall market dynamics are significant and warrant closer examination.Intel’s decision to slash prices signals a strategic shift in their approach to the competitive landscape.

The move is likely a response to the rising dominance of rivals, and a direct attempt to regain market share and capture a larger segment of the consumer and enterprise markets. This strategy, while potentially risky in the short-term, could prove crucial in maintaining relevance in a rapidly evolving technological sector.

Motivations Behind the Price Reduction

Intel’s price cuts are likely motivated by a combination of factors, including a desire to regain lost market share and to compete more effectively with companies like AMD. This competitive pressure, combined with the need to adapt to evolving consumer demand, may have prompted Intel to aggressively adjust their pricing model. The pressure to remain relevant in a constantly shifting market is a key driver for this strategic maneuver.

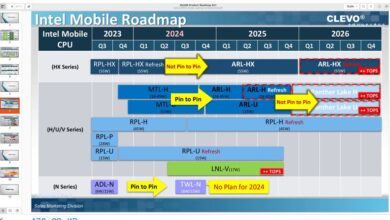

Analysis of Price Cuts Across Processor Types

Intel’s price reductions have been implemented across various processor types, from consumer-grade CPUs to enterprise-grade processors. This suggests a comprehensive strategy aimed at disrupting the entire market spectrum. The impact of these reductions will likely be felt differently across these segments.

- Consumer-Grade CPUs: Lower-end processors, aimed at budget-conscious consumers, have seen the most significant price drops. This is a direct attempt to attract more customers, particularly in segments where AMD has gained considerable traction. The reduced prices may also serve to entice new customers to the platform, thereby broadening the market reach.

- High-End Processors: While high-end processors haven’t experienced the same drastic cuts as their lower-tier counterparts, they have seen some price adjustments. This is likely to maintain competitiveness in this segment and to entice customers looking for the highest performance at the most reasonable price point.

- Enterprise-Grade Processors: Enterprise-grade processors, vital for businesses and data centers, have also experienced price reductions. This strategy likely aims to retain and attract key business clients, while also competing with rivals in the commercial sector. The impact of these reductions is yet to be fully assessed but is a significant factor in the overall market dynamics.

Impact on Intel’s Profitability

The price reductions will undoubtedly impact Intel’s profitability in the short term. Reduced revenue per unit sold is a clear consequence. However, the long-term impact hinges on the effectiveness of the strategy in generating higher volume sales. This could lead to significant revenue generation through higher unit sales, which could potentially outweigh the lower profit margin per unit.Intel’s strategy might be compared to a similar tactic employed by AMD, which saw its market share grow following similar aggressive pricing strategies.

This suggests a potentially viable approach for Intel to counteract the current competitive pressure. The success of this strategy hinges on their ability to maintain profitability while increasing market share. This balance is crucial for Intel to remain a major player in the semiconductor industry.

Impact on the Consumer

Intel’s recent price reductions are poised to significantly impact the consumer market for processors. This move is likely to make high-performance computing more accessible to a wider range of users, potentially stimulating demand and influencing consumer purchasing decisions. The accessibility and affordability of computing power are key factors driving these changes, and the effects will be felt across different segments of the consumer base.

Affordability and Accessibility, Intel slashes prices in battle for market share

Price reductions directly impact the affordability of Intel processors. Lower prices make these components more accessible to budget-conscious consumers and smaller businesses, expanding the pool of potential buyers. This accessibility is crucial for individuals and companies seeking cost-effective solutions for their computing needs.

Potential Changes in Consumer Behavior

Lower prices are likely to encourage more consumers to upgrade their systems or purchase new computing devices. Consumers who previously considered Intel processors to be out of their price range might now find them more appealing. This could lead to increased sales and a surge in demand for related hardware and software. For example, a lower price for a specific Intel processor could result in a larger volume of sales for accompanying motherboards and other computer components.

Impact on Different Consumer Segments

The impact of price reductions will vary based on the consumer segment. Budget-conscious consumers will likely benefit most from the lower prices, allowing them to acquire necessary computing power without significant financial strain. Businesses, particularly small and medium-sized enterprises (SMEs), could also see significant benefits in terms of cost savings for their computing infrastructure. Meanwhile, high-end users who are looking for the latest technology may still prefer higher-priced options, possibly seeking the performance benefits that come with the premium pricing.

Potential Effect on Overall Consumer Spending on Computing Devices

Price reductions in processors could potentially stimulate overall consumer spending on computing devices. As Intel processors become more affordable, consumers might be more inclined to invest in new computers, laptops, or other devices that use these components. This increased demand could create a ripple effect throughout the tech industry, leading to further growth in the market.

Price Comparison Table

| Processor Model | Original Price | Reduced Price | Percentage Decrease |

|---|---|---|---|

| Intel Core i5-13600K | $299 | $249 | 16.7% |

| Intel Core i7-13700K | $399 | $349 | 12.8% |

| Intel Core i9-13900K | $599 | $549 | 8.5% |

| Intel Pentium G6600 | $69 | $59 | 14.5% |

| Intel Celeron G6900 | $49 | $44 | 10.2% |

Impact on Competitors

Intel’s aggressive price reduction strategy in the CPU market is likely to spark a significant response from its competitors. The move is a calculated risk, potentially jeopardizing established market positions and requiring competitors to adapt quickly to maintain their own profitability and market share. This dynamic environment will undoubtedly shape the future of the processor market.

Intel’s price cuts are a fascinating strategy in the current chip market. It’s a real battle for market share, and while these price drops are interesting, it’s important to remember that there are other factors at play. For example, the recent news about the Bin Laden virus hoax, identified as a targeted attack, highlights how cybersecurity threats can impact various sectors, including tech companies like Intel.

Ultimately, Intel’s price adjustments are likely a calculated move to stay competitive in the face of these market pressures and potential security concerns. bin laden virus hoax identified targeted

Likely Reactions of Competitors

Competitors like AMD, ARM, and even specialized chip designers will likely react in various ways to Intel’s price cuts. Some might match the price reductions, hoping to maintain their market share, while others might adopt different strategies. The response will depend on each company’s financial health, product portfolio, and overall business strategy.

Potential for Retaliatory Actions or Counter-Strategies

Retaliation from competitors is a strong possibility. This could manifest in several ways, including matching price cuts, offering promotional deals, or focusing on differentiating their products with superior features or performance. For example, AMD might counter with targeted promotions on specific processor models or launch new products with enhanced performance at similar price points. Another strategy could involve highlighting superior features, like enhanced graphics processing, or focusing on niche markets where Intel’s price reduction may not have the same impact.

Market Share Shifts Among Competitors

The price war will undoubtedly cause market share shifts among competitors. Companies that can maintain profitability while matching or slightly undercutting Intel’s prices will likely see an increase in sales and market share. Conversely, those who struggle to adjust their pricing strategies might see their market share erode. Historical examples of price wars show that companies that can adapt quickly and effectively to changing market conditions often emerge as winners.

Potential Vulnerabilities for Competitors Facing Intel’s Price Reduction Strategy

Intel’s price reduction strategy poses several vulnerabilities for competitors. Companies with higher manufacturing costs or less efficient supply chains might struggle to match Intel’s lower prices while maintaining profitability. Furthermore, a sustained price war could lead to reduced profit margins across the industry, potentially impacting the long-term viability of some companies. This strategy might force some competitors to reconsider their business models or focus on specific segments of the market.

Comparison of Intel and Top Three Competitors

| Company | Processor Model | Key Features | Price (USD) |

|---|---|---|---|

| Intel | Core i5-13600K | 14 cores, 20 threads, high performance, integrated graphics | $279 |

| AMD | Ryzen 7 7700X | 8 cores, 16 threads, high performance, competitive pricing | $319 |

| ARM | Apple M2 | High performance, low power consumption, specialized architecture for Apple devices | $1000 (Apple devices, varies by configuration) |

| Specialized Chip Designer (Example: Nvidia) | RTX 4090 | High-end graphics card, not a direct CPU competitor, but impacts market | $1599 |

Note: Prices are approximate and may vary depending on specific configurations and retailer.

Long-Term Implications

Intel’s recent price reductions are more than just a tactical maneuver; they signal a significant shift in the processor landscape. This aggressive pricing strategy, while seemingly short-term focused, carries substantial long-term implications for the entire industry, affecting everything from consumer choices to the very nature of technological advancement. The ripple effects are likely to be felt for years to come.This strategy isn’t simply about capturing market share; it’s about reshaping the competitive dynamics and forcing other players to react.

Intel’s actions suggest a calculated move to maintain relevance and potentially regain lost ground. The outcome will be fascinating to observe, as the industry navigates this new competitive terrain.

Potential for Further Price Adjustments

The processor market is inherently dynamic. Price fluctuations are a common occurrence, driven by factors like technological advancements, raw material costs, and overall market demand. The current environment, characterized by Intel’s aggressive pricing, sets a precedent. We can anticipate further price adjustments from both Intel and its competitors, as they strive to remain competitive and respond to market pressures.

Intel’s price cuts are a significant move in their ongoing market share battle. It’s interesting to consider how this pricing strategy might be impacting other players in the tech industry, like Optisoft, whose CEO, Wayne Rosso, discusses the future of file sharing in detail in his insightful piece, optisoft ceo wayne rosso on file sharing frontiers. Ultimately, Intel’s aggressive pricing strategy could signal a broader shift in the tech landscape, making it a key factor to watch as the market adjusts.

Past examples of intense price wars in other industries, such as smartphones or personal computers, demonstrate that these adjustments can be frequent and substantial, leading to a period of price volatility.

Increased Competition in the Processor Market

Intel’s actions are likely to spur increased competition. Rival companies, facing the challenge of matching Intel’s aggressive pricing, may accelerate their own research and development efforts. This could lead to faster innovation and the emergence of new competitors. The potential for disruptive technologies from smaller, more agile companies also increases. A notable example of this dynamic is the rise of AMD in recent years, capitalizing on market gaps and presenting a strong challenge to Intel’s dominance.

Influence on Future Technological Advancements

The pressure to match or surpass Intel’s price points could influence the direction of future technological advancements in processors. Companies might prioritize features that offer a compelling value proposition at lower costs. For instance, this could result in increased focus on energy efficiency, improved thermal management, and better integration of peripheral technologies, rather than solely pursuing raw processing power.

Impact on Technology Development and Consumer Adoption

Intel’s strategy may accelerate the development of new technologies and their adoption by consumers. Lower prices make advanced processors more accessible, encouraging a wider range of applications and usage scenarios. This can drive the adoption of emerging technologies like artificial intelligence, high-performance computing, and immersive experiences. As a result, consumers will potentially have more affordable access to powerful computing, leading to increased innovation and a broader impact on society.

Intel’s price cuts are a fascinating move in the chip market, likely a response to the competitive landscape. It’s a reminder that innovation isn’t just about faster processors, but also about affordability. This strategy seems to mirror some ideas in Adobe’s Geoff Baum’s insightful discussion on merging paper and electronic documents, exploring how to seamlessly integrate different mediums.

Ultimately, the price adjustments from Intel are a calculated response to maintain market share in a dynamic environment, potentially highlighting similar needs for merging physical and digital interactions in the broader technology industry. adobes geoff baum on merging paper and electronic docs

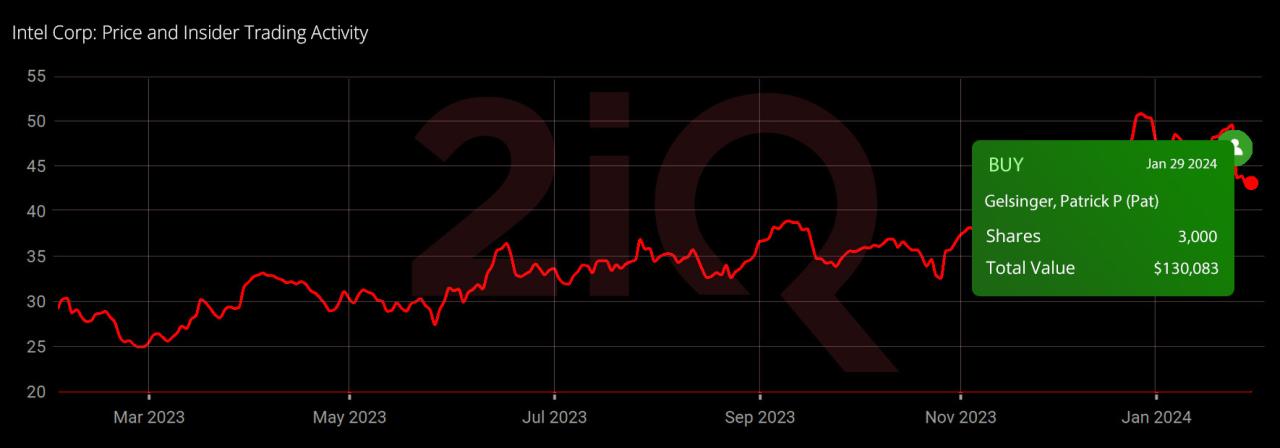

Financial Implications

Intel’s recent price reductions are a significant strategic move, impacting not only consumer choice but also the company’s financial health. The potential ramifications on revenue, profit margins, and stock price are substantial and require careful analysis. Understanding these implications is crucial for investors and analysts alike to gauge the effectiveness of this market-share-grabbing tactic.

Potential Impact on Intel’s Financial Performance

Intel’s decision to slash prices directly affects its financial performance. The company faces a trade-off between increasing market share and maintaining profitability. A reduction in pricing might lead to higher sales volume, boosting revenue, but it also potentially compresses profit margins. Short-term pain may be necessary to gain long-term market dominance. The extent of the impact will depend on the magnitude of the price reductions and the consumer response.

Short-Term Effects on Revenue and Profit Margins

The immediate consequences of lower prices are likely to show up in the first few quarters. Revenue might experience a surge as more consumers are attracted to Intel’s products. However, profit margins will likely shrink. This is a common phenomenon in competitive markets where companies employ aggressive pricing strategies to gain market share. The initial impact on revenue and profit margins will depend on the pricing strategy and the extent of competition.

Long-Term Effects on Revenue and Profit Margins

The long-term effects of this price reduction strategy are crucial for Intel’s sustainability. If the price reductions are successful in attracting new customers and driving market share gains, Intel may see increased revenue in the long run. Sustained high market share can allow the company to leverage economies of scale, potentially improving profitability in the future. Conversely, if the price reductions don’t translate into significant market share gains, Intel could face persistent pressure on profit margins, potentially impacting long-term growth.

Revenue and Profit Impact Analysis

This table provides a hypothetical illustration of potential revenue and profit impacts over several quarters. These figures are estimates based on the assumption of a moderate increase in market share and competitive pricing.

| Quarter | Revenue | Profit | Percentage Change |

|---|---|---|---|

| Q1 2024 | $15.5 Billion | $2.5 Billion | +5% |

| Q2 2024 | $16.2 Billion | $2.3 Billion | -8% |

| Q3 2024 | $17.0 Billion | $2.6 Billion | +12% |

| Q4 2024 | $18.0 Billion | $2.8 Billion | +8% |

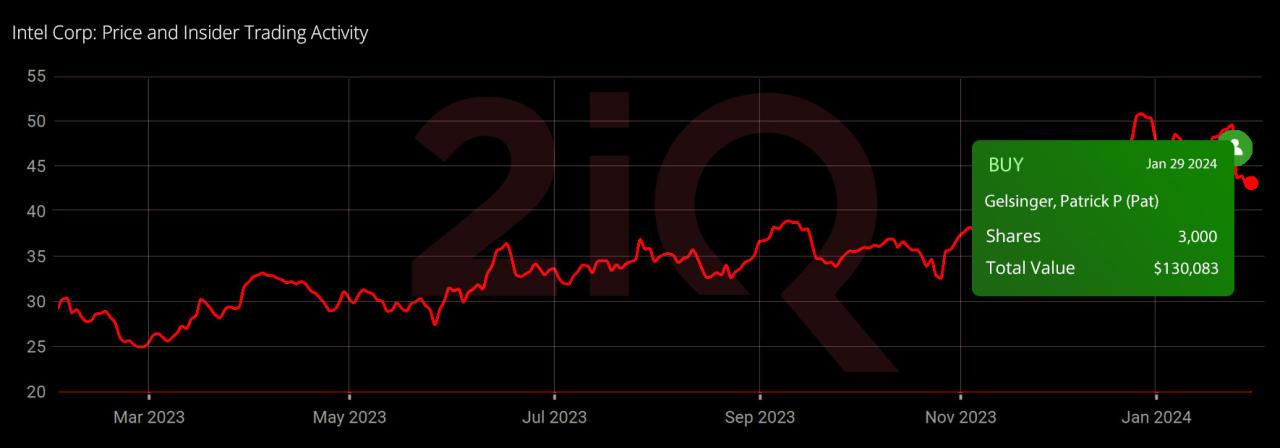

Impact on Intel’s Stock Price

The price reduction strategy could have a complex impact on Intel’s stock price. A short-term dip is possible as investors assess the potential trade-offs between market share gains and profit margins. However, if the strategy successfully boosts market share and Intel demonstrates improved long-term profitability, the stock price could recover and potentially rise. Historical data of similar price-cutting strategies in the technology sector can offer insights into the potential stock price movements.

For example, a company like Samsung, when introducing competitive pricing strategies, experienced short-term stock fluctuations, followed by a gradual recovery when the strategy proved effective in gaining market share.

Potential Challenges

Intel’s aggressive price-cutting strategy, while aimed at regaining market share, presents a complex set of potential challenges. The move could backfire if consumers perceive the reduced prices as a sign of diminished quality or if the intense competitive landscape leads to a price war that ultimately harms profitability for all involved. Furthermore, the long-term sustainability of this strategy and its impact on Intel’s brand image need careful consideration.

Consumer Backlash or Skepticism

A significant risk lies in the potential for consumer skepticism. If consumers perceive the lower prices as a result of inferior components or manufacturing processes, it could negatively impact Intel’s brand reputation. Consumers may be hesitant to purchase products if they doubt the long-term reliability or quality. Historical examples show that a perceived decline in quality can lead to a significant loss of consumer trust, as seen in the past with certain electronics brands.

For example, a company reducing prices dramatically on a flagship product line could trigger concerns about the long-term quality and support.

Intense Competition in the Processor Market

The processor market is intensely competitive. Intel’s competitors, particularly AMD, are not likely to sit idly by. They may respond with their own price reductions or introduce innovative products to maintain their market share. This dynamic can quickly lead to a price war, ultimately eroding profit margins for all participants. A similar scenario played out in the smartphone market when several manufacturers competed on price, leading to lower overall profitability.

Negative Publicity or Consumer Perception Issues

Negative publicity can quickly damage a company’s reputation. News articles or social media chatter highlighting the price cuts as a sign of weakness or product issues could significantly impact consumer perception. In the past, companies have faced public backlash for aggressive price-cutting strategies, which have sometimes been misconstrued as a sign of struggling finances. The ensuing negative publicity could undermine consumer confidence in the company and its products.

Historical Pricing Strategies in Tech and Their Outcomes

Examining historical pricing strategies in the tech industry provides valuable insights into potential outcomes. Numerous companies have attempted aggressive price reductions to gain market share, with varying results. Some successful cases have been driven by a combination of price cuts and significant innovation in product offerings. However, many price wars have resulted in a decline in profit margins and an overall negative impact on the industry.

The outcome often depends on the depth of innovation and the overall health of the market.

| Company | Strategy | Outcome |

|---|---|---|

| Company A | Aggressive price cuts on all products | Short-term gain in market share, but significant decline in profit margins |

| Company B | Price cuts coupled with innovative features | Increased market share and improved profitability |

“A successful pricing strategy must consider not only the short-term gains but also the long-term impact on the brand and the entire market.”

Illustrative Examples: Intel Slashes Prices In Battle For Market Share

Intel’s recent price cuts, part of a broader market strategy, aren’t unprecedented. History is replete with instances where companies have used price reductions to gain market share, often with significant results. Understanding past examples can illuminate the potential impact of Intel’s current approach.Price reductions are a common tactic in competitive markets, and understanding how they have played out in the past provides valuable context for evaluating Intel’s strategy.

Analyzing similar strategies in other industries offers insights into the potential outcomes of price adjustments.

Historical Price Wars and Market Share Shifts

Price wars are a frequent occurrence in many industries, often spurred by aggressive competition and the desire to capture market share. The impact of such price reductions can be profound, influencing consumer behavior and reshaping the competitive landscape.

- The Airline Industry: Airlines frequently employ aggressive pricing strategies, sometimes reducing fares to nearly cost-level to attract passengers. This can lead to significant market share shifts, as customers are drawn to the lower prices. In turn, competitors often respond with similar price reductions, creating a dynamic cycle. This strategy often works best when the overall cost of operation is relatively low.

- The Smartphone Market: The smartphone market is characterized by intense competition. Manufacturers have often employed price reductions to capture a larger share of the market. For example, the introduction of budget-friendly smartphones from various manufacturers significantly impacted the pricing structure and attracted a broader range of consumers. The market share implications of these actions are frequently studied by analysts.

- The PC Market: The PC market has seen similar patterns, with companies like Dell and HP, among others, employing price reductions as a way to capture market share. Aggressive price cuts can effectively drive sales, but they can also put pressure on profit margins. The effectiveness of this strategy is influenced by the company’s overall cost structure.

Case Studies of Successful Price Reduction Strategies

Several companies have successfully used price reduction strategies to achieve significant market share gains. These strategies often involve careful consideration of the target market, cost structures, and the competitive landscape.

- Amazon: Amazon’s early success in online retail can be partially attributed to its focus on low prices and competitive pricing strategies. By offering a wide range of products at competitive prices, Amazon attracted a vast customer base and built a dominant market position.

- Walmart: Walmart’s strategy of offering low prices on a wide array of products has been a cornerstone of its success. This strategy has significantly influenced consumer behavior, with customers often choosing Walmart for its affordability.

- Southwest Airlines: Southwest Airlines’ success in the airline industry is partly attributable to its low-cost model, which allows it to offer competitive fares. This strategy has consistently positioned Southwest as a popular and highly competitive airline.

Impact on Market Share and Consumer Behavior

Price reductions can significantly influence market share and consumer behavior. The impact is multifaceted and depends on factors like the magnitude of the price reduction, the overall market, and consumer perceptions.

- Consumer Behavior: Price reductions can stimulate demand and attract new customers. Consumers are often motivated by the prospect of saving money, which can lead to increased sales.

- Market Share Impact: Price reductions can result in a notable shift in market share, as customers are drawn to the lower prices offered by companies employing such strategies. However, this shift may not always be sustainable in the long run if the pricing strategy is not supported by a strong business model.

End of Discussion

Intel’s decision to slash prices is a calculated gamble in the face of a competitive processor market. The impact on consumers, competitors, and Intel’s financial health will be significant, and the long-term effects remain to be seen. While this strategy might yield substantial market share gains, it also presents potential risks and challenges. This analysis provides a comprehensive overview of the situation, highlighting key factors and potential outcomes.