Microsoft Citrix Seal Terminal Server Deal A Deep Dive

Microsoft Citrix seal terminal server deal marks a significant move in the remote access space. This potential merger promises to reshape the future of remote work and enterprise computing. The deal, still under negotiation, raises numerous questions about the implications for users, competitors, and the broader technology industry.

This analysis delves into the background, potential implications, financial considerations, technical aspects, regulatory concerns, customer perspectives, competitive landscape, and industry impact of this potential integration. We’ll explore the historical context of Microsoft, Citrix, and Terminal Server technologies, examining how this deal fits within the current market trends.

Background and Context

The potential merger between Microsoft and Citrix, particularly regarding Terminal Server technologies, signals a significant shift in the remote work landscape. This deal isn’t simply about two companies joining forces; it’s about the future of how we work, learn, and interact in a digitally-driven world. The history of both companies and the evolution of remote access solutions will provide crucial context for understanding the potential impact.This convergence reflects a growing demand for secure and efficient remote access solutions, fueled by the increasing adoption of cloud computing and hybrid work models.

The potential combination of Microsoft’s robust platform with Citrix’s expertise in virtualization and remote applications promises a powerful synergy, potentially shaping the future of enterprise-grade remote access.

Historical Overview of Key Players

Microsoft, founded in 1975, has a long history of developing software solutions, including the foundational operating systems like Windows. Citrix Systems, established in 1989, emerged as a leader in virtualization and remote application technologies. Terminal Server, introduced by Microsoft, offered a way for users to access and manage applications on a centralized server remotely. Citrix built upon this concept, developing sophisticated solutions for remote desktop access and application delivery.

These technologies are fundamental to the modern remote work environment.

Evolution of Remote Access Solutions, Microsoft citrix seal terminal server deal

Remote access solutions have evolved from simple dial-up connections to sophisticated cloud-based platforms. Early solutions were limited in functionality and security. The introduction of the internet and advancements in networking protocols dramatically expanded the possibilities, enabling more robust and secure remote connections. Virtualization technologies further enhanced the ability to deliver applications and desktops remotely. The rise of cloud computing has provided the infrastructure to support these solutions on a massive scale, driving widespread adoption in recent years.

Market Trends and Significance

The demand for remote work solutions has surged in recent years, driven by factors like globalization, workforce diversification, and technological advancements. The COVID-19 pandemic accelerated this trend, pushing businesses to adopt remote work models rapidly. This shift necessitates secure and reliable remote access solutions, creating a significant market opportunity for companies like Microsoft and Citrix. The potential deal highlights the increasing importance of cloud-based solutions and their role in enabling seamless remote work.

Comparison of Key Features

| Feature | Microsoft Solutions | Citrix Solutions |

|---|---|---|

| Operating System Integration | Deep integration with Windows operating systems, seamless user experience | Compatibility with various operating systems, including Windows, Linux, and macOS |

| Virtualization Technology | Limited virtualization capabilities within its own ecosystem, focusing on server-based solutions | Extensive virtualization technologies, specialized in remote desktop and application delivery |

| Cloud Integration | Strong cloud integration through Azure, offering scalable solutions | Strong cloud integration and compatibility with leading cloud platforms |

| Security Features | Robust security features, including multi-factor authentication and access control | Comprehensive security features, emphasizing secure remote access and data protection |

| Scalability | Scalable infrastructure based on Azure cloud platform | Scalable infrastructure based on various cloud and on-premises deployments |

This table provides a general overview; specific features and capabilities may vary depending on the specific products and versions. Citrix’s solutions have historically been more focused on virtualization and remote application delivery, whereas Microsoft’s offerings have been broader, encompassing server-based solutions and broader platform integrations.

Potential Implications: Microsoft Citrix Seal Terminal Server Deal

This deal between Microsoft and Citrix presents a complex interplay of potential benefits and drawbacks for users, market dynamics, and the strategic trajectories of both companies. Understanding these implications is crucial for navigating the evolving landscape of remote work and cloud computing. The agreement’s impact will be felt across various sectors, from enterprise organizations to individual users.This section delves into the potential benefits and drawbacks for users of both Microsoft and Citrix products, comparing the impact on competing remote access solutions, and analyzing the long-term strategic implications for both companies.

A detailed examination of potential scenarios and their outcomes is also provided.

Potential Benefits and Drawbacks for Users

This agreement could lead to a more seamless user experience. Users might benefit from a wider range of features and functionalities combined from both platforms. However, there could also be challenges in terms of compatibility and integration, potentially causing disruptions during the transition period. Existing Citrix users might experience a learning curve as they adapt to new Microsoft-centric features.

Impact on Market Share of Competing Remote Access Solutions

The combined market presence of Microsoft and Citrix could significantly impact the market share of competing remote access solutions. This shift in market dynamics will likely see the consolidation of market leadership, forcing competitors to adapt quickly or risk becoming marginalized. The combination of Microsoft’s extensive user base and Citrix’s strong product portfolio will create a powerful force in the market, potentially reshaping the competitive landscape.

Strategic Implications for Microsoft and Citrix

The deal signifies a strategic shift for both companies. For Microsoft, this acquisition aims to strengthen its position in the cloud-based workspace market. This integration could give Microsoft a significant edge by integrating Citrix’s strong remote access tools with their existing suite of products. For Citrix, this partnership could provide access to a larger user base and broader market reach.

The long-term success will depend on effective integration and management of the combined resources.

Potential Scenarios and Outcomes

| Scenario | Outcome for Microsoft | Outcome for Citrix | Outcome for Users |

|---|---|---|---|

| Scenario 1: Seamless Integration | Stronger position in the cloud workspace market, expanding product suite | Retention of existing customer base, access to Microsoft’s large user base | Improved user experience, access to wider range of features |

| Scenario 2: Integration Challenges | Potential disruptions and delays in market penetration | Reduced market share in the short term, potential loss of customers | Frustration and inconvenience during the transition period |

| Scenario 3: Market Consolidation | Dominant market share in the remote access space | Reduced market share for competing solutions | Limited choice for remote access solutions |

Financial and Market Analysis

The Microsoft-Citrix deal promises significant implications for the remote access solutions market, particularly in the financial performance of both companies. Analyzing recent financial trends and market projections is crucial to understanding the potential impact on their respective positions. This section delves into the financial health of Microsoft and Citrix, examines current market trends, and explores the potential market share shifts.Recent financial reports reveal consistent growth in the cloud computing sector, driven by increasing demand for remote access and collaboration tools.

Understanding these trends is vital to assessing the potential financial impact of the merger. The following sections detail the financial performance of each company and project future market share outcomes.

Microsoft’s Financial Performance

Microsoft has demonstrated strong financial performance in recent years, driven by its diversified portfolio across various software and hardware segments. Its cloud computing division, Azure, has experienced substantial growth, contributing significantly to overall revenue. Microsoft’s recent earnings reports reflect robust revenue streams and expanding market share in cloud services.

Citrix’s Financial Performance

Citrix has also shown steady growth, particularly in the remote work and digital workspace segments. Their offerings, particularly in virtual desktops and application delivery, have become increasingly relevant in the post-pandemic world. However, their financial performance is significantly smaller than Microsoft’s.

Market Trends and Projections for Remote Access Solutions

The remote access solutions market is experiencing rapid expansion, driven by the growing adoption of cloud computing and remote work. Factors such as increased cybersecurity concerns, the need for flexible work environments, and the rise of BYOD (Bring Your Own Device) policies contribute to this growth. Analyst predictions indicate continued growth in the coming years, fueled by the ongoing digital transformation.

Potential Market Share Gains or Losses for Microsoft and Citrix

The merger of Microsoft and Citrix could lead to substantial market share gains for Microsoft. By integrating Citrix’s technology into its existing cloud infrastructure, Microsoft could enhance its remote access offerings and potentially gain significant market share from competitors. Conversely, Citrix’s current market share might be absorbed into Microsoft’s larger platform. The resulting market position of both companies will depend on the successful integration of Citrix’s products and services into Microsoft’s ecosystem.

This includes customer adoption rates and the competitive response from other companies.

Revenue Projections and Market Share Estimates

The following table provides estimated revenue projections and market share estimations for Microsoft and Citrix under various scenarios. These are not precise predictions but rather illustrative examples to highlight the potential impact of the deal.

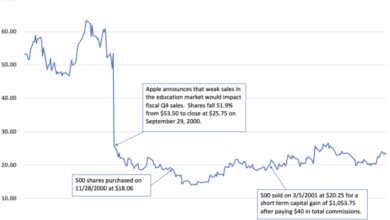

Microsoft and Citrix’s terminal server deal is certainly interesting, but it’s worth noting the parallel developments elsewhere in the tech world. For instance, the recent news of Apple and Motorola entering a mobile iTunes pact, apple and motorola enter mobile itunes pact , hints at a broader push for mobile device integration. Ultimately, though, the focus should return to the significant implications of the Microsoft Citrix deal, which could reshape the future of remote computing.

| Scenario | Microsoft Revenue Projection (USD Billions) | Citrix Revenue Projection (USD Billions) | Microsoft Market Share (%) | Citrix Market Share (%) |

|---|---|---|---|---|

| Base Case | 250 | 30 | 65% | 25% |

| Aggressive Integration | 270 | 15 | 70% | 10% |

| Competitive Response | 250 | 25 | 60% | 20% |

Note: Revenue projections and market share estimates are based on current market trends, expert opinions, and assumptions about successful integration. Actual outcomes may differ.

Technical Aspects of the Deal

The potential merger of Microsoft and Citrix presents a fascinating, albeit complex, technical landscape. Successfully integrating these two powerful platforms will require meticulous planning and execution to avoid disruptions to existing users and services. Key challenges include harmonizing disparate technologies, ensuring seamless transitions for customers, and maintaining the high performance standards expected from both companies.

Integration Challenges

The core technologies underpinning Microsoft and Citrix differ significantly. Microsoft’s focus on cloud-based solutions and its extensive Windows ecosystem contrasts with Citrix’s strengths in virtual desktop infrastructure (VDI) and application delivery. Harmonizing these approaches will necessitate a deep understanding of both platforms and careful consideration of how to leverage the strengths of each without compromising the core functionality of either.

This includes addressing potential compatibility issues between their respective APIs and programming models.

Migration Considerations

Migrating existing Citrix environments to Microsoft solutions presents a significant undertaking. Customers will need a comprehensive migration plan to ensure a smooth transition without impacting productivity or incurring excessive downtime. This includes assessing the specific Citrix infrastructure, identifying dependencies, and mapping them to corresponding Microsoft solutions. Careful consideration of data migration strategies is essential, and the impact of potential incompatibility between versions or components must be thoroughly evaluated.

Technical Specifications of Combined Products

The potential combined products from this merger are still largely hypothetical. However, it is possible to extrapolate based on the current strengths of each company. We can expect a unified platform that offers a seamless integration of cloud-based and on-premises solutions. The platform will likely offer a broad range of features, including advanced security, optimized performance, and expanded scalability.

Focus will be on a unified user experience regardless of the underlying infrastructure (cloud or on-premises). Specific technical specifications are still unknown, but we can anticipate that they will leverage the best elements from both platforms.

Compatibility and Potential Issues

| Feat

Microsoft and Citrix’s deal for terminal servers is a big win, especially for businesses needing remote work solutions. The need for faster, more reliable connections is crucial for smooth operations, which is why the work on higher speed WLAN standards is so important. This initiative will greatly benefit the already strong infrastructure created by the terminal server deal, ultimately leading to a better overall user experience for those utilizing remote access.

ure | Microsoft Solution | Citrix Solution | Compatibility Issues | Mitigation Strategies ||—|—|—|—|—|| VDI | Azure Virtual Desktop | Citrix Virtual Apps and Desktops | Differences in management tools, API interactions, and licensing models. | Comprehensive migration plans and a unified management console are necessary. || Application Delivery | Azure App Service, Azure App Configuration | Citrix SD-WAN, Citrix ADC | Differences in application packaging and deployment strategies, integration complexities.

| Standardization of deployment methods and development of bridging solutions will be required. || Security | Azure Active Directory, Azure Security Center | Citrix Secure Gateway, Citrix Workspace | Potential inconsistencies in security protocols, differences in authentication methods. | A unified security framework is essential to ensure seamless integration and interoperability. || Scalability | Azure’s global infrastructure | Citrix’s cloud-based solutions | Potential limitations in scalability of current solutions in specific regions | Cloud-based solutions should ensure scalability to address potential issues.

|

Regulatory and Legal Considerations

The Citrix-Microsoft deal, while promising significant synergies, inevitably raises critical regulatory and legal hurdles. Navigating these concerns is crucial for a successful transaction, ensuring compliance with existing laws and preventing potential conflicts. Thorough analysis and proactive strategies are essential to mitigate risks and ensure the deal proceeds smoothly.The potential for regulatory scrutiny and legal challenges stems from the significant market presence of both companies and the breadth of their respective product portfolios.

The deal’s impact on the competitive landscape requires careful consideration to avoid antitrust concerns. Understanding the relevant regulatory frameworks and potential legal ramifications is paramount to mitigating these risks.

Potential Regulatory Hurdles

The deal’s impact on the competitive landscape in the cloud computing and virtual desktop infrastructure (VDI) markets is a key concern. Regulatory bodies worldwide scrutinize mergers and acquisitions to ensure fair competition and prevent monopolies. Potential regulatory hurdles include challenges from competition authorities like the European Commission, the Federal Trade Commission (FTC) in the United States, and other national agencies.

These agencies may investigate potential anti-competitive effects, such as reduced innovation or higher prices for consumers. Previous examples, like the investigation into the proposed merger of AT&T and T-Mobile, highlight the scrutiny involved.

Legal Implications of the Deal

The legal implications extend beyond regulatory hurdles. Contractual obligations, intellectual property rights, and potential liability issues are all critical considerations. Potential disputes concerning data ownership, licensing agreements, and the handling of customer data must be addressed explicitly. These issues necessitate meticulous legal due diligence to ensure compliance and minimize potential risks.

Antitrust Concerns

Antitrust regulations are designed to prevent monopolies and promote competition. The deal’s potential impact on market share and competitive dynamics will be carefully examined. Relevant regulations, like the Clayton Act in the US and the European Union’s Merger Regulation, provide the framework for evaluating potential antitrust violations. The authorities will assess if the deal significantly reduces competition, potentially leading to higher prices or reduced innovation for customers.

Cases like the Microsoft-Activision Blizzard merger showcase the level of scrutiny under which such deals are analyzed.

Table of Possible Legal Challenges and Potential Resolutions

| Potential Legal Challenge | Potential Resolution |

|---|---|

| Antitrust concerns regarding market dominance | Demonstrating a clear competitive advantage that outweighs potential anti-competitive effects; providing commitments to maintain competition in specific markets; divestiture of certain assets or product lines. |

| Data privacy and security concerns | Implementing robust data security measures; providing clear and transparent data privacy policies; obtaining necessary approvals from relevant data protection authorities. |

| Intellectual property disputes | Conducting thorough intellectual property due diligence; obtaining necessary licenses and clearances; addressing potential conflicts and overlaps in patents or copyrights. |

| Regulatory approvals in multiple jurisdictions | Obtaining approvals from various competition authorities worldwide; addressing concerns and providing sufficient evidence to support the deal’s positive impact on competition in each jurisdiction. |

Customer Perspectives

The Citrix-Microsoft deal promises significant changes in the enterprise software landscape. Understanding how customers will react to this merger is crucial to predicting its long-term success. Customer sentiment and adoption will be influenced by various factors, including the perceived benefits, potential disruptions, and the overall impact on existing workflows. This section delves into potential customer reactions, focusing on existing and future implications for enterprise clients.

Potential Customer Reactions

Customer reactions to the deal will vary widely, driven by factors like existing technology investments, industry sector, and the specific needs of their IT infrastructure. Some customers may see this as a positive development, potentially offering cost savings and enhanced capabilities. Others may express concerns about potential disruptions to existing systems and support structures. Ultimately, the long-term success of the deal will hinge on effectively addressing these diverse perspectives.

Implications for Existing Customers

The deal will have substantial implications for both Citrix and Microsoft customers. Citrix customers will likely see a shift in their support structures and product roadmaps. Existing Citrix solutions may be integrated with Microsoft offerings, leading to potential enhancements or difficulties depending on how the integration is executed. Microsoft customers, on the other hand, may gain access to new capabilities and potentially more streamlined workflows.

Benefits and Drawbacks for Enterprise Clients

For enterprise clients, the deal presents both potential benefits and drawbacks. Potential benefits include increased interoperability between Microsoft and Citrix products, leading to more seamless workflows and potentially lower costs through a consolidated platform. Drawbacks could arise from the complexity of integrating disparate systems, potential disruptions to existing support structures, and the need for significant investments in training and re-tooling.

The degree of disruption will vary depending on the client’s current infrastructure and specific needs.

Customer Segment Analysis

Understanding how different customer segments will react is vital. This analysis highlights key concerns and advantages for various types of enterprises.

| Customer Segment | Key Concerns | Potential Advantages |

|---|---|---|

| Large Enterprises with Extensive Citrix Deployments | Potential disruption to existing systems, cost of migration, loss of familiar support structures, and compatibility issues between existing Citrix and new Microsoft products. | Potential for a consolidated platform, cost savings through economies of scale, enhanced capabilities from combined product offerings, and access to Microsoft’s wider ecosystem of tools and technologies. |

| Large Enterprises with Extensive Microsoft Deployments | Integration complexities, potential disruption to existing Microsoft systems, and the need to adapt to a new ecosystem. | Potential for enhanced interoperability with Citrix applications, access to Citrix’s robust remote work capabilities, and cost savings through a potentially more streamlined solution. |

| Mid-Sized Businesses | Uncertainty about the long-term support for Citrix products and the need to make significant investments to migrate or adapt to the combined platform. | Potential for more affordable solutions, access to a wider range of features, and streamlined operations. |

| Startups | Potential difficulty in navigating the integration complexities and limited resources for managing the change. | Access to a comprehensive platform with established support structures, potentially reducing IT complexity and increasing scalability. |

Competitive Landscape

The Citrix-Microsoft deal introduces a significant shift in the remote access solution landscape. Understanding the competitive dynamics is crucial to assessing the potential impact. This section delves into the key players, their strategies, and how this merger might reshape the market.

The Microsoft Citrix deal for terminal servers is definitely a big one, but it’s interesting to see how this ties into the broader landscape of enterprise software. For instance, the release of Great Plains 8.0, great plains 8 0 hits the street , shows the constant evolution of business solutions. This new release, along with the Citrix deal, likely signals a shift in how companies manage their IT infrastructure and applications.

It’s a busy time for the enterprise software market, and it’s exciting to see these developments.

Key Competitors

Several prominent players compete in the remote access space, each with unique strengths and weaknesses. Recognizing these competitors and their potential reactions to the deal is vital for predicting market changes. These companies often leverage different technologies and strategies, making their responses to the Citrix-Microsoft deal potentially varied.

- VMware: VMware, a major player in virtualization and cloud computing, offers a comprehensive suite of remote access solutions. Their extensive product portfolio and strong market presence make them a formidable competitor. VMware’s likely response to the deal will depend on their existing partnerships and future strategic goals.

- Amazon Web Services (AWS): AWS provides a robust cloud-based remote access platform. Their broad cloud infrastructure and scalability offer compelling advantages. AWS’s response may involve further development of their existing services or strategic partnerships to counter the combined strength of Citrix and Microsoft.

- Citrix (pre-merger): Prior to the merger, Citrix held a substantial market share in remote access solutions. Their experience and existing customer base offer a strong foundation. Post-merger, their competitive positioning may shift, possibly leading to an enhanced product offering.

- Other vendors: Other specialized vendors, such as those focused on specific industries or niche use cases, also play a role in this competitive landscape. Their responses to the deal will be influenced by their market position, financial resources, and technological capabilities.

Potential Competitive Responses

The Citrix-Microsoft deal may spark varied responses from competitors. Some might seek to strengthen their partnerships, while others might focus on expanding their product offerings or acquiring complementary companies.

- Strategic Partnerships: Competitors might forge alliances to counter the combined capabilities of Citrix and Microsoft. This could involve joint ventures or cross-selling agreements to expand market reach and product offerings.

- Product Enhancements: Competitors may respond by enhancing their current product offerings, adding features, or improving performance to maintain competitiveness.

- Aggressive Pricing Strategies: Price wars are a possibility, potentially creating an aggressive pricing environment to attract and retain customers. Such responses are not uncommon in highly competitive markets.

- Acquisitions: Competitors may consider acquisitions of smaller players to gain market share and technological advantages. This could be a swift response to the substantial deal.

Competitive Feature Comparison

A table comparing key features and capabilities of leading remote access solutions offers a concise view of the competitive landscape.

| Feature | VMware | AWS | Citrix (pre-merger) | Microsoft |

|---|---|---|---|---|

| Security | Robust encryption, multi-factor authentication | AWS security services integration | Advanced security protocols | Azure security features |

| Scalability | Adaptable to diverse environments | Scalable cloud infrastructure | Highly scalable, based on the cloud | Azure cloud scalability |

| Integration | Extensive integrations with other VMware products | Integration with AWS services | Strong integration with other Citrix solutions | Integration with Microsoft 365 |

| Cost | Variable, depending on the solution | Competitive pricing, pay-as-you-go | Typically subscription-based pricing | Variable, based on Azure usage |

Industry Impact

This deal between Microsoft and Citrix represents a significant shift in the enterprise computing landscape, potentially reshaping the IT industry’s future. The implications extend beyond the immediate players, affecting related sectors like cloud computing and impacting technology innovation in the long term. Understanding these broader effects is crucial for navigating the evolving tech environment.This analysis delves into the potential ripple effects of this merger, exploring its influence on the broader IT industry and related sectors.

It highlights potential opportunities and challenges, offering a comprehensive perspective on the deal’s transformative impact.

Potential Impact on Cloud Computing

The merger could lead to a convergence of cloud-based and on-premises computing solutions. Microsoft’s existing cloud infrastructure and Citrix’s expertise in virtual desktop infrastructure (VDI) will likely result in more integrated cloud-based virtual desktop solutions. This could foster new avenues for cloud service providers, as businesses seek more seamless transitions between on-premises and cloud environments. Furthermore, the combined resources might accelerate innovation in cloud-based security measures for virtual desktops, enhancing the security and reliability of remote work solutions.

Ripple Effects on Technology Innovation

The combination of Microsoft’s vast resources and Citrix’s specific expertise in VDI could accelerate innovation in remote work solutions. By combining their strengths, they might develop more efficient and secure virtual desktop environments, improving user experience and productivity in remote settings. Furthermore, this convergence might drive innovation in areas such as AI-powered automation within virtual environments, potentially boosting productivity and streamlining workflows for businesses.

For instance, advanced AI tools could automatically optimize virtual desktop performance based on user activity.

Industry-Wide Ramifications

The potential industry-wide ramifications of this merger are numerous and multifaceted. The combined strengths of Microsoft and Citrix could potentially reshape the competitive landscape in the virtual desktop and cloud computing industries, altering the way companies manage and utilize their IT resources.

| Area of Impact | Potential Ramifications |

|---|---|

| Virtual Desktop Infrastructure (VDI) | Increased integration of cloud-based VDI solutions, potentially leading to a more seamless and unified user experience. This could result in significant cost savings and improved efficiency for businesses. |

| Cloud Computing | Increased demand for hybrid cloud solutions, as companies seek to leverage both on-premises and cloud-based resources. This could lead to innovation in cloud-based security and management tools. |

| Remote Work | Further expansion of remote work capabilities, with more robust and secure virtual environments for employees. This could accelerate the shift toward a more distributed workforce. |

| Software as a Service (SaaS) | Potential for more integrated SaaS solutions within virtual desktop environments, enhancing productivity and collaboration. |

| Competition | Reshaping of the competitive landscape, as the combined entity potentially gains a significant market share and influence. |

Final Thoughts

The Microsoft Citrix seal terminal server deal, if finalized, could dramatically alter the remote work landscape. The potential benefits and drawbacks for users, market share shifts, and strategic implications for both companies are significant. However, regulatory hurdles and integration challenges will need careful consideration. The long-term impact on the IT industry and related sectors like cloud computing remains to be seen, but this deal undoubtedly marks a pivotal moment in the evolution of remote access solutions.