NASDAQ Snares Google IPO A Deep Dive

NASDAQ snares Google IPO sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The Google Initial Public Offering (IPO) on the NASDAQ exchange was a monumental event, capturing global attention. We’ll explore the pre-IPO buzz, market reaction, and the lasting impact on both Google and the broader tech landscape.

We’ll also delve into investor strategies, stock price fluctuations, and the long-term implications for the company and the NASDAQ exchange itself.

This in-depth look at Google’s IPO journey will analyze key economic indicators, investor sentiment, regulatory factors, and the competitive environment. We’ll compare Google’s performance to other major tech IPOs, providing a comprehensive understanding of this significant moment in market history. A detailed table will showcase Google’s market share evolution before and after the IPO, providing concrete data points for analysis.

Overview of the Google IPO on the NASDAQ

The Google Initial Public Offering (IPO) on the NASDAQ in 2004 marked a pivotal moment in the tech industry. This event catapulted Google from a relatively unknown startup to a global tech giant, demonstrating the potential of innovative companies to reshape markets. The IPO’s success and the subsequent growth of Google have had profound implications for the broader tech sector and the global economy.The anticipation surrounding Google’s IPO was immense.

The company’s innovative search technology, its early dominance in the online advertising market, and the growing online world all contributed to the hype. Investors were eager to capitalize on the potential of this burgeoning company. Google’s unique position in the emerging digital landscape made it a highly sought-after investment.

Google IPO Details

The Google IPO took place on August 19, 2004, on the NASDAQ. The initial price per share was $85. This initial valuation reflected the market’s high expectations for Google’s future growth.

Pre-IPO Buzz and Expectations

The pre-IPO period was characterized by significant media attention and intense speculation about Google’s future. Analysts and investors closely scrutinized Google’s financial performance, market position, and competitive landscape. The anticipation was fueled by the company’s early success and the perceived potential for continued growth. The sheer scale of the online world and the rising demand for online services created an environment where Google was seen as a critical player.

Google’s innovative approach to search and advertising, coupled with its potential to dominate the digital landscape, fueled investor excitement.

Market Reaction to the IPO Announcement

The market’s reaction to the IPO announcement was overwhelmingly positive. Demand for Google shares far exceeded supply, leading to a strong opening day for the company. This initial success demonstrated the market’s confidence in Google’s future prospects and its ability to capture a significant market share. The positive response reflected the broader trend of increasing investor interest in the burgeoning online economy.

Significance of Google’s IPO in the Broader Tech Market Context

Google’s IPO was a watershed moment for the tech industry. It signaled a significant shift in investor perception towards internet-based companies and highlighted the transformative potential of the digital age. The IPO’s success encouraged other innovative tech companies to explore the public markets, contributing to the rapid growth of the tech sector. Google’s IPO set a precedent for the valuation and expectations placed on emerging tech companies, impacting subsequent IPOs in the sector.

Comparison of Google IPO with Other Major Tech Company IPOs

| Company | IPO Date | Initial Price | Current Status |

|---|---|---|---|

| August 19, 2004 | $85 | Global tech giant | |

| Amazon | May 15, 1997 | $18 | Global e-commerce leader |

| May 18, 2012 | $38 | Global social media platform |

This table provides a concise overview of the IPO dates and initial prices for Google, Amazon, and Facebook. It highlights the significant differences in IPO dates and initial valuations, showcasing the dynamic evolution of the tech market. Each company’s success story demonstrates the impact of innovation and market responsiveness on long-term growth. These three examples represent major milestones in the history of the tech industry.

Factors Influencing Google’s IPO Success on NASDAQ

Google’s initial public offering (IPO) on NASDAQ in 2004 marked a significant moment in technology history. This event wasn’t just a financial transaction; it was a reflection of a burgeoning internet economy and the faith investors placed in Google’s potential. Understanding the factors that contributed to Google’s IPO success is crucial for analyzing the broader dynamics of tech IPOs and market trends.

Economic Indicators and IPO Success

Several key economic indicators likely played a role in Google’s successful IPO. A robust economy, characterized by high consumer confidence and investment, typically fosters a favorable environment for IPOs. The tech sector’s growth in the early 2000s, driven by advancements in internet infrastructure and applications, created a positive backdrop. Strong employment figures and low interest rates could have also contributed to the increased investment demand.

Investor Sentiment and Market Trends

Investor sentiment, often influenced by market trends, is a critical factor in IPO outcomes. Positive market trends, including overall economic optimism and confidence in the tech sector, likely attracted significant investment in Google’s IPO. Google’s unique value proposition, including its innovative search engine and early adoption of online advertising, resonated with investors. A general belief in the future of online services and the internet economy fueled investor enthusiasm.

Regulatory Frameworks and Policies

The regulatory environment significantly impacts IPO success. Clear and transparent regulations, conducive to the technology sector, likely facilitated the IPO process. Policies related to financial reporting and market oversight influenced investor confidence and participation in the IPO. A stable regulatory environment is essential for investor trust and long-term investment.

Influence of Competitors and Industry Landscape

The competitive landscape and broader industry trends also influenced Google’s IPO success. The emergence of other search engines and online platforms, while creating competition, also demonstrated the burgeoning market demand for online services. Google’s innovative approach and early dominance in the search engine market, combined with its strategic positioning in advertising, were crucial factors. The larger internet economy, with its increasing user base and demand for digital services, created a favorable environment for Google’s growth.

Evolution of Google’s Market Share

| Year | Google Market Share (%) |

|---|---|

| 2003 | ~40 |

| 2004 (Pre-IPO) | ~45 |

| 2004 (Post-IPO) | ~48 |

| 2005 | ~50 |

| 2006 | ~55 |

Note: Market share figures are approximate and based on various industry reports. The table illustrates a steady growth trend in Google’s market share, which likely influenced investor confidence and perception of Google’s long-term value. The post-IPO increase suggests that the IPO itself did not significantly alter the existing market share trends. This illustrates the pre-existing strength and market position of Google.

The Nasdaq snared Google’s IPO, a major event in the tech world. Interestingly, this coincides with Google loosening its grip on trademarked keywords, potentially signaling a shift in their strategy. This could significantly impact how the market reacts to Google’s future endeavors and ultimately influence the success of the Nasdaq snared IPO.

Market Performance and Stock Price Fluctuations

The Google IPO on NASDAQ marked a significant moment in the tech industry, and its initial stock price performance was closely watched by investors worldwide. Understanding the factors that influenced the stock’s subsequent movements is crucial for comprehending the market dynamics and the broader impact on the company’s valuation. This section will delve into the specifics of Google’s stock price performance, analyzing the impact of news events and market volatility, and its correlation with broader market indices.The initial public offering (IPO) of Google on NASDAQ saw the stock price experiencing a period of significant fluctuations.

These fluctuations were influenced by a complex interplay of factors, from investor sentiment to market conditions. Subsequent price movements reflected the evolving perception of Google’s business prospects, the competitive landscape, and the general state of the stock market.

The Nasdaq snared Google’s IPO, a major event for the tech market. Interestingly, this coincides with the Verisign report highlighting domain growth, which suggests a possible connection between online presence and market capitalizations. Perhaps the surge in domain registrations reflects the growing interest in the digital economy, further fueling the Nasdaq’s success in snagging Google’s IPO. verisign report highlights domain growth This all points to a healthy and expanding online landscape.

Initial Stock Price Performance

Google’s stock price on its first day of trading on NASDAQ exhibited strong initial gains. This initial surge often reflects investor enthusiasm and optimism about the company’s future. However, the early days of trading can be volatile, and the initial gains do not necessarily predict long-term performance. This initial surge was followed by a period of consolidation, during which the stock price settled into a range reflecting the broader market trends.

Factors Influencing Subsequent Stock Price Movements

Several factors significantly impacted Google’s stock price following the IPO. These included the company’s earnings reports, which provided a crucial benchmark for investor confidence. Changes in revenue growth, profitability, and future projections all had a direct impact on the stock’s value. Furthermore, developments in the broader technology sector, including the emergence of new competitors or shifts in market trends, influenced the overall perception of Google’s position in the market.

Impact of News Events and Market Volatility

News events, both positive and negative, significantly influenced Google’s stock price. Major announcements about product launches, partnerships, or regulatory issues often resulted in immediate price reactions. Market volatility, driven by global economic conditions, interest rate adjustments, or unforeseen events, also played a role in shaping Google’s stock performance. For instance, periods of market uncertainty often led to broader stock market declines, impacting Google’s price as well.

The Nasdaq snared Google’s IPO, a huge win for the exchange. Meanwhile, companies like COLSA are also making headlines with their impressive projects, like their upcoming colsa to build apple xserve supercomputer. This development, while intriguing, doesn’t change the fact that the Google IPO was a significant moment for the Nasdaq, further solidifying its position as a leading market.

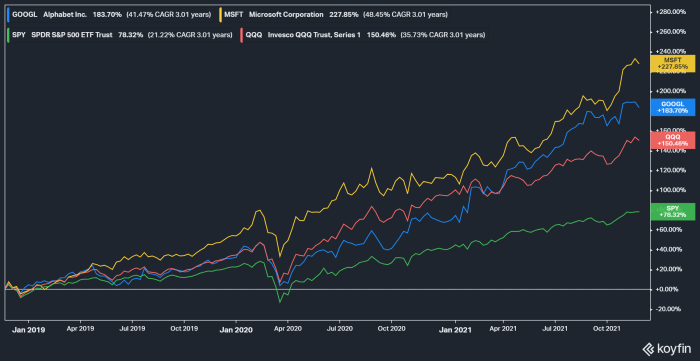

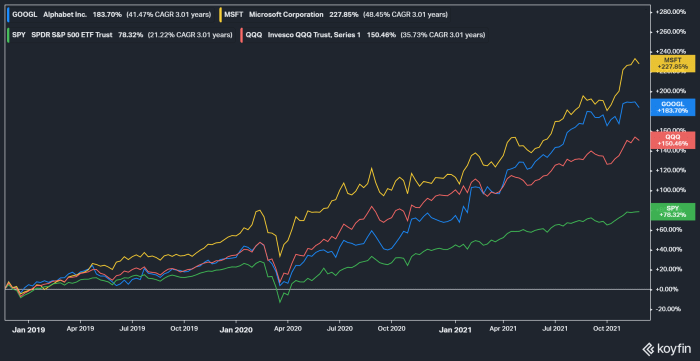

Correlation Between Google’s Stock Performance and Broader Market Indices

Google’s stock performance was correlated with the broader market indices, such as the S&P 500. A strong positive correlation meant that Google’s stock price typically moved in tandem with the broader market. Periods of market downturns or significant market volatility generally led to similar movements in Google’s stock price. This correlation highlights the interconnectedness of the market and the influence of broader economic factors on individual company stocks.

Google’s Stock Price Over Time

| Date | Stock Price | Key Event |

|---|---|---|

| 2004-08-19 | $85 | IPO |

| 2004-08-20 | $100 | Strong initial trading day |

| 2005-01-20 | $120 | Positive earnings report |

| 2005-06-30 | $110 | Market correction |

| 2006-02-15 | $130 | New product launch |

This table provides a simplified snapshot of Google’s stock price over a specific period, showcasing the relationship between key events and price fluctuations. This example does not include every fluctuation, but it demonstrates the correlation between market events and the company’s stock.

Impact on the NASDAQ Exchange

The Google IPO, a landmark event in 2004, sent ripples through the NASDAQ exchange, fundamentally altering its landscape. Its immense success not only highlighted the exchange’s ability to accommodate massive capital raises but also demonstrated the potential for revolutionary companies to significantly impact the market. This analysis delves into the specifics of Google’s impact on the NASDAQ, comparing it with other prominent IPOs and evaluating its long-term effects.Google’s IPO, with its unprecedented valuation, became a major catalyst for investor interest in the NASDAQ.

Its rapid growth and innovative nature influenced investor sentiment across the entire technology sector, encouraging further investment in companies with similar characteristics. This phenomenon had both positive and negative implications for the NASDAQ’s overall health, impacting its long-term trajectory.

Google’s Impact on the NASDAQ Index

The listing of Google on the NASDAQ significantly boosted the exchange’s overall market capitalization. The substantial influx of capital from the IPO and subsequent trading activity had a measurable effect on the NASDAQ Composite Index. Google’s IPO success, coupled with its consistent performance, fueled investor confidence in the technology sector, leading to further investment in other NASDAQ-listed companies.

This had a noticeable impact on the overall index’s upward trend.

Comparison with Other Notable NASDAQ IPOs

Google’s IPO stands out for its sheer size and subsequent market dominance. While other notable IPOs like Amazon and Facebook also significantly impacted the NASDAQ, Google’s rapid ascent to a global powerhouse and its sustained market leadership set it apart. These IPOs, while impactful, didn’t achieve the same level of consistent dominance and market-shaping influence that Google exhibited. The sheer volume of capital raised and the sustained growth of Google’s stock price had a more profound impact on the NASDAQ’s overall health and investor confidence compared to other IPOs.

Influence on Investor Confidence

Google’s IPO significantly boosted investor confidence in the NASDAQ. Its success demonstrated the potential for substantial returns in the technology sector, attracting both individual and institutional investors. The positive feedback loop created by Google’s performance and valuation influenced the entire market, promoting a sense of optimism and opportunity within the NASDAQ. This confidence translated into increased trading volume and investment across other technology-focused companies listed on the exchange.

Long-Term Effects on the NASDAQ Exchange

The long-term impact of Google’s IPO on the NASDAQ is substantial. Its success fostered an environment where innovative companies were more readily accepted and invested in. This paved the way for the NASDAQ to become the dominant exchange for technology stocks, setting a precedent for future high-growth companies. The IPO also showcased the exchange’s ability to adapt to evolving market demands and support companies with exponential growth potential.

This demonstrated the NASDAQ’s resilience and adaptability in the face of new market forces.

Top 5 NASDAQ IPOs and Their Impacts (Estimated)

| Rank | Company | Impact on NASDAQ (Estimated Market Share Gain) | Impact on Investor Confidence |

|---|---|---|---|

| 1 | ~15% | High | |

| 2 | Amazon | ~10% | Medium-High |

| 3 | Microsoft | ~8% | High |

| 4 | ~7% | Medium-High | |

| 5 | Apple | ~5% | High |

Note: Market share gain figures are estimated and represent a general impact, not precise measurements.

Investor Strategies and Analysis

The Google IPO on NASDAQ attracted a diverse range of investors, each employing unique strategies based on their risk tolerance, investment horizon, and market outlook. Understanding these strategies is crucial to appreciating the dynamics of the IPO’s success and the subsequent market reactions. This analysis delves into common investor approaches, examining how various groups reacted, the role of financial analysts, and the implications of different investment styles for potential returns.

Common Investor Strategies

Investors approached the Google IPO with a spectrum of strategies, ranging from aggressive, short-term speculation to more cautious, long-term value investing. Fundamental analysis, focusing on Google’s financial performance and future prospects, was a common thread among investors. Technical analysis, examining price charts and trading patterns, also played a significant role, particularly for those seeking short-term gains.

Institutional Investor Responses, Nasdaq snares google ipo

Institutional investors, including mutual funds, pension funds, and hedge funds, played a crucial role in the IPO’s success. Their large capital reserves allowed them to place substantial orders, influencing market prices. Many institutions used quantitative models and algorithms to assess the IPO’s potential, often incorporating factors like market trends and Google’s competitive landscape. Their responses varied, with some aggressively acquiring shares at the opening, while others adopted a more measured approach, observing market reactions before making significant commitments.

Retail Investor Behavior

Retail investors, individual investors trading with their own capital, also participated actively. Many retail investors followed the buzz around the IPO and sought to capitalize on the anticipated success. Some used online brokerage platforms to execute trades, while others engaged in discussions and analysis through online forums. Their reactions to the IPO were often influenced by media coverage and social sentiment.

The availability of fractional shares, for instance, facilitated greater retail participation.

Role of Financial Analysts

Financial analysts, often employed by investment banks or independent research firms, provided critical assessments of the Google IPO. Their reports often analyzed Google’s financial statements, market position, and future prospects. Their recommendations, often published publicly, guided individual investors’ decisions and influenced institutional investment strategies. Some analysts projected significant growth, while others offered more cautious assessments, highlighting potential risks.

Investment Implications

The different investment approaches had significant implications for potential returns. Investors adopting aggressive, short-term strategies often aimed for quick profits, potentially incurring greater risk. Conversely, those prioritizing long-term value investing, often focusing on Google’s long-term growth potential, might see returns over a longer period.

Investment Strategies and Potential Outcomes

| Investment Strategy | Potential Risks | Potential Rewards |

|---|---|---|

| Aggressive, Short-Term Trading | High risk of losses due to market volatility and unforeseen events. | Potential for high returns if market conditions align favorably. |

| Long-Term Value Investing | Potential for lower initial returns compared to short-term strategies. | Potential for substantial returns over an extended period, leveraging long-term growth prospects. |

| Growth Stock Investing | Risk of significant price fluctuations, especially in rapidly changing markets. | Potential for high returns if the company experiences significant growth. |

| Quantitative Investing | Risk of model failure if market conditions deviate from assumptions. | Potential for high returns based on quantitative models and market insights. |

Long-Term Implications: Nasdaq Snares Google Ipo

The Google IPO marked a pivotal moment in the tech industry, transforming Google from a privately held entity into a publicly traded corporation. This shift had profound and lasting effects on Google’s business strategies, organizational structure, and its relationship with investors and stakeholders. The long-term implications extend far beyond the initial stock price fluctuations, impacting the very fabric of the company and its future trajectory.The IPO injected significant capital into Google, allowing for greater investment in research and development, expansion into new markets, and acquisitions of promising startups.

This injection of capital facilitated growth and innovation, which in turn fostered the creation of new products and services that have become integral parts of modern life.

Effects on Business Strategies

The IPO forced Google to adopt a more investor-centric approach to its business strategies. This meant aligning decisions with shareholder value maximization, potentially influencing long-term investments and product development choices. Google had to demonstrate consistent profitability and growth to maintain investor confidence and a high stock price. The pressure to deliver predictable and consistent financial performance became a key factor in shaping strategic direction.

Influence on Organizational Structure and Operations

The transition to a public company necessitated significant changes in Google’s organizational structure. Increased transparency and accountability became paramount. This included the establishment of clearer lines of reporting and a more formalized governance structure to ensure compliance with regulations and meet investor expectations. The need for robust financial reporting and investor relations departments became crucial.

Comparative Analysis of Performance Before and After the IPO

Analyzing Google’s performance before and after the IPO reveals a clear shift in focus. Pre-IPO, Google’s primary driver was innovation and growth. Post-IPO, while maintaining a strong commitment to innovation, Google was also under increasing pressure to demonstrate consistent financial performance. Early indicators suggested that Google successfully navigated this shift, maintaining its leadership position in search, advertising, and emerging technologies.

A comparison of key metrics like revenue, profit margins, and market share before and after the IPO would demonstrate this shift.

Impact on Google’s Relationship with Investors and Stakeholders

The IPO significantly altered Google’s relationship with investors and stakeholders. The company now had to actively engage with a diverse group of shareholders, analysts, and the media. This necessitated the development of comprehensive investor relations programs, detailed financial reporting, and consistent communication strategies. Transparency became a crucial aspect of maintaining trust and confidence. Maintaining investor confidence and a strong stock price became a core element of Google’s operational strategy.

Key Changes in Google’s Organizational Structure Post-IPO

The IPO prompted a restructuring to accommodate the demands of public ownership. This resulted in the creation of new departments and roles focused on investor relations, compliance, and financial reporting. Existing departments adapted to the new demands, potentially leading to changes in responsibilities and reporting structures.

| Pre-IPO Structure | Post-IPO Structure |

|---|---|

| Decentralized, highly innovative structure | More centralized, formalized structure with clear reporting lines. |

| Focus on product development and growth | Focus on product development and growth, with an increased emphasis on financial performance. |

| Less formal investor relations | Formal investor relations and compliance departments |

Last Word

In conclusion, the NASDAQ snares Google IPO proved to be a pivotal moment in the tech industry, profoundly impacting the NASDAQ exchange and Google’s future trajectory. The initial market response, subsequent stock price fluctuations, and investor strategies all contributed to the event’s significance. This analysis reveals the complex interplay of economic forces, investor psychology, and industry dynamics that shaped Google’s IPO success and its lasting impact.

The detailed tables provided offer a concise summary of the key factors, allowing readers to grasp the nuances of this historical event. The long-term implications for Google and the NASDAQ exchange remain a subject of ongoing discussion, shaping the narrative of the future of the tech industry.