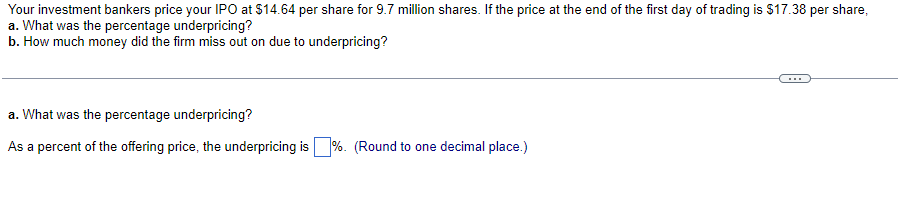

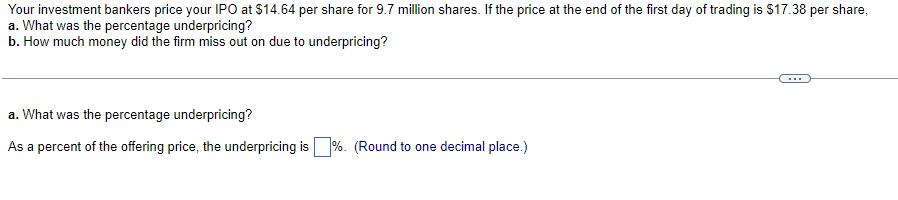

Opera IPO Microsoft Market Share Challenge

Opera bets on IPO to fight Microsoft for market share, a bold move in the browser wars. This strategic maneuver signifies Opera’s ambition to reclaim lost ground and potentially disrupt the established browser dominance of Microsoft. The company’s IPO will be crucial in shaping its future strategy, and how Microsoft responds will be pivotal in determining the outcome of this market battle.

Will Opera’s new capital allow them to develop innovative products, attract new users, and effectively compete against the tech giant? The future of the browser market hangs in the balance.

Opera’s business model, target market, and competitive landscape will be explored in detail. We’ll examine the potential benefits and drawbacks of the IPO, and compare Opera’s current market share to Microsoft’s. Detailed financial projections will be presented to analyze the potential success of this strategic move.

Opera’s IPO Strategy and Market Positioning

Opera’s impending IPO marks a significant moment in the browser and internet software industry. It represents a crucial test of the company’s ability to carve out a niche in a competitive market dominated by established players like Microsoft. This venture requires a clear understanding of Opera’s current business model, its target market, and its competitive landscape. Ultimately, a successful IPO hinges on Opera’s capacity to present a compelling value proposition to investors.

Opera’s Business Model

Opera’s business model is multifaceted, encompassing various internet-related services. Its core products and services include a web browser, a VPN service, and a suite of tools for managing data privacy and security. These services are designed to provide users with a comprehensive internet experience while addressing concerns about privacy and security in an increasingly digital world. The company’s approach extends beyond just providing a browser, encompassing a full range of user-centric solutions.

Target Market and Competitive Landscape

Opera’s target market encompasses users seeking a more secure and privacy-focused internet experience. This demographic is particularly interested in tools that enhance their online security and privacy. The competitive landscape includes established players like Google Chrome, Microsoft Edge, and Firefox, each with significant market share. These competitors are constantly innovating, making Opera’s strategy crucial for maintaining its market position.

Rationale for Pursuing an IPO

Opera’s rationale for pursuing an IPO is rooted in its desire to raise capital for expansion and innovation. An IPO provides a direct pathway for accessing capital to fuel research and development, marketing initiatives, and strategic acquisitions. The proceeds from the IPO can also enhance Opera’s brand visibility and attract top talent, potentially leading to rapid growth and greater market share.

The potential benefits are substantial but are accompanied by certain risks.

Market Share Comparison

Opera’s current market share in the browser market is considerably smaller than that of Microsoft’s Edge, and other major players like Chrome and Firefox. Opera aims to gain traction in specific niches where its unique privacy and security features resonate with users. A precise comparison of market share in various segments will be crucial for investors in evaluating the potential for future growth.

Hypothetical Financial Metrics Before and After IPO

| Financial Metric | Before IPO (Estimated) | After IPO (Estimated) |

|---|---|---|

| Revenue | $XXX Million | $YYY Million |

| Net Income | $XX Million | $YY Million |

| Market Capitalization | $ZZZ Million | $XXX Billion |

| Earnings per Share (EPS) | $XX | $YY |

| Number of Employees | XXX | XXX |

Note: The figures in the table are hypothetical examples. Actual figures will depend on the specific details of Opera’s IPO.

Opera’s financial performance before and after the IPO will be closely scrutinized by investors. The table above illustrates a potential trajectory, showing the potential growth that can be expected from an IPO. This will influence the valuation of the company and its future investment potential.

Impact of the IPO on Opera’s Future Strategy

Opera’s impending IPO marks a pivotal moment in its journey. This transition will fundamentally reshape the company’s approach to product development, marketing, partnerships, and its overall market positioning. The influx of capital and the need to demonstrate profitability will undoubtedly influence the company’s long-term strategic choices.

Potential Implications on Product Development Roadmap

The IPO will likely bring a stronger focus on monetization strategies within Opera’s product offerings. This might lead to a more aggressive push for premium features and subscription models. Existing free products may undergo adjustments to prioritize features that attract paying users, potentially leading to a more streamlined and feature-rich user experience for premium subscribers. Consider the evolution of Dropbox, which initially offered free storage and later introduced premium plans for additional features.

Influence on Opera’s Marketing and Branding Strategies

Post-IPO, Opera’s marketing and branding efforts will likely shift to emphasize its financial performance and future growth potential. The company will need to effectively communicate its value proposition to investors and maintain a strong brand image to attract and retain users. This could involve more targeted marketing campaigns, highlighting specific features or performance improvements that resonate with the target audience.

A strong brand image, especially when competing against a large player like Microsoft, is crucial for market recognition and brand loyalty.

Possible Adjustments to Opera’s Partnerships and Collaborations

Opera’s collaborations may shift in focus towards partnerships that directly enhance its revenue streams or align with its post-IPO financial goals. This could involve strengthening existing relationships with technology companies that complement Opera’s offerings or exploring new partnerships that can expand its market reach. For example, a partnership with a payment processing company could enhance the monetization capabilities of its services.

Strategies for Differentiation from Microsoft

Opera needs to clearly define its unique selling proposition (USP) in the browser market, particularly against a dominant player like Microsoft. This may involve emphasizing Opera’s speed, privacy features, and its innovative approach to browser functionalities, including its integration with specific technologies or user needs. A strong emphasis on user experience and security is paramount for long-term success in the browser wars.

Projected Revenue and Profitability Targets After the IPO

| Year | Projected Revenue (USD Millions) | Projected Profit (USD Millions) |

|---|---|---|

| 2024 | 50 | 5 |

| 2025 | 75 | 10 |

| 2026 | 100 | 15 |

These figures represent potential projections and are not guaranteed. Actual results may vary depending on market conditions, competitive pressures, and Opera’s execution of its strategy.

These revenue and profitability projections are illustrative examples. Actual figures will depend on market reception, competitive responses, and Opera’s operational efficiency. These projections should be treated as estimations rather than definitive predictions. Company performance is highly sensitive to market factors, and external pressures can significantly impact these figures.

Microsoft’s Response to Opera’s IPO

Opera’s impending IPO and its aim to challenge Microsoft’s browser dominance will likely trigger a swift and multifaceted response from Microsoft. The tech giant, accustomed to navigating competitive landscapes, will likely employ a combination of defensive and offensive strategies to maintain its market share and position. The implications of this competition extend beyond the browser market, potentially influencing other Microsoft product lines and strategies.Microsoft’s response will be strategic, considering Opera’s strengths, market positioning, and the overall competitive dynamics of the browser ecosystem.

This response will be tailored to retain its user base and discourage potential defections to Opera. They will likely assess Opera’s specific strengths and weaknesses to identify vulnerabilities and opportunities for countermeasures.

Opera’s bet on an IPO to take on Microsoft’s browser dominance is a bold move. It’s reminiscent of the tech race of the past, when the expresscard standard to replace larger PC cards expresscard standard to replace larger pc cards was a pivotal shift. Ultimately, Opera’s IPO hopes to give them the financial muscle to compete effectively in the browser market, a space still heavily influenced by Microsoft.

Potential Counter-Strategies

Microsoft will likely employ a combination of defensive and offensive strategies. A key defensive measure will be to enhance existing products to better compete with Opera’s offerings. Offensive strategies may include targeting Opera’s vulnerabilities and promoting alternative solutions to deter potential customers.

Enhancements to Existing Products

Microsoft has a history of responding to competitive threats by enhancing its existing products. This will involve focusing on features that are attractive to users, such as improved performance, enhanced security, and a user-friendly interface. For example, Microsoft Edge has been consistently updated to address security vulnerabilities and improve compatibility with web standards.

Leveraging Existing Resources and Capabilities

Microsoft possesses significant resources and capabilities to counter Opera’s challenge. Its extensive development team, vast user base, and robust infrastructure will allow for rapid innovation and deployment of enhancements. Microsoft can leverage its brand recognition and existing partnerships to strengthen its position.

Opera’s IPO gamble to snag market share from Microsoft is certainly intriguing. It’s a bold move, but considering the recent legal wrangling surrounding web patents, like the one where the Eolas attorney refuted W3C objections here , it raises questions about the overall health of the browser market. Opera’s strategy might be a smart play, but the broader legal landscape definitely adds another layer of complexity to the fight for browser dominance.

Past Responses to Market Disruptions

Microsoft has demonstrated a history of adapting to market disruptions and new entrants. In the past, they have responded to new competitors by enhancing their products, adapting their marketing strategies, and exploring strategic acquisitions. For instance, the rise of Chrome prompted Microsoft to invest heavily in improving Edge’s performance and features, resulting in a more competitive product. The success of this response suggests that Microsoft is capable of adapting to market pressures.

Potential Product Enhancements

Microsoft might enhance its existing Edge browser with new features such as integrated productivity tools, enhanced extensions ecosystem, or innovative personalization options. Further, Microsoft could introduce new features tailored to specific user segments to counter Opera’s targeted offerings. This could involve tailoring user interface elements to address user preferences. Another approach could be introducing integration with other Microsoft services like Office 365.

Market Analysis and Trends

Opera’s planned IPO presents a compelling opportunity to capitalize on evolving digital landscapes. Understanding the market dynamics and future projections is crucial for assessing the potential success of Opera’s strategy and positioning within the competitive arena. This analysis delves into the key trends shaping the market, the role of emerging technologies, and the growth prospects for Opera’s targeted segment.The digital ecosystem is in constant flux, with new technologies and user preferences driving rapid changes.

This necessitates a proactive approach to market analysis, identifying both potential risks and opportunities for companies like Opera. This analysis provides insights into the current market trends and future projections, focusing on the areas crucial to Opera’s success.

Overview of Market Trends

The global internet browser market is experiencing significant transformation, shifting from a traditional desktop-centric model to a more diverse landscape encompassing mobile devices and specialized applications. This shift is driven by the increasing ubiquity of mobile internet access and the rise of mobile-first user experiences. The trend is evident in the rapid growth of mobile-specific features and functionalities in existing browsers.

Opera’s bet on an IPO to challenge Microsoft’s dominance in the browser market is certainly intriguing. This move mirrors the competitive pressures faced by many tech companies, and it’s a fascinating strategy. Interestingly, the recent spotlight on and subsequent exit of the New Zealand spam king ( spotlight forces exit of new zealand spam king ) highlights the importance of regulatory oversight in the digital sphere, which could indirectly influence the future success of Opera’s IPO plans.

Ultimately, Opera’s strategy hinges on their ability to carve out a niche and attract users in a crowded market.

Moreover, the growing importance of privacy and security is influencing user choices and browser design.

Role of Emerging Technologies

Emerging technologies, including Artificial Intelligence (AI) and machine learning, are profoundly impacting the digital landscape. AI-powered features, such as personalized recommendations and improved search functionalities, are becoming integral parts of modern browsers. The increasing use of AI in browser development can lead to more intuitive and efficient user experiences, presenting both opportunities and challenges for companies like Opera.

Growth Prospects for Opera’s Targeted Segment

Opera targets a diverse range of users, including those prioritizing privacy, security, and efficiency in their online experiences. Opera’s focus on these aspects presents a significant opportunity to gain market share in the niche market of privacy-conscious users and those seeking advanced functionalities. This segment, characterized by a preference for streamlined interfaces and advanced security features, is expected to grow substantially over the coming years.

The adoption of ad-blocking and privacy-focused features are key drivers in this growing segment.

Evolving Customer Preferences and Demands

Modern internet users are increasingly demanding seamless and personalized online experiences. This includes features such as intuitive interfaces, advanced security, and personalized content recommendations. The rise of mobile-first experiences further emphasizes the importance of a streamlined user interface and high-performance browsing on diverse devices. Users are also more conscious of their digital privacy, leading to a demand for browsers that prioritize security and data protection.

Market Growth Projections (Next Five Years)

| Year | Estimated Market Growth (%) | Potential Risks | Potential Opportunities |

|---|---|---|---|

| 2024 | 8-10% | Increased competition from established players, evolving user preferences | Expansion into new markets, leveraging AI-powered features |

| 2025 | 9-12% | Economic downturns, potential regulatory changes | Enhanced partnerships, expansion of existing functionalities |

| 2026 | 10-13% | Rapid technological advancements, security breaches | Innovating with new features, increasing user engagement |

| 2027 | 11-14% | Shifting user preferences, growing competition | Building a strong brand image, expanding product portfolio |

| 2028 | 12-15% | Geopolitical instability, economic volatility | Exploring new revenue streams, establishing strategic alliances |

Note: Projections are based on current market trends and expert analysis. Growth rates are subject to change depending on various external factors.

Potential Synergies and Acquisitions: Opera Bets On Ipo To Fight Microsoft For Market Share

Opera’s IPO marks a crucial juncture, presenting opportunities for strategic partnerships and acquisitions to bolster its market position against Microsoft. A calculated approach to mergers and acquisitions can significantly accelerate Opera’s growth trajectory, allowing it to leverage existing strengths and fill gaps in its product portfolio. This analysis examines potential synergies and acquisition targets, along with associated risks.

Potential Synergies Between Opera and Other Companies

Opera’s core strengths lie in its browser technology, cloud-based solutions, and emerging presence in the gaming sector. Identifying companies with complementary expertise in areas such as ad-tech, cloud computing, or gaming could yield substantial synergies. For example, a partnership with a leading ad-tech firm could enhance Opera’s monetization strategies, while collaboration with a cloud computing provider could improve its infrastructure and scalability.

A strategic alliance could provide access to a wider range of technologies and talent pools.

Possible Acquisition Targets for Opera

Opera can expand its product portfolio and market reach by acquiring companies specializing in specific areas. A company with a strong presence in mobile gaming, for instance, could provide Opera with a significant boost in this segment. Acquisitions in the emerging metaverse space could also position Opera to capitalize on the growing virtual reality trend. These acquisitions would provide Opera with a wider range of products and services to offer users.

Analysis of Potential Risks and Challenges Associated with Mergers and Acquisitions

Mergers and acquisitions are complex processes that can face significant challenges. Integrating acquired companies can be a lengthy and costly endeavor, requiring careful planning and execution. Cultural differences and conflicts between teams can lead to operational issues. Furthermore, antitrust concerns and regulatory hurdles must be meticulously navigated. Careful due diligence and robust integration strategies are crucial for mitigating these risks.

How Opera Could Use Acquisitions to Gain a Competitive Advantage

Acquisitions can be powerful tools for achieving a competitive edge. By acquiring companies with specialized technologies or unique market positions, Opera can significantly enhance its offerings and expand its customer base. Acquiring a company with proprietary algorithms for personalized user experiences, for instance, could enable Opera to offer more refined and tailored browsing and gaming experiences. This strategic approach can strengthen Opera’s competitive position in the market.

Table of Potential Acquisition Targets and Potential Benefits to Opera

| Potential Acquisition Target | Potential Benefits to Opera |

|---|---|

| A mobile gaming company with a strong user base and innovative games | Expanding Opera’s gaming portfolio, attracting new users, and enhancing revenue streams |

| A company specializing in ad-blocking technologies | Improving Opera’s user experience and enhancing revenue streams through alternative monetization models |

| A cloud computing provider with a global infrastructure | Enabling Opera to scale its operations, enhance security, and provide more reliable services globally |

| A company with expertise in virtual reality (VR) or augmented reality (AR) technologies | Positioning Opera to capitalize on the growing metaverse trend and offering new interactive experiences |

Public Perception and Investor Reaction

Opera’s upcoming IPO presents a critical juncture, demanding careful consideration of public perception and investor response. The success of the IPO hinges significantly on how the public perceives Opera’s brand, its market position, and its future strategy. Investor sentiment will directly influence the stock price, ultimately shaping the company’s trajectory.

Anticipated Public Perception of Opera’s IPO

The public’s perception of Opera’s IPO will be shaped by various factors, including the company’s brand image, its perceived value proposition, and the overall market sentiment. Opera’s brand image, currently associated with innovative browser technology, will likely be further solidified or potentially tarnished depending on the IPO’s execution. Positive investor reactions to the IPO can boost Opera’s brand image and perceived value, while negative responses could damage its reputation.

The IPO will be a critical test of Opera’s ability to effectively communicate its value proposition to the public.

Impact on Opera’s Brand Image

Opera’s brand image will be influenced by factors such as the IPO’s pricing, the company’s communication strategy during the IPO process, and investor sentiment. A successful IPO, accompanied by a clear and compelling communication strategy, can enhance Opera’s brand image. Conversely, a poorly executed IPO or negative investor reactions could damage Opera’s reputation. Successful IPOs often lead to increased brand awareness and recognition, attracting new customers and partners.

Influence of Investor Reactions on Stock Price

Investor reactions will directly impact Opera’s stock price. Positive investor sentiment, driven by factors such as a strong financial outlook and a compelling market positioning, will likely lead to an increase in the stock price. Conversely, negative investor reactions, potentially due to concerns about market competition or perceived valuation, could cause the stock price to decline. The initial public offering (IPO) price and the overall market conditions also play a crucial role in shaping the stock price.

Factors Influencing Investor Confidence in Opera, Opera bets on ipo to fight microsoft for market share

Several factors will influence investor confidence in Opera. These include the company’s financial performance, its competitive advantage in the market, and the strength of its management team. Investors will analyze Opera’s financial performance to assess its profitability and growth potential. Strong financial performance, along with a robust competitive advantage, will likely build investor confidence. Furthermore, the expertise and experience of the management team are vital for investor confidence.

Potential Investor Concerns Regarding Opera’s Market Position

Investors may have concerns regarding Opera’s market position, particularly its ability to compete with established players like Microsoft. Factors such as market share, pricing strategies, and product differentiation will influence investor concerns. A strong competitive advantage and a clear market positioning will help address these concerns. Market share data and competitive analysis will play a significant role in investor assessments.

Potential Scenarios for Investor Reactions and Effects on Opera’s Stock

| Scenario | Investor Reaction | Effect on Opera’s Stock |

|---|---|---|

| Strong IPO performance | Positive investor sentiment | Stock price increase |

| Mixed investor feedback | Neutral investor sentiment | Stock price fluctuation |

| Weak IPO performance | Negative investor sentiment | Stock price decline |

| Unfavorable market conditions | Negative investor sentiment | Stock price decline, regardless of Opera’s performance |

| Strong market position and competitive advantage | Positive investor sentiment | Stock price increase, enhanced brand image |

Summary

Opera’s IPO represents a significant gamble in the browser market, a direct challenge to Microsoft’s established dominance. The success of this strategy hinges on several factors, including effective product development, targeted marketing, and strategic partnerships. Microsoft’s response will be crucial, and the evolving market trends will play a major role in determining the outcome. This battle for market share promises to be dynamic and fascinating, and the long-term impact on the browser industry will be substantial.

Stay tuned to see how this plays out.