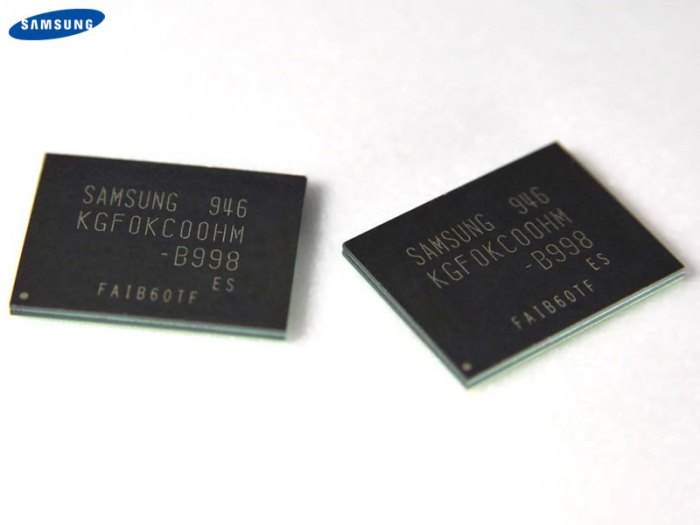

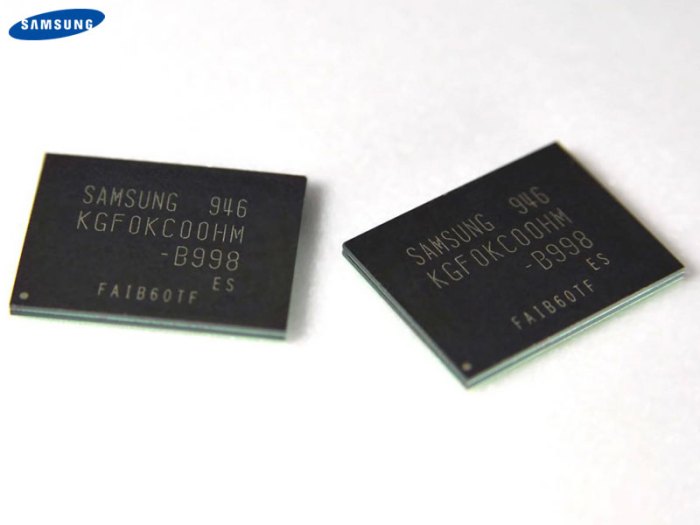

Samsung to Mass Produce High-Density NAND Flash Memory Devices

Samsung to mass produce high density nand flash memory devices, signaling a significant shift in the semiconductor market. This move promises to dramatically increase the density and capacity of storage solutions, impacting everything from smartphones to data centers. The implications for pricing, availability, and the competitive landscape are substantial, and this article dives deep into the factors driving this decision, the technological advancements involved, and the potential consequences for the industry as a whole.

The current semiconductor market is characterized by intense competition, with Samsung facing off against established rivals. This article will explore the technological advancements that have enabled the production of higher-density NAND flash memory, examining the production processes and infrastructure required to support this mass production initiative. A crucial aspect will be evaluating Samsung’s production capacity relative to its competitors and the potential impact on the global supply chain.

We’ll also consider the financial implications for Samsung and the overall economic impact on the global economy.

Market Overview

The semiconductor industry is experiencing a period of rapid transformation, driven by the insatiable demand for high-performance computing and connectivity. This dynamic environment is particularly evident in the NAND flash memory market, where the need for ever-increasing storage capacity is fueling a constant push for innovation and higher density. Samsung, a key player in this arena, is poised to capitalize on these trends.

Current Semiconductor Market Trends

The semiconductor market is characterized by fluctuating demand, driven by economic cycles and technological advancements. Mobile devices, data centers, and artificial intelligence are major drivers of demand for memory chips, including NAND flash. These sectors rely heavily on high-density storage for processing, storage, and transfer of massive datasets. Emerging technologies like the Internet of Things (IoT) and edge computing further amplify the need for readily available and affordable storage solutions.

Competitive Landscape of NAND Flash Memory Production

The NAND flash memory market is highly competitive, with established players like Samsung, SK Hynix, and Micron vying for market share. This intense competition necessitates continuous investment in research and development to maintain and improve production efficiency, technological advancements, and cost effectiveness. Differentiation is achieved through proprietary manufacturing processes, advanced materials, and superior yields.

Projected Growth and Demand for High-Density NAND Flash Memory

The demand for high-density NAND flash memory is projected to surge in the coming years. The increasing storage needs of data centers, mobile devices, and cloud services are significant drivers. Data generation and consumption are growing exponentially, and high-density NAND flash memory is essential to manage this increasing data volume. Examples of this include the ever-increasing storage capacity of smartphones and the need for more efficient storage in data centers supporting cloud services.

Role of Samsung in the Current Market

Samsung plays a crucial role in the NAND flash memory market. Its significant market share stems from its advanced manufacturing capabilities, extensive research and development investments, and strategic partnerships. Samsung’s commitment to innovation is essential to meeting the evolving needs of the market. The company is often a frontrunner in adopting new technologies and scaling up production for high-density NAND flash.

Major Competitors and Market Shares

| Competitor | Estimated Market Share (approximate %) |

|---|---|

| Samsung | ~30% |

| SK Hynix | ~25% |

| Micron | ~20% |

| Other Manufacturers | ~25% |

Note: Market share figures are approximate and can vary depending on the reporting period and methodology used.

Technological Advancements

The quest for higher density in NAND flash memory is a continuous evolution driven by the insatiable demand for more storage capacity in portable devices, servers, and data centers. This relentless pursuit necessitates constant innovation in materials, fabrication processes, and architectural designs. The advancements in these areas are fundamentally altering the way we interact with and store information.The relentless pursuit of higher density in NAND flash memory necessitates a profound understanding of the underlying technological advancements.

Different architectures, production processes, and scaling trends all play critical roles in achieving these density goals. This discussion delves into the key components driving the advancement of this crucial technology.

Key Technological Advancements

Several key technological advancements are propelling the evolution of high-density NAND flash memory. These include improvements in materials science, enabling the creation of smaller, more reliable memory cells. Innovative fabrication processes are crucial in precisely positioning these cells, maximizing storage capacity while maintaining stability. Furthermore, architectural advancements are essential in optimizing data storage and retrieval efficiency.

Different NAND Flash Memory Architectures, Samsung to mass produce high density nand flash memory devices

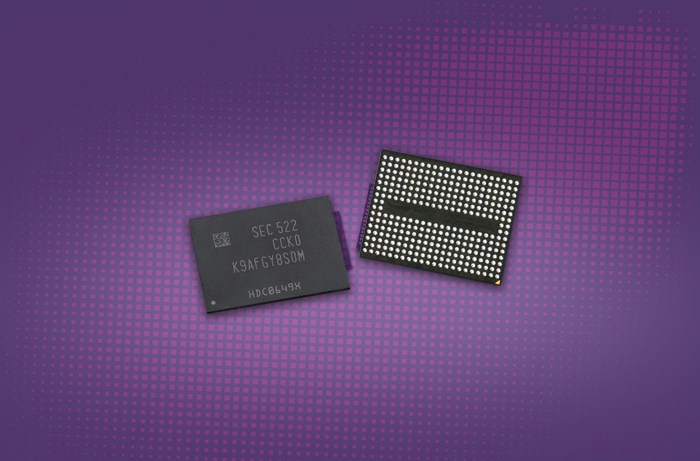

NAND flash memory comes in various architectures, each with unique characteristics impacting density and performance. The most prevalent architectures include planar, 3D vertical NAND, and more recently, 3D stacked NAND.

- Planar NAND: This is the foundational architecture, employing a relatively simple structure. However, its inherent limitations in scaling further storage capacity have spurred the development of more advanced structures.

- 3D Vertical NAND: This architecture stacks memory cells vertically, enabling a dramatic increase in density compared to planar designs. This approach involves intricate layering and precise fabrication techniques to ensure the stability of data stored within these stacked cells.

- 3D stacked NAND: Building on the 3D vertical architecture, stacked NAND introduces additional layers to further increase density. The development of advanced materials and processes is critical to maintain data integrity across these multiple layers.

Production Processes

The manufacturing of high-density NAND flash memory devices involves intricate and complex processes. These processes can be broadly categorized into several steps: material deposition, lithography, etching, and memory cell formation.

- Material Deposition: This step involves depositing thin layers of specific materials onto a substrate. The quality and uniformity of these layers are critical to ensure the stability and functionality of the memory cells.

- Lithography: This crucial process involves creating patterns on the surface of the substrate. These patterns dictate the precise location and structure of the memory cells. Advances in lithography are critical for smaller feature sizes and increased precision.

- Etching: This process removes unwanted material, defining the final structure of the memory cells. Sophisticated etching techniques are essential to achieve the desired patterns with high accuracy.

- Memory Cell Formation: This step involves forming the actual memory cells, incorporating the deposited materials and patterned structures. The precise alignment and formation of these cells are crucial to maintaining data integrity.

Scaling Trends

The scaling of NAND flash memory technology follows Moore’s Law, albeit with increasing challenges. The drive to shrink feature sizes, increase the number of memory cells, and maintain reliability is a constant push. The scaling trends are vital to understanding the future capabilities of this technology.

Comparison of NAND Flash Memory Types

| NAND Flash Type | Density Capability (Approximate) | Characteristics |

|---|---|---|

| Planar NAND | Lower density | Simpler structure, but limited scaling potential. |

| 3D Vertical NAND | Higher density than planar | Significant increase in density through vertical stacking. |

| 3D stacked NAND | Highest density | Further enhancement of density through multiple stacking layers. |

Production Capacity and Infrastructure

Samsung’s ambition to dominate the high-density NAND flash memory market hinges on its ability to scale production efficiently and effectively. This involves not only maintaining a robust production capacity but also adapting to the ever-evolving technological landscape. A significant investment in infrastructure, alongside careful consideration of potential bottlenecks, is crucial for achieving this goal.Samsung currently boasts substantial production capacity for high-density NAND flash memory, leading the market in several key areas.

However, sustained growth requires continuous upgrades and expansions to meet the escalating demand. This necessitates significant investments in new facilities, advanced equipment, and skilled personnel.

Samsung’s Current Production Capacity

Samsung’s current production capacity for high-density NAND flash memory is substantial and constantly evolving. The company employs cutting-edge fabrication processes, including advanced 3D NAND technology, which allows for greater storage density within the same physical space. Precise figures regarding production capacity are often proprietary information, but Samsung’s market share and reported output clearly indicate a significant manufacturing capability.

Required Infrastructure and Investments

The infrastructure required for mass production of high-density NAND flash memory is complex and costly. It necessitates advanced fabrication facilities, including extremely cleanrooms, specialized equipment for wafer handling and processing, and sophisticated testing labs. Investments are needed in state-of-the-art equipment like advanced lithography machines and complex automated assembly systems. These investments are not just capital expenditures but also include significant ongoing research and development to stay ahead of technological advancements.

Potential Bottlenecks and Challenges

Several potential bottlenecks could hinder the smooth production of high-density NAND flash memory. One major concern is the availability of raw materials, particularly the specialized materials required for the fabrication process. Fluctuations in raw material prices and supply chains could disrupt production schedules. Another significant challenge is the ongoing development and integration of new technologies, which requires consistent research and development to maintain leading-edge performance.

Labor shortages, particularly in skilled technical roles, also pose a risk to production timelines and efficiency.

Comparison with Competitors

Samsung’s production capacity is often compared to that of its major competitors, including SK Hynix and Micron. Direct comparisons are challenging due to proprietary data. However, market share data and industry reports generally show Samsung maintaining a leading position in terms of both capacity and innovation. This position, however, requires constant vigilance and proactive adaptation to remain competitive.

Geographical Distribution of Samsung’s Production Facilities

Samsung’s production facilities for NAND flash memory are strategically located across various regions globally. This distribution ensures proximity to key markets, reduces transportation costs, and allows for more efficient supply chains.

| Location | Facility Type | Description |

|---|---|---|

| South Korea | Primary Manufacturing Hub | Multiple advanced fabrication facilities, research and development centers, and testing laboratories. |

| Other Asian Countries (e.g., China, Malaysia) | Secondary Manufacturing Hubs | Facilities designed for specific production stages or specialized components. |

| United States | Research and Development/Testing | Advanced R&D centers focused on cutting-edge technologies and testing for new products. |

Implications for the Industry

Samsung’s decision to ramp up high-density NAND flash memory production will undoubtedly reshape the entire semiconductor landscape. This massive investment signifies a significant commitment to pushing technological boundaries and capturing a larger market share. The implications ripple through various sectors, from consumer electronics to data centers, and will undoubtedly affect pricing strategies and competitive dynamics across the industry.

Impact on the Overall NAND Flash Memory Market

Samsung’s increased production capacity will likely lead to a surge in the supply of high-density NAND flash memory. This increased supply, if not countered by corresponding demand growth, could potentially drive down prices in the short term. The impact on other manufacturers will be varied, with some facing pressure to adjust their production strategies or risk falling behind.

The market will likely experience a period of adjustment as players adapt to the new supply dynamics.

Potential Implications for Pricing and Availability

The increased supply of high-density NAND flash memory will likely put downward pressure on prices. This is a typical market response to increased supply, and consumers will benefit from lower costs for products incorporating this technology. However, the availability of these components might not always be uniform. There could be periods of higher demand exceeding supply, potentially leading to temporary shortages in certain regions or for specific applications.

Effect on Related Industries

The availability of higher-density NAND flash memory will have significant implications for related industries. Smartphones will benefit from the increased storage capacity and faster data transfer rates. Data centers will be able to store more data more efficiently, driving down the cost of storage and enabling new applications. The impact on automotive industries, including self-driving cars, will be notable due to the growing demand for massive data storage and processing power.

Potential for Price Fluctuations in the Semiconductor Market

The semiconductor market is known for its volatility, with prices often fluctuating based on supply and demand. Samsung’s increased production capacity will likely introduce a period of price sensitivity. The market will experience fluctuations, particularly in the short term, as demand adjusts to the new supply conditions. The price of NAND flash memory and related components is likely to experience a dip as the industry readjusts.

This is exemplified by previous market cycles where significant production increases by key players have led to temporary price declines.

Potential Opportunities for Other Players in the Semiconductor Industry

Despite the potential challenges posed by Samsung’s increased production, opportunities exist for other players in the semiconductor industry. Companies that can focus on niche markets, offer specialized solutions, or develop innovative applications for high-density NAND flash memory can still thrive. Partnerships and strategic collaborations will be crucial for leveraging specific strengths and exploiting untapped opportunities. Companies that excel in manufacturing efficiency, developing new applications, or creating specialized products for particular markets can position themselves favorably.

Samsung’s move to mass-produce high-density NAND flash memory devices is a big deal for tech, boosting storage capacity. This increased capacity, however, could potentially lead to some interesting legal battles, especially when considering groups like the Electronic Frontier Foundation, which is actively targeting abusive patents. Their work is crucial in ensuring fair competition and preventing excessive control over essential technologies, ensuring that innovation isn’t stifled by unnecessary roadblocks.

Ultimately, Samsung’s advancements in NAND flash will benefit consumers, driving down costs and improving the capabilities of countless electronic devices. electronic frontier foundation targets abusive patents The impact of this technology will be profound.

Financial and Economic Factors

Samsung’s decision to mass produce high-density NAND flash memory devices carries significant financial implications, both for the company itself and the global semiconductor industry. This initiative will require substantial upfront investment in new factories, equipment, and personnel, while also potentially facing challenges in maintaining profitability amidst intense competition. The potential returns and the broader economic impact are key factors to consider.

Financial Implications for Samsung

Samsung’s investment in high-density NAND flash memory production will involve substantial capital expenditure. This includes the cost of building new fabrication facilities, acquiring advanced equipment, and training a skilled workforce. The financial implications extend beyond the initial investment, encompassing ongoing operational costs, research and development efforts, and potential market fluctuations. Successfully navigating these financial hurdles is crucial for maintaining profitability and market leadership.

Return on Investment (ROI) Potential

The ROI for Samsung’s investment hinges on several factors, including market demand for high-density NAND flash memory, production efficiency, and pricing strategies. A strong demand coupled with efficient production and competitive pricing can yield substantial returns. Historical examples of successful semiconductor investments, like those made by Intel and TSMC, demonstrate the potential for high returns when aligned with market trends and technological advancements.

Samsung’s announcement about mass producing high-density NAND flash memory devices is a significant step forward, paving the way for advancements in various tech sectors. This increased storage capacity will undoubtedly impact high tech healthcare, enabling faster processing of medical data and potentially improving diagnostic accuracy and patient care, like in high tech healthcare will improve lives. Ultimately, this breakthrough in memory technology will boost the overall efficiency and accessibility of healthcare solutions, driving further innovation in the field and making a positive impact on patients’ lives, mirroring the advancements Samsung is making in memory technology.

However, the highly competitive nature of the semiconductor industry necessitates careful planning and execution to maximize returns.

Samsung’s announcement about mass-producing high-density NAND flash memory devices is pretty exciting, especially considering the growing demand for data storage. This new technology will likely have a ripple effect throughout the tech industry, impacting everything from mobile phones to data centers. Interestingly, this also aligns with the current trend of traditional telcos like Verizon and AT&T increasingly focusing on cable services, which also rely heavily on robust storage solutions like those Samsung is creating.

Ultimately, Samsung’s advancements in high-density NAND flash memory devices are crucial for powering the next generation of tech and the evolution of telecommunications services like traditional telcos rallying around cable services , ensuring data storage remains efficient and affordable.

Comparative Financial Performance

Comparing Samsung’s financial performance with its competitors in the semiconductor sector, like SK Hynix and Micron, is essential. This comparison reveals insights into market share, profitability margins, and overall financial health. Factors such as revenue growth, operating expenses, and net income provide a comprehensive understanding of the financial landscape. Such analysis is vital for assessing Samsung’s competitive standing and potential for future growth.

Economic Impact on the Global Economy

Samsung’s mass production initiative will have a ripple effect on the global economy. The increased supply of high-density NAND flash memory will drive down prices for end-users, making devices like smartphones and laptops more affordable. This, in turn, can boost consumer spending and stimulate economic growth. The investment in new technologies and infrastructure will also create jobs and stimulate related industries, fostering innovation and economic activity.

Financial Data of Major Semiconductor Players

This table summarizes the financial data of major semiconductor players, providing a snapshot of their performance. The data includes revenue, operating income, and net income figures for the past few years. This information can be used to compare performance, identify trends, and gain a comprehensive understanding of the competitive landscape. Please note that specific figures are subject to change and may not represent the absolute most up-to-date values.

| Company | Revenue (USD billions) 2022 | Operating Income (USD billions) 2022 | Net Income (USD billions) 2022 |

|---|---|---|---|

| Samsung Electronics | 446.7 | 94.8 | 47.5 |

| SK Hynix | 34.4 | 5.8 | 4.0 |

| Micron Technology | 30.2 | 6.0 | 2.8 |

Potential Applications and Future Trends: Samsung To Mass Produce High Density Nand Flash Memory Devices

High-density NAND flash memory is poised to revolutionize numerous sectors, from consumer electronics to industrial automation. Its increasing storage capacity and improved performance are paving the way for new applications and innovative use cases. This shift necessitates a deeper understanding of the potential applications and emerging technologies influencing its future trajectory.

Potential Applications Across Industries

High-density NAND flash memory is increasingly crucial across diverse industries. Its compact size, high storage capacity, and rapid access times make it a suitable replacement for traditional storage solutions in various applications. This trend will continue to drive innovation and efficiency in numerous sectors.

- Consumer Electronics: Enhanced multimedia capabilities, larger game libraries, and more realistic virtual experiences will be possible with high-density NAND flash memory. Consider the impact on smartphones, tablets, and gaming consoles. The storage capacity increase will enable larger and higher-resolution images and videos to be captured and stored.

- Data Centers and Cloud Computing: The massive amounts of data generated and processed in data centers require ever-increasing storage capacity. High-density NAND flash memory is an ideal solution to meet these demands. This will enable faster data retrieval and processing, crucial for cloud-based services.

- Automotive: Advanced driver-assistance systems (ADAS) and autonomous vehicles rely on vast amounts of data. High-density NAND flash memory is key for storing and processing this data in real-time. The enhanced storage capacity enables more sophisticated algorithms and more advanced safety features.

- Industrial Automation: High-density NAND flash memory facilitates real-time data acquisition and analysis in industrial settings. This is critical for optimizing processes, improving efficiency, and enabling predictive maintenance.

- Healthcare: High-density NAND flash memory can be applied to medical imaging, storing large datasets of patient records, and supporting complex diagnostic tools.

Emerging Technologies and Trends

Several technologies and trends are shaping the future of NAND flash memory. These advancements drive improvements in performance, capacity, and reliability, influencing future applications.

- 3D NAND: The stacking of memory cells vertically allows for greater storage density in a smaller form factor. This innovation is crucial for the continued growth of high-density NAND flash memory. Examples include the implementation of 3D NAND in consumer electronics to enhance their storage capacity.

- Emerging Memory Technologies: Research into alternative memory technologies like phase-change memory (PCM) and resistive RAM (ReRAM) is ongoing. These technologies may eventually compete with or complement NAND flash memory, depending on the specific application. However, NAND flash memory currently remains the dominant technology due to its cost-effectiveness and established infrastructure.

- Artificial Intelligence (AI): The increasing reliance on AI necessitates more powerful and efficient storage solutions. High-density NAND flash memory will be critical for supporting the vast datasets and complex computations required for AI algorithms.

Future Research and Development Efforts

Ongoing research and development efforts focus on enhancing NAND flash memory technology. These efforts aim to address the limitations of current technology and create more robust and efficient storage solutions.

- Improving Endurance and Reliability: Researchers are continually working to improve the endurance and reliability of NAND flash memory to increase the lifespan of storage devices.

- Lowering Power Consumption: Reducing power consumption is a key focus. This is critical for mobile devices and embedded systems, where power efficiency is paramount. The trend towards lower power consumption is crucial for the widespread adoption of high-density NAND flash memory in mobile devices.

Impact of Artificial Intelligence on the Future of High-Density NAND Flash Memory

Artificial intelligence (AI) will significantly impact the future of high-density NAND flash memory. The demands of AI-driven applications, requiring extensive data storage and processing, will propel the need for even higher density and faster access speeds.

- Training and Deployment of AI Models: AI model training and deployment require vast datasets and complex computations. High-density NAND flash memory is crucial for storing and accessing these data sets, enabling faster processing times for AI algorithms.

- Enhanced Data Analytics: High-density NAND flash memory supports the processing and analysis of large datasets, facilitating insights and enabling advanced analytics in various sectors.

Innovative Use Cases

High-density NAND flash memory enables innovative use cases across diverse sectors. Its capabilities extend beyond traditional applications.

- Autonomous Vehicles: Self-driving cars require vast amounts of data for training algorithms and decision-making. High-density NAND flash memory is essential for storing this data efficiently.

- Edge Computing: Edge computing requires local storage and processing capabilities. High-density NAND flash memory is ideal for supporting edge computing applications, enabling real-time data processing and decision-making at the source.

Societal Impact

Samsung’s mass production of high-density NAND flash memory devices will profoundly impact global society. This technological leap will ripple through various sectors, altering the way we store, access, and utilize information. From reshaping the global supply chain to influencing data security, the implications are far-reaching and require careful consideration.

Impact on the Global Supply Chain

Samsung’s increased production of NAND flash memory will inevitably influence the global supply chain. The demand for these components will drive related industries, such as semiconductor manufacturing equipment and raw material suppliers. This will create opportunities for companies in these sectors, but also potential for competition and supply chain vulnerabilities if bottlenecks emerge. Samsung’s dominance in production could lead to a concentration of power in the sector, which may need to be balanced by government regulations or alternative production strategies.

The demand for specialized equipment and materials will also increase, driving innovation and specialization within these sub-sectors.

Ethical Considerations in Production and Use

The mass production of high-density NAND flash memory raises several ethical concerns. The production process may involve the use of rare earth minerals, which could pose challenges regarding responsible sourcing and environmental sustainability. Furthermore, the widespread availability of this technology may lead to concerns about data privacy and security, especially as the capacity for storing vast amounts of personal data increases.

The potential for misuse of this technology, such as for surveillance or manipulation of information, also requires careful consideration. Clear guidelines and regulations regarding responsible development and deployment of this technology are crucial.

Environmental Impact of Manufacturing

The manufacturing of high-density NAND flash memory is energy-intensive. The process involves complex chemical procedures, generating substantial waste and greenhouse gas emissions. Minimizing the environmental footprint of this production process is critical. Companies need to prioritize sustainable practices and invest in cleaner manufacturing technologies to reduce their environmental impact. Recycling and reuse programs for materials used in the production process will also be essential to lessen the environmental impact.

Implications for Data Storage and Accessibility

The availability of high-density NAND flash memory will significantly enhance data storage capacity. This will lead to more efficient data management and access, allowing for greater storage of data from various sources such as scientific research, medical records, and personal archives. Increased storage capacity will also foster the development of new applications and services, including cloud storage and advanced data analytics tools.

The ease of data accessibility, in turn, may increase the risk of data breaches and require robust security measures.

Impact on Global Data Security

The increased storage capacity offered by high-density NAND flash memory will make it easier to store vast amounts of sensitive data. This will increase the potential for data breaches and require stronger security measures. Data encryption and secure storage protocols will be critical to safeguard sensitive information. The rise of sophisticated cyberattacks necessitates robust cybersecurity infrastructure and practices to mitigate risks.

Governments and organizations will need to work together to establish international standards and best practices to enhance global data security.

Last Word

Samsung’s decision to mass produce high-density NAND flash memory devices marks a pivotal moment in the semiconductor industry. This initiative will undoubtedly reshape the market, impacting pricing, availability, and the competitive landscape. The technological advancements behind this production are impressive, but the potential implications for related industries, such as smartphones and data centers, are equally significant. This article has explored the various facets of this strategic move, from market trends to financial considerations, and highlighted the potential opportunities and challenges that lie ahead for Samsung and the wider semiconductor sector.

The future of data storage and accessibility will undoubtedly be shaped by this significant advancement.