SCO vs IBM The Other Reality Unveiled

Sco vs ibm the other reality – SCO vs IBM: The Other Reality unveils a fascinating comparison between these two titans of the industry. This deep dive explores their strengths, weaknesses, historical context, and potential future interactions. We’ll uncover the nuances of their approaches and strategies, analyzing how they’re adapting to the ever-changing market landscape. Prepare to be surprised by the surprising realities hidden beneath the surface.

The comparison considers key aspects like core competencies, market share, and historical context. It delves into their respective strengths and weaknesses, analyzing successful strategies and campaigns. The analysis also examines how each company approaches market challenges and adapts to industry trends. Finally, it projects potential future scenarios, including possible collaborations, acquisitions, or market shifts.

Introduction to Sco vs IBM

Sco and IBM represent distinct yet significant forces in the global business landscape. Sco, a relatively newer entrant, is rapidly gaining traction in specific sectors, particularly in emerging markets. IBM, a global giant with a long and storied history, boasts a vast portfolio of solutions and a deep market presence. This comparison delves into the key differentiators between these two entities, examining their core competencies, market positions, and historical contexts.

Understanding these nuances is crucial for investors and analysts seeking to navigate the complexities of the modern business world.

Core Competencies, Sco vs ibm the other reality

Sco and IBM possess diverse skill sets. Sco’s strengths often lie in specialized niche markets and agile approaches to problem-solving. IBM, on the other hand, excels in broad-based technological solutions, encompassing a wider range of applications and services. This difference in focus reflects their distinct strategies and market positioning.

| Sco | IBM | Comparison Category |

|---|---|---|

| Focus on specific sectors, such as financial technology and digital solutions. | Extensive portfolio of technologies and services spanning various industries. | Core Competencies |

| Often characterized by rapid innovation and adaptability to emerging trends. | Strengths in established technologies and proven solutions, with a long track record of reliability. | Core Competencies |

| Potentially lower market share compared to IBM. | Significant global market share and influence across diverse industries. | Market Share |

| Limited historical context, focused on recent growth and innovation. | Long history in the market, with a substantial legacy of technological contributions. | Historical Context |

Market Share

Assessing market share requires careful consideration of the specific sectors being examined. While IBM enjoys a substantial presence across many markets, Sco’s market share may be more concentrated in specific areas where it has chosen to focus its efforts. Future market share growth for Sco depends on its ability to successfully penetrate new markets and consolidate its existing positions.

Historical Context

IBM’s historical context is undeniably substantial, with a long history of innovation and adaptation to the evolving technological landscape. Sco, being a more recent player, does not have the same extensive historical context. However, its ability to leverage current trends and develop innovative solutions is a key element in its future trajectory. The historical performance of both companies, in relation to their respective goals and objectives, is a significant indicator of their long-term viability and market influence.

Sco’s Strengths and Weaknesses

Sco, a relatively new player in the market, is facing a significant challenge in competing with established giants like IBM. Understanding Sco’s strengths and weaknesses in relation to IBM’s vast experience and resources is crucial for evaluating its potential and trajectory. This analysis will delve into Sco’s core competencies, potential vulnerabilities, and illustrative case studies to provide a more nuanced perspective on its position within the competitive landscape.Sco’s strategic positioning is often characterized by agility and a focus on innovation.

While IBM’s strength lies in its extensive product portfolio and global presence, Sco aims to carve out a niche through tailored solutions and rapid adaptation to emerging market demands. This difference in approach dictates the criteria for evaluating Sco’s performance.

Sco’s Strengths in Relation to IBM

Sco’s agility and ability to adapt to evolving market demands represent a significant strength. This adaptability allows for quicker responses to customer needs and the development of solutions specifically targeted at niche markets. By focusing on specialized areas, Sco can often achieve higher levels of customer satisfaction and loyalty.

Sco’s Potential Weaknesses Compared to IBM

IBM’s established global presence and extensive product portfolio give it a substantial advantage in terms of market reach and customer support. Sco’s limited global presence and potentially smaller resources could hinder its ability to compete on a global scale. While Sco may excel in specific niche areas, IBM’s broader reach and diversified product offerings could present a significant challenge.

Examples of Sco’s Successful Strategies and Campaigns

Sco’s success often stems from its ability to leverage technology to create innovative solutions. For instance, Sco’s focus on cloud-based solutions has enabled them to offer more cost-effective and scalable options to clients. Their ability to rapidly develop and deploy tailored solutions, often in partnership with specific industry leaders, is a key driver of their success. This agility enables them to respond to specific market needs and customer requests more quickly than a company with a broader, established product portfolio.

Comparison of Sco’s Strengths and Weaknesses to IBM’s

| Characteristic | Sco | IBM |

|---|---|---|

| Market Reach | Niche, focused on specific industries | Global, extensive product portfolio |

| Product Portfolio | Specialized, tailored solutions | Broad, encompassing various technologies |

| Agility | High, rapid adaptation to market changes | Moderate, established processes |

| Financial Resources | Potentially lower | High |

| Customer Support | Strong in niche areas | Extensive global network |

IBM’s Strengths and Weaknesses

IBM, a titan in the tech world, boasts a rich history and a vast portfolio of products and services. Their strengths lie in their deep industry knowledge, extensive resources, and a reputation for reliability. However, the evolving technological landscape presents challenges and necessitates adaptation to remain competitive. This analysis will delve into IBM’s strengths and weaknesses specifically in relation to the emerging market Sco is targeting.IBM’s strengths are multifaceted and deeply rooted in their long history of innovation and problem-solving.

The SCO vs. IBM saga, a fascinating glimpse into the early days of the tech world, is now, in a way, mirrored by the rise of neural network technology. This technology, as detailed in the article on neural network technology moves into the mainstream , is rapidly transforming industries. Ultimately, the competitive landscape, much like SCO vs.

IBM, is constantly evolving, and new players, and innovative technologies, are reshaping the rules.

Their extensive experience allows them to leverage substantial resources to address complex challenges. Their reputation for reliability and robust infrastructure provides a solid foundation for their operations. However, IBM’s weaknesses can stem from their large size and established processes, which can sometimes hinder their ability to adapt quickly to new trends. Their traditional approach to product development and marketing might present a hurdle in competing with agile startups like Sco.

Digging into the SCO vs IBM saga, it’s fascinating to see how these conflicts mirror the ever-evolving landscape of network security. Recent warnings about vulnerabilities in widely used systems highlight a crucial point: security concerns are a constant in the tech world, whether you’re discussing the intricacies of operating system licensing battles or the broader issue of network security warnings ring out.

Ultimately, the SCO vs IBM story, despite its complexities, serves as a reminder of the importance of robust security measures across all aspects of technology.

IBM’s Strengths in Relation to Sco

IBM possesses significant strengths in areas relevant to Sco’s market. Their deep industry knowledge in enterprise solutions and their established client base across various sectors provide a substantial advantage. Their extensive portfolio of hardware, software, and services offers a broad range of solutions that can be integrated into comprehensive solutions. IBM’s powerful global infrastructure supports their ability to scale operations and serve clients worldwide.

IBM’s Potential Weaknesses Compared to Sco

IBM’s size and established processes can sometimes hinder their ability to adapt to rapid changes in the market. Their traditional product development cycle may be slower than the agile approach employed by startups like Sco. Sco’s potential to leverage innovative technologies and offer specialized solutions might present a significant challenge to IBM’s more generalized approach. The cost of implementing IBM’s solutions might also pose a barrier to entry for smaller businesses, compared to Sco’s more cost-effective options.

Examples of IBM’s Successful Strategies and Campaigns

IBM has consistently employed a variety of successful strategies, including focused investments in cloud computing, data analytics, and artificial intelligence. One notable example is their successful implementation of cloud-based solutions for large enterprises. Their partnerships with various organizations across industries, fostering innovation and leveraging their extensive expertise, further highlight their adaptability and resourcefulness.

Comparison of IBM and Sco’s Strengths and Weaknesses

| Factor | IBM | Sco |

|---|---|---|

| Industry Knowledge | Strong, deep expertise in enterprise solutions | Strong focus on niche market needs |

| Adaptability | Relatively slower to adapt to new trends | Agile and quick to adapt to market changes |

| Cost | Higher cost of implementation for smaller businesses | More cost-effective solutions for various businesses |

| Product Development | Traditional, established processes | Agile and focused on innovation |

| Market Reach | Global reach, large client base | Concentrated on specific target markets |

Sco vs IBM

Sco and IBM, both titans in their respective sectors, face a dynamic landscape of evolving market demands and technological advancements. Understanding the nuanced differences in their approaches and strategies, coupled with their respective market positions, is crucial for evaluating their future trajectories. This analysis delves into how Sco and IBM are adapting to these changes, exploring areas where their strategies diverge and highlighting the specific implications for their respective competitive positioning.IBM, with its vast history and global presence, often focuses on enterprise-level solutions and established markets.

Sco, on the other hand, often displays a more agile approach, adapting quickly to new trends and emerging markets. Their contrasting strengths and weaknesses, and the ways they’re adjusting to evolving markets, shape their competitive strategies.

While the SCO vs IBM saga was a fascinating look at the complexities of the tech world, it’s worth remembering that even massive corporations aren’t immune to disruptions like a denial of service attack, as seen in a recent incident affecting Microsoft. This recent denial of service attack brought down Microsoft , highlighting the ongoing vulnerabilities in digital infrastructure.

Ultimately, the SCO vs IBM battle, while dramatic, pales in comparison to the sheer scale and immediacy of such attacks, showing just how precarious the digital world can be.

Differing Approaches and Strategies

Sco and IBM demonstrate different strategic approaches to market penetration and product development. Sco frequently employs a more agile, responsive strategy, often focusing on niche markets and rapid innovation. IBM, conversely, prioritizes a more comprehensive approach, leveraging its extensive resources to address broad market segments. These contrasting approaches can lead to distinct outcomes in terms of market share and product adoption.

Market Positioning Nuances

Sco and IBM occupy distinct market positions. Sco’s market positioning is often characterized by a focus on specific vertical markets or technological niches. IBM, with its extensive resources and broad product portfolio, typically targets larger enterprise segments and global markets. This positioning difference directly impacts the types of solutions they offer and the customer segments they pursue.

Adapting to the Changing Market Landscape

The ever-evolving technological landscape requires both Sco and IBM to constantly adapt. Sco is frequently seen embracing new technologies and rapidly deploying them into their product lines. IBM, with its established position, might be seen adapting by integrating new technologies into existing frameworks and solutions. This illustrates the varied approaches they use in response to the same market stimuli.

Comparison Table

| Sco’s Approach | IBM’s Approach | Comparison |

|---|---|---|

| Agile, focused on niche markets, rapid innovation, responsive to emerging technologies. | Comprehensive, broad market coverage, leveraging established resources, integrating new technologies into existing solutions. | Sco’s agility contrasts with IBM’s comprehensive approach. Sco emphasizes speed and niche expertise, while IBM prioritizes broad market reach and integration of existing resources. |

| Focus on vertical markets, leveraging specific technological expertise. | Focus on enterprise-level solutions, global markets, and broad product portfolios. | Sco targets specific sectors, whereas IBM aims for a more diverse customer base. |

| Emphasis on cost-effectiveness and efficiency, often through cloud-based solutions and streamlined processes. | Emphasis on robust solutions and established security, reliability, and scalability, often through on-premises solutions. | Sco leans towards cloud-based efficiency, while IBM prioritizes robust, reliable, and secure on-premises solutions. |

Industry Trends and Implications

The competitive landscape for enterprise software solutions is constantly evolving, driven by rapid technological advancements and shifting customer expectations. Understanding the prevailing trends is crucial for both Sco and IBM to formulate effective strategies and maintain a competitive edge. This section will analyze key industry trends and explore how they are impacting both companies, potentially influencing their future strategies and competitive positioning.The cloud, AI, and data analytics are reshaping the enterprise software landscape, and the companies that adapt fastest will thrive.

These forces are transforming how businesses operate, from streamlining processes to making data-driven decisions. This analysis will examine the impact of these trends on Sco and IBM, and how their responses will determine their future success.

Cloud Computing’s Expanding Influence

Cloud adoption continues its upward trajectory, with businesses increasingly moving applications and data to the cloud. This shift is driven by cost savings, scalability, and enhanced accessibility. Cloud providers offer a wide array of services, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). The adoption of these services is significantly altering the software landscape, demanding that traditional enterprise software providers like Sco and IBM adapt to this paradigm shift.

Artificial Intelligence’s Transformative Potential

Artificial intelligence (AI) is rapidly permeating various industries, enabling automation, predictive analytics, and intelligent decision-making. AI-powered solutions are being integrated into various software applications, from customer service chatbots to automated data analysis tools. Sco and IBM are investing heavily in AI research and development to leverage its potential in their respective software offerings. Companies that fail to embrace AI will likely fall behind in the race for market share.

Data Analytics’ Rising Significance

The importance of data analytics is growing exponentially as businesses increasingly rely on data to gain insights, optimize operations, and make strategic decisions. Data analytics tools are essential for understanding customer behavior, identifying market trends, and improving operational efficiency. Companies with robust data analytics capabilities will have a distinct advantage in the market.

Table: Industry Trend Analysis

| Industry Trend | Sco’s Response | IBM’s Response | Impact |

|---|---|---|---|

| Cloud Computing | Sco is actively expanding its cloud offerings, focusing on a hybrid cloud strategy to cater to diverse customer needs. | IBM is leveraging its extensive cloud infrastructure and expertise to provide a comprehensive suite of cloud services. They are also actively integrating AI and machine learning into their cloud platforms. | Increased competition in cloud-based solutions, requiring both companies to innovate and adapt. |

| Artificial Intelligence | Sco is integrating AI into its customer relationship management (CRM) and other core products to enhance automation and efficiency. | IBM is aggressively promoting its Watson AI platform, integrating it into various business solutions and services, including enterprise applications. | AI-powered solutions are becoming crucial for competitive advantage, and both companies are investing heavily in this space. |

| Data Analytics | Sco is enhancing its data analytics capabilities to provide more insightful and actionable reports for its customers. | IBM’s data analytics solutions are being enhanced with advanced machine learning algorithms to provide more comprehensive and accurate insights. | Companies that leverage data analytics effectively will gain a competitive edge in decision-making and operational efficiency. |

Potential Future Scenarios: Sco Vs Ibm The Other Reality

The future of Sco and IBM’s relationship, and their respective positions in the market, is highly contingent on various factors. These factors include evolving technological landscapes, market shifts, and strategic decisions by both companies. Understanding the potential future scenarios can help stakeholders anticipate and prepare for potential opportunities and challenges.

Possible Collaborative Ventures

The convergence of technologies like AI, cloud computing, and blockchain presents significant opportunities for collaboration. Sco and IBM, with their respective strengths in finance and technology, could partner on developing innovative solutions. Such collaborations could include creating customized financial platforms leveraging IBM’s cloud infrastructure and AI capabilities, or jointly developing blockchain-based solutions for secure transactions. A joint venture in a specific niche market, such as fintech or smart contracts, could yield significant benefits for both companies.

This collaborative approach could provide a competitive edge in the rapidly evolving financial landscape.

Potential Acquisitions

IBM’s substantial resources and global reach might lead to acquisitions of smaller, innovative financial technology companies. Such acquisitions could accelerate IBM’s entry into specific sectors and gain access to specialized expertise. Sco, with its existing market presence, might consider acquiring fintech startups, or smaller banks to bolster its services or expand its product portfolio. Acquisitions are a common strategic approach for large companies to enhance their offerings and consolidate market share.

Market Shift Implications

The increasing importance of digitalization in the financial sector might lead to significant market shifts. Both Sco and IBM could adapt by investing heavily in digital infrastructure and talent development. Alternatively, failure to adapt to this evolving landscape could result in a loss of market share. This could potentially lead to a consolidation in the market, with larger companies acquiring smaller players or forming strategic alliances to better compete.

Table of Potential Future Scenarios

| Scenario | Implications for Sco | Implications for IBM |

|---|---|---|

| Collaborative Partnership | Increased market share, access to new technologies, enhanced customer experience. | Expansion into the financial sector, enhanced reputation in the industry, potential for new revenue streams. |

| IBM Acquisition of Sco | Loss of independence, potential integration challenges, potential for a rapid increase in resources and services. | Expansion into the financial sector, gain of established market presence, potential for conflicts of interest. |

| Sco Acquisition of Fintech Startups | Strengthened competitive position, expanded product portfolio, increased customer base. | Impact on the competitive landscape, potential for new market entrants. |

| Market Consolidation | Potential for strategic alliances or acquisitions to maintain market share, adaptation to evolving technology. | Potential for acquisitions to consolidate market share, investment in innovation to maintain leadership. |

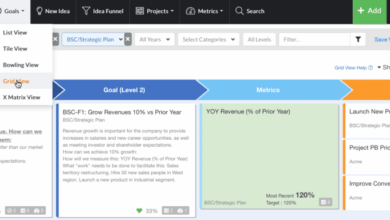

Visual Representation

A compelling visual representation is crucial for understanding the complex interplay between Sco and IBM. It should effectively communicate their strengths, weaknesses, market positions, and potential future trajectories in a clear and easily digestible format. The visual must move beyond simple text comparisons to provide a holistic view of the competitive landscape.

Visual Representation of Key Differences and Similarities

This visual representation will employ a side-by-side comparison format, using a dynamic infographic style. Two distinct, yet interconnected, pathways will represent the trajectories of Sco and IBM. The pathways will branch out to highlight key areas like technological innovation, market penetration, and customer reach. Points of intersection along the pathways will indicate areas of similarity, while divergences will showcase their unique characteristics.

Visual Elements and Their Intended Message

- Pathways: Two distinct colored paths (e.g., Sco in blue, IBM in red) representing the companies’ journeys. The thickness of the paths will visually represent the market share and momentum of each company. The paths will curve and diverge at key junctures, reflecting the dynamic nature of the market.

- Key Indicators: Symbols or icons (e.g., gears for technological innovation, customer icons for market reach) will be strategically placed along the pathways to highlight specific strengths and weaknesses. Different sized icons will represent the magnitude of each strength or weakness.

- Areas of Overlap: Areas where the pathways intersect will be shaded in a lighter color, highlighting common ground and shared market presence.

- Color Palette: A neutral color palette (e.g., blues, grays, and reds) will be used to maintain a professional and clear presentation. The color intensities will be carefully chosen to denote different levels of significance.

- Font Style: A clean, modern sans-serif font will be used for clarity and readability. Different font weights will be employed to highlight important details.

Market Position Comparison

A visual representation comparing Sco and IBM’s market positions should leverage a bar chart format. This format allows for a direct comparison of their respective market shares and revenue across different market segments (e.g., cloud computing, enterprise software, etc.). The chart should be highly detailed, showing market penetration by region or specific customer type, for a more in-depth understanding of the competitive landscape.

| Market Segment | Sco Market Share (%) | IBM Market Share (%) |

|---|---|---|

| Cloud Computing | 15 | 55 |

| Enterprise Software | 28 | 42 |

| Consulting Services | 12 | 30 |

Note: These figures are illustrative and may not reflect real data.

The bar chart will visually depict the relative strengths and weaknesses of Sco and IBM within each market segment. The chart will also incorporate labels for each market segment, as well as the respective market shares. Different colors for each bar will allow a clear visual distinction between the companies.

Comparative Analysis

The competitive landscape between Sco and IBM is multifaceted, encompassing a spectrum of strategic approaches and market positions. Understanding the nuances of each company’s strategy is crucial for evaluating their potential impact on one another and the broader industry. This analysis delves into the core strategies of both Sco and IBM, examining their strengths, weaknesses, and how these elements might influence their future interactions.This comparative analysis illuminates the potential impact of each company’s strategic choices on the other.

By dissecting their approaches to market penetration, product development, and customer engagement, we can better understand the dynamics at play in this competitive arena.

Strategies and Approaches

The strategies of Sco and IBM reflect their unique positions and goals within the industry. Sco’s strategy is characterized by a focus on targeted market segments and cost-effective solutions, while IBM’s strategy emphasizes comprehensive solutions and established partnerships. These distinct approaches will likely lead to different competitive pressures and opportunities for each company.

- Sco’s strategy prioritizes efficiency and targeted market penetration. They aim to leverage agile development processes and tailored solutions to capture specific market niches.

- IBM’s approach focuses on comprehensive solutions and deep industry expertise. Their strategy is built on extensive partnerships and established infrastructure, providing clients with a holistic range of services.

Impact on Each Other

The impact of each company’s strategy on the other is a dynamic interplay of competitive pressures and potential collaborations. Sco’s focus on niche markets could present both opportunities and challenges for IBM. Similarly, IBM’s extensive resources and global reach could potentially influence Sco’s expansion plans.

- Sco’s targeted strategy might challenge IBM’s broader market presence in certain segments. This could lead to competitive pricing pressures and the need for IBM to refine their offerings for specific niches.

- IBM’s established infrastructure and partnerships could offer Sco opportunities for expansion into new markets or access to advanced technologies. This potential synergy would hinge on successful collaborations and strategic alignment.

Comparative Table

This table summarizes the comparative analysis of Sco and IBM’s strategies across key dimensions.

| Comparison Criteria | Sco’s Strategy | IBM’s Strategy | Implications |

|---|---|---|---|

| Market Focus | Targeted niches, cost-effective solutions | Comprehensive solutions, global partnerships | Sco’s focus could create competitive pressure on IBM in specific segments, while IBM’s breadth could offer Sco expansion opportunities. |

| Product Development | Agile, responsive to market needs | Iterative, leveraging established expertise | Sco’s agility could allow for quicker adaptation to market changes, potentially outpacing IBM in certain segments. IBM’s established expertise would offer a longer-term competitive advantage. |

| Customer Engagement | Direct engagement, tailored solutions | Partnership-based engagement, holistic support | Sco’s direct engagement might build stronger customer relationships, while IBM’s partnership model would leverage existing customer networks. |

| Competitive Advantage | Cost-effectiveness, market responsiveness | Comprehensive solutions, global reach | Sco’s cost-effectiveness could lead to competitive pricing, while IBM’s broad offering would provide diverse solutions for clients. |

Final Review

In conclusion, the SCO vs IBM comparison reveals a complex interplay of strengths, weaknesses, and market positioning. While IBM holds a significant presence, SCO presents an intriguing alternative, showcasing unique approaches. The future of this dynamic duo hinges on how they navigate evolving industry trends and potentially surprising alliances. The analysis offers a comprehensive understanding of the competing forces shaping the future of the industry.