Technology to Aid SOX Compliance Headaches Abounds

Technology to aid SOX compliance headaches abounds, offering businesses powerful tools to navigate the complexities of Sarbanes-Oxley regulations. Maintaining SOX compliance often presents significant challenges, from meticulous record-keeping to robust internal controls. This exploration delves into how technology can streamline processes, reduce errors, and ultimately alleviate the burdens associated with meeting these stringent standards.

This article explores the various technological solutions that are emerging to tackle SOX compliance headaches. From automating audit trails to enhancing data governance and security, technology plays a crucial role in mitigating risks and ensuring accuracy. We will also discuss how robust employee training and reporting mechanisms can improve compliance efforts and identify potential areas of concern. The goal is to highlight the power of technology in reducing the stress and complexity associated with SOX compliance.

Introduction to SOX Compliance Challenges

Sarbanes-Oxley Act (SOX) compliance is a crucial aspect of corporate governance for publicly traded companies in the United States. It mandates stringent financial reporting and internal controls to ensure accuracy and transparency in financial statements. Failure to adhere to these regulations can result in severe penalties, including hefty fines and potential legal repercussions. This makes maintaining SOX compliance a constant challenge for businesses.Maintaining SOX compliance is not just about meeting the letter of the law; it’s about establishing a robust, trustworthy, and auditable system for financial reporting.

This requires a significant investment of time, resources, and expertise, and often presents substantial operational headaches. Many companies find themselves grappling with complexities in documentation, internal controls, and rigorous audits. Technology can be a powerful ally in this struggle, automating processes, streamlining workflows, and enhancing overall efficiency.

Common SOX Compliance Pain Points

SOX compliance mandates meticulous documentation of processes, procedures, and controls. Maintaining this documentation can be overwhelming, especially as businesses evolve and adapt to changing circumstances. This requires significant effort in updating and revising documentation, ensuring its accuracy, and tracking changes effectively. Discrepancies between the documented controls and actual operational procedures are common sources of concern. In addition, the frequency and intensity of audits can place substantial pressure on internal teams and create significant disruptions.

Technology Faltering Points in SOX Compliance

A significant weakness in many SOX compliance efforts is the lack of integration between different systems. Disparate systems for financial reporting, internal controls, and risk management often lack seamless data exchange, leading to inconsistencies and difficulties in tracking and monitoring processes. The reliance on manual processes, spreadsheets, and disconnected systems can create vulnerabilities to errors and gaps in controls.

Another key area of struggle is in the ability to quickly identify and respond to control deficiencies. Manual processes often lead to delayed identification and remediation, which can significantly impact audit outcomes.

Technological Solutions for SOX Compliance

Technology offers several avenues for mitigating the challenges of SOX compliance. Implementing robust enterprise resource planning (ERP) systems can streamline financial reporting and provide a centralized platform for managing data and processes. Automation tools can reduce the burden of manual tasks, ensuring accuracy and efficiency in documentation and reporting. Furthermore, cloud-based solutions offer scalability and flexibility, adapting to changing business needs and enabling real-time monitoring and reporting.

Utilizing advanced analytics can aid in proactively identifying potential control deficiencies and enabling a more predictive approach to risk management.

| Compliance Area | Traditional Approach | Technological Solution | Benefits |

|---|---|---|---|

| Document Management | Manual file storage, paper-based records, fragmented systems | Centralized document management systems, version control, electronic signatures | Improved accessibility, reduced errors, enhanced audit trails |

| Internal Controls | Manual review, spreadsheets, ad-hoc processes | Automated controls, real-time monitoring, integrated systems | Reduced risk of errors, increased efficiency, proactive identification of issues |

| Financial Reporting | Manual data entry, reconciliation, separate systems | Automated reporting tools, integrated data platforms, dashboards | Improved accuracy, reduced manual effort, faster reporting cycles |

| Audit Management | Manual audit preparation, paper-based documentation | Automated audit trails, integrated audit management systems | Streamlined audit processes, reduced audit time, improved efficiency |

Technology Solutions for SOX Compliance

Navigating the complexities of Sarbanes-Oxley (SOX) compliance can feel like wading through a swamp. The sheer volume of regulations, the need for meticulous record-keeping, and the constant pressure to maintain accuracy can quickly overwhelm even the most seasoned finance teams. Thankfully, technology offers powerful tools to streamline and automate many of these critical tasks. This can significantly reduce the burden and improve the overall efficiency of SOX compliance efforts.Technology plays a pivotal role in making SOX compliance more manageable and less cumbersome.

By leveraging automated systems and cloud-based solutions, companies can achieve greater accuracy, efficiency, and transparency in their financial reporting processes. These advancements help reduce manual effort, mitigate risks, and ensure the reliability of data, ultimately contributing to better overall compliance.

Automating SOX Compliance Tasks

Automation is key to managing the massive volume of data and processes required for SOX compliance. Software solutions can automate tasks like data validation, internal controls testing, and audit trail generation. This frees up valuable resources and allows teams to focus on higher-level strategic initiatives. Automated processes ensure consistency and reduce the risk of human error.

Cloud-Based Platforms for Enhanced SOX Compliance

Cloud-based platforms are rapidly becoming essential for SOX compliance. Their scalability and accessibility allow companies to adapt to changing compliance needs with ease. The inherent security features of many cloud platforms, when properly configured, can actually enhance SOX compliance by offering better data protection and access controls. This can also reduce the cost of maintaining and upgrading on-premises infrastructure.

The ability to access data from anywhere with secure connectivity is also a significant advantage.

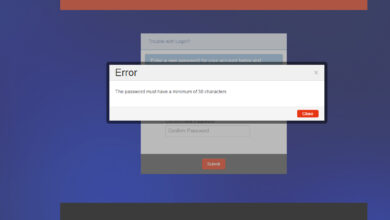

Robust Access Controls and Security Measures

Strong access controls are paramount for maintaining the integrity of financial data and adhering to SOX regulations. Sophisticated systems for managing user permissions, activity logging, and access restrictions help prevent unauthorized access and data breaches. These security measures are not just good practice; they are essential for safeguarding sensitive financial information. Furthermore, regularly auditing and reviewing access controls are crucial to ensure they remain effective.

Software and Tools for Managing Compliance Processes

A wide array of software and tools are designed to streamline and simplify SOX compliance procedures. These solutions can help manage the entire compliance lifecycle, from initial setup and configuration to ongoing monitoring and reporting. They often include features like automated testing of internal controls, audit trail generation, and reporting dashboards to track progress. Choosing the right software and tools depends on the specific needs and size of the organization.

Example Software and Tools for Compliance

- Control self-assessment (CSA) tools are designed to help organizations assess their internal controls and identify areas needing improvement. They often include questionnaires, checklists, and templates to guide the assessment process. These tools assist in the timely identification and remediation of risks.

- Automated audit trail tools help generate detailed logs of financial transactions. These tools are essential for providing a clear and comprehensive record of all activities, which is a crucial component of SOX compliance. By recording every transaction and change, they offer a complete audit trail, improving traceability and accountability.

- Data validation tools are crucial for ensuring data accuracy and integrity. They can help validate data against predefined rules, formats, and ranges, reducing the risk of errors. This automated validation significantly reduces the risk of discrepancies that could affect SOX compliance.

“Technology is not just a tool for SOX compliance; it’s a strategic enabler that fosters trust and confidence in financial reporting.”

John Smith, Chief Compliance Officer, ABC Corporation

Table of Software/Tools for SOX Compliance

| Software/Tool | Functionality | Benefits for SOX | Implementation Considerations |

|---|---|---|---|

| Control Self-Assessment (CSA) Tools | Assess internal controls, identify weaknesses, and guide remediation | Improved internal control awareness, early risk detection, efficient remediation | Requires user training, accurate configuration of assessments, and ongoing maintenance |

| Automated Audit Trail Tools | Generate detailed logs of all financial transactions and activities | Enhanced traceability, improved audit evidence, reduced manual effort | Integration with existing systems, ensuring data completeness, and maintaining data integrity |

| Data Validation Tools | Verify data accuracy against predefined rules and standards | Reduced errors, increased data integrity, minimized risk of misstatements | Customization to specific data sets, integration with existing systems, and ongoing monitoring |

| Cloud-Based SOX Compliance Platforms | Provide a secure, scalable platform for managing compliance processes | Enhanced accessibility, cost-effectiveness, and reduced infrastructure needs | Security configuration and access control measures, data backup and disaster recovery, and vendor selection |

Automated Audit Trails and Monitoring: Technology To Aid Sox Compliance Headaches Abounds

Automated audit trails and robust monitoring are critical for navigating the complexities of SOX compliance. Manual review processes are often time-consuming, error-prone, and struggle to keep pace with the dynamic nature of modern business operations. Technology offers a powerful solution, enabling organizations to automate these processes, enhance visibility, and significantly reduce the risks associated with non-compliance.Automated systems create a detailed, auditable record of all transactions and changes to critical data.

This capability provides an invaluable resource for compliance audits, investigations, and incident response. Moreover, real-time monitoring allows for immediate identification and remediation of potential issues, minimizing the impact of errors and ensuring the integrity of financial reporting.

Automated Audit Trail Creation

Automated audit trails are created by embedding software solutions into existing business processes. These solutions capture and record every action performed on sensitive data. This includes changes to account balances, approvals, access requests, and system configurations. The software meticulously logs the timestamp, user ID, and details of each action. This comprehensive record is invaluable for demonstrating compliance with SOX regulations.

Technology to aid SOX compliance headaches abounds, but sometimes older approaches to risk management, like manual processes, get in the way. These legacy systems often struggle to integrate with modern compliance tools, highlighting how old ideas threaten new technology and create friction for organizations trying to streamline their processes. This ultimately leads to a less efficient and potentially more costly compliance strategy.

The software often leverages database triggers, API integrations, and logging mechanisms to automatically record events. This ensures a complete and verifiable audit trail that spans the entire lifecycle of critical data.

Benefits of Automated Monitoring

Automated monitoring offers significant benefits for SOX compliance. It enables organizations to identify anomalies and potential issues proactively. Real-time alerts and dashboards can flag unusual transactions or access patterns, enabling swift intervention and prevention of potential fraud. Furthermore, the comprehensive visibility afforded by automated monitoring helps to strengthen internal controls and risk management frameworks. Reduced manual effort and increased efficiency are key factors in minimizing costs associated with compliance.

Leveraging Technology for Change Tracking

Technology plays a vital role in tracking and managing changes to critical data. Systems can be configured to identify and record any modification to sensitive data, such as financial records, customer information, or internal controls. This capability enables organizations to maintain a precise history of every change, allowing for easy tracking and validation during audits. Effective change management is crucial for SOX compliance and ensuring the integrity of financial reporting.

Solutions can be designed to alert administrators to changes and require approvals for critical updates.

Key Features of Automated Audit Trail Systems

A robust audit trail system offers several key features crucial for SOX compliance. These features enable comprehensive tracking, monitoring, and reporting of all activities related to sensitive data.

- Real-time logging of all transactions and changes.

- Detailed user activity tracking, including timestamps, user IDs, and descriptions of actions.

- Integration with existing financial systems to capture data from various sources.

- Customizable alerts and notifications for unusual activities or potential violations.

- Comprehensive reporting and analysis tools to track trends and patterns.

- Secure storage and retrieval of audit logs to ensure long-term accessibility.

- Automated generation of compliance reports to streamline audit processes.

Audit Trail System Features Table

This table summarizes key features of automated audit trail systems, their descriptions, SOX compliance benefits, and potential implementation challenges.

| Audit Trail Feature | Description | SOX Compliance Benefit | Implementation Challenges |

|---|---|---|---|

| Real-time Logging | Continuous recording of every transaction and change. | Immediate detection of anomalies, improved responsiveness to potential issues. | Requires robust system infrastructure and integration with existing systems. |

| User Activity Tracking | Detailed records of user actions, including timestamps and descriptions. | Enhanced accountability, easier investigation of suspicious activities. | Potential for data overload, need for effective data retention policies. |

| System Integration | Connection with various financial systems to capture data from diverse sources. | Comprehensive audit trail encompassing all relevant data points. | Complex integration requirements, potential for compatibility issues between systems. |

| Customizable Alerts | Configurable notifications for unusual activities or potential violations. | Proactive identification and remediation of risks, improved response times. | Defining appropriate thresholds and triggers, ensuring alert accuracy. |

Data Governance and Security

SOX compliance isn’t just about following procedures; it’s about safeguarding sensitive financial data. Robust data governance and security are paramount, ensuring the integrity and availability of information critical for audits. This necessitates a layered approach, encompassing everything from encryption and access controls to data loss prevention measures. A strong security posture is not only a regulatory necessity but also a critical business imperative.Data governance and security are critical pillars of SOX compliance.

Implementing robust systems for managing data access, encryption, and preventing loss are crucial for maintaining the integrity and confidentiality of financial information. This not only meets SOX requirements but also protects the organization from financial and reputational damage.

Data Encryption and Access Controls

Data encryption is a fundamental security measure. Encrypting sensitive financial data, such as transaction records and financial statements, renders it unreadable to unauthorized individuals. Strong encryption algorithms, combined with robust key management, are essential. Access controls, meticulously defining who can access specific data and what actions they can perform, are equally vital. Role-based access control (RBAC) and granular permissions ensure only authorized personnel have the necessary access, minimizing the risk of unauthorized data modification or disclosure.

Different Approaches to Data Security

Various approaches to data security exist, each with its strengths and weaknesses. One approach emphasizes perimeter security, focusing on protecting the network’s boundaries. Another prioritizes data loss prevention (DLP), actively preventing sensitive data from leaving the organization’s control. Choosing the appropriate approach often depends on the specific security needs and the sensitivity of the data being protected.

A hybrid approach combining aspects of both perimeter and DLP security can be highly effective.

Data Loss Prevention Tools

Data loss prevention (DLP) tools play a critical role in preventing sensitive data breaches. These tools employ various techniques to monitor and control data movement, ensuring compliance with SOX regulations and safeguarding confidential information. DLP tools can monitor emails, file transfers, and other data flows to identify and block the unauthorized transmission of sensitive data. They can also provide comprehensive logging and reporting capabilities to assist in incident response and regulatory audits.

Data Security Measures Table

| Data Security Measure | Implementation | SOX Compliance Benefit | Example Tools |

|---|---|---|---|

| Data Encryption | Implementing encryption algorithms (e.g., AES-256) on databases and file systems containing sensitive financial data. Regularly updating encryption keys and protocols. | Ensures confidentiality and integrity of sensitive financial data. Protects against unauthorized access and disclosure. | Sophos, BitLocker, VeraCrypt |

| Access Controls | Implementing role-based access control (RBAC) to restrict access to sensitive data based on employee roles and responsibilities. Regularly reviewing and updating access permissions. | Reduces the risk of unauthorized data modification or deletion. Ensures accountability for data access. | Okta, Active Directory, SailPoint |

| Data Loss Prevention (DLP) | Deploying DLP tools to monitor data movement, identify sensitive data, and block its unauthorized transmission. Integrating DLP with existing security infrastructure. | Prevents the leakage of sensitive financial data. Reduces the risk of data breaches and associated penalties. | CipherTrust, Proofpoint DLP, Forcepoint DLP |

| Data Governance Policies | Creating and enforcing clear data governance policies that define data access, retention, and disposal procedures. Regularly reviewing and updating these policies. | Ensures compliance with SOX regulations. Provides a clear framework for data management and security. | No single tool; involves policy management systems, data classification tools. |

Risk Management and Control

Navigating the complexities of SOX compliance often involves a delicate dance between preventing financial irregularities and ensuring operational efficiency. A robust risk management strategy is crucial for maintaining compliance and minimizing the potential for costly errors or penalties. Effective technology implementation can significantly streamline this process, allowing organizations to proactively identify and mitigate risks.Technology empowers organizations to move beyond reactive measures to a proactive approach, allowing for more accurate estimations of risk exposure and more effective control measures.

This approach leads to a more streamlined and secure compliance process, ultimately saving time and resources.

Predictive Analytics for Risk Identification

Predictive analytics leverages historical data, patterns, and trends to forecast future risks. By identifying potential vulnerabilities before they materialize, organizations can proactively implement controls to mitigate the risks. For example, an anomaly detection system can flag unusual transactions that deviate from established norms, potentially indicating fraudulent activity. This early identification allows for swift intervention and prevents the damage that a fraud or error could cause.

Automated Controls for Minimizing Breaches

Automated controls, often integrated into enterprise resource planning (ERP) and financial management systems, can automatically enforce compliance policies. This automation streamlines the process of verifying transactions and ensuring adherence to SOX regulations. Real-time monitoring of critical controls can identify potential breaches as they occur, allowing for immediate corrective action and preventing the issue from escalating.

Technology to aid SOX compliance headaches is definitely a hot topic right now. It’s a real pain point for businesses, and tools are popping up everywhere to help. Thinking about how the iTunes phenomenon, with its early P2P networks and the rise of music lite, the iTunes phenomenon, P2P networks, and music lite really changed the way we consume digital media, offers a glimpse into how innovative solutions can reshape entire industries.

It’s a reminder that technological solutions to complex compliance problems are always evolving.

Different Risk Types Relevant to SOX Compliance

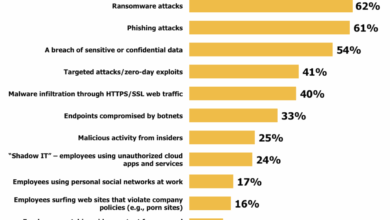

SOX compliance requires a comprehensive understanding of various risk types. These range from financial reporting risks to operational risks, and technological risks. Financial reporting risks include misstatements, fraud, and errors in financial records. Operational risks include inadequate internal controls, ineffective processes, and insufficient segregation of duties. Technological risks arise from system failures, cybersecurity threats, and data breaches.

Categorizing SOX Risks

| Risk Type | Description | Mitigation Strategy | Technology Application |

|---|---|---|---|

| Financial Reporting Risk | Inaccurate or fraudulent financial statements; misstatements in accounting records. | Implement strong internal controls, robust segregation of duties, and regular audits. | Automated reconciliation tools, real-time reporting dashboards, and predictive analytics for detecting anomalies. |

| Operational Risk | Inadequate internal controls, ineffective processes, and insufficient segregation of duties. | Strengthen internal controls, improve process efficiency, and implement robust authorization and approval processes. | Workflow automation tools, access control systems, and audit trails for tracking activities. |

| Technological Risk | System failures, cybersecurity threats, and data breaches. | Implement robust cybersecurity measures, regular security assessments, and data backups. | Security information and event management (SIEM) systems, intrusion detection systems, and data encryption tools. |

Reporting and Dashboards

SOX compliance isn’t just about adhering to regulations; it’s about demonstrating that adherence. Effective reporting and dashboards are crucial for this demonstration. They provide a clear, concise view of the organization’s compliance posture, enabling proactive identification of risks and areas needing improvement. Without robust reporting, demonstrating ongoing compliance becomes a complex and time-consuming process.Comprehensive reporting goes beyond just generating numbers; it’s about providing actionable insights.

By visualizing key metrics and trends, organizations can quickly spot deviations from established controls, allowing for immediate corrective actions. This proactive approach minimizes the potential for non-compliance issues and significantly strengthens the organization’s overall compliance posture.

Importance of Generating Reports and Dashboards

Generating reports and dashboards is critical for tracking compliance progress, identifying potential issues, and facilitating corrective actions. Regular reports highlight areas needing attention, and dashboards offer a real-time overview, allowing for immediate response to deviations. This proactive approach significantly enhances the organization’s ability to meet SOX compliance requirements and mitigate risks.

Key Metrics for SOX Compliance

Tracking specific metrics is vital for understanding the state of SOX compliance. Key performance indicators (KPIs) provide a quantifiable measure of the effectiveness of internal controls. These metrics should cover various aspects of the compliance process, from internal control assessments to audit findings.Examples of critical metrics include the number of control deficiencies identified, the time taken to remediate control deficiencies, the number of audit exceptions, and the overall compliance status.

These metrics should be aggregated across different business units and processes for a comprehensive view.

Technology Simplifying the Reporting Process

Technology plays a transformative role in simplifying SOX reporting. Automated reporting tools can generate reports quickly and accurately, reducing the manual effort involved. These tools often integrate with existing systems, streamlining data collection and reducing errors. Advanced analytics tools can identify trends and patterns in the data, providing valuable insights into potential risks.

Real-Time Visibility into Compliance Status

Real-time visibility into compliance status is paramount. Dashboards offering real-time data provide a clear overview of the current compliance posture, enabling organizations to react quickly to deviations or emerging issues. This immediate feedback loop allows for prompt corrective actions, minimizing the impact of potential non-compliance issues. The ability to see trends and anomalies as they occur is crucial for proactive risk management.

Example Reports for SOX Compliance, Technology to aid sox compliance headaches abounds

| Report Type | Data Source | Key Metrics | Visualization Method |

|---|---|---|---|

| Control Deficiency Report | Internal Control Assessment Tools, Audit Management Systems | Number of Deficiencies, Type of Deficiencies, Location of Deficiencies, Remediation Status | Bar Charts, Heat Maps, Geographic Maps |

| Audit Exception Report | Audit Findings, Audit Management Systems | Number of Exceptions, Type of Exceptions, Root Cause of Exceptions, Remediation Status | Table Charts, Trend Charts, Scatter Plots |

| Compliance Status Report | Internal Control Assessment Tools, Reporting Systems, Audit Findings | Overall Compliance Rating, Compliance Status by Business Unit, Compliance Status by Control Area | Gauge Charts, Scorecards, Summary Tables |

| Financial Reporting Controls Report | Financial Systems, Transaction Logs, Reporting Tools | Number of transactions violating controls, Time taken to remediate issues, Amount of financial impact | Trend charts, Scatter plots, Heatmaps, Interactive dashboards |

Employee Training and Awareness

Staying compliant with SOX regulations requires a proactive approach to employee training. Simply providing a document isn’t enough; effective training engages employees and fosters a culture of compliance. This proactive approach ensures employees understand their responsibilities and the potential risks of non-compliance.SOX compliance training goes beyond a simple overview of the rules. It needs to be interactive and relevant to daily work activities.

The aim is to build a deep understanding of the procedures and principles, not just rote memorization. This empowers employees to identify and report potential issues, thus mitigating risks and preventing costly errors.

Interactive Training Modules

Interactive training modules are a powerful tool for improving employee engagement and comprehension. These modules often use scenarios, quizzes, and simulations to make the learning process more engaging and memorable. This approach helps reinforce understanding of the intricacies of SOX compliance, unlike static documents.

Interactive Training Platforms

Modern learning management systems (LMS) offer robust platforms for delivering interactive SOX compliance training. These platforms allow for personalized learning paths, progress tracking, and detailed reporting. Some platforms even incorporate gamification elements to further enhance engagement. For instance, a platform might award points for completing modules or offer leaderboards to foster healthy competition among employees.

Measuring Employee Understanding

Measuring employee understanding of SOX compliance is crucial for demonstrating effectiveness and identifying areas needing improvement. Methods include quizzes, simulations, and practical exercises that test comprehension and application. This assessment process helps identify areas where employees may need additional support. Regular testing and feedback loops are vital in maintaining a strong understanding of the principles of SOX compliance among all employees.

Technology to aid SOX compliance headaches abounds, offering solutions to streamline processes and reduce errors. Think about how the digital age has changed the way we consume media, like music and film, and the impact on pricing structures. For example, exploring the evolution of downloading costs in music film and the price of downloading highlights a similar struggle with managing digital assets.

Ultimately, these parallels highlight the need for robust technological tools to navigate complex compliance issues.

Training Module Examples

| Training Module | Topic Covered | Interactive Elements | Assessment Method |

|---|---|---|---|

| SOX Compliance Fundamentals | Overview of SOX, key principles, and responsibilities | Interactive presentations, short quizzes, case studies | Multiple-choice quiz, short answer questions, scenario-based assessments |

| Internal Controls | Understanding internal controls and their importance in SOX compliance | Simulations of potential control failures, interactive diagrams, role-playing exercises | Scenario-based assessments, simulations of internal control breakdowns, practical application exercises |

| Financial Reporting | Understanding the importance of accurate financial reporting and how it relates to SOX | Interactive exercises involving data manipulation, real-world financial reporting examples, discussions on errors and their impact | Quizzes with real-world financial data, practical exercises requiring the application of financial reporting rules, simulated financial reporting scenarios |

| Record Keeping and Retention | Understanding proper record keeping procedures and retention policies in line with SOX | Interactive exercises simulating the creation and management of records, timelines, and deadlines | Record review and auditing simulations, document retention policy tests, exercises involving legal requirements for record keeping |

Addressing Compliance Headaches

SOX compliance, while crucial for financial reporting integrity, often presents significant challenges for organizations. These headaches stem from the complexity of the regulations, the sheer volume of data involved, and the need for meticulous record-keeping. Effective solutions demand a proactive approach, moving beyond simply meeting the minimum requirements to actively preventing potential failures.Addressing SOX compliance headaches requires a multifaceted strategy, combining robust technological solutions with a deep understanding of the underlying causes and potential pitfalls.

This proactive approach is crucial for preventing costly errors and maintaining a strong, credible financial image. A comprehensive understanding of the root causes, combined with innovative technological tools, can minimize the risks associated with SOX compliance failures.

Common Compliance Headaches

SOX compliance headaches are often manifested in a variety of issues. These range from inadequate internal controls to difficulties in maintaining accurate audit trails. Maintaining the integrity of financial records, ensuring timely reporting, and maintaining the accuracy of audit trails are frequently cited concerns. Ensuring data accuracy, consistency, and reliability across various systems is a major challenge.

Key Factors Contributing to Headaches

Several key factors contribute to the challenges faced in SOX compliance. These factors include a lack of clear communication and collaboration between departments, inconsistent application of policies and procedures, and a lack of adequate training for employees. Ineffective internal controls, inadequate oversight, and a lack of real-time monitoring of transactions all contribute to the overall compliance burden. Resistance to change within the organization and the inherent complexity of the regulations also contribute to these headaches.

Potential Causes of SOX Compliance Failures

SOX compliance failures can stem from various sources. A common cause is inadequate internal controls that do not effectively mitigate risks. Inadequate oversight and monitoring of transactions and processes can lead to significant discrepancies and ultimately, compliance failures. Lack of employee training and awareness regarding SOX requirements is another significant contributor. Poor data governance and security practices, leading to data breaches or loss of critical information, can also jeopardize compliance.

How Technology Can Prevent Headaches

Technology plays a crucial role in preventing SOX compliance headaches. Automated tools can streamline the process of maintaining audit trails, enhancing the accuracy and efficiency of internal controls. Implementing robust data governance and security solutions ensures the integrity and confidentiality of sensitive financial information. Real-time monitoring and reporting systems can proactively identify and address potential compliance issues before they escalate.

Automated alerts and notifications can be triggered when deviations from established procedures are detected.

Evaluating Technology Solutions

Evaluating the effectiveness of technology solutions for SOX compliance requires a thorough assessment of the system’s capabilities. Key considerations include the solution’s ability to integrate with existing systems, its scalability to accommodate future growth, and its user-friendliness to ensure smooth adoption by employees. The solution’s ability to provide detailed audit trails and reports, as well as its effectiveness in preventing and detecting potential issues, should be thoroughly evaluated.

Table of Compliance Headaches, Root Causes, Solutions, and Outcomes

| Compliance Headache | Root Cause | Technological Solution | Expected Outcome |

|---|---|---|---|

| Inconsistent application of policies | Lack of standardized procedures | Automated policy management system | Improved consistency and reduced errors |

| Inadequate audit trails | Manual processes, lack of automation | Automated audit trail software | Enhanced visibility and traceability of transactions |

| Data breaches | Weak security measures | Robust data security platform | Improved data protection and reduced risk of breaches |

| Lack of employee training | Insufficient knowledge of SOX requirements | Interactive online training modules | Improved employee understanding and adherence to regulations |

Wrap-Up

In conclusion, technology provides a crucial avenue for mitigating SOX compliance headaches. By automating tasks, improving data security, and enhancing reporting, businesses can streamline their processes and improve their overall compliance posture. The key is to choose the right tools, implement them effectively, and maintain ongoing training to ensure the solution meets the ever-evolving demands of SOX compliance.

A well-implemented technological strategy can significantly reduce the burdens associated with SOX compliance, allowing businesses to focus on growth and innovation.